New Nuclear Requires New Hiring at the NRC

The next generation of nuclear energy deployment depends on the Nuclear Regulatory Commission’s (NRC) willingness to use flexible hiring authorities to shape its workforce. Many analysts and policymakers propose increasing nuclear power production to ensure energy security and overall emissions reduction, and the U.S. recently joined 20 other countries in a pledge to triple global nuclear energy capacity by 2050. Additional nuclear deployment at this scale requires commercializing advanced reactor concepts or reducing capital costs for proven reactor technologies, and these outcomes rely on the capacity of the NRC to efficiently license and oversee a larger civilian nuclear industry. The ADVANCE Act, which became law in July, 2024, empowers the agency to accelerate licensing processes, mandates a new mission statement that reflects the benefits of nuclear energy, and provides additional direction to existing hiring flexibilities authorized by the Atomic Energy Act (AEA) of 1954. To meet expected demand for licensing and oversight, the NRC should not hesitate to implement new hiring practices under this direction.

The potential of the ADVANCE Act’s provisions should be understood in context of NRC’s existing authorities, practices, and history. NRC is exempt from the federal competitive hiring system for most positions. When Congress created the NRC in 1974 as a partial replacement of the Atomic Energy Commission (AEC), it maintained AEA provisions that allowed the AEC to hire without regard to civil service laws. Most NRC positions are in the Excepted Service, a category of positions across the federal workforce exempt from competitive hiring, which is particularly useful for highly-skilled positions that are impracticable to assess using traditional federal examining methods. The AEA allows NRC to hire staff to the Excepted Service provided salaries do not exceed grade 18 of the General Schedule (GS) (GS-16-18 were replaced with the Senior Executive Service in 1978) for scientific and technical positions and provided salaries for other positions follow the General Schedule when the occupation is comparable. Other agencies can hire to the Excepted Service in limited circumstances such as for candidates that are veterans or for specific occupations defined by the Office of Personnel Management (OPM).

Non-Competitive Hiring In Practice

Based on a review of NRC policies, procedures, and reports, NRC underuses its non-competitive hiring authorities provided under the AEA. Management Directives (or MDs, NRC’s internal policy documents) repeatedly state that NRC is exempt from competitive hiring under the AEA while outlining procedures that mirror government-wide practices derived from other laws and regulations such as the Senior Executive Service, Administrative Judges, experts and consultants, advisory committee members, and veterans, which are common flexible hiring pathways available to other agencies. MD 10.1 outlines NRC’s independent competitive merit system that generally follows OPM’s general schedule qualification standards. MD 10.13 on NRC’s non-competitive hiring practices under AEA authority is limited to part-time roles and student programs. While the policy includes a disclaimer that it covers only the most common uses, it does not include guidance on applying non-competitive hiring to other use cases.

The NRC has also been slow to reconcile its unique flexible hiring authorities with OPM Direct Hire Authority (DHA), a separate expedited process to hire to the Competitive Service. As far back as 2007, NRC hiring managers and human resources reported in Government Accountability Office interviews that DHA was highly desired and the agency was exploring how to obtain the authority. OPM denied NRC’s request for DHA the year before because it determined that it does not apply to NRC’s already-excepted positions under the AEA. NRC decided to replicate its own version of DHA that follows OPM’s restrictions for hiring of certain occupational categories. While this increased flexibility for hiring managers, a 2023 OIG audit found confusion among staff, managers, and directors about which laws and internal policies applied to DHA.

Making Sense of the ADVANCE Act

As NRC updates guidance on its version of DHA for hiring managers, the ADVANCE Act provides NRC with more direction for hiring to the Excepted Service. The law creates new categories of hires for positions that fill critical needs related to licensing, regulatory oversight, or matters related to NRC efficiency if the chair and the Executive Director for Operations (EDO) agree on the need. It specifies that the hires should be diverse in career level and have salaries commensurate with experience, with a maximum matching level III of the Executive Schedule. Additional limitations on the number of hires fall into two categories. The first category limits use of the authority to 210 hires at any time. The second category limits use of the authority to an additional 20 hires each fiscal year which are limited to a term of four years. The total number of staff serving at one time under the second category could reach 80 appointments if the authority is used to the maximum over four consecutive years. If NRC maximizes hiring in both categories each year for at least 4 years, the total number of staff serving at one time could reach 290, which is almost 7% of the current total NRC workforce. Several analyses and press releases mischaracterized or overlooked the specifics of these provisions, reporting the total number of 120 for the number of appointments in the first category, which could be a typo of 210 or a figure derived from a prior draft version of the bill. Appropriations are provided in NRC’s normal process of budget recovery through fees charged to license applicants.

The Regulatory Workforce for the Next Generation of Nuclear Power Plants

The capacity of the NRC to license new nuclear power plants and provide oversight to a larger number of operating reactors impacts the viability of nuclear power as part of the U.S.’s abundant and reliable energy system. For decades, the AEA has provided NRC staff with unique flexibility to shape a workforce to regulate the civilian nuclear energy and protect people and the environment. Under recent direction and specificity from Congress, the EDO should not hesitate to hire staff in new, specialized positions across the agency that are dedicated to implementing updates to licensing and oversight as mandated by the ADVANCE Act. In parallel, the EDO should work with the Office of Human Resources to promote NRC’s version of DHA to hiring managers more widely to solve long-standing hiring challenges for hard-to-recruit positions. Effective use of NRC’s broad hiring flexibilities are critical to realizing the next generation of nuclear energy deployment.

Federation of American Scientists (FAS) Celebrates 2nd Anniversary of the Inflation Reduction Act

The Inflation Reduction Act (IRA) is the largest climate investment in history. FAS scientists offer policy ideas to maximize the impacts of this investment on U.S. competitiveness, energy security, resilience, and more.

Washington, D.C. – August 16, 2024 – The Federation of American Scientists (FAS), the non-partisan, nonprofit science think tank dedicated to using evidence-based science for the public good, is celebrating the two-year anniversary of the signing of the Inflation Reduction Act (IRA) by sharing policy ideas to drive continued successful implementation of this landmark legislation.

The IRA is a United States federal law which aims to reduce the federal government budget deficit, lower prescription drug prices, and invest in domestic energy production while promoting clean energy. It was passed by the 117th United States Congress and it was signed into law by President Biden on August 16, 2022. The IRA has catalyzed $265 billion in new clean energy investments and created hundreds of thousands of jobs in the United States, putting us on a path to achieving climate goals while boosting the economy.

“In just two years, the Inflation Reduction Act has driven down costs of energy and transportation for everyday Americans while reining in catastrophic climate change” says Hannah Safford, Associate Director of Climate and Environment. “This legislation proves that when we invest in a better future, everyone wins.”

“The IRA enables the country to move toward ambitious climate goals. We already see the effects with new policy proposal ideas that could supercharge pursuit of these goals,” says Kelly Fleming, Associate Director of Clean Energy. “The Department of Energy finds that with the Inflation Reduction Act and Bipartisan Infrastructure Law, we can double the share of clean electricity generation to 80% in 2030.”

FAS, one of the country’s oldest science policy organizations, works with scientists and technologists to propose policy-ready ideas to address current and emerging threats, including climate change and energy insecurity.

On today’s two-year anniversary of the IRA, FAS is highlighting policy proposals that build on the IRA’s successes to date and suggest opportunities for continued impact. Examples include:

Geothermal

Geothermal technologies became eligible for tax credits under IRA.

Breaking Ground on Next-Generation Geothermal Energy The Department of Energy (DOE) could take a number of different approaches to accelerating progress in next-generation geothermal energy, from leasing agency land for project development to providing milestone payments for the costly drilling phases of development.

Low-Carbon Cement

The IRA provides $4.5B to support government procurement of low-carbon versions of this cornerstone material.

Laying the Foundation for the Low-Carbon Cement and Concrete Industry Cement and concrete production is one of the hardest industries to decarbonize. Using its Other Transactions Authority, DOE could design a demand-support program involving double-sided auctions, contracts for difference, or price and volume.

Critical Minerals and Energy Manufacturing

Supply chains necessary for battery technologies are being built out in the U.S. thanks to IRA incentives. The new Manufacturing and Energy Supply Chain Office (MESC) has implemented and unveiled programs to retool existing facilities for EV manufacturing, and rehire existing work, and provide tax incentives for clean energy manufacturing facilities with funding provided in the IRA. The office supports the development and deployment of a domestic clean energy supply chain, including for critical minerals needed for batteries and other advanced technologies.

Critical Thinking on Critical Minerals: How the U.S. Government Can Support the Development of Domestic Production Capacity for the Battery Supply Chain Batteries for electric vehicles, in particular, will require the U.S. to consume an order of magnitude more lithium, nickel, cobalt, and graphite than it currently consumes.

Nature Based Solutions

Billions of dollars have been invested into nature based solutions, including $1 billion in urban forestry, that will make communities more resilient to climate change.

A National Framework For Sustainable Urban Forestry To Combat Extreme Heat. To realize the full benefits of the federal government’s investment in urban forestry, there will need to be a coordinated, equity-focused, and economically validated federal plan to guide the development and maintenance of urban forestry that will allow the full utilization of this critical resource.

Submit Your Science and Technology Policy Ideas

The IRA is one lever to make real-world change; good ideas can come from anyone, including you.

FAS is soliciting federal policy ideas to present to the next U.S. presidential administration through the Day One 2025 project, which closes soon. Interested parties can submit science and technology related policy ideas year-round at FAS’s Day One website page.

###

ABOUT FAS

The Federation of American Scientists (FAS) works to advance progress on a broad suite of contemporary issues where science, technology, and innovation policy can deliver dramatic progress, and seeks to ensure that scientific and technical expertise have a seat at the policymaking table. Established in 1945 by scientists in response to the atomic bomb, FAS continues to work on behalf of a safer, more equitable, and more peaceful world. More information at fas.org.

Putting FESI on a Maximum Impact Path

The Foundation for Energy Security and Innovation is now a reality: an affiliated but autonomous non-profit organization authorized by Congress to support the mission of the U.S. Department of Energy and to accelerate the commercialization of energy technologies. FESI’s establishment was a vital first step, but its value depends on what happens next. In order to maximize FESI’s impact, the board and staff should think big from the start, identify unique high-leverage opportunities to complement DOE’s work, and systematically build the capacity to realize them. This memo suggests that:

- FESI should align with DOE’s energy mission,

- FESI should serve as catalyst and incubator of initiatives that advance this mission, especially initiatives that drive public-private technology partnerships, and

- FESI should develop lean and highly-networked operational capabilities that enable it to perform these functions well.

Three appendices to this memo provide background information on FESI’s genesis, excerpt its authorizing legislation, and link to other federal agency-affiliated foundations and resources about them.

Thinking Big: FESI’s Core Mission

DOE is responsible for managing the nation’s nuclear stockpile, cleaning up the legacy of past nuclear weapons development, and advancing basic scientific research as well as transforming the nation’s energy system. Although FESI’s authorizing legislation allows it to support DOE in carrying out the Department’s entire mission [Partnerships for Energy Security and Innovation Act Section b(3)(A)], the detailed description of FESI’s purposes [Sections b(1)(B)(ii), b(3)(B)] and the qualifications specified for its board members [Section b(2)(B)] signal that Congress viewed the energy mission as FESI’s primary focus. This conclusion is also supported by the hearing testimony gathered by the House Science Committee.

“Catalyz[ing] the timely, material, and efficient transformation of the nation’s energy system and secur[ing] U.S. leadership in energy technologies,” the two pillars of DOE’s energy mission, are extremely challenging responsibilities. The energy system makes up about 6% of the U.S. economy, or about $4000 per person per year, and its importance outweighs this financial value. This system keeps Americans warm in the winter and cool in the summer, gets us to our jobs and schools, and allows us to work, learn, and enjoy life. The system’s transformation to cleaner and more secure resources must not interrupt the affordable and reliable provision of these and many other vital services.

In addition to posing daunting system management challenges, the incipient energy transition is testing America’s global technological leadership. The United States now leads the world in oil and natural gas production, thanks in part to breakthroughs enabled by DOE. But the risks imposed by the use of conventional energy resources have risen. Other nations, notably China and Russia, have taken aggressive actions to establish leadership positions in new energy technologies, such as advanced nuclear power, solar panels, and lithium-ion batteries. DOE is tasked with reclaiming these fields.

DOE’s ambitious energy mission would benefit more from FESI’s support than would DOE’s other responsibilities. The energy system, unlike the nuclear stockpile or cleanup, and to a far greater extent than basic science, lies outside federal control. To transform it and secure global leadership in key technologies, DOE will have to collaborate closely with the private sector, philanthropy, and non-profits. Strengthening such collaboration, particularly to accelerate commercialization of energy technologies, is precisely the purpose specified for FESI by Congress. [Sections b(1)(B)(ii); b(3)(B)(i)]

FESI’s alignment with DOE’s energy mission should be resilient to changes in Congress and the administration. Its authorizing legislation was sponsored by members of both parties across three Congresses and won overwhelming majorities when voted on as a freestanding bill. By law, a majority of its board members must have experience in the energy sector, research, or technology commercialization [Section b(2)(B)(iii)(III)] FESI will have difficulty building strong collaborations and thus achieving its congressional mandate unless it is seen as a long-term partner with a clear and stable mission.

Filter, Catalyst, and Incubator: FESI’s Core Functions

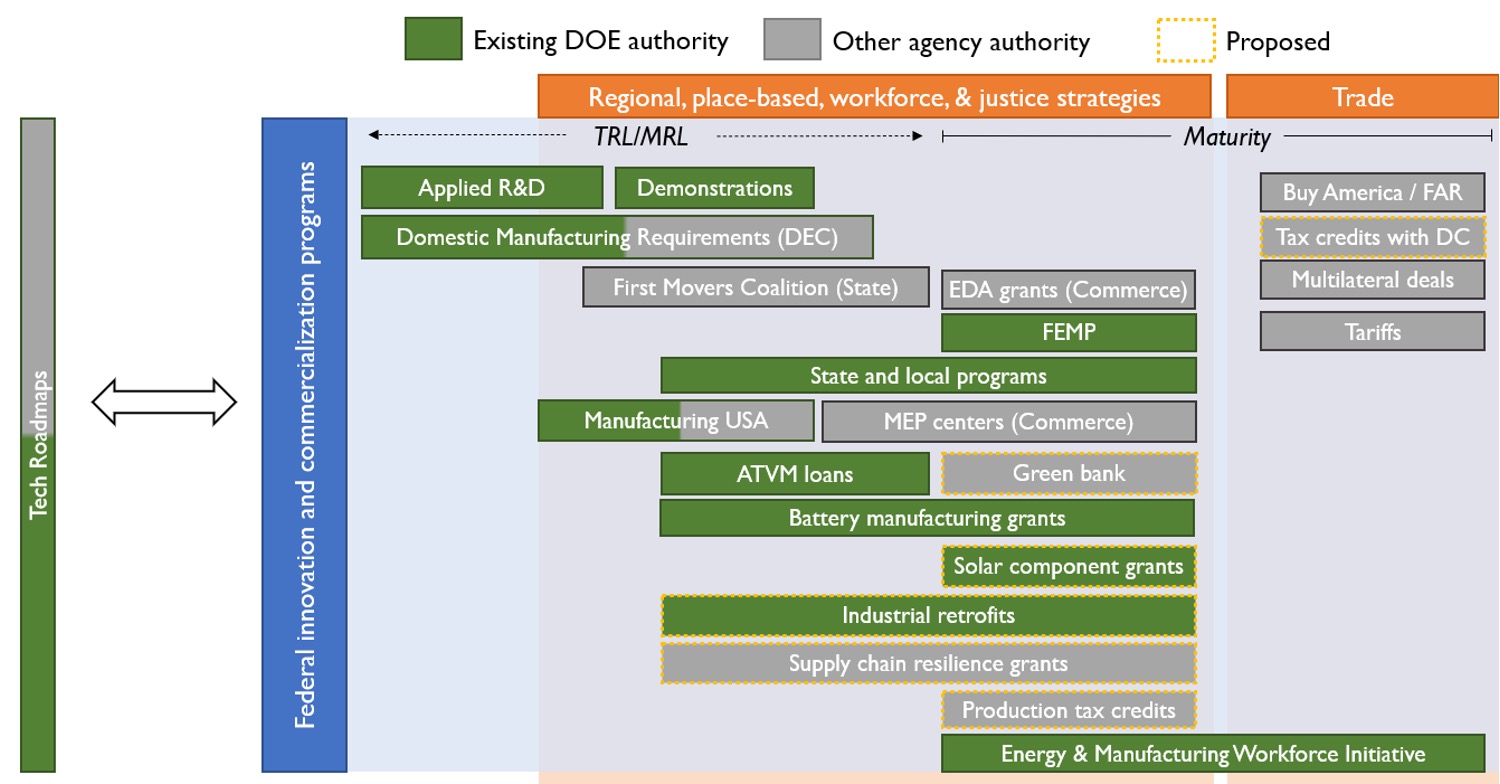

DOE brings many assets to its mission of energy system transformation and global technological leadership. It invests over $9 billion per year in energy research, development, and demonstration, far more than any other entity in the world. Its network of 17 national laboratories and thousands of academic collaborators converts those funds into a vast store of knowledge and opportunities for real-world impact. It possesses financial and regulatory tools that allow it to shape energy markets to varying degrees.

FESI’s responsibility – and opportunity – is to help DOE use these assets to more effectively advance its energy mission. More effective public-private partnerships to accelerate technology commercialization, including such dimensions as technology maturation, new product development, and regional economic development [Sections b(3)(B)(ii), (iii), and (v)] will be an enduring priority. But the specific use-cases and projects that FESI invests in will change as the global energy landscape does. Indeed, the dynamic nature of that landscape, along with structural constraints on DOE, is a key justification for FESI’s creation. FESI must develop processes that enable it to quickly identify and act on points of leverage that enhance the impact of DOE’s assets in a rapidly-changing system.

These processes should perform three vital functions, all of which will benefit from collaboration between FESI and the national laboratory-affiliated foundations [Section b(4)(G)]. The first is to serve as a filter that helps DOE gather and sift valuable insights about the global energy landscape that the department’s leadership might otherwise miss. Information flows in a large bureaucracy like DOE are inevitably shaped by its organizational structure. The structure of DOE’s energy-focused units and the national labs is in many respects a legacy of the times in which they were established and does not map well to today’s energy system. In addition, DOE’s immense scale means that the voices of newer and less powerful players in the system, such as start-up companies and community groups, may be drowned out. Some voices of the grassroots internal to DOE and the labs may also be hard to discern at the leadership level. The Secretary of Energy’s Advisory Board helps to fill these gaps, but it is constrained by the Federal Advisory Committee Act and other laws and regulations. FESI’s flexibility, bipartisan character, and non-governmental status, bolstered by a strong relationship with the lab foundations, will allow it to recognize DOE’s blind spots, whether internal or external.

FESI should draw on this new or neglected information to perform the second function: catalyzing actionable opportunities that advance DOE’s energy mission. It can develop these opportunities (jointly, as appropriate, with one or more lab foundations) by convening a broad range of stakeholders in formats that DOE cannot effectively utilize and at a pace that DOE cannot match. For example, a group of firms in an emerging clean energy industry may identify a shared technological need that international competitors are pursuing aggressively. FESI could support these firms to articulate their need, identify DOE-affiliated assets that could address it, and rapidly assemble a public-private partnership that aligns the two. Such a partnership might have a regional focus and engage state and local governments and regionally-focused philanthropy as well. If FESI’s information filter were to pick up unrecognized obstacles to effective community engagement or lack of attention to end-user priorities, it could assemble cross-sectoral partnerships appropriate to those opportunities. The catalyst function could be particularly important for crisis response, when speed and agility are essential, and DOE’s formal processes are likely to slow the agency down.

FESI’s third core function should be to incubate and ultimately spin out the initiatives that it has catalyzed. The process of assembling each initiative will require FESI to provide basic administrative support, like internal communication and coordination. FESI should frequently go several steps further by raising seed funding for each initiative, particularly from non-governmental sources, and serving as its external champion. FESI should not, however, become the permanent home of mature partnerships. The managerial demands imposed by carrying out this function risk undermining the filter and catalyst functions. Spinning out the successes will permit FESI’s leadership to hunt more effectively for new opportunities. The destination for the spinoffs might be new or expanded programs within DOE, an existing non-profit like an industry consortium or community foundation, or a new organization.

Lean and Intensely Networked: FESI’s Operational Capabilities

FESI’s high ambition, dynamic functions, and unique institutional position determine the capabilities it will need to operate effectively. Above all, it must be plugged intensively into a broad network that spans the energy industry; DOE and the national labs; states, communities, and Congress; and philanthropy. FESI will only be able to spot what DOE could do better by having a savvy understanding of what DOE is already doing and what its potential partners want to be doing. FESI must be able to gather and interpret this information continuously at a modest cost, which puts a premium on networking.

FESI board members must be vital nodes of its network. FESI’s authorizing statute specifies that the board represent “a broad cross-section of stakeholders.” The members will hold positions that provide insights and contacts of value to FESI and should be selected to build and maintain the network’s breadth. The board’s ex officio representatives from DOE will provide complementary perspectives and connections inside the Department. FESI’s staff will only have the knowledge and resources required to do their jobs well if the entire board is active and engaged (but not micro-managing the staff).

FESI’s staff should be led by an executive director who is responsible for its day-to-day operations [Section b(5)(A)] and has high credibility throughout the energy system and with both political parties. Staff members should bring sector-spanning networks to the organization that leverage those of the board. Even more important, the staff must possess the entrepreneurial skills, and technological and market knowledge, to recognize and act on promising opportunities. Prior experience in business, social, or public entrepreneurship – building new companies, non-profit organizations, and government programs – is likely to be particularly valuable to FESI.

Running lean should be a value for a FESI and will likely be a necessity as well. The value lies in taking initiative and moving quickly. The necessity arises from the likely limits on federal appropriations for operations, which are authorized at $3 million annually [Section b(11)] and may not rise to that level. To be sure, FESI must raise resources from non-federal sources – indeed, that will be one of its core challenges. But those resources are likely to be much easier to raise if they are devoted to projects rather than operations.

Finally, FESI will need to mitigate risks to its reputation that might arise from real and perceived conflicts of interest of the board and staff as well as from the images and interests of its potential partners. A pristine reputation will be vital to maintaining the confidence of DOE, Congress, and external stakeholders. FESI should seek to reduce the cost in money and time of rigorous vetting and disclosure, but ultimately this investment is an essential one that must be borne.

Appendix 1. A Brief Prehistory of FESI

- The immediate genesis of FESI’s authorizing legislation was idea #22 in this 2016 ITIF report.

- ITIF and its partners socialized the concept beginning in the 115th Congress, including at this 2018 event, which featured Reps. Fleischmann (current chair of the House Energy & Water Development appropriations subcommittee) and Lujan (now Senator from New Mexico)

- During the same Congress, Rep. Lujan and Sen. Coons authored the first bills to authorize a DOE-affiliated foundation, which were co-sponsored on a bipartisan basis, a pattern that was sustained through the concept’s ultimate passage.

- Jetta Wong took the lead role along with me in driving the foundation initiative for ITIF during the 116th Congress (2019-2020). That work included two stakeholder workshops and extensive interview and documentary research, leading to our 2020 “Mind the Gap” report, which provides our fullest vision for the foundation’s potential role in innovation and commercialization.

- In July 2020, Jetta testified on the foundation before the House Science Committee along with Jennifer States (Maritime Blue), Farah Benahmed (Breakthrough Energy), Emily Reichert (Greentown Labs), and Lee Cheatham (PNNL)

- Our work led to an appropriations report that required DOE to sponsor a study by the National Academy of Public Administration, which was issued in January 2021. This report has a good round-up of other agency foundations, as does the 2019 CRS report on the topic

- The Partnerships for Energy Security and Innovation Act, sponsored by Rep. Stansbury and Sen. Coons in the 117th Congress, won an 83-14 vote in the Senate in 2021, passed the House in early 2022, and was ultimately incorporated into the August 2022 CHIPS and Science Act. The Act passed just after Jetta joined the administration; I partnered with Kerry Duggan of SustainabiliD for the next phase of work. Our August 2022 blog post provides a good synopsis of the effort up to the bill’s passage.

- With SustainabiliD and later with the Federation of American Scientists and with support from Schmidt Futures and Breakthrough Energy, the “Friends of FESI” focused on sustaining support for FESI and generating project ideas.

- Jetta joined the panel on FESI at the 2023 ARPA-E summit, where DOE held its first public events on FESI, and we participated in the workshop that DOE organized there.

- We responded to DOE’s RFI on FESI, along with several other NGOs. We also focused on FESI in a response to to DOE’s RFI on place-based innovation.

- We developed a set of broad use-cases and held two workshops, one on geothermal energy and the other on “fast track” commercialization.

- We worked with supporters and allies to secure FESI’s appropriation

Appendix 2. Other Federal Agency-Affiliated and National Laboratory Foundations

Numerous federal agencies have Congressionally authorized non-governmental foundations that work with them to advance their missions. The National Park Foundation (NPF) is the oldest, dating back to 1935. Anyone who wants to support a particular national park, or the system as a whole, can do so through a contribution to NPF. Similarly, donors who care about public health can give to the CDC Foundation (CDC Foundation) or the Foundation for NIH (FNIH). A 2021 report by the National Academy of Public Administration (NAPA), which recommended establishing a foundation for DOE, reviews a wide range of agency-related foundations, as does the 2020 ITIF “Mind the Gap” report and a 2019 CRS report.

As the NAPA report describes, all of these foundations leverage federal investment with private contributions to complement and supplement their agency affiliate, while guarding against potential conflict of interest. Yet, more remarkable than this commonality among is the foundations’ diversity. Each seeks to complement and supplement its partner agency, but because each agency has a different mission, structure, and functions, each affiliated foundation is unique.

FESI will likely have much in common with the FNIH. Like NIH, DOE is a major research funder that advances a critical national mission. Like NIH, DOE must rely on the private sector to turn advances made possible by the R&D it funds into technologies that make a difference on the ground. FNIH’s contributions to fighting the pandemic illustrate how having a flexible non-profit partner for an agency can advance the agency’s mission in a moment of need. Its Pandemic Response Fund and Accelerating COVID-19 Therapeutic Interventions and Vaccines (ACTIV) partnership with NIH, private firms, other federal agencies, and allied governments, aids the search for treatments and vaccines and prepares the nation to defend against future pandemics.

The Foundation for Food and Agriculture Research, which is affiliated with the U.S. Department of Agriculture, is another potential source of inspiration and learning for FESI. One notable innovation made by FFAR is its use of prizes and challenges, along with more traditional competitive, cost-shared grants. To ensure technologies can scale, FFAR brings industry experts into its project design and administration. In a review of the FFAR’s progress, the Boston Consulting Group (BGC) found that FFAR’s “Congressional funding allows it to bring partners to the table and serve as an independent, neutral third party.”

Links to agency-affiliated foundations not linked above:

- Foundation for America’s Public Lands (Interior/Bureau of Land Management)

- Henry M. Jackson Foundation for the Advancement of Military Medicine (DOD)

- National Association of Veterans’ Research and Education Foundations (VA)

- National Fish and Wildlife Foundation (Interior/Fish and Wildlife Service and NOAA)

- National Forest Foundation (Interior/US Forest Service)

- Reagan-Udall Foundation for the FDA (Food and Drug Administration)

Appendix 3. Selected Provisions of FESI’s Authorizing Statute1

Partnerships for Energy Security and Innovation (42 USC 19281)

CHIPS AND SCIENCE ACT SEC. 10691. FOUNDATION FOR ENERGY SECURITY AND INNOVATION

(b)(1)(B) MISSION.—The mission of the Foundation shall be—

(i) to support the mission of the Department; and

(ii) to advance collaboration with energy researchers, institutions of higher education, industry, and nonprofit and philanthropic organizations to accelerate the commercialization of energy technologies.

(b)(2)(B)(iii)(II) REPRESENTATION.—The appointed members of the Board shall reflect a broad cross-section of stakeholders from academia, National Laboratories, industry, nonprofit organizations, State or local governments, the investment community, and the philanthropic community.

(III) EXPERIENCE.—The Secretary shall ensure that a majority of the appointed members of the

Board— (aa)(AA) has experience in the energy sector; (BB) has research experience in the

energy field; or (CC) has experience in technology commercialization or foundation operations;

and (bb) to the extent practicable, represents diverse regions, sectors, and communities.

(b)(3) PURPOSES.—The purposes of the Foundation are—

(A) to support the Department in carrying out the mission of the Department to ensure the security and prosperity of the United States by addressing energy and environmental challenges through transformative science and technology solutions; and

(B) to increase private and philanthropic sector investments that support efforts to create, characterize, develop, test, validate, and deploy or commercialize innovative technologies that address crosscutting national energy challenges, including those affecting minority, rural, and other

underserved communities, by methods that include—

(i) fostering collaboration and partnerships with researchers from the Federal Government, State

governments, institutions of higher education, including historically Black colleges or universities,

Tribal Colleges or Universities, and minority-serving institutions, federally funded research and development centers, industry, and nonprofit organizations for the research, development, or commercialization of transformative energy and associated technologies;

(ii) strengthening and sharing best practices relating to regional economic development through scientific and energy innovation, including in partnership with an Individual Laboratory-Associated Foundation;

(iii) promoting new product development that supports job creation;

(iv) administering prize competitions—

(I) to accelerate private sector competition and investment; and

(II) that complement the use of prize authority by the Department;

(v) supporting programs that advance technology maturation, especially where there may be gaps in Federal or private funding in advancing a technology to deployment or commercialization from the prototype stage to a commercial stage;

(vi) supporting efforts to broaden participation in energy technology development among individuals from historically underrepresented groups or regions; and

(vii) facilitating access to Department facilities, equipment, and expertise to assist in tackling national challenges.

(b)(4)(G) INDIVIDUAL AND FEDERAL LABORATORY-ASSOCIATED FOUNDATIONS.—

(ii) SUPPORT.—The Foundation shall provide support to and collaborate with covered foundations.

(iv) AFFILIATIONS.—Nothing in this subparagraph requires—

(I) an existing Individual Laboratory-Associated Foundation to modify current practices or

affiliate with the Foundation

(b)(5)(I) INTEGRITY.—

(i) IN GENERAL.—To ensure integrity in the operations of the Foundation, the Board shall develop and enforce procedures relating to standards of conduct, financial disclosure statements, conflicts of interest (including recusal and waiver rules), audits, and any other matters determined appropriate by the Board.

(b)(6) DEPARTMENT COLLABORATION.—

(A) NATIONAL LABORATORIES.—The Secretary shall collaborate with the Foundation to develop a process to ensure collaboration and coordination between the Department, the Foundation, and National Laboratories

Restarting the Palisades Nuclear Plant and Keeping Momentum on Clean Energy

The Department of Energy (DOE) announced recently that it will finance the restart of a nuclear power plant through a new program to revitalize energy infrastructure and reduce greenhouse gas emissions. Restarting the Palisades Nuclear Power Plant, which was shut down in 2022, will be the first restarted nuclear power plant in U.S. history, bringing back much needed clean firm energy supply to Michigan, Illinois, and Indiana. DOE estimates that the addition of this clean capacity will prevent yearly emissions equivalent to that emitted by nearly one million gas-powered cars. The plant owners also shared intentions to use existing infrastructure to build two small modular reactors, a newer type of reactor technology that can be deployed more flexibly than existing commercial light-water reactors. DOE’s announcement is a significant step in addressing emerging energy needs and reducing emissions, but more is needed to ensure a successful plant restart and to expand clean energy capacity broadly.

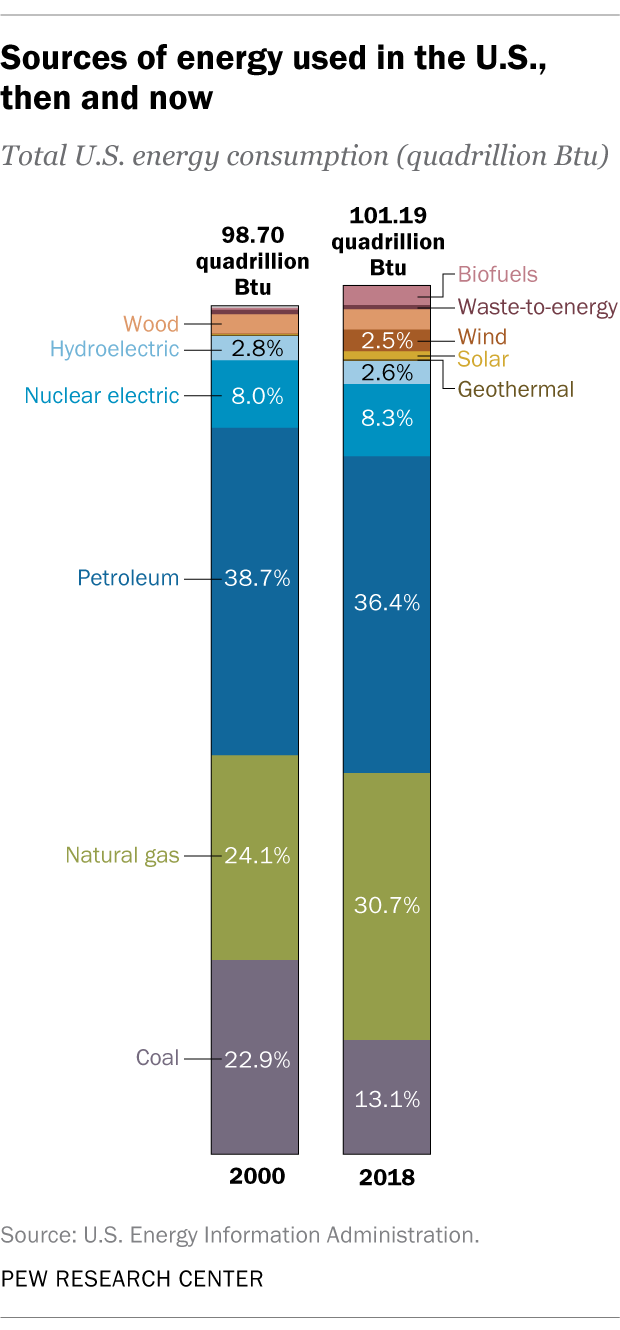

Nuclear power was commercialized in the U.S. in the 1950s, and electricity generated by this technology accounts today for about 19% of the country’s electricity supply. Nuclear is a baseload power source, also called clean firm power, that complements generation from intermittent sources such as wind and solar energy. But in many cases, nuclear energy struggles to compete economically with other energy sources. The original decision to close the Palisades was primarily financial. Consumers Energy, the utility that purchased energy from the plant, intended to replace the nuclear energy with natural gas, which is ample and inexpensive. The dynamic is not unique—utilities are using more fossil fuels as the grid attempts to respond to a rapid increase in demand. But commercial light-water reactors, like those at the Palisades, are the most mature clean technology option to meet near-term energy needs while reducing emissions. The federal government should shape the market for nuclear power, or risk more plants shutting down—and making ambitious emissions reductions goals likely impossible to meet.

The conditional commitment from the DOE Loan Programs Office (LPO) to finance the Palisades restart ensures nuclear power is cost-competitive, and this particular type of loan is an important tool for DOE to develop and deploy more clean energy technologies. Since the loans are conditional on the companies meeting agreed-upon commitments, the arrangement allows DOE to closely monitor progress and halt funding if the project does not meet expectations. The LPO, established by Congress in 2005 to invest in critical energy and infrastructure projects, has found much success, especially with an increase in funding from the recent Inflation Reduction Act (IRA). Since the IRA passed in 2022, LPO has issued over $16 billion in conditional commitments and disbursed over $30 billion. The office’s approaches to lending seem to work well—for FY2023, they reported actual losses of only 3.1% of total funds disbursed. Other examples of recent conditional commitments include a real-time methane emissions monitoring network and a solar energy storage microgrid, reflecting investments across key clean energy technologies. But the Palisades commitment is unique as it is the first issued through DOE’s Energy Infrastructure Reinvestment program, which has $250 billion available to fund clean energy projects that revitalize or replace existing infrastructure. The $1.5 billion loan to Palisades will help fund refurbishment, upgrades, and testing to operate the plant for an estimated 25 years. Since the initial appropriations for this program expire in September of 2026, the DOE should act quickly to finance similar projects that revitalize existing infrastructure.

Outside of loans, the federal government can do more to support the restart and ensure other nuclear plants continue generating clean baseload energy for as long as safely possible. Next, the Nuclear Regulatory Commission (NRC) will need to amend the license of a plant it already classified in a state of decommissioning. The NRC formed the Palisades Restart Panel (PRP) to advise on the reviews required for this new regulatory situation. Although the primary objective of the PRP is to advise on the Palisades, NRC gave the panel the option to provide general recommendations if other licensees pursue a restart. Twenty other nuclear power reactor sites are in decommissioning status. To provide clarity to the nuclear industry on options for these sites, the panel should take advantage of this opportunity to advise generally on a process for restarts. The DOE should also signal whether it intends to make further investments in this area. This first-of-kind project could demonstrate that restarting plants is a fast and economical way to increase clean firm generating capacity.

Federal policymakers, agencies, and the private sector should consider additional options for expanding nuclear capacity at this moment when nuclear power is viewed favorably by most of the public and partisan division is low. For example, utilities could form consortiums to build multiple reactors of the same design, reducing risk and cost with the construction of each new reactor. The DOE could mass-acquire NRC permits on behalf of developers, or use the Foundation for Energy Security and Innovation (FESI) to accelerate licensing through stakeholder and community engagement. Congress could also consider categorical exclusions under the National Environmental Policy Act for actions that use existing energy infrastructure and have a net positive benefit to the environment, such as building nuclear power plants on former coal plant sites. The LPO has nearly $412 billion in loan authority to advance clean energy. It should continue to negotiate and award conditional commitments for more clean energy projects across the country, working closely with applicants and recipients to ensure adequate progress and effective use of taxpayer dollars. Other federal policymakers should keep momentum on DOE’s commitment to Palisades with further actions to keep nuclear power on the grid.

Engaging Coal Communities in Decarbonization Through Nuclear Energy

The United States is committed to the ambitious goal of reaching net-zero emissions globally by 2050, requiring rapid deployment of clean energy domestically and across the world. Reducing emissions while meeting energy demand requires firm power sources that produce energy at any time and in adverse weather conditions, unlike solar or wind energy. Advanced nuclear reactors, the newest generation of nuclear power plants, are firm energy sources that offer potential increases in efficiency and safety compared to traditional nuclear plants. Adding more nuclear power plants will help the United States meet energy demand while reducing emissions. Further, building advanced nuclear plants on the sites of former coal plants could create benefits for struggling coal communities and result in significant cost savings for project developers. Realizing these benefits for our environment, coal communities, and utilities requires coordinating and expanding existing efforts. The Foundation for Energy Security and Innovation (FESI), the US Department of Energy (DOE), and Congress should each take actions to align and strengthen advanced nuclear initiatives and engagement with coal communities in the project development process.

Challenge and Opportunity

Reducing carbon emissions while meeting energy demand will require the continued use of firm power sources. Coal power, once a major source of firm energy for the United States, has declined since 2009, due to federal and state commitments to clean energy and competition with other clean energy sources. Power generated from coal plants is expected to drop to half of current levels by 2050 as upwards of 100 plants retire. The DOE found that sites of retiring coal plants are promising candidates for advanced nuclear plants, considering the similarities in site requirements, the ability to reuse existing infrastructure, and the overlap in workforce needs. Advanced nuclear reactors are the next generation of nuclear technology that includes both small modular reactors (SMRs), which function similar to traditional light-water reactors except on a smaller site, and non-light-water reactors, which are also physically smaller but use different methods to control reactor temperature. However, the DOE’s study and additional analysis from the Bipartisan Policy Center also identified significant challenges to constructing new nuclear power plants, including the risk of cost overrun, licensing timeline uncertainties, and opposition from communities around plant sites. Congress took steps to promote advanced nuclear power in the Inflation Reduction Act and the CHIPS and Science Act, but more coordination is needed. To commercialize advanced nuclear to support our decarbonization goals, the DOE estimates that utilities must commit to deploying at least five advanced nuclear reactors of the same design by 2025. There are currently no agreements to do so.

The Case for Coal to Nuclear

Coal-dependent communities and the estimated 37,000 people working in coal power plants could benefit from the construction of advanced nuclear reactors. Benefits include the potential addition of more than 650 jobs, about 15% higher pay on average, and the ability for some of the existing workforce to transition without additional experience, training, or certification. Jobs in nuclear energy also experience fewer fatal accidents, minor injuries, and harmful exposures than jobs in coal plants. Advanced nuclear energy could revitalize coal communities, which have suffered labor shocks and population decline since the 1980s. By embracing advanced nuclear power, these communities can reap economic benefits and create a pathway toward a sustainable and prosperous future. For instance, in one case study by the DOE, replacing a 924 MWe coal plant with nuclear increased regional economic activity by $275 million. Before benefits are realized, project developers must partner with local communities and other stakeholders to align interests and gain public support so that they may secure agreements for coal-to-nuclear transition projects.

Communities living near existing nuclear plants tend to view nuclear power more favorably than those who do not, but gaining acceptance to construct new plants in communities less familiar with nuclear energy is challenging. Past efforts using a top-down approach were met with resistance and created a legacy of mistrust between communities and the nuclear industry. Stakeholders can slow or stop nuclear construction through lawsuits and lengthy studies under the National Environmental Policy Act (NEPA), and 12 states have restrictions or total bans on new nuclear construction. Absent changes to the licensing and regulatory process, project developers must mitigate this risk through a process of meaningful stakeholder and community engagement. A just transition from coal to nuclear energy production requires developers to listen and respond to local communities’ concerns and needs through the process of planning, siting, licensing, design, construction, and eventual decommissioning. Project developers need guidance and collective learning to update the siting process with more earnest practices of engagement with the public and stakeholders. Coal communities also need support in transitioning a workforce for nuclear reactor operations.

Strengthen and Align Existing Efforts

Nuclear energy companies, utilities, the DOE, and researchers are already exploring community engagement and considering labor transitions for advanced nuclear power plants. NuScale Power, TerraPower, and X-energy are leading in both the technical development of advanced nuclear and in considerations of community benefits and stakeholder management. The Utah Associated Municipal Power Systems (UAMPS), which is hosting NuScale’s demonstration SMR, spent decades engaging with communities across 49 utilities over seven states before signing an agreement with NuScale. Their carbon-free power project involved over 200 public meetings, resulting in several member utilities choosing to pursue SMRs. Universities are collaborating with the Idaho National Laboratory to analyze energy markets using a multidisciplinary framework that considers community values, resources, capabilities, and infrastructure. Coordinated efforts by researchers near the TerraPower Natrium demonstration site investigate how local communities view the cost, benefits, procedures, and justice elements of the project.

The DOE also works to improve stakeholder and community engagement across multiple offices and initiatives. Most notably, the Office of Nuclear Energy is using a consent-based siting process, developed with extensive public input, to select sites for interim storage and disposal of spent nuclear fuel. The office distributed $26 million to universities, nonprofits, and private partners to facilitate engagement with communities considering the costs and benefits of hosting a spent fuel site. DOE requires all recipients of funds from the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, including companies hosting advanced nuclear demonstration projects, to submit community benefits plans outlining community and labor organization engagement. The DOE’s new Commercial Liftoff Reports for advanced nuclear and other clean energy technologies are detailed and actionable policy documents strengthened by the inclusion of critical societal considerations.

Through the CHIPS and Science Act, Congress established or expanded DOE programs that promote both the development of advanced nuclear on sites of former coal plants and the research of public engagement for nuclear energy. The Nuclear Energy University Program (NEUP) has funded technical nuclear energy research at universities since 2009. The CHIPS Act expanded the program to include research that supports community engagement, participation, and confidence in nuclear energy. The Act also established, but did not fund, a new advanced nuclear technology development program that prioritizes projects at sites of retiring coal plants and those that include elements of workforce development. An expansion of an existing nuclear energy training program was cut from the final CHIPS Act, but the expansion is proposed again in the Nuclear Fuel Security Act of 2023.

More coordination is required among DOE, the nuclear industry, and utilities. Congress should also take action to fund initiatives authorized by recent legislation that enable the coal-to-nuclear transition.

Plan of Action

Recommendations for Federal Agencies

Recommendation 1. A sizable coordinating body, such as the Foundation for Energy Security and Innovation (FESI) or the Appalachian Regional Commission (ARC), should support the project developer’s efforts to include community engagement in the siting, planning, design, and construction process of advanced nuclear power plants.

FESI is a new foundation to help the DOE commercialize energy technology by supporting and coordinating stakeholder groups. ARC is a partnership between the federal government and Appalachian states that supports economic development through grantmaking and conducting research on issues related to the region’s challenges. FESI and ARC are coordinating bodies that can connect disparate efforts by developers, academic experts, and the DOE through various enabling and connecting initiatives. Efforts should leverage existing resources on consent-based siting processes developed by the DOE. While these processes are specific to siting spent nuclear fuel storage facilities, the roadmap and sequencing elements can be replicated for other goals. Stage 1 of the DOE’s planning and capacity-building process focuses on building relationships with communities and stakeholders and engaging in mutual learning about the topic. FESI or ARC can establish programs and activities to support planning and capacity building by utilities and the nuclear industry.

FESI could pursue activities such as:

- Hosting a community of practice for public engagement staff at utilities and nuclear energy companies, experts in public engagement methods design, and the Department of Energy

- Conducting activities such as stakeholder analysis, community interest surveys, and engagement to determine community needs and concerns, across all coal communities

- Providing technical assistance on community engagement methods and strategies to utilities and nuclear energy companies

ARC could conduct studies such as stakeholder analysis and community interest surveys to determine community needs and concerns across Appalachian coal communities.

Recommendation 2. The DOE should continue expanding the Nuclear Energy University Program (NEUP) to fund programs that support nontechnical nuclear research in the social sciences or law that can support community engagement, participation, and confidence in nuclear energy systems, including the navigation of the licensing required for advanced reactor deployment.

Evolving processes to include effective community engagement will require new knowledge in the social sciences and shifting the culture of nuclear education and training. Since 2009, the DOE Office of Nuclear Energy has supported nuclear energy research and equipment upgrades at U.S. colleges and universities through the NEUP. Except for a few recent examples, including the University of Wyoming project cited above, most projects funded were scientific or technical. Congress recognized the importance of supporting research in nontechnical areas by authorizing the expansion of NEUP to include nontechnical nuclear research in the CHIPS and Science Act. DOE should not wait for additional appropriations to expand this program. Further, NEUP should encourage awardees to participate in communities of practice hosted by FESI or other bodies.

Recommendation 3. The DOE Office of Energy Jobs and the Department of Labor (DOL) should collaborate on the creation and dissemination of training standards focused on the nuclear plant jobs for which extensive training, licensing, or experience is required for former coal plant workers.

Sites of former coal plants are promising candidates for advanced nuclear reactors because most job roles are directly transferable. However, an estimated 23% of nuclear plant jobs—operators, senior managers, and some technicians—require extensive licensing from the Nuclear Regulatory Commission (NRC) and direct experience in nuclear roles. It is possible that an experienced coal plant operator and an entry-level nuclear hire would require the same training path to become an NRC-licensed nuclear plant operator.

Supporting the clean energy workforce transition fits within existing priorities for the DOE’s Office of Energy Jobs and the DOL, as expressed in the memorandum of understanding signed on June 21, 2022. Section V.C. asserts the departments share joint responsibility for “supporting the creation and expansion of high-quality and equitable workforce development programs that connect new, incumbent, and displaced workers with quality energy infrastructure and supply chain jobs.” Job transition pathways and specific training needs will become apparent through additional studies by interested parties and lessons from programs such as the Advanced Reactor Demonstration Program and the Clean Energy Demonstration Program on Current and Former Mine Land. The departments should capture and synthesize this knowledge into standards from which industry and utilities can design targeted job transition programs.

Recommendations for Congress

Recommendation 4. Congress should fully appropriate key provisions of the CHIPS and Science Act to support coal communities’ transition to nuclear energy.

- Appropriate $800 million over FY2024 to FY2027 to establish the DOE Advanced Nuclear Technologies Federal Research, Development, and Demonstration Program: The CHIPS and Science Act established this program to promote the development of advanced nuclear reactors and prioritizes projects at sites of retiring coal power plants and those that include workforce development programs. These critical workforce training programs need direct funding.

- Appropriate an additional $15 million from FY2024 to FY2025 to the NEUP: The CHIPS and Science Act authorizes an additional $15 million from FY 2023 to FY 2025 to the NEUP within the Office of Nuclear Energy, increasing the annual total amount from $30 million to $45 million. Since CHIPS included an authorization to expand the program to include nontechnical nuclear research, the expansion should come with increased funding.

Recommendation 5. Congress should expand the Nuclear Energy Graduate Traineeship Subprogram to include workforce development through community colleges, trade schools, apprenticeships, and pre-apprenticeships.

The current Traineeship Subprogram supports workforce development and advanced training through universities only. Expanding this direct funding for job training through community colleges, trade schools, and apprenticeships will support utilities’ and industries’ efforts to transition the coal workforce into advanced nuclear jobs.

Recommendation 6. Congress should amend Section 45U, the Nuclear Production Tax Credit for existing nuclear plants, to require apprenticeship requirements similar to those for future advanced nuclear plants covered under Section 45Y, the Clean Energy Production Tax Credit.

Starting in 2025, new nuclear power plant projects will be eligible for the New Clean Energy Production and Investment Tax Credits if they meet certain apprenticeship requirements. However, plants established before 2025 will not be eligible for these incentives. Congress should add apprenticeship requirements to the Nuclear Production Tax Credit so that activities at existing plants strengthen the total nuclear workforce. Credits should be awarded with priority to companies implementing apprenticeship programs designed for former coal industry workers.

Conclusion

The ambitious goal of reaching net-zero emissions globally requires the rapid deployment of clean energy technologies, in particular firm clean energy such as advanced nuclear power. Since the 1980s, communities around coal power plants have suffered from industry shifts and will continue to accumulate disadvantages without support. Coal-to-nuclear transition projects advance the nation’s decarbonization efforts while creating benefits for developers and revitalizing coal communities. Utilities, the nuclear industry, the DOE, and researchers are advancing community engagement practices and methods, but more effort is required to share best practices and ensure coordination in these emerging practices. FESI or other large coordinating bodies should fill this gap by hosting communities of practice, producing knowledge on community values and attitudes, or providing technical assistance. DOE should continue to promote community engagement research and help articulate workforce development needs. Congress should fully fund initiatives authorized by recent legislation to promote the coal to nuclear transition. Action now will ensure that our clean firm power needs are met and that coal communities benefit from the clean energy transition.

Transitioning coal miners directly into clean energy is challenging considering the difference in skills and labor demand between the sectors. Most attempts to transition coal miners should focus on training in fields with similar skill requirements, such as job training for manufacturing roles within the Appalachian Climate Technology Coalition. Congress could also provide funding for unemployed coal miners to pursue education for other employment.

A significant challenge is aligning the construction of advanced nuclear plants with the decommissioning of coal plants. Advanced nuclear project timelines are subject to various delays and uncertainties. For example, the first commercial demonstration of small modular reactor technology in the United States, the TerraPower plant in Wyoming, is delayed due to the high-assay low-enriched uranium supply chain. The Nuclear Regulatory Commission’s licensing process also creates uncertainty and extends project timelines.

Methods exist to safely contain radioactive material as it decays to more stable isotopes. The waste is stored on site at the power plant in secure pools in the shorter term and in storage casks capable of containing the material for at least 100 years in the longer term. The DOE must continue pursuing interim consolidated storage solutions as well as a permanent geological repository, but the lack of these facilities should not pose a significant barrier to constructing advanced nuclear power plants. The United States should also continue to pursue recycling spent fuel.

More analysis is required to better understand these impacts. A study conducted by Argonne National Laboratory found that while the attributes of spent fuel vary by the exact design of reactor, overall there are no unique challenges to managing fuel from advanced reactors compared to fuel from traditional reactors. A separate study found that spent fuel from advanced reactors will contain more fissile nuclides, which makes waste management more challenging. As the DOE continues to identify interim and permanent storage sites through a consent-based process, utilities and public engagement efforts must interrogate the unique waste management challenges when evaluating particular advanced nuclear technology options.

Similar to waste output, the risk of proliferation from advanced reactors varies on the specific technologies and requires more interrogation. Some advanced reactor designs, such as the TerraPower Natrium reactor, require the use of fuel that is more enriched than the fuel used in traditional designs. However, the safeguards required between the two types of fuel are not significantly different. Other designs, such as the TerraPower TWR, are expected to be able to use depleted or natural uranium sources, and the NuScale VOYGR models use traditional fuel. All reactors have the capacity to produce fissile material, so as the United States expands its nuclear energy capabilities, efforts should be made to expand current safeguards limiting proliferation to fuel as it is prepared for plants and after it has been used.

118th Congress: Ensuring Energy Security

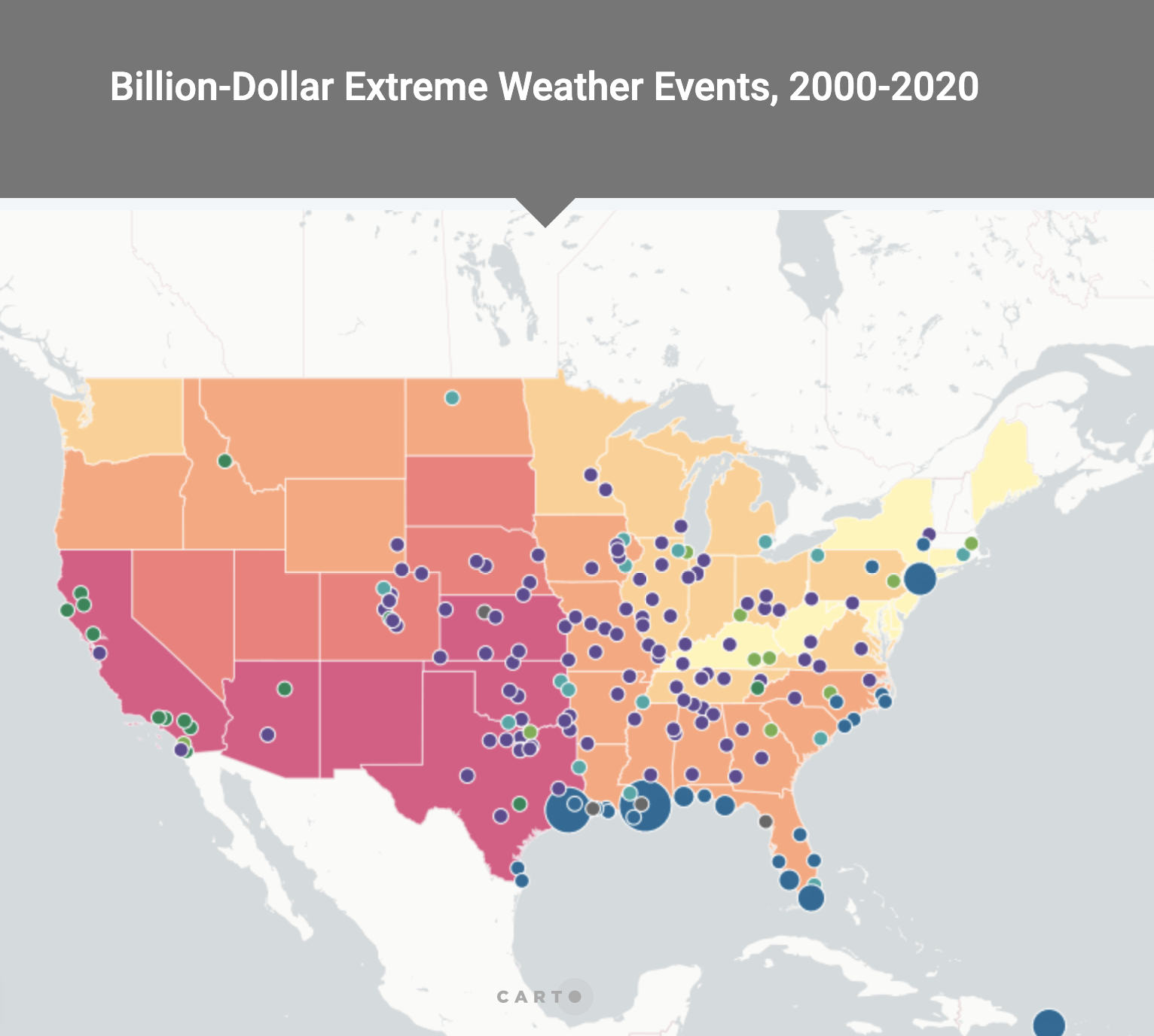

Recent crises, such as the pandemic and the Russia-Ukraine war, have led to volatile fossil fuel prices and raised national concerns about energy security. The growing frequency of blackouts across the country due to extreme weather points to an increasingly vulnerable and aging electric grid. Grid capacity right now is incapable of supporting the rapid deployment of renewable energy projects that can generate clean, reliable, domestic energy. Further, as global competition rises, the United States finds itself overly reliant on foreign manufacturing and supply chains for these very technologies we want to deploy.

In order to improve energy security, affordability, and reliability for everyday Americans, the 118th Congress should act decisively to strengthen our energy infrastructure while leveraging emerging energy technology for the energy system of the future. Below are some recommendations for action.

Transmission Lines. The current U.S. electrical grid is an aging piece of infrastructure with sluggish growth and increasing vulnerability to threats from extreme weather and foreign attacks. The 118th Congress should implement policies to revitalize domestic manufacturing and construction, strengthen national energy security and reliability, and generate new jobs and economic growth. The $83 billion worth of planned transmission projects that the ISO/RTO Board has approved or recommended is projected to add $42 billion to U.S. GDP, create more than 400,000 well-paying jobs, and boost direct local spending by nearly $40 billion. However, the rate of construction for new transmission lines must substantially increase to fully harness the new energy economy and achieve ambitious emissions reductions.

High voltage direct current (HVDC) transmission lines are particularly important for connecting renewable energy producing regions with low demand, such as the Southwest and Midwest, to high demand regions. At these distances greater than 300 miles, HVDC transmission lines transmit power with fewer losses than AC lines. HVDC lines can also avoid some of the challenges to AC transmission line development because they can be buried underground, eliminating resident concerns of visual pollution and avoiding vulnerability to extreme weather. Further, if HVDC lines are built along existing rail corridors, their construction only requires negotiation with the seven major American rail companies rather than a myriad of private landowners and federal land management agencies. Congress took an important first step to advancing HVDC technology by directing DOE to develop an HVDC moonshot initiative on cost reduction, as part of the FY 2023 omnibus bill. Now, the 118th Congress can further support this goal by working with the Federal Energy Regulatory Commission (FERC) to eliminate regulatory obstacles preventing the private sector from building more of these lines along existing corridors. Congress should also create federal tax credits to stimulate domestic manufacturing and construction of HVDC transmission, as well as transmission line construction in general.

Manufacturing. To spur domestic manufacturing capabilities and regain competitive advantages in clean energy technologies, the 118th Congress should fund a new manufacturing-focused branch of DOE’s highly effective State Energy Program (SEP). Congress can double down on this action by scaling investments in domestic capacity to manufacture key industrial products, such as low-carbon cement and steel.

Workforce. Our nation needs a workforce equipped with the skills to build a robust energy economy. To that end, Congress could provide the Department of Energy (DOE) with $30 million annually to establish an Energy Extension System (EES). Modeled after the USDA’s Cooperative Extension System (CES), and in partnership with the DOE’s National Labs, the EES would provide technical assistance to help institutions and individuals across the country take full advantage of emerging opportunities in the energy economy, including carbon capture and storage (CCS), installation and maintenance of electric vehicle (EV) charging infrastructure, geothermal power, and more.

Permitting Reform. In order to improve government efficiency, reduce costs, and enable the construction of new infrastructure for the clean energy transition, the 118th Congress should pass legislation on permitting reform to improve National Environmental Policy Act (NEPA) compliance timelines. These reforms should include:

- Shortening the statute of limitations on litigation under NEPA to 6 months or less in order to be more consistent with state-level policies;

- Requiring that any public-interest group bringing a case against a NEPA decision to have submitted input during public comment periods;

- Clarifying the duties of federal, state, tribal and local governments when conducting environmental reviews and communicating information to project applicants and the public;

- Clarifying vague statutes, such as the requirement that agencies consider “all reasonable alternatives”;

- Clarifying the appropriate admissibility or substitutability of documents that may reduce burdens on executive staff; and

- Permitting fast-track approval to site zero-emission fueling stations (see next section), in consultation with local utility regulators.

Zero-Emission Fueling Stations. Zero-emission vehicles powered by electric batteries and hydrogen fuel cells are the future of American auto manufacturing. The 118th Congress should pass key legislation to provide the federal government and states with the authorities and resources necessary to build a nationwide network of zero-emission fueling stations, so these new vehicles can refuel anywhere in the country. This includes:

- Amending Title 23 in the United States Code so that the federal government and states can apply gas tax dollars towards funding zero-emission fueling stations;

- Directing the Department of Transportation to use “Jason’s Law” surveys to identify medium- and heavy-duty vehicle parking locations that should be used for zero-emission fueling stations; and

- Authorizing pilot programs and public-private partnerships to develop “best practices” and techniques with key stakeholders for building out a commercially viable nationwide network of zero-emission fueling stations.

Electricity Markets. Power grids are being transformed from simple, fixed energy sources and points of demand to complex webs that feature distributed energy storage, demand response, and power quality factors. “Qualifying facilities” are a special class of small power production facilities and cogeneration facilities created by the Power Utility Regulatory Policy Act (PURPA) of 1978 with the right to sell energy or capacity to a utility and purchase services from utilities while being relieved of certain regulatory burdens. The definition of “qualifying facilities” should be expanded beyond power generation facilities to include households and businesses that provide grid services (e.g., feeding power back to the grid during times of peak energy demand). This would ensure that utilities properly compensate customers if they supply these services, thus allowing individual Americans to participate in electricity markets and spurring the adoption of novel clean-energy technologies.

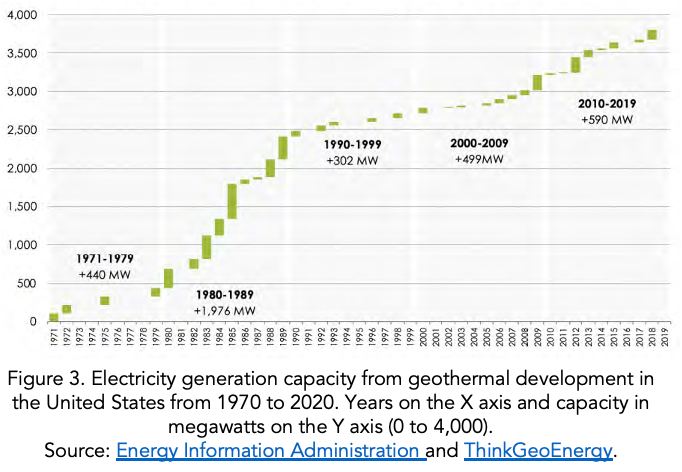

Geothermal Energy. The Earth’s crust holds more than enough untapped geothermal energy to meet U.S.energy needs. Yet, only 0.4% of U.S. electricity is generated by geothermal energy. There’s a major opportunity to leverage this emerging domestic source for U.S. consumers. Congress should support the Geothermal Earthshot and drive innovation by:

- Establishing a $2 billion risk mitigation fund for geothermal energy development within the DOE’s Office of Energy Efficiency and Renewable Energy, modeled off of successful programs in Iceland, Costa Rica, and Kenya;

- Establishing a $450 million USDA Rural Development grant program to transition industrial cooling and heating systems in the agricultural sector to geothermal energy

- Expanding the authority of the Leaking Underground Storage Tank (LUST) Trust Fund within the EPA to include the conversion of existing and abandoned oil and gas fields into geothermal wells; and

- Provide $15 million for a national geothermal team within the Bureau of Land Management to develop training materials, standard operating procedures, and provide technical support to district offices to ensure timely review of geothermal power and cooling/heating projects on federal lands.

A policy memo on Empowering the Geothermal Earthshot is forthcoming from FAS.

Appropriations Recommendations

- CHIPS and Science: Research and Development in the Office of Science at the Department of EnergyA number of line items for basic science research at the Department of Energy (DOE) were authorized as part of the CHIPS and Science Act – including materials, physical, chemical, and others. These research programs are central to building a new wave of clean energy technologies and ensuring domestic energy security for decades to come. Subsections of this part of the bill include authorizations for research on nuclear energy, energy storage, carbon sequestration, and other technologies. We recommend that the Office of Science, and especially items in Section 10102 of the CHIPS and Science Act covering Basic Energy Sciences, be funded in alignment with the amounts authorized.

- CHIPS and Science: Funding for the Office of Technology Transitions and prize authorized programs Two additional line items in the CHIPS and Science Act that were authorized but are not yet funded are sections 10713 and 10714. Both authorize prize programs housed in the Office of Technology Transitions (OTT) at the Department of Energy–programs that, if funded, could support innovation and commercialization of clean energy technology. Section 10713 authorizes an awards program for clean energy startup incubators, and section 10714 authorizes a new clean energy technology prize competition for universities. Congress should appropriate the authorized funds for these programs.In addition, Congress should appropriate funds authorized in section 10715 of the CHIPS and Science Act. This section authorizes $3 million per year through FY 2027 for coordination capacity at OTT, including to develop metrics for the impact of OTT programs and to engage more effectively with the clean energy ecosystem. Additional capacity for OTT is critical to the office’s success, and to the development of clean energy technologies more broadly.

- IIJA: Funding for the Critical Minerals Mining and Recycling Grant Program in the DOECritical minerals are crucial for clean energy and semiconductor technologies. The U.S. lacks a sufficient domestic supply of critical minerals and is currently overly reliant on foreign critical minerals, which have volatile prices and are often controlled by adversarial countries. The Infrastructure Investment and Jobs Act (IIJA) authorized $100 million from FY 2022 to FY 2024 for the DOE Critical Minerals Mining and Recycling Grant Program to fund pilot projects that process, recycle, or develop critical minerals. This program is not limited to critical minerals for lithium-ion battery production, and has the potential to impact critical minerals used in a variety of clean energy and semiconductor technologies. Congress should appropriate the authorized funds for this program, since it fills the pre-commercialization funding gap for scaling these technologies that is not met by other programs in the IIJA.

- FY 2024: Research and Development in the DOE’s Office of Energy Efficiency and Renewable Energy (EERE) and the Advanced Research Project Agency for Energy (ARPA-E)

These two offices are key investors in clean energy technologies at different stages of research and commercialization and provide a direct way for the government to scale up American-made energy technologies. To accelerate the energy transition, Congress should provide robust increases for these offices, and at least meet EERE and ARPA-E’s FY 2024 budget requests, such that they can scale up their proven ability of identifying and supporting promising candidates for energy innovation.

Empower the Geothermal Earthshot: Solve the Climate Crisis with Earth’s Energy

Summary

As a result of human activity, greenhouse gas emissions are increasing so rapidly that climate disaster is imminent. To avoid catastrophe, all economic sectors––industry, agriculture, transport, buildings, and electricity––require immediate energy and climate policy solutions. Only with a resilient and renewable, bipartisan, clean, and reliable partner can America fully decarbonize its economy and avert the devastating effects of climate change. As America’s clean energy transformation proceeds, there is one energy technology up for the task across all these sectors––geothermal.

Geothermal is the energy source naturally produced by the Earth. It is a proven technology with decades of utilization across the United States, including New York, Idaho, North Dakota, California, Arkansas, New Mexico, and everywhere in between.

Government agencies and academic institutions have already identified more than enough untapped Earth-powered energy in the United States alone to meet the nation’s energy needs while also achieving its emissions goals. In fact, the total amount of heat energy in the Earth’s crust is many times greater than the energy available globally from all fossil fuels.

Despite these benefits, geothermal represented just 0.4% of total U.S. utility-scale electricity generation in 2021 and only 1% of the residential and commercial building heating and cooling market. What is holding geothermal back is a lack of policy attention at both the federal and state levels. Geothermal has been drastically underfunded and continues to be left out of energy, climate, and appropriations legislation. By acting as the primary facilitator and coordinator for geothermal technology policy and deployment, the U.S. government can significantly accelerate the clean energy transformation.

Our Empowering the Geothermal Earthshot proposal is a multibillion dollar interagency effort to facilitate the energy revolution America needs to finally solve the climate crisis and complete its clean energy transformation. This top-down support would allow the geothermal industry to fully utilize the power of the free market, commercialize innovation into mass production, and scale technologies.

Challenge and Opportunity

Geothermal energy––clean renewable energy derived from the unlimited heat in the Earth––is a proven technology that can contribute to achieving aggressive climate goals but only if it gets much-needed policy support. Geothermal urgently requires the same legislative and executive attention, policy momentum, and funding that all other energy technologies receive. The Biden Administration as well as Republicans and Democrats in Congress need to lift up the profile of geothermal on par with other energy technologies if we are to reach net-zero by 2050 and eventually 24/7 carbon-free energy.

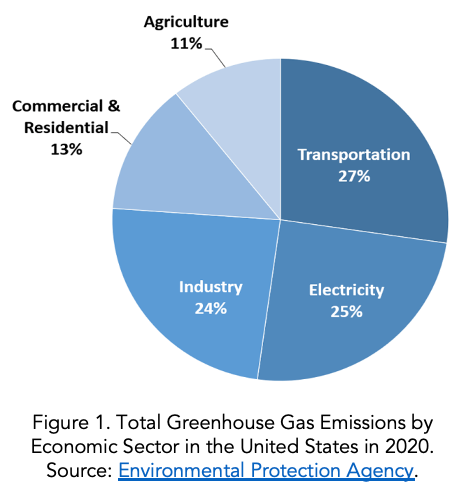

On day one of his administration, President Biden charged his National Climate Task Force to utilize all available government resources to develop a new target for reductions in greenhouse gas (GHG) emissions. As a result, in April 2021 the Biden Administration announced an aggressive new GHG target: a 50% reduction from 2005 levels by 2030. To meet this challenge, the administration outlined four high-priority goals:

Pie chart showing Total Greenhouse Gas Emissions by Economic Sector in the U.S. in 2020. Transportation is responsible for 27%; Electricity, 25%; Industry, 24%; Commercial; Residential, 13%; Agriculture, 11%.

- Invest in clean technology infrastructure.

- Fuel an economic recovery that creates jobs.

- Protect our air and water and advance environmental justice.

- Do this all in America.

Geothermal energy’s primary benefits make it an ideal energy candidate in America’s fight against climate change. First, geothermal electricity offers clean firm, reliable, and stable baseload power. As such, it easily complements wind and solar energy, which can fluctuate and produce only intermittent power. Not only does geothermal energy offer more resilient and renewable energy, but––unlike nuclear and biomass energy and battery storage––it does so with no harmful waste by-products. Geothermal energy does not depend on extractive activities (i.e., mining) that have a history of adversely impacting the environment and Indigenous communities. The underlying energy source––the literal heat beneath our feet––is local, is 100% American, and has demonstrated gigawatt-scale operation since the 1980s, unlike every other prospective clean energy technology. Geothermal energy offers a technology that we can export as a service provider and manufacturer to the rest of the world to reduce global GHG emissions, increase U.S. energy independence, and improve the country’s economy and national defense.