Agenda for an American Renewal

Imperative for a Renewed Economic Paradigm

So far, President Trump’s tariff policies have generated significant turbulence and appear to lack a coherent strategy. His original tariff schedule included punitive tariffs on friends and foes alike on the mistaken basis that trade deficits are necessarily the result of an unhealthy relationship. Although they have been gradually paused or reduced since April 2, the uneven rollout (and subsequent rollback) of tariffs continues to generate tremendous uncertainty for policymakers, consumers, and businesses alike. This process has weakened America’s geopolitical standing by encouraging other countries to seek alternative trade, financial, and defense arrangements.

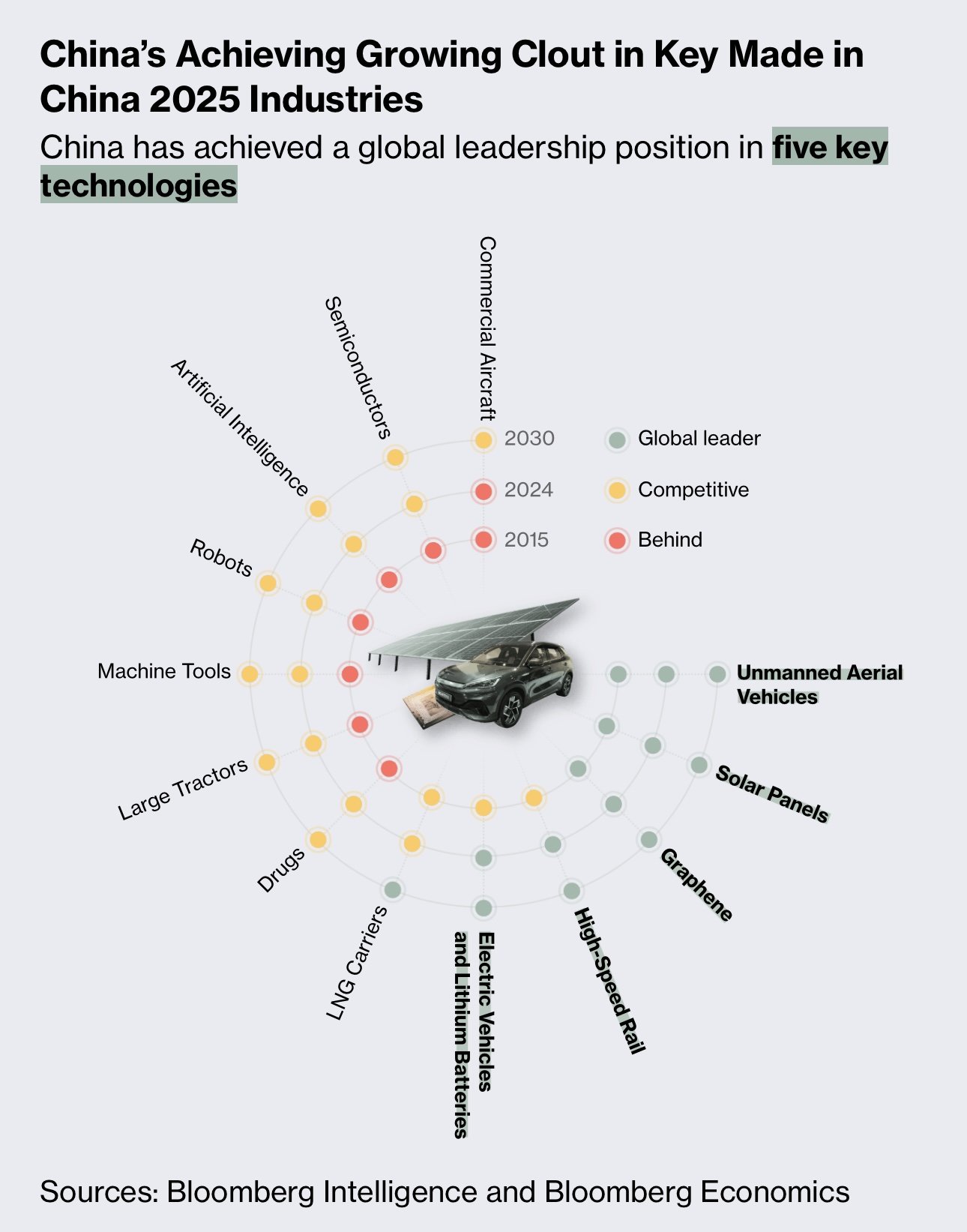

However, notwithstanding the uncoordinated approach to date, President Trump’s mistaken instinct for protectionism belies an underlying truth: that American manufacturing communities have not fared well in the last 25 years and that China’s dominance in manufacturing poses an ever-growing threat to national security. After China’s admission to the WTO in 2001, its share of global manufacturing grew from less than 10% to over 35% today. At the same time, America’s share of manufacturing shrank from almost 25% to less than 15%, with employment shrinking from more than 17 million at the turn of the century to under 13 million today. These trends also create a deep geopolitical vulnerability for America, as in the event of a conflict with China, we would be severely outmatched in our ability to build critical physical goods: for example, China produces over 80% of the world’s batteries, over 90% of consumer drones, and has a 200:1 shipbuilding capacity advantage over the U.S. While not all manufacturing is geopolitically valuable, the erosion in strategic industries, which went hand-in-hand with the loss of key manufacturing skills in recent decades, poses potential long-term challenges for America.

In addition to its growing manufacturing dominance, China is now competing with America’s preeminence in technology leadership, having leveraged many of the skills gained in science, engineering, and manufacturing for lower-value add industries to compete in higher-end sectors. DeepSeek demonstrated that China can natively generate high-quality artificial intelligence models, an area in which the U.S. took its lead for granted. Meanwhile, BYD rocketed past Tesla in EV sales and accounted for 22% of global sales in 2024 as compared to Tesla’s 10%. China has also been operating an extensive satellite-enabled secure quantum communications channel since 2016, preventing others from eavesdropping.

China’s growing leadership in advanced research may give it a sustained edge beyond its initial gains: according to one recent analysis of frontier research publications across 64 critical technologies, global leadership has shifted dramatically to China, which now leads in 57 research domains. These are not recent developments: they have been part of a series of five year plans, the most well known of which is Made in China 2025, giving China an edge in many critical technologies that will continue to grow if not addressed by an equally determined American response.

An Integrated Innovation, Economic Foreign Policy, and Community Development Approach

Despite China’s growing challenge and recent self-inflicted damage to America’s economic and geopolitical relationships, America still retains many ingrained advantages. The U.S. still has the largest economy, the deepest public and private capital pools for promising companies and technologies, and the world’s leading universities; it has the most advanced military, continues to count most of the world’s other leading armed forces as formal treaty allies, and remains the global reserve currency. Ordinary Americans have benefited greatly from these advantages in the form of access to cutting edge products and cheaper goods that increase their effective purchasing power and quality of life – notwithstanding Secretary Bessent’s statements to the contrary.

The U.S. would be wise to leverage its privileged position in high-end innovation and in global financial markets to build “industries of the future.” However, the next economic and geopolitical paradigm must be genuinely equitable, especially to domestic communities that have been previously neglected or harmed by globalization. For these communities, policies such as the now-defunct Trade Adjustment Assistance program were too slow and too reactive to help workers displaced by the “China Shock,” which is estimated to have caused up to 2.4 million direct and indirect job losses.

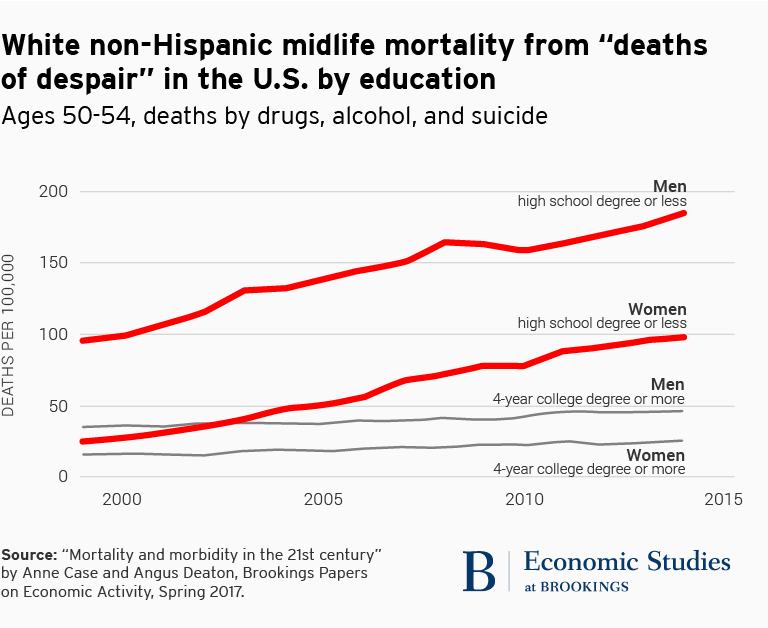

Although jobs in trade-affected communities were eventually “replaced,” the jobs that came after were disproportionately lower-earning roles, accrued largely to individuals who had college degrees, and were taken by new labor force entrants rather than providing new opportunities for those who had originally been displaced. Moreover, as a result of ineffective policy responses, this replacement took over a decade and has contributed to heinous effects: look no further than the rate at which “deaths of despair” for white individuals without a college degree skyrocketed after 2000.

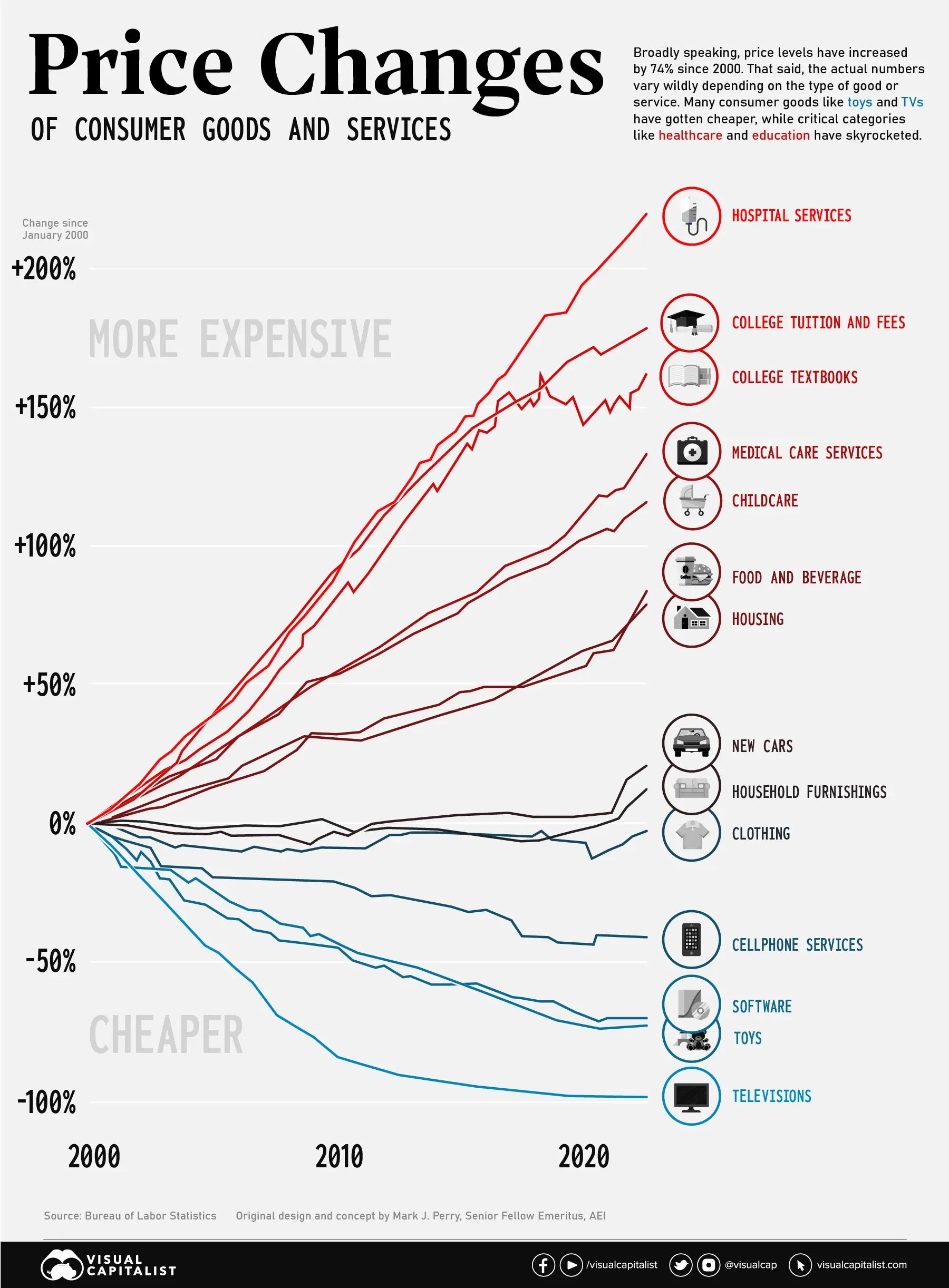

Nonetheless, surrendering America’s hard-won advantages in technology and international commerce, especially in the face of a growing challenge from China, would be an existential error. Rather, our goal is to address the shortcomings of previous policy approaches to the negative externalities caused by globalization. Previous approaches have focused on maximizing growth and redistributing the gains, but in practice, America failed to do either by underinvesting in the foundational policies that enable both. Thus, we are proposing a two-pronged approach that focuses on spurring cutting-edge technologies, growing novel industries, and enhancing production capabilities while investing in communities in a way that provides family-supporting, upwardly mobile jobs as well as critical childcare, education, housing, and healthcare services. By investing in broad-based prosperity and productivity, we can build a more equitable and dynamic economy.

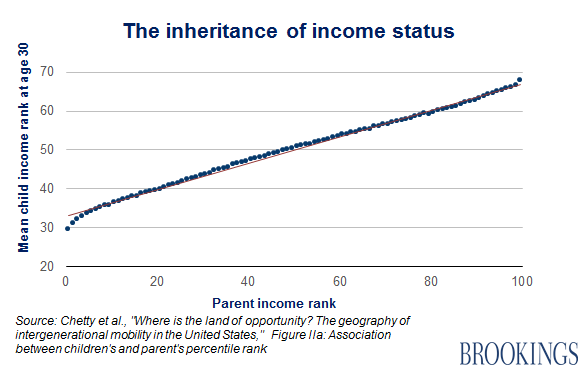

Our agenda is intentionally broad (and correspondingly ambitious) rather than narrow in focus on manufacturing communities, even though current discourse is focused on trade. This is not simply a “political bargain” that provides greater welfare or lip-service concessions to hollowed-out communities in exchange for a return to the prior geoeconomic paradigm. Rather, we genuinely believe that economic dynamism which is led by an empowered middle-class worker, whether they work in manufacturing or in a service industry, is essential to America’s future prosperity and national security – one in which economic outcomes are not determined by parental income and one where black-white disparities are closed in far less than the current pace of 150+ years.

Thus, the ideas and agenda presented here are neither traditionally “liberal” nor “conservative,” “Democrat” nor “Republican.” Instead, we draw upon the intellectual traditions of both segments of the political spectrum. We agree with Ezra Klein’s and Derek Thompson’s vision in Abundance for a technology-enabled future in which America remembers how to build; at the same time, we take seriously Oren Cass’s view in The Once and Future Worker that the dignity of work is paramount and that public policy should empower the middle-class worker. What we offer in the sections below is our vision for a renewed America that crosses traditional policy boundaries to create an economic and political paradigm that works for all.

Policy Recommendations

Investing in American Innovation

Given recent trends, it is clear that there is no better time to re-invigorate America’s innovation edge by investing in R&D to create and capture “industries of the future,” re-shoring capital and expertise, and working closely with allies to expand our capabilities while safeguarding those technologies that are critical to our security. These investments will enable America to grow its economic potential, providing fertile ground for future shared prosperity. We emphasize five key components to renewing America’s technological edge and manufacturing base:

Invest in R&D. Increase federally funded R&D, which has declined from 1.8% of GDP in the 1960s to 0.6% of GDP today. Of the $200 billion federal R&D budget, just $16 billion is allocated to non-healthcare basic science, an area in which the government is better suited to fund than the private sector due to positive spillover effects from public funding. A good start is fully funding the CHIPS and Science Act, which authorized over $200 billion over 10 years for competitiveness-enhancing R&D investments that Congress has yet to appropriate. Funding these efforts will be critical to developing and winning the race for future-defining technologies, such as next-gen battery chemistries, quantum computing, and robotics, among others.

Capability-Building. Develop a coordinated mechanism for supporting translation and early commercialization of cutting-edge technologies. Otherwise, the U.S. will cede scale-up in “industries of the future” to competitors: for example, Exxon developed the lithium-ion battery, but lost commercialization to China due to the erosion of manufacturing skills in America that are belatedly being rebuilt. However, these investments are not intended to be a top-down approach that selects winners and losers: rather, America should set a coordinated list of priorities (leveraging roadmaps such as the DoD’s Critical Technology Areas), foster competition amongst many players, and then provide targeted, lightweight financial support to industry clusters and companies that bubble to the top.

Financial support could take the form of a federally-funded strategic investment fund (SIF) that partners with private sector actors by providing catalytic funding (e.g., first-loss loans). This fund would focus on bridging the financing gap in the “valley of death” as companies transition from prototype to first-of-a-kind / “nth-of-a-kind” commercial product. In contrast to previous attempts at industrial policy, such as the Inflation Reduction Act (IRA) or CHIPS Act, they should have minimal compliance burdens and focus on rapidly deploying capital to communities and organizations that have proven to possess a durable competitive advantage.

Encourage Foreign Direct Investment (FDI). Provide tax incentives and matching funds (potentially from the SIF) for companies who build manufacturing plants in America. This will bring critical expertise that domestic manufacturers can adopt, especially in industries that require deep technical expertise that America would need to redevelop (e.g., shipbuilding). By striking investment deals with foreign partners, America can “learn from the best” and subsequently improve upon them domestically. In some cases, it may be more efficient to “share” production, with certain components being manufactured or assembled abroad, while America ramps up its own capabilities.

For example, in shipbuilding, the U.S. could focus on developing propulsion, sensor, and weapon systems, while allies such as South Korea and Japan, who together build almost as much tonnage as China, convert some shipyards to defense production and send technical experts to accelerate development of American shipyards. In exchange, they would receive select additional access to cutting-edge systems and financially benefit from investing in American shipbuilding facilities and supply chains.

Immigration. America has long been described as a “nation of immigrants.” Their role in innovation is impossible to deny: 46% of companies in the Fortune 500 were founded by immigrants and accounted for 24% of all founders; they are 19% of the overall STEM workforce but account for nearly 60% of doctorates in computer science, mathematics, and engineering. Rather than spurning them, the U.S. should attract more highly educated immigrants by removing barriers to working in STEM roles and offering accelerated paths to citizenship. At the same time, American policymakers should acknowledge the challenges caused by illegal immigration. One such solution is to pass legislation such as the Border Control Act of 2024, which had bipartisan support and increased border security, supplemented by a “points-based” immigration system such as Canada’s which emphasizes educational credentials and in-country work experience.

Create Targeted Fences. Employ tariffs and export controls to defend nascent, strategically important industries such as advanced chips, fusion energy, or quantum communications. However, rather than employing these indiscriminately, tariffs and export controls should be focused on ensuring that only America and its allies have access to cutting-edge technologies that shape the global economic and security landscape. They are not intended to keep foreign competition out wholesale; rather, they should ensure that burgeoning technology developers gain sufficient scale and traction by accelerating through the “learn curve.”

Building Strong Communities

Strong communities are the foundation of a strong workforce, without which new industries will not thrive beyond a small number of established tech hubs. However, strengthening American communities will require the country to address the core needs of a family-sustaining life. Childcare, education, housing, and healthcare are among the largest budget items for families and have been proven time and again to be critical to economic mobility. Nevertheless, they are precisely the areas in which costs have skyrocketed the most, as has been frequently chronicled by the American Enterprise Institute’s “Chart of the Century.” These essential services have been underinvested in for far too long, creating painful shortages for communities that need them most. As such, addressing these issues form the core pillars of our domestic reinvestment plan. Addressing them means grappling with the underlying drivers of their cost and scarcity. These include issues of state capacity, regulatory and licensing barriers, and low productivity growth in service-heavy care sectors. A new policy agenda that addresses the fundamental supply-side issues is needed to reshape the contours of this debate.

Expand Childcare. Inadequate childcare costs the U.S. economy $122 billion in lost wages and productivity as otherwise capable workers, especially women, are forced to reduce hours or leave the labor force. Access is further exacerbated by supply shortages: more than half the population lives in a “childcare desert,” where there are more than three times as many children as licensed slots. Addressing these shortages will alleviate the affordability issue, enabling workers to stay in the workforce and allow families to move up the income ladder.

Fund Early Education. Investments in early childhood education have been demonstrated to generate compelling ROI, with high-quality studies such as the Perry preschool study demonstrating up to $7 – $12 of social return for every $1 invested. While these gains are broadly applicable across the country, they would make an even greater difference in helping to rebuild manufacturing communities by making it easier to grow and sustain families. Given the return on investment and impact on social mobility, American policymakers should consider investing in universal pre-K.

Invest in Workforce Training and Community Colleges. The cost of a four-year college education now exceeds $38K per year, indicating a clear need for cheaper BA degrees but also credible alternatives. At the same time, community colleges can be reimagined and better funded to enable them to focus on high-paying jobs in sectors with critical labor shortages, many of which are in or adjacent to “industries of the future.” Some of these roles, such as IT specialists and skilled tradespeople, are essential to manufacturing. Others, such as nursing and allied healthcare roles, will help build and sustain strong communities.

Build Housing Stock. America has a shortage of 3.2 million homes. Simply put, the country needs to build more houses to address the cost of living and enable Americans to work and raise families. While housing policy is generally decided at lower levels of government, the federal government should provide grants and other incentives to states and municipalities to defray the cost of developing affordable housing; in exchange, state and local jurisdictions should relax zoning regulations to enable more multi-family and high-density single-family housing.

Expand Healthcare Access. American healthcare is plagued with many problems, including uneven access and shortages in primary care. For example, the U.S. has 3.1 primary care physicians (PCPs) per 10,000 people, whereas Germany has 7.1 and France has 9.0. As such, the federal government should focus on expanding the number of healthcare practitioners (especially primary care physicians and nurses), building a physical presence for essential healthcare services in underserved regions, and incentivizing the development of digital care solutions that deliver affordable care.

Allocating Funds to Invest in Tomorrow’s Growth

Investment Requirements

While we view these policies as essential to America’s reinvigoration, they also represent enormous investments that must be paid for at a time when fiscal constraints are likely to tighten. To create a sense of the size of the financial requirements and trade-offs required, we lay out each of the key policy prescriptions above and use bipartisan proposals wherever possible, many of which have been scored by the Congressional Budget Office (CBO) or another reputable institution or agency. Where this is not possible, we created estimates based on key policy goals to be accomplished. Although trade deals and targeted tariffs are likely to have some budget impact, we did not evaluate them given multiple countervailing forces and political uncertainties (e.g., currency impacts).

Potential Pay-Fors

Given the budgetary requirements of these proposals, we looked for opportunities to prune the federal budget. The CBO laid out a set of budgetary options that collectively could save several trillion over the next decade. In laying out the potential pay-fors, we used two approaches that focused on streamlining mandatory spending and optimizing tax revenues in an economically efficient manner. Our first approach is to include budgetary options that eliminate unnecessary spending that are distortionary in nature or are unlikely to have a meaningful direct impact on the population that they are trying to serve (e.g., kickback payments to state health plans). Our second approach is to include budgetary options in which the burden would fall upon higher-earning populations (e.g., raising the cap on payroll and Social Security taxes).

As the table below shows, there is a menu of options available to policymakers that raise funding well in excess of the required investment amounts above, allowing them to pick and choose which are most economically efficient and politically viable. In addition, they can modify many of these options to reduce the size or magnitude of the effect of the policy (e.g., adjust the point at which Social Security benefits for “high earners” is tapered or raise capital gains by 1% instead of 2%). While some of these proposals are potentially controversial, there is a clear and pressing need to reexamine America’s foundational policy assumptions without expanding the deficit, which is already more than 6% of GDP.

Conclusion

America is in need of a new economic paradigm that renews and refreshes rather than dismantles its hard-won geopolitical and technological advantages. Trump’s tariffs, should they be fully enacted, would be a self-defeating act that would damage America’s economy while leaving it more vulnerable, not less, to rivals and adversaries. However, we also recognize that the previous free trade paradigm was not truly equitable and did not do enough to support manufacturing communities and their core strengths. We believe that our two-pronged approach of investing in American innovation alongside our allies along with critical community investments in childcare, higher education, housing, and healthcare bridges the gap and provides a framework for re-orienting the economy towards a more prosperous, fair, and secure future.

Using Targeted Industrial Policy to Address National Security Implications of Chinese Chips

Last year the Federation of American Scientists (FAS), Jordan Schneider (of ChinaTalk), Chris Miller (author of Chip War) and Noah Smith (of Noahpinion) hosted a call for ideas to address the U.S. chip shortage and Chinese competition. A handful of ideas were selected based on the feasibility of the idea and its and bipartisan nature. This memo is one of them.

In recent years, China has heavily subsidized its legacy chip manufacturing capabilities. Although U.S. sanctions have restricted China’s access to and ability to develop advanced AI chips, they have done nothing to undermine China’s production of “legacy chips,” which are semiconductors built on process nodes 28nm or larger. It is important to clarify that the “22 nm” “20nm” “28nm” or “32nm” lithography process is simply a commercial name for a generation of a certain size and its technology that has no correlation to the actual manufacturing specification, such as the gate length or half pitch. Furthermore, it is important to note that different firms have different specifications when it comes to manufacturing. For instance, Intel’s 22nm lithography process uses a 193nm wavelength argon fluoride laser (ArF laser) with a 90nm Gate Pitch and a 34 nm Fin height. These specifications vary between fab plats such as Intel and TSMC. The prominence of these chips makes them a critical technological component in applications as diverse as medical devices, fighter jets, computers, and industrial equipment. Since 2014, state-run funds in China have invested more than $40 billion into legacy chip production to meet their goal of 70% chip sufficiency by 2030. Chinese legacy chip dominance—made possible only through the government’s extensive and unfair support—will undermine the position of Western firms and render them less competitive against distorted market dynamics.

Challenge and Opportunity

Growing Chinese capacity and “dumping” will deprive non-Chinese chipmakers of substantial revenue, making it more difficult for these firms to maintain a comparative advantage. China’s profligate industrial policy has damaged global trade equity and threatens to create an asymmetrical market. The ramifications of this economic problem will be most felt in America’s national security, as opposed to from the lens of consumers, who will benefit from the low costs of Chinese dumping programs until a hostile monopoly is established. Investors—anticipating an impending global supply glut—are already encouraging U.S. firms to reduce capital expenditures by canceling semiconductor fabs, undermining the nation’s supply chain and self-sufficiency. In some cases, firms have decided to cease manufacturing particular types of chips outright due to profitability concerns and pricing pressures. Granted, the design of chip markets is intentionally opaque, so pricing data is insufficient to fully define the extent of this phenomenon; however, instances such as Taiwan’s withdrawal from certain chip segments shortly after a price war between China and its competitors in late 2023 indicate the severity of this issue. If they continue, similar price disputes are capable of severely subverting the competitiveness of non-Chinese firms, especially considering how Chinese firms are not subject to the same fiscal constraints as their unsubsidized counterparts. In an industry with such high fixed costs, the Chinese state’s subsidization gives such firms a great advantage and imperils U.S. competitiveness and national security.

Were the U.S. to engage in armed conflict with China, reduced industrial capacity could quickly impede the military’s ability to manufacture weapons and other materials. Critical supply chain disruptions during the COVID-19 pandemic illustrate how the absence of a single chip can hold hostage entire manufacturing processes; if China gains absolute legacy chip manufacturing dominance, these concerns would be further amplified as Chinese firms become able to outright deny American access to critical chips, impose harsh costs through price hikes, or impose diplomatic compromises and quid-pro-quo.Furthermore, decreased Chinese reliance on Taiwanese semiconductors reduces their economic incentive to pursue a diplomatic solution in the Taiwan Strait—making armed conflict in the region more likely. This weakened posture endangers global norms and the balance of power in Asia—undermining American economic and military hegemony in the region.

China’s legacy chip manufacturing is fundamentally an economic problem with national security consequences. The state ought to interfere in the economy only when markets do not operate efficiently and in cases where the conduct of foreign adversaries creates market distortion. While the authors of this brief do not support carte blanche industrial policy to advance the position of American firms, it is the belief of these authors that the Chinese government’s efforts to promote legacy chip manufacturing warrant American interference to ameliorate harms that they have invented. U.S. regulators have forced American companies to grapple with the sourcing problems surrounding Chinese chips; however, the issue with chip control is largely epistemic. It is not clear which firms do and do not use Chinese chips, and even if U.S. regulators knew, there is little political appetite to ban them as corporations would then have to pass higher costs onto consumers and exacerbate headline inflation. Traditional policy tools for achieving economic objectives—such as sanctions—are therefore largely ineffectual in this circumstance. More innovative solutions are required.

If its government fully commits to the policy, there is little U.S. domestic or foreign policy can do to prevent China from developing chip independence. While American firms can be incentivized to outcompete their Chinese counterparts, America cannot usurp Chinese political directives to source chips locally. This is true because China lacks the political restraints of Western countries in financially incentivizing production, but also because in the past—under lighter sanctions regimes—China’s Semiconductor Manufacturing International Corporation (SMIC) acquired multiple Advanced Semiconductor Materials Lithography (ASML) DUV (Deep Ultraviolet Light) machines. Consequently, any policy that seeks to mitigate the perverse impact of Chinese dominance of the legacy chip market must a) boon the competitiveness of American and allied firms in “third markets” such as Indonesia, Vietnam, and Brazil and b) de-risk America’s supply chain from market distortions and the overreliance that Chinese policies have affected. China’s growing global share of legacy chip manufacturing threatens to recreate the global chip landscape in a way that will displace U.S. commercial and security interests. Consequently, the United States must undertake both defensive and offensive measures to ensure a coordinated response to Chinese disruption.

Plan of Action

Considering the above, we propose the United States enact a policy mutually predicated on innovative technological reform and targeted industrial policy to onshore manufacturing capabilities.

Recommendation 1. Weaponizing electronic design automation

Policymakers must understand that from a lithography perspective, the United States controls all essential technologies when it comes to the design and manufacturing of integrated circuits. This is a critically overlooked dimension in contemporary policy debates because electronic design automation (EDA) software closes the gap between high-level chip design in software and the lithography system itself. Good design simulates a proposed circuit before manufacturing, plans large integrated circuits (IC) by “bundling” small subcomponents together, and verifies the design is connected correctly and will deliver the required performance. Although often overlooked, the photolithography process, as well as the steps required before it, is a process as complex as coming up with the design of the chip itself.

No profit-maximizing manufacturer would print a chip “as designed” because it would suffer certain distortions and degradations throughout the printing process; therefore, EDA software is imperative to mitigate imperfections throughout the photolithography process. In much the same way that software within a home-use printer automatically screens for paper material (printer paper vs glossy photo paper) and automatically adjusts the mixture of solvent, resins, and additives to display properly, EDA software learns design kinks and responds dynamically. In the absence of such software, the yield of usable chips would be much lower, making these products less commercially viable. Contemporary public policy discourse focuses only on chips as a commodified product, without recognizing the software ecosystem that is imperative in their design and use.

Today, there exist only two major suppliers of EDA software for semiconductor manufacturing: Synopsys and Cadence Design Systems. This reality presents a great opportunity for the United States to assert dominance in the legacy chips space. In hosting all EDA in a U.S.-based cloud—for instance, a data center located in Las Vegas or another secure location—America can force China to purchase computing power needed for simulation and verification for each chip they design. This policy would mandate Chinese reliance on U.S. cloud services to run electromagnetic simulations and validate chip design. Under this proposal, China would only be able to use the latest EDA software if such software is hosted in the U.S., allowing American firms to a) cut off access at will, rendering their technology useless and b) gain insight into homegrown Chinese designs built on this platform. Since such software would be hosted on a U.S.-based cloud, Chinese users would not download the software which would greatly mitigate the risk of foreign hacking or intellectual property theft. While the United States cannot control chips outright considering Chinese production, it can control where they are integrated. A machine without instructions is inoperable, and the United States can make China’s semiconductors obsolete.

The emergence of machine learning has introduced substantial design innovation in older lithography technologies. For instance, Synopsis has used new technologies to discern the optimal route for wires that link chip circuits, which can factor in all the environmental variables to simulate the patterns a photo mask design would project throughout the lithography process. While the 22nm process is not cutting edge, it is legacy only in the sense of its architecture. Advancements in hardware design and software illustrate the dynamism of this facet in the semiconductor supply chain. In extraordinary circumferences, the United States could also curtail usage of such software in the event of a total trade war. Weaponizing this proprietary software could compel China to divulge all source code for auditing purposes since hardware cannot work without a software element.

The United States must also utilize its allied partnerships to restrict critical replacement components from enabling injurious competition from the Chinese. Software notwithstanding, China currently has the capability to produce 14nm nodes because SMIC acquired multiple ASML DUV machines under lighter Department of Commerce restrictions; however, SMIC heavily relies on chip-making equipment imported from the Netherlands and Japan. While the United States cannot alter the fact of possession, it has the capacity to take limited action against the realization of these tools’ potential by restricting China’s ability to import replacement parts to service these machines, such as the lenses they require to operate. Only the German firm Zeiss has the capability to produce such lenses that ArF lasers require to focus—illustrating the importance of adopting a regulatory outlook that encompasses all verticals within the supply chain. The utility of controlling critical components is further amplified by the fact that American and European firms have limited efficacy in enforcing copyright laws against Chinese entities. For instance, while different ICs are manufactured within the 22nm instruction set, not all run on a common instruction set such as ARM. However, even if such designs run on a copyrighted instruction set, the United States has no power to enforce domestic copyright law in a Chinese jurisdiction. China’s capability to reverse engineer and replicate Western-designed chips further underscores the importance of controlling 1) the EDA landscape and 2) ancillary components in the chip manufacturing process. This reality presents a tremendous yet overlooked opportunity for the United States to reassert control over China’s legacy chip market.

Recommendation 2. Targeted industrial policy

In the policy discourse surrounding semiconductor manufacturing, this paper contends that too much emphasis has been placed on the chips themselves. It is important to note that there are some areas in which the United States is not commercially competitive with China, such as in the NAND flash memory space. China’s Yangtze Memory Technologies has become a world leader in flash storage and can now manufacture a 232-layer 3D NAND on par with the most sophisticated American and Korean firms, such as Western Digital and Samsung, at a lower cost. However, these shortcomings do not preclude America from asserting dominance over the semiconductor market as a whole by leveraging its dynamic random-access memory (DRAM) dominance, bolstering nearshore NAND manufacturing, and developing critical mineral processing capabilities. Both DRAM and NAND are essential components for any computationally integrated technology.

While the U.S. cannot compete on rote manufacturing prowess because of high labor costs, it would be strategically beneficial to allow supply chain redundancies with regard to NAND and rare earth metal processing. China currently processes upwards of 90% of the world’s rare earth metals, which are critical to any type of semiconductor chips. While the U.S. possesses strategic reserves for commodities such as oil, it does not have any meaningful reserve when it comes to rare earth metals—making this a critical national security threat. Should China stop processing rare earth metals for the U.S., the price of any type of semiconductor—in any form factor—would increase dramatically. Furthermore, as a strategic matter, the United States would not have accomplished its national security objectives if it built manufacturing capabilities yet lacked critical inputs to supply this potential. Therefore, any legacy chips proposal must first establish sufficient rare earth metal processing capabilities or a strategic reserve of these critical resources.

Furthermore, given the advanced status of U.S. technological manufacturing prowess, it makes little sense to outright onshore legacy chip manufacturing capabilities—especially considering high U.S. costs and the substantial diversion of intellectual capital that such efforts would require. Each manufacturer must develop their own manufacturing process from scratch. A modern fab runs 24×7 and has a complicated workflow, with its own technique and software when it comes to lithography. For instance, since their technicians and scientists are highly skilled, TSMC no longer focuses on older generation lithography (i.e., 22nm) because it would be unprofitable for them to do so when they cannot fulfill their demand for 3nm or 4nm. The United States is better off developing its comparative advantage by specializing in cutting-edge chip manufacturing capabilities, as well as research and development initiatives; however, while American expertise remains expensive, America has wholly neglected the potential utility of its southern neighbors in shoring up rare earth metals processing. Developing Latin American metals processing—and legacy chip production—capabilities can mitigate national security threats. Hard drive manufacturers have employed a similar nearshoring approach with great success.

To address both rare earth metals and onshoring concerns, the United States should pursue an economic integration framework with nations in Latin America’s Southern Cone, targeting a partialized (or multi-sectoral) free trade agreement with the Southern Common Market (MERCOSUR) bloc. The United States should pursue this policy along two industry fronts, 1) waiving the Common External Tariff for United States’ petroleum and other fuel exports, which currently represent the largest import group for Latin American members of the bloc, and 2) simultaneously eliminating all trade barriers on American importation of critical minerals––namely arsenic, germanium, and gallium––which are necessary for legacy chip manufacturing. Enacting such an agreement and committing substantial capital to the project over a long-term time horizon would radically increase semiconductor manufacturing capabilities across all verticals of the supply chain. Two mutually inclusive premises underpin this policy’s efficacy:

Firstly, the production of economic interdependence with a bloc of Latin American states (as opposed to a single nation) serves to diversify risk in the United States; each nation provides different sets and volumes of critical minerals and has competing foreign policy agendas. This reduces the capacity of states to exert meaningful and organized diplomatic pressure on the United States, as supply lines can be swiftly re-adjusted within the bloc. Moreover, MERCOSUR countries are major energy importers, specifically with regard to Bolivian natural gas and American petroleum. Under an energy-friendly U.S. administration, the effects of this policy would be especially pronounced: low petroleum costs enable the U.S. to subtly reassert its geopolitical sway within its regional sphere of influence, notably in light of newly politically friendly Argentinian and Paraguayan governments. China has been struggling to ratify its own trade accords with the bloc given industry vulnerability, this initiative would further undermine its geopolitical influence in the region. Refocusing critical mineral production within this regional geography would decrease American reliance on Chinese production.

Secondly, nearshoring the semiconductor supply chain would reduce transport costs, decrease American vulnerability to intercontinental disruptions, and mitigate geopolitical reliance on China. Reduced extraction costs in Latin America, minimized transportation expenses, and reduced labor costs in especially Midwestern and Southern U.S. states enable America to maintain export competitiveness as a supplier to ASEAN’s booming technology industry in adjacent sectors, which indicates that China will not automatically fill market distortions. Furthermore, establishing investment arbitration procedures compliant with the General Agreement on Tariffs and Trade’s Dispute Settlement Understanding should accompany the establishment of transcontinental commerce initiatives, and therefore designate the the World Trade Organization as the exclusive forum for dispute settlement.

This policy is necessary to avoid the involvement of corrupt states’ backpaddling on established systems, which has historically impeded corporate involvement in the Southern Cone. This international legal security mechanism serves to assure entrepreneurial inputs that will render cooperation with American enterprises mutually attractive. However, partial free trade accords for primary sector materials are not sufficient to revitalize American industry and shift supply lines. To address the demand side, the exertion of downward pressure on pricing, alongside the reduction of geopolitical risk, should be accompanied by the institution of a state-subsidized low-interest loan, with available rate reset for approved legacy chip manufacturers, and a special-tier visa for hired personnel working in legacy chip manufacturing. Considering the sensitive national security interests at stake, the U.S. Federal Contractor Registration ought to employ the same awarding mechanisms and security filtering criteria used for federal arms contracts in its company auditing mechanisms. Under this scheme, vetted and historically capable legacy chip manufacturing firms will be exclusively able to take advantage of significant subventions and exceptional ‘wartime’ loans. Two reasons underpin the need for this martial, yet market-oriented industrial policy.

Firstly, legacy chip production requires highly specialized labor and immensely expensive fixed costs given the nature of accompanying machinery. Without targeted low-interest loans, the significant capital investment required for upgrading and expanding chip manufacturing facilities would be prohibitively high–potentially eroding the competitiveness of American and allied industries in markets that are heavily saturated with Chinese subsidies. Such mechanisms for increased and cheap liquidity also render it easier to import highly specialized talent from China, Taiwan, Germany, the Netherlands, etc., by offering more competitive compensation packages and playing onto the attractiveness of the United States lifestyle. This approach would mimic the Second World War’s “Operation Paperclip,” executed on a piecemeal basis at the purview of approved legacy chip suppliers.

Secondly, the investment fluidity that accompanies significant amounts of accessible capital serves to reduce stasis in the research and development of sixth-generation automotive, multi-use legacy chips (in both autonomous and semi-autonomous systems). Much of this improvement a priori occurs through trial-and-error processes within state-of-the-art facilities under the long-term commitment of manufacturing, research, and operations teams.

Acknowledging the strategic importance of centralizing, de-risking, and reducing reliance on foreign suppliers will safeguard the economic stability, national defense capabilities, and the innovative flair of the United States––restoring the national will and capacity to produce on its own shores. The national security ramifications of Chinese legacy chip manufacturing are predominantly downstream of their economic consequences, particularly vis-à-vis the integrity of American defense manufacturing supply chains. In implementing the aforementioned solutions and moving chip manufacturing to closer and friendlier locales, American firms can be well positioned to compete globally against Chinese counterparts and supply the U.S. military with ample chips in the event of armed conflict.

In 2023, the Wall Street Journal exposed the fragility of American supply chain resilience when they profiled how one manufacturing accident took offline 100% of the United States’ production capability for black powder—a critical component of mortar shells, artillery rounds, and Tomahawk missiles. This incident illustrates how critical a consolidated supply chain can be for national security and the importance of mitigating overreliance on China for critical components. As firms desire lower prices for their chips, ensuring adequate capacity is a significant component of a successful strategy to address China’s growing global share of legacy chip manufacturing. However, there are additional national security concerns for legacy chip manufacturing that supersede their economic significance–mitigating supply chain vulnerabilities is among the most consequential of these considerations.

Lastly, when there are substantial national security objectives at stake, the state is justified in acting independently of economic considerations; markets are sustained only by the imposition of binding and common rules. Some have argued that the possibility of cyber sabotage and espionage through military applications of Chinese chip technology warrants accelerating the timeline of procurement restrictions. The National Defense Authorization Act for Fiscal Year 2023’s Section 5949 prohibits the procurement of China-sourced chips from 2027 onwards. Furthermore, the Federal Communications Commission has the power to restrict China-linked semiconductors in U.S. critical infrastructure under the Secure Networks Act and the U.S. Department of Commerce reserves the right to restrict China-sourced semiconductors if they pose a threat to critical communications and information technology infrastructure.

However, Matt Blaze’s 1994 article “Protocol Failure in the Escrowed Encryption Standard” exposed the shortcomings of supposed hardware backdoors, such as the NSA’s “clipper chip” that they designed in the 1990s to surveil users. In the absence of functional software, a Chinese-designed hardware backdoor into sensitive applications could not function. This scenario would be much like a printer trying to operate without an ink cartridge. Therefore, instead of outright banning inexpensive Chinese chips and putting American firms at a competitive disadvantage, the federal government should require Chinese firms to release source code to firmware and supporting software for the chips they sell to Western companies. This would allow these technologies to be independently built and verified without undermining the competitive position of American industry. The U.S. imposed sanctions against Huawei in 2019 on suspicion of the potential espionage risks that reliance on Chinese hardware poses. While tighter regulation of Chinese semiconductors in sensitive areas seems to be a natural and pragmatic extension of this logic, it is unnecessary and undermines American dynamism.

Conclusion

Considering China’s growing global share of legacy chip manufacturing as a predominantly economic problem with substantial national security consequences, the American foreign policy establishment ought to pursue 1) a new technological outlook that exploits all facets of the integrated chip supply chain—including EDA software and allied replacement component suppliers—and 2) a partial free-trade agreement with MERCOSUR to further industrial policy objectives.

To curtail Chinese legacy chip dominance, the United States should weaponize its monopoly on electronic design automation software. By effectively forcing Chinese firms to purchase computing services from a U.S.-based cloud, American EDA software firms can audit and monitor Chinese innovations while reserving the ability to deny them service during armed conflict. Restricting allied firms’ ability to supply Chinese manufacturers with ancillary components can likewise slow the pace of Chinese legacy chip ascendence.

Furthermore, although China no longer relies on the United States or allied countries for NAND manufacturing, the United States and its allies maintain DRAM superiority. The United States must leverage capabilities to maintain Chinese reliance on its DRAM prowess and sustain its competitive edge while considering restricting the export of this technology for Chinese defense applications under extraordinary circumstances. Simultaneously, efforts to nearshore NAND technologies in South America can delay the pace of Chinese legacy chip ascendence, especially if implemented alongside a strategic decision to reduce reliance on Chinese rare earth metals processing.

In nearshoring critical mineral inputs to the end of preserving national security and reducing costs, the United States should adopt a market-oriented industrial policy of rate-reset, and state-subsidized low-interest loans for vetted legacy chip manufacturing firms. Synergy between greater competitiveness, capital solvency, and de-risked supply chains would enable U.S. firms to compete against Chinese counterparts in critical “third markets,” and reduce supply chain vulnerabilities that undermine national security. As subsidy-induced Chinese market distortions weigh less on the commercial landscape, the integrity of American defense capabilities will simultaneously improve, especially if bureaucratic agencies move to further insulate critical U.S. infrastructure against potential cyber espionage.

CHIPS and Science Funding Gaps Continues to Stifle Scientific Competitiveness

The bipartisan CHIPS and Science Act sought to accelerate U.S. science and innovation, to let us compete globally and solve problems at home. The multifold CHIPS approach to science and tech reached well beyond semiconductors: it authorized long-term boosts for basic science and education, expanded the geography of place-based innovation, mandated a whole-of-government science strategy, and other moves.

But appropriations in FY 2024, and the strictures of the Fiscal Responsibility Act in FY 2025, make clear that we’re falling well short of CHIPS aspirations. The ongoing failure of the U.S. to invest comes at a time when our competitors continue to up their investments in science, with China pledging 10% growth in investment, the EU setting forth new strategies for biotechnology and manufacturing, and Korea’s economy approaching 5% R&D investment intensity, far more than the U.S.

Research Agency Funding Shortfalls

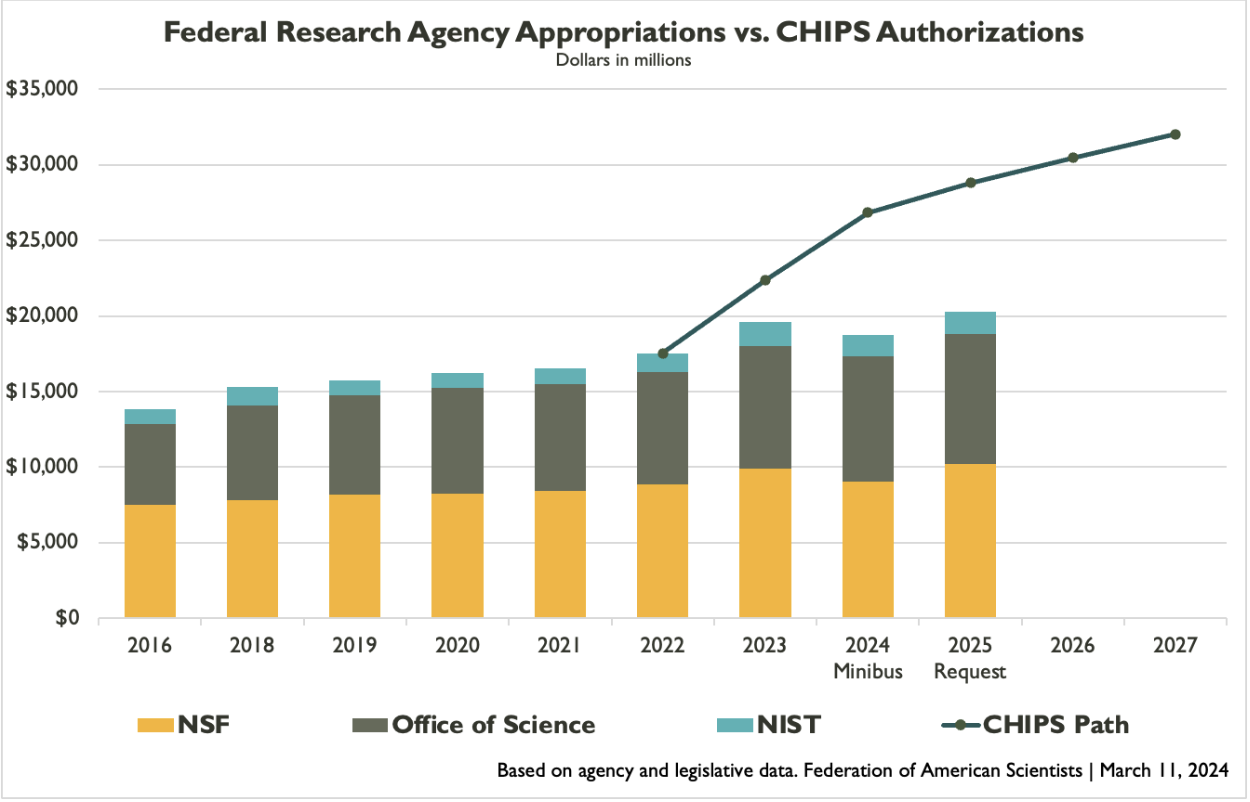

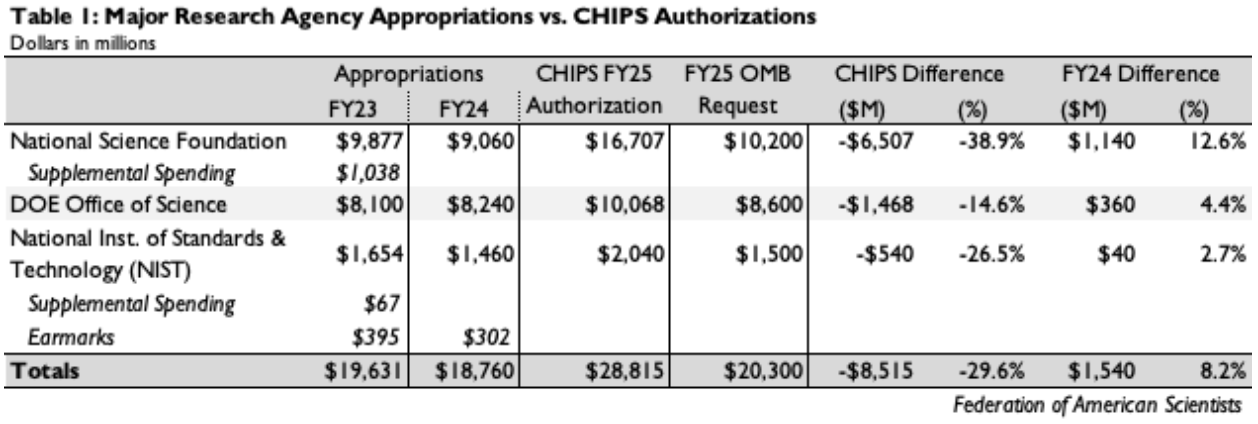

In the aggregate, CHIPS and Science authorized three research agencies – the National Science Foundation (NSF), the Department of Energy Office of Science (DOE SC), and the National Institute of Standards and Technology (NIST) – to receive $26.8 billion in FY 2024 and $28.8 billion in FY 2025, representing substantial growth in both years. But appropriations have increasingly underfunded the CHIPS agencies, with a gap now over $8 billion (see graph).

The table below shows agency funding data in greater detail, including FY 2023 and FY 2024 appropriations, the FY 2025 CHIPS authorization, and the FY 2025 request.

The National Science Foundation is experiencing the largest gap between CHIPS targets and actual appropriations following a massive year-over-year funding reduction in FY 2024. That cut is partly the result of appropriators rescuing NSF in FY 2023 with over $1 billion in supplemental spending to support both NSF base activities and implementation of the Technology, Innovation and Partnerships Directorate (TIP). While that spending provided NSF a welcome boost in FY 2023, it could not be replicated in FY 2024, and NSF only received a modest boost in base appropriations. As a result, the full year-over-decline for NSF amounted to over $800 million, which will likely mean cutbacks in both core and TIP (the exact distribution is to be determined though Congress called for an even-handed approach). It also means a CHIPS shortfall of $6.5 billion in both FY 2024 and FY 2025.

The National Institute of Standards and Technology also requires some additional explanation. Like NSF, NIST received some supplemental spending for both lab programs and industrial innovation in FY 2023, but NIST also has been subject to quite substantial earmarks in FY 2023 and FY 2024, as seen in the table above. The presence of earmarks in FY 2024 meant, in practice, a nearly $100 million reduction in funding for core NIST lab programs, which cover a range of activities in measurement science and emerging technology areas.

The Department of Energy’s Office of Science fared better than the other two in the omnibus with a modest increase, but still faces a $1.5 billion shortfall below CHIPS targets in the White House request.

Select Account Shortfalls

National Science Foundation

Core research. Excluding the newly-created TIP Directorate, purchasing power of core NSF research activities in biology, computing, engineering, geoscience, math and physical sciences, and social science dropped by over $300 million between FY 2021 and FY2023. If the FY 2024 funding cuts are distributed proportionally across directorates, their collective purchasing power would have dropped by over $1 billion all-in between FY 2021 and the present, representing a decline of more than 15%. This would also represent a shortfall of $2.9 billion below the CHIPS target for FY 2024, and will likely result in hundreds of fewer research awards.

STEM Education. While not quite as large as core research, NSF’s STEM directorate has still lost over 8% of its purchasing power since FY 2021, and remains $1.3 billion below its CHIPS target after a 15% year-over-year cut in the FY 2024 omnibus. This cut will likely mean hundreds of fewer graduate fellowships and other opportunities for STEM support, let alone multimillion-dollar shortfalls in CHIPS funding targets for programs like CyberCorps and Noyce teacher scholarships. The minibus did allocate $40 million for the National STEM Teacher Corps pilot program established in CHIPS, but implementing this carveout will pose challenges in light of funding cuts elsewhere.

TIP Programs. FY 2023 funding fell over $800 million shy of the CHIPS target for the new technology directorate, which had been envisioned to grow rapidly but instead will now have to deal with fiscal retrenchment. Several items established in CHIPS remain un- or under-funded. For instance, NSF Entrepreneurial Fellowships have received only $10 million from appropriators to date out of $125 million total authorized, while Centers for Transformative Education Research and Translation – a new initiative intended to research and scale educational innovations – has gotten no funding to date. Also underfunded are the Regional Innovation Engines (see below).

Department of Energy

Microelectronics Centers. While the FY 2024 picture for the Office of Science (SC) is perhaps not quite as stark as it is for NSF – partly because SC didn’t enjoy the benefit of a big but transient boost in FY 2023 – there remain underfunded CHIPS priorities throughout. One more prominent initiative is DOE’s Microelectronics Science Research Centers, intended to be a multidisciplinary R&D network for next-generation science funded across the SC portfolio. CHIPS authorized these at $25 million per center per year.

Fission and Fusion. Fusion energy was a major priority in CHIPS and Science, which sought among other things expansion of milestone-based development to achieve a fusion pilot plant. But following FY 2024 appropriations, the fusion science program continues to face a more than $200 million shortfall, and DOE’s proposal for a stepped-up research network – now dubbed the Fusion Innovation Research Engine (FIRE) centers – remains unfunded. CHIPS and Science also sought to expand nuclear research infrastructure at the nation’s universities, but the FY 2024 omnibus provided no funding for the additional research reactors authorized in CHIPS.

Clean Energy Innovation. CHIPS Title VI authorized a wide array of energy innovation initiatives – including clean energy business vouchers and incubators, entrepreneurial fellowships, a regional energy innovation program, and others. Not all received a specified funding authorization, but those that did have generally not yet received designated line-item appropriations.

NIST

In addition to the funding challenges for NIST lab programs described above – which are critical for competitiveness in emerging technology – NIST manufacturing programs also continue to face shortfalls, of $192 million in the FY 2024 omnibus and over $500 million in the FY 2025 budget request.

Regional Innovation

As envisioned when CHIPS was signed, three major place-based innovation and economic development programs – EDA’s Regional Technology and Innovation Hubs (Tech Hubs), NSF’s Regional Innovation Engines (Engines), and EDA’s Distressed Area Recompete Pilot Program (Recompete) – would be moving from exclusively planning and selection into implementation phases as well in FY25. But with recent budget announcements, some implementation may need to be scaled back from what was originally planned, putting at risk our ability to rise to the confluence of economic and industrial challenges we face.

EDA Tech Hubs. In October 2023, the Biden-Harris administration announced the designation of 31 inaugural Tech Hubs and 29 recipients of Tech Hubs Strategy Development Grants from nearly 400 applicants. These 31 Tech Hubs designees were chosen for their potential to become global centers of innovation and job creators. Upon announcement, the designees were then able to apply to receive implementation grants of $40-$70 million to each of approximately 5-10 of the designated Tech Hubs. Grants are expected to be announced in summer 2024.

The FY 2025 budget request for Tech Hubs includes $41 million in discretionary spending to fund additional grants to the existing designees, and another $4 billion in mandatory spending – spread over several years – to allow for additional Tech Hubs designees and strategy development grants. CHIPS and Science authorized the Hubs at $10 billion in total, but the program has only received 5% of this in actual appropriations to date. The FY25 request would bring total program funding up to 46% of the authorization.

The ambitious goal of Tech Hubs is to restore the U.S. position as a leader in critical technology development, but this ambition is dependent on our ability to support the quantity and quality of the program as originally envisioned. Without meeting the funding expectations set in CHIPS, the Tech Hubs’ ability to restore American leadership will be vastly limited.

NSF Engines. In January 2024, NSF announced the first NSF Engines awards to 10 teams across the United States. Each NSF Engine will receive an initial $15 million over the next two years with the potential to receive up to $160 million each over the next decade.

Beyond those 10 inaugural Engines awards, a selection of applicants were invited to apply for NSF Engines development awards, with each receiving up to $1 million to support team-building, partnership development, and other necessary steps toward future NSF Engines proposals. NSF’s initial investment in the 10 awardee regions is being matched almost two to one in commitments from local and state governments, other federal agencies, private industry, and philanthropy. NSF previously announced 44 Development Awardees in May 2023.

To bolster the efforts of NSF Engines, NSF also announced the Builder Platform in September 2023, which serves as a post-award model to provide resources, support, and engagement to awardees.

The FY25 request level for NSF Engines is $205 million, which will support up to 13 NSF Regional Innovation Engines. While this $205 million would be a welcome addition – especially in light of the funding risks and uncertainty in FY24 mentioned above – total funding to date is considerably below CHIPS aspirations, accounting for just over 6% of authorized funding.

EDA Recompete. The EDA Recompete Program, authorized for up to $1 billion in the CHIPS and Science Act, aims to allocate resources towards economically disadvantaged areas and create good jobs. By targeting regions where prime-age (25-54 years) employment lags behind the national average, the program seeks to revitalize communities long overlooked, bridging the gap through substantial and flexible investments.

Recompete received $200 million in appropriations in 2023 for the initial competition. This competition received 565 applications, with total requests exceeding $6 billion. Of those applicants, 22 Phase 1 Finalists were announced in December 2023.

Recompete Finalists are able to apply for the Phase 2 Notice of Funding Opportunity and are provided access to technical assistance support for their plans. In Phase 2, EDA will make approximately 4-8 implementation investments, with awarded regions receiving between $20 to $50 million on average.

Alongside the 22 Finalists, Recompete Strategy Development Grant recipients were announced. These grants support applicant communities in strategic planning and capacity building.

Following a shutout in FY 2024 appropriations, Recompete funding in the FY25 request is $41 million, bringing total funding to date to $241 million or just over 24% of authorized funding.

Congress will soon have the chance to rectify these collective shortfalls, with FY 2025 appropriations legislation coming down the pike soon. But the November elections throw substantial uncertainty over what was already a difficult situation. If Congress can’t muster the votes necessary to properly fund CHIPS and Science programs, U.S. competitiveness will continue to suffer.