Promoting American Resilience Through a Strategic Investment Fund

Critical minerals, robotics, advanced energy systems, quantum computing, biotechnology, shipbuilding, and space are some of the resources and technologies that will define the economic and security climate of the 21st century. However, the United States is at risk of losing its edge in these technologies of the future. For instance, China processes the vast majority of the world’s batteries and critical metals and has successfully launched a quantum communications satellite. The implications are enormous: the U.S. relies on its qualitative technological edge to fuel productivity growth, improve living standards, and maintain the existing global order. Indeed, the Inflation Reduction Act (IRA) and CHIPS Act were largely reactionary moves to shore up atrophied manufacturing capabilities in the American battery and semiconductor industries, requiring hundreds of billions in outlays to catch up. In an ideal world, critical industries would be sufficiently funded well in advance to avoid economically costly catch-up spending.

However, many of these technologies are characterized by long timelines, significant capital expenditures, and low and uncertain profit margins, presenting major challenges for private-sector investors who are required by their limited partners (capital providers such as pension funds, university endowments, and insurance companies) to underwrite to a certain risk-adjusted return threshold. This stands in contrast to technologies like artificial intelligence and pharmaceuticals: While both are also characterized by large upfront investments and lengthy research and development timelines, the financial payoffs are far clearer, incentivizing private sectors to play a leading role in commercialization. This issue for technologies in economically and geopolitically vital industries such as lithium processing and chips is most acute in the “valley of death,” when companies require scale-up capital for an early commercialization effort: the capital required is too large for traditional venture capital, yet too risky for traditional project finance.

The United States needs a strategic investment fund (SIF) to shepherd promising technologies in nationally vital sectors through the valley of death. An American SIF is not intended to provide subsidies, pick political winners or losers, or subvert the role of private capital markets. On the contrary, its role would be to “crowd in” capital by uniquely managing risk that no private or philanthropic entities have the capacity to do. In doing so, an SIF would ensure that the U.S. maintains an edge in critical technologies, promoting economic dynamism and national security in an agile, cost-efficient manner.

Challenges

The Need for Private Investment

A handful of resources and technologies, some of which have yet to be fully characterized, have the potential to play an outsized role in the future economy. Most of these key technologies have meaningful national security implications.

Since ChatGPT’s release in November 2022, artificial intelligence (AI) has experienced a commercial renaissance that has captured the public’s imagination and huge sums of venture dollars, as evidenced by OpenAI’s October 2024 $6.5 billion round at a $150 billion pre-money valuation. However, AI is not the only critical resource or technology that will power the future economy, and many of those critical resources and technologies may struggle to attract the same level of private investment. Consider the following:

- To meet climate goals, the world needs to increase production of lithium by nearly 475%, rare earths by 100%, and nickel by 60% through 2035. For defense applications, rare earths are especially important; the construction of one F-35, for instance, uses 920 pounds of rare earth materials.

- The conflict in Ukraine has unequivocally demonstrated the value of low-cost drones on the battlefield. However, drones also have significant commercial applications, including safety and last-mile delivery. Reducing production and component costs could make a meaningful difference.

- Quantum technology has the potential to exponentially expand compute power, which can be used to simulate biological pathways, accelerate materials development, and process vast amounts of financial data. However, quantum technology can also be used to break existing encryption technologies and safeguard communications. China launched its first quantum communications satellite in 2020.

Few sectors receive the level of consistent venture attention that software technology, most recently in AI, has gotten in the last 18 months. However, this does not make them unbackable or unimportant; on the contrary, technologies that increase mineral recovery yields or make drone engines cheaper should receive sufficient support to get to scale. While private-sector capital markets have supported the development of many important industries, they are not perfect and may miss important opportunities due to information asymmetries and externalities.

Overcoming the Valley of Death

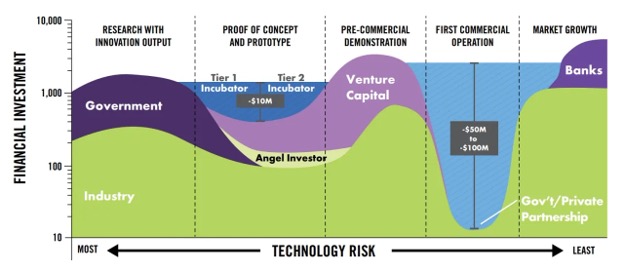

Many strategically important technologies are characterized by high upfront costs and low or uncertain margins, which tends to dissuade investment by private-sector organizations at key inflection points, namely, the “valley of death.”

By their nature, innovative technologies are complex and highly uncertain. However, some factors make future economic value—and therefore financeability—more difficult to ascertain than others. For example, innovative battery technologies that enable long-term storage of energy generated from renewables would greatly improve the economics of utility-scale solar and wind projects. However, this requires production at scale in the face of potential competition from low-cost incumbents. In addition, there is the element of scientific risk itself, as well as the question of customer adoption and integration. There are many good reasons why technologies and companies that seem feasible, economical, and societally valuable do not succeed.

These dynamics result in lopsided investment allocations. In the early stages of innovation, venture capital is available to fund startups with the promise of outsized return driven partially by technological hype and partially by the opportunity to take large equity stakes in young companies. At the other end of the barbell, private equity and infrastructure capital are available to mature companies seeking an acquisition or project financing based on predictable cash flows and known technologies.

However, gaps appear in the middle as capital requirements increase (often by an order of magnitude) to support the transition to early commercialization. This phenomenon is called the “valley of death” as companies struggle to raise the capital they need to get to scale given the uncertainties they face.

Figure 1. The “valley of death” describes the mismatch between existing financial structures and capital requirements in the crucial early commercialization phase. (Source: Maryland Energy Innovation Accelerator)

Shortcoming of Federal Subsidies

While the federal government has provided loans and subsidies in the past, its programs remain highly reactive and require large amounts of funding.

Aside from asking investors to take on greater risk and lower returns, there are several tools in place to ameliorate the valley of death. The IRA one such example: It appropriated some $370 billion for climate-related spending with a range of instruments, including tax subsidies for renewable energy production, low-cost loans through organizations such as the Department of Energy’s Loan Program Office (LPO), and discretionary grants.

On the other hand, there are major issues with this approach. First, funding is spread out across many calls for funding that tend to be slow, opaque, and costly. Indeed, it is difficult to keep track of available resources, funding announcements, and key requirements—just try searching for a comprehensive, easy-to-understand list of opportunities.

More importantly, these funding mechanisms are simply expensive. The U.S. does not have the financial capacity to support an IRA or CHIPS Act for every industry, nor should it go down that route. While one could argue that these bills reflect the true cost of achieving the stated policy aims of energy transition or securing the semiconductor supply chain, it is also the case that there both knowledge (engineering expertise) and capital (manufacturing facility) capabilities underpin these technologies. Allowing these networks to atrophy created greater costs down the road, which could have been prevented by targeted investments at the right points of development.

The Future Is Dynamic

The future is not perfectly knowable, and new technological needs may arise that change priorities or solve previous problems. Therefore, agility and constant re-evaluation are essential.

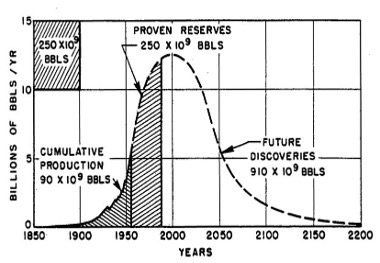

Technological progress is not static. Take the concept of peak oil: For decades, many of the world’s most intelligent geologists and energy forecasters believed that the world would quickly run out of oil reserves as the easiest to extract resources were extracted. In reality, technological advances in chemistry, surveying, and drilling enabled hydraulic fracturing (fracking) and horizontal drilling, creating access to “unconventional reserves” that substantially increased fossil fuel supply.

Figure 2. In 1956, M.K. Hubbert created “peak oil” theory, projecting that reserves would be exhausted around the turn of the millennium.

Fracking greatly expanded fossil fuel production in the U.S., increasing resource supply, securing greater energy independence, and facilitating the transition from coal to natural gas, whose expansion has proved to be a helpful bridge towards renewable energy generation. This transition would not have been possible without a series of technological innovations—and highly motivated entrepreneurs—that arose to meet the challenge of energy costs.

To meet the challenges of tomorrow, policymakers need tools that provide them with flexible and targeted options as well as sufficient scale to make an impact on technologies that might need to get through the valley of death. However, they need to remain sufficiently agile so as not to distort well-functioning market forces. This balance is challenging to achieve and requires an organizational structure, authorizations, and funding mechanisms that are sufficiently nimble to adapt to changing technologies and markets.

Opportunity

Given these challenges, it seems unlikely that solutions that rely solely on the private sector will bridge the commercialization gap in a number of capital-intensive strategic industries. On the other hand, existing public-sector tools, such as grants and subsidies, are too costly to implement at scale for every possible externality and are generally too retrospective in nature rather than forward-looking. The government can be an impactful player in bridging the innovation gap, but it needs to do so cost-efficiently.

An SIF is a promising potential solution to the challenges posed above. By its nature, an SIF would have a public mission focused on strategic technologies crossing the valley of death by using targeted interventions and creative financing structures that crowd in private investors. This would enable the government to more sustainably fund innovation, maintain a light touch on private companies, and support key industries and technologies that will define the future global economic and security outlook.

Plan of Action

Recommendation 1. Shepherd technologies through the valley of death.

While the SIF’s investment managers are expected to make the best possible returns, this is secondary to the overarching public policy goal of ensuring that strategically and economically vital technologies have an opportunity to get to commercial scale.

The SIF is meant to crowd in capital such that we achieve broader societal gains—and eventually, market-rate returns—enabled by technologies that would not have survived without timely and well-structured funding. This creates tension between two competing goals: The SIF needs to act as if it will intend to make returns, or else there is the potential for moral hazard and complacency. However, it also has to be willing to not make market-rate returns, or even lose some of its principal, in the service of broader market and ecosystem development.

Thus, it needs to be made explicitly clear from the beginning that an SIF has the intent of achieving market rate returns by catalyzing strategic industries but is not mandated to do so. One way to do this is to adopt a 501(c)(3) structure that has a loose affiliation to a department or agency, similar to that of In-Q-Tel. Excess returns could either be recycled to the fund or distributed to taxpayers.

The SIF should adapt the practices, structures, and procedures of established private-sector funds. It should have a standing investment committee made up of senior stakeholders across various agencies and departments (expanded upon below). Its day-to-day operations should be conducted by professionals who provide a range of experiences, including investing, engineering and technology, and public policy across a spectrum of issue areas.

In addition, the SIF should develop clear underwriting criteria and outputs for each investment. These include, but are not limited to, identifying the broader market and investment thesis, projecting product penetration, and developing potential return scenarios based on different permutations of outcomes. More critically, each investment needs to create a compelling case for why the private sector cannot fund commercialization on its own and why public catalytic funding is essential.

Recommendation 2. The SIF should have a permanent authorization to support innovation under the Department of Commerce.

The SIF should be affiliated with the Department of Commerce but work closely with other departments and agencies, including the Department of Energy, Department of Treasury, Department of Defense, Department of Health and Human Services, National Science Foundation, and National Economic Council.

Strategic technologies do not fall neatly into one sector and cut across many customers. Siloing funding in different departments misses the opportunity to capture funding synergies and, more importantly, develop priorities that are built through information sharing and consensus. Enter the Department of Commerce. In addition to administering the National Institute of Standards and Technology, they have a strong history of working across agencies, such as with the CHIPS Act.

Similar arguments can also be made for the Treasury, and it may even be possible to have Treasury and Commerce work together to manage an SIF. They would be responsible for bringing in subject matter experts (for example, from the Department of Energy or National Science Foundation) to provide specific inputs and arguments for why specific technologies need government-based commercialization funding and at what point such funding is appropriate, acting as an honest broker to allocate strategic capital.

To be clear: The SIF is not intended to supersede any existing funding programs (e.g., the Department of Energy’s Loan Program Office or the National Institute of Health’s ARPA-H) that provide fit-for-purpose funding to specific sectors. Rather, an SIF is intended to fill in the gaps and coordinate with existing programs while providing more creative financing structures than are typically available from government programs.

Recommendation 3. Create a clear innovation roadmap.

Every two years, the SIF should develop or update a roadmap of strategically important industries, working closely with private, nonprofit, and academic experts to define key technological and capability gaps that merit public sector investment.

The SIF’s leaders should be empowered to make decisions on areas to prioritize but have the ability to change and adapt as the economic environment evolves. Although there is a long list of industries that an SIF could potentially support, resources are not infinite. However, a critical mass of investment is required to ensure adequate resourcing. One acute challenge is that this is not perfectly known in advance and changes depending on the technology and sector. However, this is precisely what the strategic investment roadmap is supposed to solve for: It should provide an even-handed assessment of the likely capital requirements and where the SIF is best suited to provide funding compared to other agencies or the private sector.

Moreover, given the ever-changing nature of technology, the SIF should frequently reassess its understanding of key use cases and their broader economic and strategic importance. Thus, after initial development of the SIF, it should be updated every two years to ensure that its takeaways and priorities remain relevant. This is no different than documents such as the National Security Strategy, which are updated every two to four years; in fact, the SIF’s planning documents should flow seamlessly into the National Security Strategy.

To provide a sufficiently broad set of perspectives, the government should include the expertise and insights of outside experts to develop its plan. Existing bodies, such as the President’s Council of Advisors on Science and Technology and the National Quantum Initiative, provide some of the consultative expertise required. However, the SIF should also stand up subject matter specific advisory bodies where a need arises (for example, on critical minerals and mining) and work internally to set specific investment areas and priorities.

Recommendation 4. Limit the SIF to financing.

The government should not be an outsized player in capital markets. As such, the SIF should receive no governance rights (e.g., voting or board seats) in the companies that it invests in.

Although the SIF aims to catalyze technological and ecosystem development, it should be careful not to dictate the future of specific companies. Thus, the SIF should avoid information rights beyond financial reporting. Typical board decks and stockholder updates include updates on customers, technologies, personnel matters, and other highly confidential and specific pieces of information that, if made public through government channels, would play a highly distortionary role in markets. Given that the SIF is primarily focused on supporting innovation through a particularly tricky stage to navigate, the SIF should receive the least amount of information possible to avoid disrupting markets.

Recommendation 5. Focus on providing first-loss capital.

First-loss capital should be the primary mechanism by which the SIF supports new technologies, providing greater incentives for private-sector funders to support early commercialization while providing a means for taxpayers to directly participate in the economic upside of SIF-supported technologies.

Consider the following stylized example to demonstrate a key issue in the valley of death. A promising clean technology company, such as a carbon-free cement or long-duration energy storage firm, is raising $100mm of capital for facility expansion and first commercial deployment. To date, the company has likely raised $30 – $50mm of venture capital to enable tech development, pilot the product, and grow the team’s engineering, R&D, and sales departments.

However, this company faces a fundraising dilemma. Its funding requirements are now too big for all but the largest venture capital firms, who may or may not want to invest in projects and companies like these. On the other hand, this hypothetical company is not mature enough for private equity buyouts nor is it a good candidate for typical project-based debt, which typically require several commercial proof points in order to provide sufficient risk reduction for an investor whose upside is relatively limited. Hence, the “valley of death.”

First-loss capital is an elegant solution to this issue: A prospective funder could commit to equal (pro rata) terms as other investors, except that this first-loss funder is willing to use its investment to make other investors whole (or at least partially offset losses) in the event that the project or company does not succeed. In this example, a first-loss funder would commit to $33.5 million of equity funding (roughly one-third of the company’s capital requirement). If the company succeeds, the first-loss funder makes the same returns as the other investors. However, if the company is unable to fully meet these obligations, the first-loss funder’s $33.5 million would be used to pay the other investors back (the other $66.5 million that was committed). This creates a floor on losses for the non-first-loss investors: Rather than being at risk of losing 100% of their principal, they are at risk of losing 50% of their principal.

The creation of a first-loss layer has a meaningful impact on the risk-reward profile for non-first-loss investors, who now have a floor on returns (in the case above, half their investment). By expanding the acceptable potential loss ratio, growth equity capital (or another appropriate instrument, such as project finance) can fill the rest, thereby crowding in capital.

From a risk-adjusted returns standpoint, this is not a free lunch for the government or taxpayers. Rather, it is intended to be a capital-efficient way of supporting the private-sector ecosystem in developing strategically and economically vital technologies. In other words, it leverages the power of the private sector to solve externalities while providing just enough support to get them to the starting line in the first place.

Conclusion

Many of tomorrow’s strategically important technologies face critical funding challenges in the valley of death. Due to their capital intensity and uncertain outcomes, existing financing tools are largely falling short in the critical early commercialization phases. However, a nimble, properly funded SIF could bridge key gaps while allowing the private sector to do most of the heavy lifting. The SIF would require buy-in from many stakeholders and well-defined sources of funding, but these can be solved with the right mandates, structures, and pay-fors. Indeed, the stakes are too high, and the consequences too dire, to not get strategic innovation right in the 21st century.

This action-ready policy memo is part of Day One 2025 — our effort to bring forward bold policy ideas, grounded in science and evidence, that can tackle the country’s biggest challenges and bring us closer to the prosperous, equitable and safe future that we all hope for whoever takes office in 2025 and beyond.

PLEASE NOTE (February 2025): Since publication several government websites have been taken offline. We apologize for any broken links to once accessible public data.

Put simply, there needs to be an entity that is actually willing and able to absorb lower returns, or even lose some of its principal, in the service of building an ecosystem. Even if the “median” outcome is a market-rate return of capital, the risk-adjusted returns are in effect far lower because the probability of a zero outcome for first-loss providers is substantially nonzero. Moreover, it’s not clear exactly what the right probability estimate should be; therefore, it requires a leap of faith that no economically self-interested private market actor would be willing to take. While some quasi-social-sector organizations can play this role (for example, Bill Gates’s Breakthrough Energy Ventures for climate tech), their capacity is finite, nor is there a guarantee that such a vehicle will appear for every sector of interest. Therefore, a publicly funded SIF is an integral solution to bridging the valley of death.

No, the SIF would not always have to use first-loss structures. However, it is the most differentiated structure that is available to the U.S. government; otherwise, a private-sector player is likely able—and better positioned—to provide funding.

The SIF should be able to use the full range of instruments, including project finance, corporate debt, convertible loans, and equity capital, and all combinations thereof. The instrument of choice should be up to the judgment of the applicant and SIF investment team. This is distinct from providing first-loss capital: Regardless of the financial instrument used, the SIF’s investment would be used to buffer other investors against potential losses.

The target return rate should be commensurate with that of the instrument used. For example, mezzanine debt should target 13–18% IRR, while equity investments should aim for 20–25% IRR. However, because of the increased risk of capital loss to the SIF given its first loss position, the effective blended return should be expected to be lower.

The SIF should be prepared to lose capital on each individual investment and, as a blended portfolio, to have negative returns. While it should underwrite such that it will achieve market-rate returns if successful in crowding in other capital that improves the commercial prospects of technologies and companies in the valley of death, the SIF has a public goal of ecosystem development for strategic domains. Therefore, lower-than-market-rate returns, and even some principal degradation, is acceptable but should be avoided as much as possible through the prudence of the investment committee.

By and large, the necessary public protections are granted through CFIUS, which requires regulatory approval for export or foreign ownership stakes with voting rights above 25% of critical technologies. The SIF can also enact controls around information rights (e.g., customer lists, revenue, product roadmaps) such that they have a veto on parties that can receive such information. However, given its catalytic mission, the SIF does not need board seats or representation and should focus on ensuring that critical technologies and assets are properly protected.

In most private investment firms, the investment committee is made up of the most senior individuals in the fund. These individuals can cross asset classes, sectors of expertise, and even functional backgrounds. However, the investment committee represents a wide breadth of expertise and experiences that, when brought together, enable intellectual honesty and the application of collective wisdom and judgment to the opportunity at hand.

Similarly, the SIF’s investment committee could include the head of the fund and representatives from various departments and agencies in alignment with its strategic priorities. The exact size of the investment committee should be defined by these priorities, but approval should be driven by consensus, and unanimity (or near unanimity) should be expected for investments that are approved.

Given the fluid nature of investment opportunities, the committee should be called upon whenever needed to evaluate a potential opportunity. However, given the generally long process times for investments discussed above (6–12 months), the investment committee should have been briefed multiple times before a formal decision is made.

Check sizes can be flexible to the needs of the investment opportunity. However, as an initial guiding principle, first loss capital should likely make up 20–35% of capital invested so as to require private-sector investors to have meaningful skin in the game. Depending on the fundraise size, this could imply investments of $25 million to $100 million.

Target funding amounts should be set over multiyear timeframes, but the annual appropriations process implies that there will likely be a set cap in any given year. In order to meet the needs of the market, there should be mechanisms that enable emergency draws, up to a cap (e.g., 10% of the annual target funding amount, which will need to be “paid for” by reducing future outlays).

An economically efficient way to fund a government program in support of a positive externality is a Pigouvian tax on negative externalities (such as carbon). However, carbon taxes are as politically unappealing as they are economically sensible and need to be packaged into other policy goals that could potentially support such legislation. Notwithstanding the questionable economic wisdom of tariffs in general, some 56% of voters support a 10% tax on all imports and 60% tariffs on China. Rather than using tariffs harmfully, they could be used more productively. One such proposal is a carbon import tariff that taxes imports on the carbon emitted in the production and transportation of goods into the U.S.

The U.S. would not be a first mover: in fact, the European Union has already implemented a similar mechanism called the Carbon Border Adjustment Mechanism (CBAM), which is focused on heavy industry, including cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen, with chemicals and polymers potentially to be included after 2026. At full rollout in 2030, the CBAM is expected to generate roughly €10–15 billion of tax revenue. Tax receipts of a similar size could be used to fund an SIF or, if Congress authorizes an upfront amount, could be used to nullify the incremental deficit over time.

The EU’s CBAM phased in its reporting requirements over several years. Through July 2024, companies were allowed to use default amounts per unit of production without an explanation as to why actual data was not used. Until January 1, 2026, companies can make estimates for up to 20% of goods; thereafter, the CBAM requires reporting of actual quantities and embedded greenhouse gas emissions.

The U.S. could use a similar phase-in, although given the challenges of carbon reporting, could allow companies to use the lower of actual, verified emissions or per-unit estimates. Under a carbon innovation fee regime, exporters and countries could apply for exemption on a case-by-case basis to the Department of Commerce, which they could approve in line with other goals (e.g., economic development in a region).

The SIF could also be funded by repurposing other funding and elevating their strategic importance. Potential candidates include the Small Business Innovation Research (SBIR) and Small State Business Credit Initiative (SSBCI), which could play a bigger role if moved into the SIF umbrella. For example, the SBIR program, whose latest reporting data is as of FY2019, awarded $3.3 billion in funding that year and $54.6 billion over its lifespan. Moreover, the SSBCI, a $10 billion fund that already provides loan guarantees and other instruments similar to those described above, can be used to support technologies that fall into the purview of the SIF.

Congress could also assess reallocating dollars towards an SIF from spending reforms that are likely inevitable given the country’s fiscal position. In 2023, the Congressional Budget Office (CBO) published a report highlighting potential solutions for reducing the budget deficit. Some potential solutions, like establishing caps on Medicaid federal spending, while fiscally promising, seem unlikely to pass in the near future. However, others are more palatable, especially those that eliminate loopholes or ask higher-income individuals to pay their fair share.

For instance, increasing the amount subject to Social Security taxes above the $250,000 threshold has the potential to raise up to $1.2 trillion over 10 years; while this can be calibrated, an SIF would take only a small fraction of the taxes raised. In addition, the CBO found that federal matching funds for Medicaid frequently ended up getting back to healthcare providers in the form of higher reimbursement rates; eliminating what are effectively kickbacks could reduce the deficit by up to $525 billion over 10 years.

To secure the U.S. bio-infrastructure, maintain global leadership in biotechnology, and safeguard American citizens from emerging threats to their privacy, the federal government must modernize its approach to human genetic and biological data.

From use to testing to deployment, the scaffolding for responsible integration of AI into high-risk use cases is just not there.

The Federation of American Scientists supports Congress’ ongoing bipartisan efforts to strengthen U.S. leadership with respect to outer space activities.

By preparing credible, bipartisan options now, before the bill becomes law, we can give the Administration a plan that is ready to implement rather than another study that gathers dust.