CHIPS and Science Funding Gaps Continues to Stifle Scientific Competitiveness

The bipartisan CHIPS and Science Act sought to accelerate U.S. science and innovation, to let us compete globally and solve problems at home. The multifold CHIPS approach to science and tech reached well beyond semiconductors: it authorized long-term boosts for basic science and education, expanded the geography of place-based innovation, mandated a whole-of-government science strategy, and other moves.

But appropriations in FY 2024, and the strictures of the Fiscal Responsibility Act in FY 2025, make clear that we’re falling well short of CHIPS aspirations. The ongoing failure of the U.S. to invest comes at a time when our competitors continue to up their investments in science, with China pledging 10% growth in investment, the EU setting forth new strategies for biotechnology and manufacturing, and Korea’s economy approaching 5% R&D investment intensity, far more than the U.S.

Research Agency Funding Shortfalls

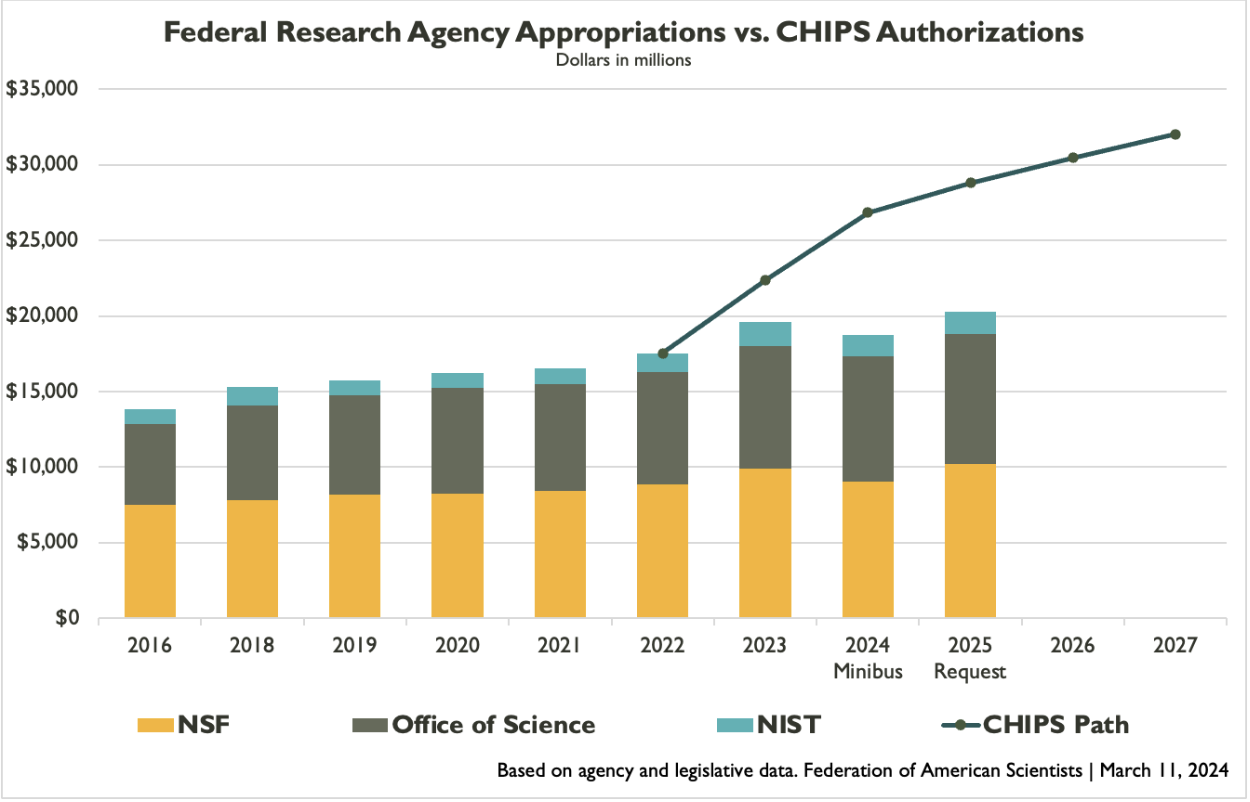

In the aggregate, CHIPS and Science authorized three research agencies – the National Science Foundation (NSF), the Department of Energy Office of Science (DOE SC), and the National Institute of Standards and Technology (NIST) – to receive $26.8 billion in FY 2024 and $28.8 billion in FY 2025, representing substantial growth in both years. But appropriations have increasingly underfunded the CHIPS agencies, with a gap now over $8 billion (see graph).

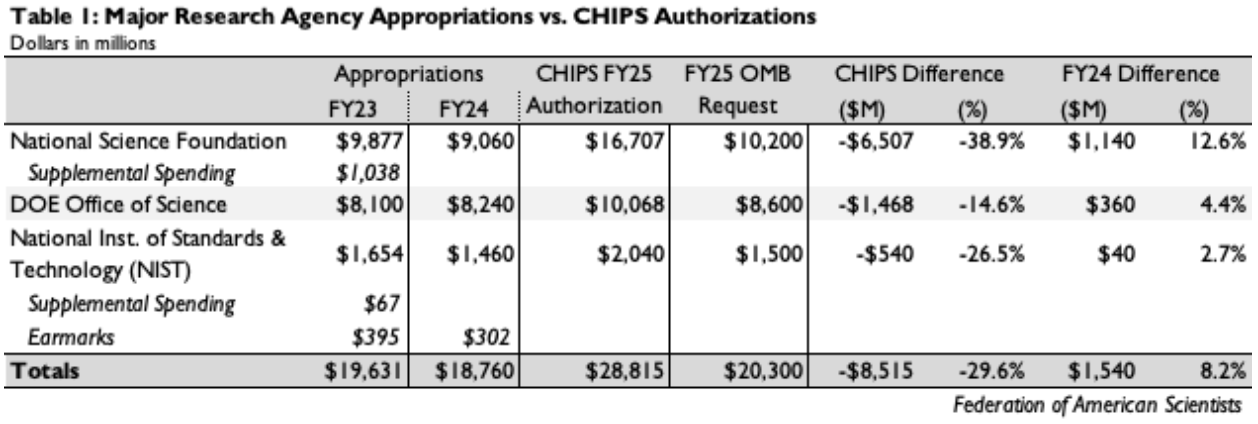

The table below shows agency funding data in greater detail, including FY 2023 and FY 2024 appropriations, the FY 2025 CHIPS authorization, and the FY 2025 request.

The National Science Foundation is experiencing the largest gap between CHIPS targets and actual appropriations following a massive year-over-year funding reduction in FY 2024. That cut is partly the result of appropriators rescuing NSF in FY 2023 with over $1 billion in supplemental spending to support both NSF base activities and implementation of the Technology, Innovation and Partnerships Directorate (TIP). While that spending provided NSF a welcome boost in FY 2023, it could not be replicated in FY 2024, and NSF only received a modest boost in base appropriations. As a result, the full year-over-decline for NSF amounted to over $800 million, which will likely mean cutbacks in both core and TIP (the exact distribution is to be determined though Congress called for an even-handed approach). It also means a CHIPS shortfall of $6.5 billion in both FY 2024 and FY 2025.

The National Institute of Standards and Technology also requires some additional explanation. Like NSF, NIST received some supplemental spending for both lab programs and industrial innovation in FY 2023, but NIST also has been subject to quite substantial earmarks in FY 2023 and FY 2024, as seen in the table above. The presence of earmarks in FY 2024 meant, in practice, a nearly $100 million reduction in funding for core NIST lab programs, which cover a range of activities in measurement science and emerging technology areas.

The Department of Energy’s Office of Science fared better than the other two in the omnibus with a modest increase, but still faces a $1.5 billion shortfall below CHIPS targets in the White House request.

Select Account Shortfalls

National Science Foundation

Core research. Excluding the newly-created TIP Directorate, purchasing power of core NSF research activities in biology, computing, engineering, geoscience, math and physical sciences, and social science dropped by over $300 million between FY 2021 and FY2023. If the FY 2024 funding cuts are distributed proportionally across directorates, their collective purchasing power would have dropped by over $1 billion all-in between FY 2021 and the present, representing a decline of more than 15%. This would also represent a shortfall of $2.9 billion below the CHIPS target for FY 2024, and will likely result in hundreds of fewer research awards.

STEM Education. While not quite as large as core research, NSF’s STEM directorate has still lost over 8% of its purchasing power since FY 2021, and remains $1.3 billion below its CHIPS target after a 15% year-over-year cut in the FY 2024 omnibus. This cut will likely mean hundreds of fewer graduate fellowships and other opportunities for STEM support, let alone multimillion-dollar shortfalls in CHIPS funding targets for programs like CyberCorps and Noyce teacher scholarships. The minibus did allocate $40 million for the National STEM Teacher Corps pilot program established in CHIPS, but implementing this carveout will pose challenges in light of funding cuts elsewhere.

TIP Programs. FY 2023 funding fell over $800 million shy of the CHIPS target for the new technology directorate, which had been envisioned to grow rapidly but instead will now have to deal with fiscal retrenchment. Several items established in CHIPS remain un- or under-funded. For instance, NSF Entrepreneurial Fellowships have received only $10 million from appropriators to date out of $125 million total authorized, while Centers for Transformative Education Research and Translation – a new initiative intended to research and scale educational innovations – has gotten no funding to date. Also underfunded are the Regional Innovation Engines (see below).

Department of Energy

Microelectronics Centers. While the FY 2024 picture for the Office of Science (SC) is perhaps not quite as stark as it is for NSF – partly because SC didn’t enjoy the benefit of a big but transient boost in FY 2023 – there remain underfunded CHIPS priorities throughout. One more prominent initiative is DOE’s Microelectronics Science Research Centers, intended to be a multidisciplinary R&D network for next-generation science funded across the SC portfolio. CHIPS authorized these at $25 million per center per year.

Fission and Fusion. Fusion energy was a major priority in CHIPS and Science, which sought among other things expansion of milestone-based development to achieve a fusion pilot plant. But following FY 2024 appropriations, the fusion science program continues to face a more than $200 million shortfall, and DOE’s proposal for a stepped-up research network – now dubbed the Fusion Innovation Research Engine (FIRE) centers – remains unfunded. CHIPS and Science also sought to expand nuclear research infrastructure at the nation’s universities, but the FY 2024 omnibus provided no funding for the additional research reactors authorized in CHIPS.

Clean Energy Innovation. CHIPS Title VI authorized a wide array of energy innovation initiatives – including clean energy business vouchers and incubators, entrepreneurial fellowships, a regional energy innovation program, and others. Not all received a specified funding authorization, but those that did have generally not yet received designated line-item appropriations.

NIST

In addition to the funding challenges for NIST lab programs described above – which are critical for competitiveness in emerging technology – NIST manufacturing programs also continue to face shortfalls, of $192 million in the FY 2024 omnibus and over $500 million in the FY 2025 budget request.

Regional Innovation

As envisioned when CHIPS was signed, three major place-based innovation and economic development programs – EDA’s Regional Technology and Innovation Hubs (Tech Hubs), NSF’s Regional Innovation Engines (Engines), and EDA’s Distressed Area Recompete Pilot Program (Recompete) – would be moving from exclusively planning and selection into implementation phases as well in FY25. But with recent budget announcements, some implementation may need to be scaled back from what was originally planned, putting at risk our ability to rise to the confluence of economic and industrial challenges we face.

EDA Tech Hubs. In October 2023, the Biden-Harris administration announced the designation of 31 inaugural Tech Hubs and 29 recipients of Tech Hubs Strategy Development Grants from nearly 400 applicants. These 31 Tech Hubs designees were chosen for their potential to become global centers of innovation and job creators. Upon announcement, the designees were then able to apply to receive implementation grants of $40-$70 million to each of approximately 5-10 of the designated Tech Hubs. Grants are expected to be announced in summer 2024.

The FY 2025 budget request for Tech Hubs includes $41 million in discretionary spending to fund additional grants to the existing designees, and another $4 billion in mandatory spending – spread over several years – to allow for additional Tech Hubs designees and strategy development grants. CHIPS and Science authorized the Hubs at $10 billion in total, but the program has only received 5% of this in actual appropriations to date. The FY25 request would bring total program funding up to 46% of the authorization.

The ambitious goal of Tech Hubs is to restore the U.S. position as a leader in critical technology development, but this ambition is dependent on our ability to support the quantity and quality of the program as originally envisioned. Without meeting the funding expectations set in CHIPS, the Tech Hubs’ ability to restore American leadership will be vastly limited.

NSF Engines. In January 2024, NSF announced the first NSF Engines awards to 10 teams across the United States. Each NSF Engine will receive an initial $15 million over the next two years with the potential to receive up to $160 million each over the next decade.

Beyond those 10 inaugural Engines awards, a selection of applicants were invited to apply for NSF Engines development awards, with each receiving up to $1 million to support team-building, partnership development, and other necessary steps toward future NSF Engines proposals. NSF’s initial investment in the 10 awardee regions is being matched almost two to one in commitments from local and state governments, other federal agencies, private industry, and philanthropy. NSF previously announced 44 Development Awardees in May 2023.

To bolster the efforts of NSF Engines, NSF also announced the Builder Platform in September 2023, which serves as a post-award model to provide resources, support, and engagement to awardees.

The FY25 request level for NSF Engines is $205 million, which will support up to 13 NSF Regional Innovation Engines. While this $205 million would be a welcome addition – especially in light of the funding risks and uncertainty in FY24 mentioned above – total funding to date is considerably below CHIPS aspirations, accounting for just over 6% of authorized funding.

EDA Recompete. The EDA Recompete Program, authorized for up to $1 billion in the CHIPS and Science Act, aims to allocate resources towards economically disadvantaged areas and create good jobs. By targeting regions where prime-age (25-54 years) employment lags behind the national average, the program seeks to revitalize communities long overlooked, bridging the gap through substantial and flexible investments.

Recompete received $200 million in appropriations in 2023 for the initial competition. This competition received 565 applications, with total requests exceeding $6 billion. Of those applicants, 22 Phase 1 Finalists were announced in December 2023.

Recompete Finalists are able to apply for the Phase 2 Notice of Funding Opportunity and are provided access to technical assistance support for their plans. In Phase 2, EDA will make approximately 4-8 implementation investments, with awarded regions receiving between $20 to $50 million on average.

Alongside the 22 Finalists, Recompete Strategy Development Grant recipients were announced. These grants support applicant communities in strategic planning and capacity building.

Following a shutout in FY 2024 appropriations, Recompete funding in the FY25 request is $41 million, bringing total funding to date to $241 million or just over 24% of authorized funding.

Congress will soon have the chance to rectify these collective shortfalls, with FY 2025 appropriations legislation coming down the pike soon. But the November elections throw substantial uncertainty over what was already a difficult situation. If Congress can’t muster the votes necessary to properly fund CHIPS and Science programs, U.S. competitiveness will continue to suffer.

Despite growing international competition, appropriations for research agencies have fallen quite short of the CHIPS and Science targets.

The CHIPS and Science Act establishes a compelling vision for U.S. innovation and place-based industrial policy, but that vision is already being hampered by tight funding.

Here’s how CHIPS and Science funding is shaping up in the battle over the federal budget.

On Thursday, President Biden kicked off the FY 2024 cycle with the latest budget request. This skinny version of the budget – full details of which will come on Monday – contained similar themes as prior budgets: a focus on clean energy and climate, manufacturing and supply chains, applied R&D, place-based innovation, and cancer research, among […]