Using Home Energy Rebates to Support Market Transformation

Without market-shaping interventions, federal and state subsidies for energy-efficient products like heat pumps often lead to higher prices, leaving the overall market worse off when rebates end. This is a key challenge that must be addressed as the Department of Energy (DOE) and states implement the Inflation Reduction Act’s Home Electrification and Appliance Rebates (HEAR) program.

DOE should prioritize the development of evidence-based market-transformation strategies that states can implement with their HEAR funding. The DOE should use its existing allocation of administrative funds to create a central capability to (1) develop market-shaping toolkits and an evidence base on how state programs can improve value for money and achieve market transformation and (2) provide market-shaping program implementation assistance to states.

There are proven market-transformation strategies that can reduce costs and save consumers billions of dollars. DOE can look to the global public health sector for an example of what market-shaping interventions could do for heat pumps and other energy-efficient technologies. In that arena, the Clinton Health Access Initiative (CHAI) has shown how public funding can support market-based transformation, leading to sustainably lower drug and vaccine prices, new types of “all-inclusive” contracts, and improved product quality. Agreements negotiated by CHAI and the Bill and Melinda Gates Foundation have generated over $4 billion in savings for publicly financed health systems and improved healthcare for hundreds of millions of people.

Similar impact can be achieved in the market for heat pumps if DOE and states can supply information to empower consumers to purchase the most cost-effective products, offer higher rebates for those cost-effective products, and seek supplier discounts for heat pumps eligible for rebates.

Challenge and Opportunity

HEAR received $4.5 billion in appropriations from the Inflation Reduction Act and provides consumers with rebates to purchase and install high-efficiency electric appliances. Heat pumps, the primary eligible appliance, present a huge opportunity for lowering overall greenhouse gas emissions from heating and cooling, which makes up over 10% of global emissions. In the continental United States, studies have shown that heat pumps can reduce carbon emissions up to 93% compared to gas furnaces across their lifetime.

However, direct-to-consumer rebate programs have been shown to enable suppliers to increase prices unless these subsidies are used to reward innovation and reduce cost. If subsidies are dispersed and the program design is not aligned with a market-transformation strategy, the result will be a short-term boost in demand followed by a fall-off in consumer interest as prices increase and the rebates are no longer available. This is a problem because program funding for heat pump rebates will support only ~500,000 projects over the life of the program—but more than 50 million households will need to convert to heat pumps in order to decarbonize the sector.

HEAR aims to address this through Market Transformation Plans, which states are required to submit to DOE within a year after receiving the award. States will then need to obtain DOE approval before implementing them. We see several challenges with the current implementation of HEAR:

- Need for evidence: There is a lack of evidence and policy agreement on the best approaches for market transformation. The DOE provides a potpourri of areas for action, but no evidence of cost-effectiveness. Thus, there is no rational basis for states to allocate funding across the 10 recommended areas for action. There are no measurable goals for market transformation.

- Redundancy: It is wasteful and redundant to have every state program allocate administrative expenses to design market-transformation strategies incorporating some or all of the 10 recommended areas for action. There is nothing unique to Georgia, Iowa, or Vermont in creating a tool to better estimate energy savings. A best-in-class software tool developed by DOE or one of the states could be adapted for use in each state. Similarly, if a state develops insights into lower-cost ways to install heat pumps, these insights will be valuable in many other state programs. The best tools should be a public good made known to every state program.

Despite these challenges, DOE has a clear opportunity to increase the impact of HEAR rebates by providing program design support to states for market-transformation goals. To ensure a competitive market and better value for money, state programs need guidance on how to overcome barriers created by information asymmetry – meaning that HVAC contractors have a much better understanding of the technical and cost/benefit aspects of heat pumps than consumers do. Consumers cannot work with contractors to select a heat pump solution that represents the best value for money if they do not understand the technical performance of products and how operating costs are affected by Seasonal Energy Efficiency Rating, coefficient of performance, and utility rates. If consumers are not well-informed, market outcomes will not be efficient. Currently, consumers do not have easy access to critical information such as the tradeoff in costs between increased Seasonal Energy Efficiency Rating and savings on monthly utility bills.

Overcoming information asymmetry will also help lower soft costs, which is critical to lowering the cost of heat pumps. Based on studies conducted by New York State, Solar Energy Industries Association and DOE, soft costs run over 60% of project costs in some cases and have increased over the past 10 years.

There is still time to act, as thus far only a few states have received approval to begin issuing rebates and state market-transformation plans are still in the early stages of development.

Plan of Action

Recommendation 1. Establish a central market transformation team to provide resources and technical assistance to states.

To limit cost and complexity at the state level for designing and staffing market-transformation initiatives, the DOE should set up central resources and capabilities. This could either be done by a dedicated team within the Office of State and Community Energy Programs or through a national lab. Funding would come from the 3% of program funds that DOE is allowed to use for administration and technical assistance.

This team would:

- Collect, centralize, and publish heat pump equipment and installation cost data to increase transparency and consumer awareness of available options.

- Develop practical toolkits and an evidence base on how to achieve market transformation most cost-effectively.

- Provide market-shaping program design assistance to states to create and implement market transformation programs.

Data collection, analysis, and consistent reporting are at the heart of what this central team could provide states. The DOE data and tools requirements guide already asks states to provide information on the invoice, equipment and materials, and installation costs for each rebate transaction. It is critical that the DOE and state programs coordinate on how to collect and structure this data in order to benefit consumers across all state programs.

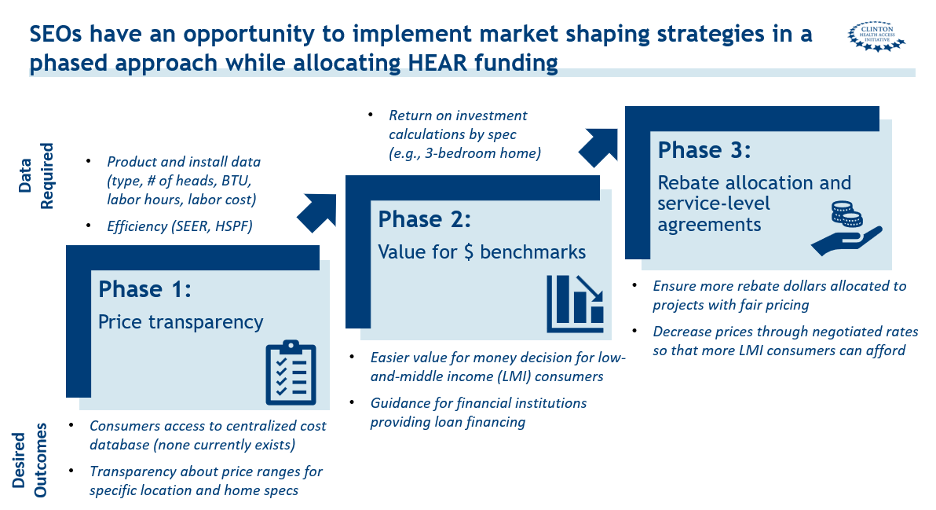

A central team could provide resources and technical assistance to State Energy Offices (SEOs) on how to implement market-shaping strategies in a phased approach.

Phase 1. Create greater price transparency and set benchmarks for pricing on the most common products supported by rebates.

The central market-transformation team should provide technical support to states on how to develop benchmarking data on prices available to consumers for the most common product offerings. Consumers should be able to evaluate pricing for heat pumps like they do for major purchases such as cars, travel, or higher education. State programs could facilitate these comparisons by having rebate-eligible contractors and suppliers provide illustrative bids for a set of 5–10 common heat pump installation scenarios, for example, installing a ductless mini-split in a three-bedroom home.

States should also require contractors to provide hourly rates for different types of labor, since installation costs are often ~70% of total project costs. Contractors should only be designated as recommended or preferred service providers (with access to HEAR rebates) if they are willing to share cost data.

In addition, the central market-transformation team could facilitate information-sharing and data aggregation across states to limit confusion and duplication of data. This will increase price transparency and limit the work required at the state level to find price information and integrate with product technical performance data.

Phase 2. Encourage price and service-level competition among suppliers by providing consumers with information on how to judge value for money.

A second area to improve market outcomes is by promoting competition. Price transparency supports this goal, but to achieve market transformation programs need to go further to help consumers understand what products, specific to their circumstances, offer best value for money.

In the case of a heat pump installation, this means taking account of fuel source, energy prices, house condition, and other factors that drive the overall value-for-money equation when achieving improved energy efficiency. Again, information asymmetry is at play. Many energy-efficiency consultants and HVAC contractors offer to advise on these topics but have an inherent bias to promoting their products and services. There are no easily available public sources of reliable benchmark price/performance data for ducted and ductless heat pumps for homes ranging from 1500 to 2700 square feet, which would cover 75% of the single-family homes in the United States.

In contrast, the commercial building sector benefits from very detailed cost information published on virtually every type of building material and specialty trade procedure. Data from sources such as RSMeans provides pricing and unit cost information for ductwork, electrical wiring, and mean hourly wage rates for HVAC technicians by region. Builders of newly constructed single-family homes use similar systems to estimate and manage the costs of every aspect of the new construction process. But a homeowner seeking to retrofit a heat pump into an existing structure has none of this information. Since virtually all rebates are likely to be retrofit installations, states and the DOE have a unique interest in making this market more competitive by developing and publishing cost/performance benchmarking data.

State programs have considerable leverage that can be used to obtain the information needed from suppliers and installers. The central market-transformation team should use that information to create a tool that provides states and consumers with estimates of potential bill savings from installation of heat pumps in different regions and under different utility rates. This information would be very valuable to low- and middle-income (LMI) households, who are to receive most of the funding under HEAR.

Phase 3. Use the rebate program to lower costs and promote best-value products by negotiating product and service-level agreements with suppliers and contractors and awarding a higher level of rebate to installations that represent best value for money.

By subsidizing and consolidating demand, SEOs will have significant bargaining power to achieve fair prices for consumers.

First, by leveraging relationships with public and private sector stakeholders, SEOs can negotiate agreements with best-value contractors, offering guaranteed minimum volumes in return for discounted pricing and/or longer warranty periods for participating consumers. This is especially important for LMI households, who have limited home improvement budgets and experience disproportionately higher energy burdens, which is why there has been limited uptake of heat pumps by LMI households. In return, contractors gain access to a guaranteed number of additional projects that can offset the seasonal nature of the business.

Second, as states design the formulas used to distribute rebates, they should be encouraged to create systems that allocate a higher proportion of rebates to projects quoted at or below the benchmark costs and a smaller proportion or completely eliminate the rebates to projects higher than the benchmark. This will incentivize contractors to offer better value for money, as most projects will not proceed unless they receive a substantial rebate. States should also adopt a similar process as New York and Wisconsin in creating a list of approved contractors that adhere to “reasonable price” thresholds.

Recommendation 2. For future energy rebate programs, Congress and DOE can make market transformation more central to program design.

In future clean energy legislation, Congress should direct DOE to include the principles recommended above into the design of energy rebate programs, whether implemented by DOE or states. Ideally, that would come with either greater funding for administration and technical assistance or dedicated funding for market-transformation activities in addition to the rebate program funding.

For future rebate programs, DOE could take market transformation a step further by establishing benchmarking data for “fair and reasonable” prices from the beginning and requiring that, as part of their applications, states must have service-level agreements in place to ensure that only contractors that are at or below ceiling prices are awarded rebates. Establishing this at the federal level will ensure consistency and adoption at the state level.

Conclusion

The DOE should prioritize funding evidence-based market transformation strategies to increase the return on investment for rebate programs. Learning from U.S.-funded programs for global public health, a similar approach can be applied to the markets for energy-efficient appliances that are supported under the HEAR program. Market shaping can tip the balance towards more cost-effective and better-value products and prevent rebates from driving up prices. Successful market shaping will lead to sustained uptake of energy-efficient appliances by households across the country.

This action-ready policy memo is part of Day One 2025 — our effort to bring forward bold policy ideas, grounded in science and evidence, that can tackle the country’s biggest challenges and bring us closer to the prosperous, equitable and safe future that we all hope for whoever takes office in 2025 and beyond.

PLEASE NOTE (February 2025): Since publication several government websites have been taken offline. We apologize for any broken links to once accessible public data.

There is compelling evidence that federal and state subsidies for energy-efficient products can lead to price inflation, particularly in the clean energy space. The federal government has offered tax credits in the residential solar space for many years. While there has been a 64% reduction in the ex-factory photovoltaic module price for residential panels, the total residential installed cost per kWh has increased. The soft costs, including installation, have increased over the same period and are now ~65% or more of total project costs.

In 2021, the National Bureau of Economic Research linked consumer subsidies with firms charging higher prices, in the case of Chinese cell phones. The researchers found that by introducing competition for eligibility, through techniques such as commitment to price ceilings, price increases were mitigated and, in some cases, even reduced, creating more consumer surplus. This type of research along with the observed price increases after tax credits for solar show the risks of government subsidies without market-shaping interventions and the likely detrimental long-term impacts.

CHAI has negotiated over 140 agreements for health commodities supplied to low-and-middle-income countries (LMICs) with over 50 different companies. These market-shaping agreements have generated $4 billion in savings for health systems and touched millions of lives.

For example, CHAI collaborated with Duke University and Bristol Myers Squibb to combat hepatitis-C, which impacts 71 million people, 80% of whom are in LMICs, mostly in Southeast Asia and Africa [see footnote]. The approval in 2013 of two new antiviral drugs transformed treatment for high-income countries, but the drugs were not marketed or affordable in LMICs. Through its partnerships and programming, CHAI was able to achieve initial pricing of $500 per treatment course for LMICs. Prices fell over the next six years to under $60 per treatment course while the cost in the West remained at over $50,000 per treatment course. This was accomplished through ceiling price agreements and access programs with guaranteed volume considerations.

CHAI has also worked closely with the Bill and Melinda Gates Foundation to develop the novel market-shaping intervention called a volume guarantee (VG), where a drug or diagnostic test supplier agrees to a price discount in exchange for guaranteed volume (which will be backstopped by the guarantor if not achieved). Together, they negotiated a six-year fixed price VG with Bayer and Merck for contraceptive implants that reduced the price by 53% for 40 million units, making family planning more accessible for millions and generating $500 million in procurement savings.

Footnote: Hanafiah et al., Global epidemiology of hepatitis C virus infection: New estimates of age-specific antibody to HCV seroprevalence, J Hepatol. (2013), Volume 57, Issue 4, Pages 1333–1342; Gower E, Estes C, Blach S, et al. Global epidemiology and genotype distribution of the hepatitis C virus infection. J Hepatol. (2014),61(1 Suppl):S45-57; World Health Organization. Work conducted by the London School of Hygiene and Tropical Medicine. Global Hepatitis Report 2017.

Many states are in the early stages of setting up the program, so they have not yet released their implementation plans. However, New York and Wisconsin indicate which contractors are eligible to receive rebates through approved contractor networks on their websites. Once a household applies for the program, they are put in touch with a contractor from the approved state network, which they are required to use if they want access to the rebate. Those contractors are approved based on completion of training and other basic requirements such as affirming that pricing will be “fair and reasonable.” Currently, there is no detail about specific price thresholds that suppliers need to meet (as an indication of value for money) to qualify.

DOE’s Data and Tools Requirements document lays out the guidelines for states to receive federal funding for rebates. This includes transaction-level data that must be reported to the DOE monthly, including the specs of the home, the installation costs, and the equipment costs. Given that states already have to collect this data from contractors for reporting, this proposal recommends that SEOs streamline data collection and standardize it across all participating states, and then publish summary data so consumers can get an accurate sense of the range of prices.

There will be natural variation between homes, but by collecting a sufficient sample size and overlaying efficiency metrics like Seasonal Energy Efficiency Rating, Heating Seasonal Performance Factor, and coefficient of performance, states will be able to gauge value for money. Rewiring America and other nonprofits have software that can quickly make these calculations to help consumers understand the return on investment for higher-efficiency (and higher-cost) heat pumps given their location and current heating/cooling costs.

In the global public health markets, CHAI has promoted price transparency for drugs and diagnostic tests by publishing market surveys that include product technical specifications, and links to product performance studies. We show the actual prices paid for similar products in different countries and by different procurement agencies. All this information has helped public health programs migrate to the best-in-class products and improve value for money. Stats could do the same to empower consumers to choose best-in-class and best-value products and contractors.

As the former U.S. Chief Data Scientist, I know first-hand how valuable and vulnerable our nation’s federal data assets are. Like many things in life, we’ve been taking our data for granted and will miss it terribly when it’s gone.

Direct File redefined what IRS service could look like, with real-time help and data-driven improvements. Let’s apply that bar elsewhere.

There is a lot to like in OPM’s new memos on federal hiring and senior executives, much of which reformers have been after for years, but there’s also a troubling focus on politicizing the federal workforce.

The public rarely sees the quiet, often messy work that goes into creating, passing, and implementing a major piece of legislation like the CHIPS and Science Act.