Fueling the Bioeconomy: Clean Energy Policies Driving Biotechnology Innovation

The transition to a clean energy future and diversified sources of energy requires a fundamental shift in how we produce and consume energy across all sectors of the U.S. economy. The transportation sector, a sector that heavily relies on fossil-based energy, stands out not only because it is the sector that releases the most carbon into the atmosphere, but also for its progress in adopting next-generation technologies when it comes to new technologies and fuel alternatives.

Over the past several years, the federal government has made concerted efforts to support clean energy innovation in transportation, both for on-road and off-road. Particularly, in hard-to-electrify transportation sub-sectors, there has been added focus such as through the Sustainable Aviation Fuel (SAF) Grand Challenge. These efforts have enabled a wave of biotechnology-driven solutions to move from research labs to commercial markets, such as LanzaJets alcohol-to-jet technology in producing SAF. From renewable fuels to bio-based feedstocks, biotechnologies are enabling the replacement of fossil-derived energy sources and contributing to a more sustainable, secure, and diversified energy system.

SAF in particular has gained traction, enabled in part by public investment and interagency coordination, like the SAF Grand Challenge Roadmap. This increased federal attention demonstrated how strategic federal action, paired with demand signals from government, targeted incentives, and industry buy-in, can create the conditions needed to accelerate biotechnology adoption.

To better understand the factors driving this progress, FAS conducted a landscape analysis at the federal and regional level of biotechnology innovation within the clean energy sector, complemented by interviews with key stakeholders. Several policy mechanisms, public-private partnerships, and investment strategies were identified that were enablers of advanced SAF adoption and production and similar technologies. By identifying the enabling conditions that supported biotechnology’s uptake and commercialization, we aim to inform future efforts on how to accelerate other sectors that utilize biotechnologies and overall, strengthen the U.S. bioeconomy.

Key Findings & Recommendations

An analysis of the federal clean energy landscape reveals several critical insights that are vital for advancing the development and deployment of biotechnologies. Federal and regional strategies are central to driving innovation and facilitating the transition of biotechnologies from research to commercialization. The following key findings and actionable recommendations address the challenges and opportunities in accelerating this transition.

Federal Level Key Findings & Recommendations

The federal government plays a pivotal role in guiding market signals and investment toward national priorities. In the clean energy sector, decarbonizing aviation has emerged as a strategic objective, with SAF serving as a critical lever. Federal initiatives such as the SAF Grand Challenge, the SAF Roadmap, and the SAF Metrics Dashboard have helped to elevate SAF within national climate priorities and enabled greater interagency coordination. These mechanisms not only track progress but also communicate federal commitment. Still, despite these efforts, current SAF production remains far below target levels, with capacity largely concentrated in HEFA, a pathway with constrained feedstock availability and limited scalability.

This production gap reflects deeper structural challenges, many of which parallel broader issues across the clean-energy biotech interface. One of the main challenges is the fragmented, short-duration policy incentives currently in use. Tax credits like 40B and 45Z, while important, lack the longevity and clarity required to unlock large-scale, long-term private investment. The absence of binding fuel mandates further undermines market certainty. These policy gaps limit the ability of the clean energy sector to serve as a sustained demand signal for emerging biotechnologies and slow the transition from pilot to commercial scale.

Importantly, these challenges point to a broader opportunity: SAF as a test case for how the clean energy sector can serve as a driver of biotechnology uptake. Promising biotechnologies, such as alcohol-to-jet and power-to-liquid, are currently stalled by high capital costs, uncertain regulatory pathways, and a lack of coordinated federal support. Addressing these bottlenecks through aligned incentives, technology-neutral mandates, and harmonized accounting frameworks could not only accelerate SAF deployment but also establish a broader policy blueprint for scaling biotechnology across other clean energy applications.

To alleviate some of the challenges identified, the federal government should:

Extend & Clarify Incentives

While tax incentives such as the 45Z Clean Fuel Production Credit offer a promising framework to accelerate low-carbon fuel deployment, current design and implementation challenges limit their impact, particularly for emerging bio-based and synthetic fuels. To fully unlock the climate and market potential of these incentives, Congress and relevant agencies should take the following steps:

- Congress should amend the 45Z tax credit structure to differentiate between fuel types, such as SAF, e-fuels, biofuels, and renewable diesel, based on life cycle CI and production pathways. This would better reflect technology-specific costs and accelerate deployment across multiple clean fuel markets, adding specificity as to how to utilize and earn the credits based on the type of fuel.

- Congress should extend the duration of the 45Z credit and other clean-fuel related incentives to provide long-term policy certainty. Multi-year extensions with a defined minimum value floor would reduce investment risk and enable financing of capital-intensive projects.

- Congress and the Department of Treasury should clarify eligibility to ensure inclusion of co-processing methods and hybrid production systems, which are currently in regulatory gray areas. This would ensure broader participation by innovative fuel producers.

- Federal agencies, including the Department of Energy (DOE), Department of Transportation (DOT), and the Department of Defense, should be directed to enter into long-term (more than 10 years) procurement agreements for low-carbon fuels, including electrofuels and SAF. These offtake mechanisms would complement tax incentives and send strong market signals to producers and investors.

Scale Biotech Commercialization Support

The clean energy transition depends in part on the successful commercialization of enabling biotechnologies, ranging from advanced biofuels to bio-based carbon capture, SAF and biomanufacturing platforms that reduce industrial emissions. Recent or proposed funding cuts to clean energy programs risk stalling this progress and undermining U.S. competitiveness in the bioeconomy.

To accelerate biotechnology deployment and bridge the gap between lab-scale innovation and commercial-scale production, Congress should take the following actions:

- Authorize and appropriate expanded funding to the DOE, particularly through Bioenergy Technologies Office (BETO) and to the Department of Agriculture (USDA) to support pilot, demonstration, and first-of-a-kind commercial scale projects that enable biotechnology applications across clean energy sectors.

- Direct and fund the DOE Loan Programs Office to establish a dedicated loan guarantee program focused on biotechnology commercialization, targeting platforms that can be integrated into the energy system, such as bio-based fuels, bioproducts, carbon utilization technologies, and electrification-enabling materials.

- Encourage DOE and USDA to enter into long-term offtake agreements or structured purchasing mechanisms with qualified bioenergy and biomanufacturing companies. These agreements would help de-risk early commercial projects, crowd in private investment, and provide market certainty during the critical scale-up phase.

- Strengthen public-private coordination mechanisms, such as cross-sector working groups or interagency task forces, to align commercialization support with industry needs, improve program targeting, and reduce time-to-market for promising technologies.

Design and Promote Next-Gen Biofuel Policies

To accelerate the deployment of low-carbon fuels and enable innovation in next-generation bioenergy technologies, Congress and relevant agencies should take the following actions:

- Congress should direct the Environmental Protection Agency (EPA) to modernize the Renewable Fuel Standard by incorporating life cycle carbon intensity as a core metric, moving beyond volume-based mandates. Legislative authority could also support the development of a national Low Carbon Fuel Standard, modeled on successful state-level programs to drive demand for fuels with demonstrable climate benefits.

- EPA should update its emissions accounting framework to reflect the latest science on life cycle greenhouse gas (GHG) emissions, enabling more accurate assessment of advanced biofuels and synthetic fuels.

- DOE should expand R&D and demonstration funding for biofuel pathways that meet stringent carbon performance thresholds, with an emphasis on scalability and compatibility.

Regional Level Key Findings & Recommendations

Regional strengths continue to serve as foundational drivers of clean energy innovation, with localized assets shaping the pace and direction of technology development. Federal designations, such as the Economic Development Administration (EDA) Tech Hub program (Tech Hub), have proven catalytic. These initiatives enable regions to unlock state-level co-investment, attract private capital, and align workforce training programs with local industry needs. Early signs suggest that the Tech Hub framework is helping to seed innovation ecosystems where they are most needed, but long-term impact will depend on sustained funding support and continued regional coordination.

Workforce readiness and enabling infrastructure remain critical differentiators. Regions with deep and committed involvement from major research universities, national labs, or advanced manufacturing clusters are better positioned to scale innovation from prototype to deployment. Real-world testbeds provide environments for stress-testing technologies and accelerating regulatory and market readiness, reinforcing the importance of place-based strategies in federal innovation planning.

At the same time, private investment in clean energy and enabling biotechnologies remains crucial to developing and scaling innovative technologies. High capital costs, regulatory uncertainty, and limited early-stage demand signals continue to inhibit market entry, especially in geographies with less mature innovation ecosystems. Addressing these barriers through coordinated federal procurement, long-term incentives, and regional capacity-building will be essential to supporting growth in regions with strong assets to develop industry clusters that could yield clean energy benefits.

To accomplish this, the federal government and regional governments should:

Strengthen Regional Workforce Pipelines

A skilled and regionally distributed workforce is essential to realizing the full economic and technological potential of clean energy investments, particularly as they intersect with the bioeconomy. While federal funding is accelerating deployment through initiatives such as the IRA and DOE programs, workforce gaps, especially outside major innovation hubs, pose barriers to implementation. Addressing these gaps through targeted education, training, and talent retention efforts will be critical to ensuring that clean energy projects deliver durable, regionally inclusive economic growth. To this end:

- Federal agencies like the Department of Education and National Science Foundation should explore expanding support for STEM programs at community colleges and Minority Serving Institutions, with a focus on biosciences, engineering, and agricultural technologies relevant to the clean energy transition.

- Federally supported training and reskilling programs tailored to regional clean energy and biomanufacturing workforce needs could benefit new and existing cross-sector partnerships between state workforce agencies and regional employers.

- State and local governments should consider implementing talent retention strategies, including local hiring incentives, relocation support, and career placement services, to ensure that skilled workers remain in and contribute to regional clean energy ecosystems.

Strengthen Regional Infrastructure and Foster Cross-Sector Collaboration

Robust regional infrastructure and cross-sector collaboration are essential to accelerating the deployment of clean energy technologies that leverage advancements in biotechnology and manufacturing. Strategic investments in shared facilities, modernized logistics, and coordinated innovation ecosystems will strengthen supply chain resilience and improve technology transfer across sectors. Facilitating access to R&D infrastructure, particularly for small and mid-sized enterprises, will ensure that innovation is not limited to large firms or major metropolitan areas. To support these outcomes:

- Federal support for regional testbeds, prototyping sites, and grid modernization labs, coordinated by agencies such as DOE and EDA, would support the demonstration and scaling of biologically enabled clean energy technologies.

- State and local governments, in coordination with federal agencies including DOT and DOC, explore investment in logistics infrastructure to enhance supply chain reliability and support distributed manufacturing.

- States should consider creating or expanding the use of innovation voucher programs that allow small and mid-sized enterprises to access national lab facilities, pilot-scale infrastructure, and technical expertise, fostering cross-sector collaboration between clean energy, biotech, and advanced manufacturing firms.

Attract and De-Risk Private Capital

Attracting and de-risking private capital is critical for scaling clean energy and biotechnology innovations. By offering targeted financial mechanisms and leveraging federal visibility, governments can reduce the financial uncertainties that often deter private investment. Effective strategies, such as state-backed loan guarantees and co-investment models, can help bridge funding gaps while strategic partnerships with philanthropic and venture capital entities can unlock additional resources for emerging technologies. To this end:

- State governments, in collaboration with the federal agencies such as DOE and Treasury, should consider implementing state-backed loan guarantees and co-investment models to attract private capital into high-risk clean energy and biotech projects.

- Federal agencies like EDA, DOE, and the SBA should explore additional programs and partnerships to attract philanthropic and venture capital to emerging clean energy technologies, particularly in underserved regions.

- Federal agencies should increase efforts to facilitate connecting early-stage companies with potential investors, using federal initiatives to build investor confidence and reduce perceived risks in the clean energy sector.

Cross-Cutting Key Findings

The successful deployment of federal clean energy and biotechnology initiatives, such as the SAF Grand Challenge, relies heavily on the capacity of regional ecosystems and the private sector to absorb and implement national goals. Many regions, particularly those outside established innovation hubs, lack the infrastructure, resources, and technical expertise to effectively utilize federal funding. As a result, the impact of national policies is often limited, and the full potential of federal investments goes unrealized in certain areas.

Federal programs often take a one-size-fits-all approach, overlooking regional variability in feedstocks, industrial bases and cost structures. Programs like tax credits and life cycle analysis models can unintentionally disadvantage regions with different economic contexts, creating disparities in access to federal incentives. This lack of regional customization prevents certain areas from fully benefiting from national clean energy and biotech initiatives.

The diffusion of innovation in clean energy and biotechnology remains concentrated in a few key regions, leaving others underutilized. Despite robust federal R&D investments, commercialization and scaling of innovations are primarily concentrated in regions with established infrastructure, hindering the broader geographic spread of these technologies. In addition, workforce development efforts across federal and regional programs are fragmented, creating misalignments in talent pipelines and further limiting the ability of local industries to leverage available resources effectively. The absence of a unified system for tracking key metrics, such as SAF production and emissions reductions, makes it difficult to coordinate efforts or assess progress consistently across regions. To address this, the federal and regional governments should:

Create a Federal–Regional Clean Energy Deployment Compact

A Federal-Regional Clean Energy Deployment Compact is critical for aligning federal clean energy initiatives with the unique capabilities and needs of regional ecosystems. By establishing formal mechanisms, such as intergovernmental councils and regional liaisons, federal programs can be more effectively tailored to local conditions. These mechanisms will ensure two-way communication between federal agencies and regional stakeholders, fostering a collaborative approach that adapts to evolving technological, economic, and environmental conditions. In addition, treating regional tech hubs and initiatives as testbeds for new policy tools, such as performance-based incentives or carbon standards, will allow for innovative solutions to be tested locally before scaling them nationally, ensuring that policies are effective and contextually relevant across diverse regions. To this end:

- The White House Office of Science and Technology Policy (OSTP), in collaboration with the DOE and EPA, should establish formal intergovernmental councils or regional liaisons to facilitate ongoing dialogue between federal agencies and regional stakeholders. These councils would focus on aligning federal clean energy initiatives with regional needs, ensuring that local priorities, such as feedstock availability or infrastructure readiness, are considered in policy design.

- The DOE and EPA should treat tech hubs and regional clean energy initiatives as testbeds for policy innovation. These regions can pilot performance-based incentives, carbon standards, and other policy tools to assess their effectiveness before scaling them nationally. Successful models developed in these testbeds should be expanded to other regions, with lessons learned shared across state and local governments.

- Regional universities and innovation hubs should collaborate with federal and state agencies to develop pilot programs that test new policy tools and technologies. These institutions can serve as incubators for innovative clean energy solutions, providing valuable data on what policies work best in specific regional contexts.

Build a National Innovation-to-Deployment Pipeline

Creating a seamless innovation-to-deployment pipeline is essential for scaling clean energy technologies and ensuring that regional ecosystems can fully participate in national clean energy transitions. By linking DOE national labs, Tech Hubs, and regional consortia into a coordinated network, the U.S. can support the full life cycle of innovation, from early-stage R&D to commercialization and deployment, across diverse geographies. Additionally, co-developing curricula and training programs between federal agencies, regional tech hubs, and industry partners will ensure that talent pipelines are closely aligned with the evolving needs of the clean energy sector, providing the skilled workforce necessary to implement and scale innovations effectively. To accomplish this the:

- DOE should facilitate the creation of a national network that connects federal labs, regional tech hubs and innovation consortia. This network would provide a clear pathway for the transition of technologies from research to commercialization, ensuring that innovations can be deployed across different regions based on local needs and capacities.

- Regional Tech Hubs, in partnership with local universities and research institutions, should be integrated into the pipeline to provide localized innovation support and commercialization expertise. These hubs can act as nodes in the broader network, offering the infrastructure and expertise necessary for scaling up clean energy technologies.

Develop a Shared Metrics and Monitoring Platform

A centralized dashboard for tracking key metrics related to clean energy and biotechnology initiatives is crucial for guiding investment and policy decisions. By integrating federal and regional data can provide a comprehensive, real-time view of progress across the country. This shared platform would enable better coordination among federal, state, and local agencies, ensuring that resources are allocated efficiently and that policy decisions are informed by accurate, up-to-date data. Moreover, a unified system would allow for more effective tracking of regional performance, enabling tailored solutions and based on localized needs and challenges. To this end:

- The DOE, in partnership with the EPA, should lead the development of a centralized dashboard that integrates existing federal and regional data on SAF production, emissions reductions, workforce needs, and infrastructure gaps. This platform should be publicly accessible, allowing stakeholders at all levels to monitor progress and identify opportunities for improvement.

- State and local governments should contribute relevant data from regional initiatives, including workforce training programs, infrastructure development projects, and emissions reductions efforts. These contributions would help ensure that the platform reflects the full range of activities across different regions, providing a more accurate picture of national progress.

The Department of Labor and the DOC should integrate workforce development and industrial capacity data into the platform. This would include information on training programs, regional workforce readiness, and skills gaps, helping policymakers align talent development efforts with regional needs.

The DOT should ensure that transportation infrastructure data, particularly related to SAF production and distribution networks, is included in the platform. This would provide a comprehensive view of the supply chain and infrastructure readiness necessary to scale clean energy technologies across regions.

The clean energy sector, and specifically SAF, highlights both the promise and the persistent challenges of scaling biotechnologies, reflecting broader issues, such as fragmented regulation, limited commercialization support, and misaligned incentives that hinder the deployment of advanced biotechnologies. Overcoming these systemic barriers requires coordinated, long-term policies including performance-based incentives, and procurement mechanisms that reduce investment risk and free up capital. SAF should be seen not as a standalone initiative but as a model for integrating biotechnology into industrial and energy strategy, supported by a robust innovation pipeline, expanded infrastructure, and shared metrics to guide progress. With sustained federal leadership and strategic alignment, the bioeconomy can become a key pillar of a low-carbon, resilient energy future.

Translating Vision into Action: FAS Commentary on the NSCEB Final Report and the Future of U.S. Biotechnology

Advancing the U.S. leadership in emerging biotechnology is a strategic imperative, one that will shape regional development within the U.S., economic competitiveness abroad, and our national security for decades to come. In the past few years, the contribution of biotechnology to the U.S. economy (referred to as the bioeconomy) has grown significantly, contributing over $210 billion to GDP and creating more than 640,000 domestic jobs, cementing its role as a major and expanding economic force. The impact of biotechnologies and biomanufacturing can be seen across diverse sectors and geographies, with applications spanning agriculture, energy, industrial manufacturing, and health. As biotechnology continues to drive innovation, it is emerging as a core engine of the next industrial revolution.

To maximize the strategic potential of emerging biotechnology, Congress established the bipartisan National Security Commission on Emerging Biotechnology (NSCEB) through the FY22 National Defense Authorization Act. The commission was tasked with conducting a comprehensive review of how advancements in biotechnology and related technologies will shape the current and future missions of the Department of Defense (DOD), and developing actionable policy recommendations to support the adoption and advancement of biotechnology within DOD and across the federal government. This effort culminated in a report, “Charting the Future of Biotechnology”, delivered to Congress in April 2025. The final report outlines 49 recommendations aimed at accelerating biotechnology innovation and scaling the U.S. biomanufacturing base, reinforcing the bioeconomy as a strategic pillar of national security and economic competitiveness.

In addition to developing a series of recommendations to promote and grow the U.S. bioeconomy, the Commission has also been tasked with facilitating the implementation and adoption of these policy recommendations by Congress and relevant federal agencies. To date, several pieces of legislation have been introduced in both the 118th and 119th Congress that incorporate recommendations from NSCEB’s interim and final reports (Table 1). This Legislation Tracker will be updated as this legislation moves through the process and as new bills are introduced.

The NSCEB report represents a critical policy opportunity for the U.S. bioeconomy. It proposes an injection of $15 billion to support sustained growth in biotechnology innovation and biomanufacturing through strategic investment and improved coordination. This level of investment is significant and would signal congressional support for the bioeconomy that goes beyond that seen in CHIPS and Science Act and the Inflation Reduction Act of 2022. This much needed infusion of federal investment offers a timely opportunity to build on existing momentum and unlock the next phase of U.S. leadership in the bioeconomy.

The recommendations in the report should be seen as opportunities for engagement with the Commission and with Congress for further refinement of these policy ideas. As the Commission begins its work on implementation, they have called on stakeholders across the bioeconomy to help refine and strengthen its proposals. Responding to this need, the Federation of American Scientists (FAS) has identified priority areas requiring greater clarity and has issued an open call for supplemental recommendations and policy proposals through the Day One Open Call process.

Overall, FAS supports the Commission’s final report and we applaud the Commission’s efforts to elevate the national conversation around emerging biotechnologies. The report provides a necessary foundation for long-term federal strategy and investment in biotechnology and biomanufacturing. At the same time, there remain clear opportunities to strengthen the recommendations through greater specificity and deeper stakeholder engagement. Two overarching decisions by the Commission deserve some additional scrutiny. First, the report’s adversarial framing towards China, while grounded in strategic reality, risks overlooking opportunities for targeted collaboration that could yield global benefits, particularly in areas where scientific progress depends on multinational cooperation. Second, the final report gives limited attention to the agricultural sector, despite its clear relevance to national security and the DOD’s growing interest in agricultural biotechnology. The “Additional Considerations” section does include a constructive call to modernize the USDA’s BioPreferred Program and update federal classification systems, recommendations that echo those issued by FAS. A more comprehensive approach toward this sector is needed.

The following sections summarize the report’s key pillars and provide analysis, highlighting core recommendations and identifying opportunities where additional detail and stakeholder input, through the Day One Open Call, will be essential for translating the report’s vision into actionable, high-impact policy. Additionally, the Supplementary Recommendations Table for the NSCEB Final Report (Table 2) lists each of the recommendations from the pillars and cross references related proposals from prior FAS work, subject matter experts, and Day One Memos submitted by external stakeholders.

Table 2: Supplementary Recommendations Table for the NSCEB Final Report

Pillar 1. Prioritize Biotechnology at the National Level

Pillar 1 of the report emphasizes the need to prioritize biotechnology at the national level. The recommendations within this pillar are essential for the development of a cohesive national strategy, and we encourage Congress to consider incorporating terminology and drawing on previous policy related to the bioeconomy to ensure that previous progress related to emerging biotechnologies is not lost.

A central recommendation within this Pillar is the establishment of the National Biotechnology Coordination Office (NBCO), which would reduce fragmentation and elevate biotechnology as a national priority. To succeed, the NBCO must address challenges faced by past coordination bodies and be empowered by the administration to drive cross-agency strategy despite differing institutional perspectives. While the presidential appointment of the director could lend authority, it also risks politicization and strategic shifts that may destabilize the sector. Success will depend on clarity of roles, coordination across functions, and strong institutional support for implementation.

FAS provided several additional recommendations and insights on these topics (see Table 2) to make them more nuanced and actionable by Congress, including:

- Coordinating the U.S. Government Approach to the Bioeconomy by Sarah Carter

- A National Bioeconomy Manufacturing and Innovation Initiative by Alexander Titus

Pillar 2. Mobilize the Private Sector to get U.S. Products to Scale

Pillar 2 of the final report focuses on mobilizing the private sector to strengthen biotechnology products by addressing key challenges to the sector, including regulatory reform, financing obstacles, and infrastructure and data needs. While the report correctly identifies long standing regulatory bottlenecks for products of biotechnology under the Coordinated Framework, including unclear oversight and interagency conflicts, it also acknowledges statutory complexities that make reform difficult. Empowering the Office of Management and Budget’s Office of Information and Regulatory Affairs (OIRA) to mediate these disputes is a promising approach, but would require statutory reinforcement. Similarly, proposals to modernize regulatory capacity, such as agency fellowships and regulatory science programs, highlight a critical need for technical expertise within government, though questions remain about institutional placement and long-term sustainability.

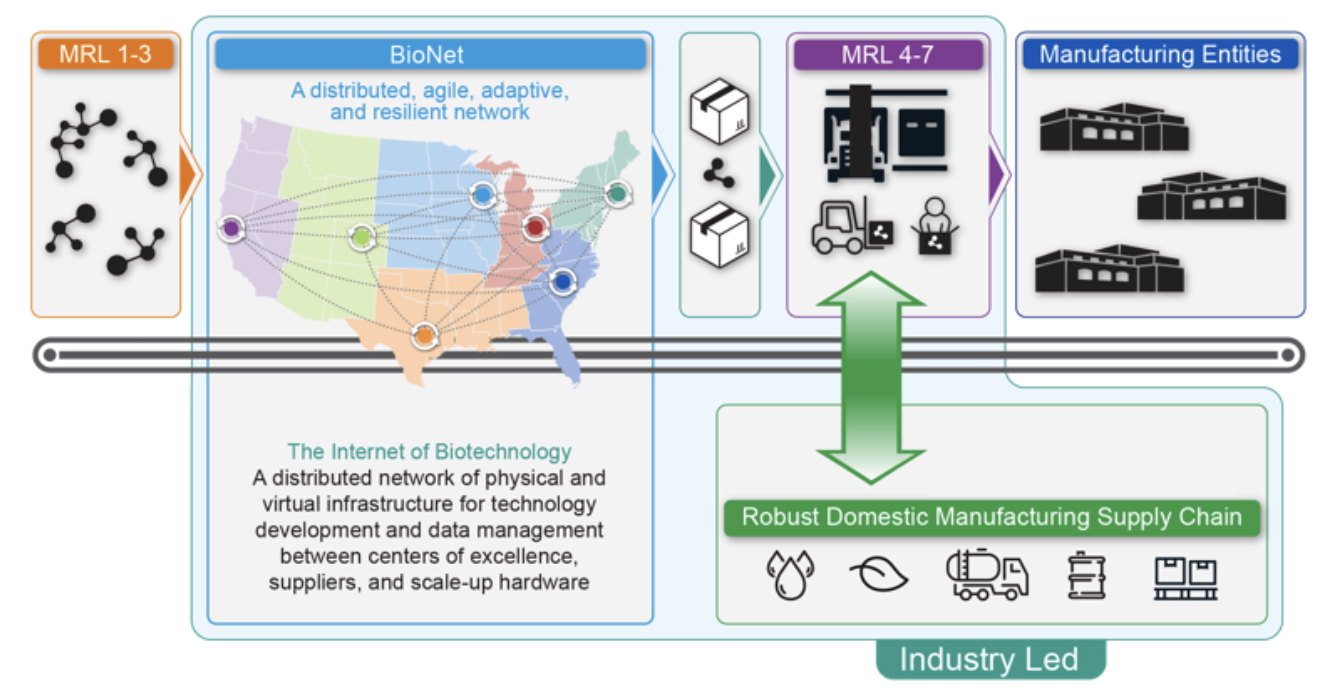

On financing and infrastructure, the report points to real gaps in early-stage capital and scale-up capacity, particularly for bridging the “Valley of Death” for biotechnology manufacturing. Concepts like advance market commitments and a new investment fund have potential, but their impact will depend heavily on design, risk management, and alignment with existing capital pipelines. The infrastructure recommendations are strong, but coordination challenges, particularly among national labs, regional hubs, and entities like BioMADE, must be addressed to avoid duplication or underutilization and approaches to securing bioeconomy infrastructure and data are underdeveloped. It will be critical to better define what constitutes critical biotechnology infrastructure and how it should be protected.

FAS provided significant expertise on these topics (see Table 2), such as:

- Coordinating the U.S. Government Approach to the Bioeconomy by Sarah Carter

- Regulations for the Bioeconomy by Sarah Carter

- A National Frontier Tech Public-Private Partnership to Spur Economic Growth by Katie Rae, Orin Hoffman & Michael Kearney

- De-Risking the U.S. Bioeconomy by Establishing Financial Mechanisms to Drive Growth and Innovation by Nazish Jeffery & Zak Weston

- Advancing the U.S. Bioindustrial Production Sector by Michael Fisher

- Closing Critical Gaps from Lab to Market by Phil Weilerstein, Shaheen Mamawala, and Heath Naquin

- Strengthening the U.S. Biomanufacturing Sector Through Standardization by Chris Stowers

- Summary Report – December 7, 2022, Bioeconomy Policy Workshop: Financial and Economic Tools

- Project BOoST: A Biomanufacturing Test Facility Network for Bioprocess Optimization, Scaling, and Training by Ed Charles & Chris Fracchia

One of the NSCEB’s recommendations in particular would benefit from additional input from external subject matter experts to make it more concrete and actionable for Congress:

- Recommendation 2.2d: Congress should improve the effectiveness and reach of the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs to support early-stage innovation. Specifically, stakeholder input on:

- Which areas of biotechnology or sectors within the bioeconomy would most benefit from SBIR and STTR investment?

- How can these programs better support not only early- but also late-stage innovation?

If you have specific policy suggestions related to this topic, we encourage you to submit your ideas through the Day One Open Call page at FAS.

Pillar 3. Maximize the Benefits of Biotechnology for Defense

Pillar 3 of the final report focuses on maximizing the benefits of biotechnology for national defense, with an emphasis on the intelligence community and the Department of Defense (DOD). This pillar includes recommendations related to BioMADE oversight as well as internal workforce education on biotechnology. While oversight of BioMADE is important, it is unclear why additional oversight from Congress is needed for this manufacturing institute above and beyond that provided by its federal sponsor. Additionally, it will be essential for DOD to establish a mechanism for regularly updating workforce education in biotechnology, given the sector’s rapid and continuous evolution.

More broadly, this Pillar appropriately reframes biotechnology as a strategic capability, beyond its traditional role in R&D. This shift in perspective is timely, but realizing the potential of these technologies will require significant institutional change. Ethical use frameworks, particularly around dual-use risks (warfighter enhancement, surveillance, and environmental impact) must be developed through a transparent process that extends beyond DOD to include external stakeholders and independent organizations. In addition, proposed investment and export controls aimed at limiting adversarial advantage must be carefully scoped and implemented. The Department of Commerce (DOC) has published multiple Requests for Information (2018, 2020) to understand and delineate “high-risk” biotech products. Yet, DOC has not added new biotech products to the export list, which highlights the complexity of this task, and underscores the need for precision to avoid stifling beneficial collaboration or disrupting global supply chains.

FAS provided several additional recommendations and insights on these topics (see Table 2) to make them more nuanced and actionable by Congress, including:

- CLimate Improvements through Modern Biotechnology (CLIMB) — A National Center for Bioengineering Solutions to Climate Change and Environmental Challenges by Jennifer Panlilio & Hanny Rivera

- A Foundational Technology Development and Deployment Office to Create Jobs by Katie Rae, Michael Kearney, and Orin Hoffman

Pillar 4. Out-Innovate our Strategic Competitors

Pillar 4 of the NSCEB’s report offers recommendations for strengthening the biotechnology sector to out-innovate global competitors. It focuses on building robust data ecosystems, enhancing biosecurity, and expanding bio R&D infrastructure within the U.S. A central theme is the creation of a modern biological data ecosystem, which would provide the foundational infrastructure necessary to accelerate innovation. While a biological data ecosystem and associated standards are timely, several technical and governance challenges must be addressed, like harmonizing legacy systems, defining AI-readiness, and coordinating cloud lab integration. These complexities present an opportunity for stakeholder engagement and thoughtful design.

Within the Pillar, proposals that call for expanding National Lab capabilities and funding interdisciplinary biotechnology research are directionally strong, but success will depend on interagency coordination and alignment with industry needs. Finally, the report calls for stronger governance of biosafety and biosecurity, though its assertion that past efforts have “failed” could benefit from more nuanced analysis.

While FAS provided expertise on these topics (see Table 2), such as:

- A National Bioeconomy Manufacturing and Innovation Initiative by Alexander Titus

- Kickstarting Collaborative, AI-Ready Datasets in the Life Sciences with Government-funded Projects by Erika DeBenedictis, Ben Andrew, and Pete Kelly

- Creating a National Exposome Project by Gurdane Bhutani, Gary Miller, and Sandeep Patel

- Accelerating Biomanufacturing and Producing Cost-Effective Amino Acids through a Grand Challenge by Allison Berke

- Accelerating Bioindustry Through Research, Innovation, and Translation by Jon Roberts

A few of the report’s recommendations would benefit from additional stakeholder input to enhance clarity and ensure they are actionable for Congress:

- Recommendation 4.1c: Congress should authorize and fund the Department of Interior to create a Sequencing Public Lands Initiative to collect new data from U.S. public lands that researchers can use to drive innovation and Recommendation 4.1d: Congress should authorize the National Science Foundation to establish a network of “cloud labs,” giving researchers state-of-the-art tools to make data generation easier. Specifically, stakeholder input on:

- What type of data should be generated and what types of data generation or collection should be prioritized?

- How can we best draw on or expand existing cloud lab capabilities?

- Recommendation 4.3b: Congress should initiate a grand research challenge focused on making biotechnology predictably engineerable. Specifically, stakeholder input on:

- What specific grand challenge should Congress pursue and how should it be implemented?

- How should the U.S. government engage the scientific community (and others) in establishing and pursuing grand challenges for biotechnology?

- Recommendation 4.4a: Congress must direct the executive branch to advance safe, secure, and responsible biotechnology research and innovation. Specifically, stakeholder input on:

- The report calls for establishment of a body within the U.S. government for this purpose. What should this look like and how would it operate?

If you have specific policy suggestions related to these topics, we encourage you to submit your ideas through the Day One Open Call at FAS.

Pillar 5. Build the Biotechnology Workforce of the Future

Pillar 5 of the final report looks to the future by offering recommendations to secure and build the biotechnology workforce needed in the future. It addresses both the modernization of the federal biotech workforce and the development of the broader U.S. biotech workforce. Modernizing the federal workforce requires more than training programs. It requires coordination across HR systems, consistent standards, and better integration of biotechnology experts into national security and diplomacy. Proposals to expand Congressional science capacity are long overdue and necessary to equip lawmakers to address rapidly evolving biotechnology issues. On the national level, scaling the biomanufacturing workforce will depend on aligning credentials with industry needs and securing input from labor, academia, and employers. Expanding biotechnology education is promising, but successful implementation will require investment in teacher training and curriculum development.

While FAS contributed several recommendations to support this critical capacity-building effort (see Table 2), such as:

- Gathering Industry Perspectives on how the U.S. Government can Support the Bioeconomy by Sarah Carter

- Meeting Biology’s “Sputnik Moment”: A Plan to Position the United States as a World Leader in the Bioeconomy by Natalie Kuldell

One of the NSCEB’s recommendation would benefit from additional stakeholder input to enhance its clarity and make it more actionable for Congress:

- Recommendation 5.2a: Congress must maximize the impact of domestic biomanufacturing workforce training programs. Specifically, stakeholder input on:

- How should the government approach creating competency models for biomanufacturing training and microcredentialing?

- Which specific areas are best suited for microcredentialing efforts?

If you have specific policy suggestions related to these topics, we encourage you to submit your ideas through the Day One Open Call at FAS.

Pillar 6. Mobilize the Collective Strengths of our Allies and Partners

Pillar 6 of the final report focuses on strengthening alliances and partnerships on the global stage to enhance the U.S. biotechnology sector. It highlights the role of the State Department (DOS) in facilitating this effort through development of foreign policy tools, strengthening global data and market infrastructure, and leading in the establishment of international standards within the sector. Elevating biotechnology within U.S. foreign policy is both timely and necessary, particularly as biotech becomes increasingly strategic in areas like health security, climate resilience, and defense. Leveraging existing tools like the International Technology Security and Innovation (ITSI) Fund could provide a solid foundation, but effective execution will require clearer interagency coordination, transparency in funding allocation, and defined metrics for impact, especially across overlapping technology domains.

Proposals to create shared data infrastructure, joint purchasing mechanisms, and international fellowships point to smart long-term strategies for building trust and interoperability with allies. Yet, success hinges on careful coordination, especially around sensitive areas like dual-use biotechnology export controls. If U.S. standards are significantly more restrictive than those of allies, it could create friction and undermine broader goals of international collaboration and leadership.

FAS provided several additional recommendations and insights on these topics (see Table 2) to make them more nuanced and actionable by Congress, including:

- A Matter of Trust: Helping the Bioeconomy Reach Its Full Potential with Translational Governance by Christopher J. Gillespie

- Strategic Investments the U.S. Should Make in the Bioeconomy Right Now by Nazish Jeffery

- Strengthening U.S. Engagement in International Standards Bodies by Natalie Thompson and Mark Montgomery

- What’s Next for the U.S. Bioeconomy? Defining It. by Nazish Jeffery

One particularly important recommendation emphasizes the need to engage the public and build trust in the sector by collecting data on public acceptance. This data can help inform national governance and ensure it is more responsive and translatable to public concerns.

Additional Considerations

The additional considerations section of the NSCEB report brings several key recommendations that do not fit with the rest of the report, though are still very important. Many focus on aligning federal leadership and economic infrastructure with the needs of a growing and strategically vital biotechnology sector. Elevating biotechnology leadership within DOD is a logical step to align R&D with budget authority and operational needs. Similarly, expanding the scope of the Bioenergy Technologies Office (BETO) beyond biofuels and codifying the Office of Critical and Emerging Technology (OCET) role reflects an overdue shift toward recognizing biotech’s relevance to national security and broader innovation policy, though these changes will require institutional buy-in and cultural adjustment. On the economic side, proposals to create a public-private innovation consortium are timely, especially for supporting smaller firms and navigating the convergence of biotechnology with other technologies, like AI. However, care should be taken to not overly narrow the scope at the expense of other critical intersections.

While FAS provided a few recommendations on these topics (see Table 2), such as:

- Summary Report – December 5, 2022, Bioeconomy Policy Workshop: Measurement and Language

- Laying the Groundwork for the Bioeconomy by Sarah Carter

One of the report’s recommendations would benefit from additional stakeholder input to enhance clarity and ensure that it is actionable for Congress:

- Recommendation 8: Congress should direct the National Science Foundation (NSF) to establish a federal grant program for a national system of community biology labs that would engage Americans in informal learning. Specifically, stakeholder input on:

- What is most needed to support community biology labs?

- Should community labs be incorporated within universities or run as independent institutions?

If you have specific policy suggestions related to these topics, we encourage you to submit your ideas through the Day One Open Call at FAS.

Next Steps for the U.S. Bioeconomy

The NSCEB’s final report outlines a vision for a national biotechnology strategy aimed at securing U.S. leadership in a sector that is not only rapidly advancing but also delivering significant economic returns, outpacing even AI. While the report offers thoughtful, well-grounded recommendations that address many of the core challenges facing the U.S. biotechnology landscape, several proposals would benefit from greater specificity and refinement to make them actionable in legislative form. This moment presents a unique opportunity for stakeholders across the biotechnology ecosystem to contribute meaningfully to the development of a national bioeconomy strategy.

The U.S. bioeconomy, which encompasses biotechnology, holds enormous strategic and economic potential. Without a clear, well-implemented plan, the nation risks repeating the mistakes of past industrial shifts, such as the decline in domestic semiconductor leadership. FAS urges Congress to act on the Commission’s recommendations and leverage FAS’ additional proposals to strengthen them further (see Table 2). We also call on the scientific community to provide additional input on these recommendations to ensure they are viable and impactful. If you have actionable policy ideas on how to shape the path forward for the U.S. bioeconomy, we encourage you to submit them through the Day One Open Call. Applicants with compelling ideas will be partnered with our team at FAS to develop their idea into an implementation ready policy memo. Click here to learn more about the Day One Open Call.

FAS Bioeconomy Open Call Areas

- Recommendation 2.2d (SBIR and STTR): Congress should improve the effectiveness and reach of the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs to support early-stage innovation.

- Which areas of biotechnology or sectors within the bioeconomy would most benefit from SBIR and STTR investment?

- How can these programs better support not only early- but also late-stage innovation?

- Recommendation 4.1c (Bio Data Generation): Congress should authorize and fund the Department of Interior to create a Sequencing Public Lands Initiative to collect new data from U.S. public lands that researchers can use to drive innovation and Recommendation 4.1d: Congress should authorize the National Science Foundation to establish a network of “cloud labs,” giving researchers state-of-the-art tools to make data generation easier.

- What type of data should be generated and what types of data generation or collection should be prioritized?

- How can we best draw on or expand existing cloud lab capabilities?

- Recommendation 4.3b (Predictable BioEngineering): Congress should initiate a grand research challenge focused on making biotechnology predictably engineerable.

- What specific grand challenge should Congress pursue and how should it be implemented?

- How should the U.S. government engage the scientific community (and others) in establishing and pursuing grand challenges for biotechnology?

- Recommendation 4.4a (Safe, Secure, Responsible): Congress must direct the executive branch to advance safe, secure, and responsible biotechnology research and innovation.

- The report calls for establishment of a body within the U.S. government for this purpose. What should this look like and how would it operate?

- Recommendation 5.2a (Domestic Bio Workforce): Congress must maximize the impact of domestic biomanufacturing workforce training programs.

- How should the government approach creating competency models for biomanufacturing training and microcredentialing?

- Which specific areas are best suited for microcredentialing efforts?

- Additional Considerations #8 (Grant Programs): Congress should direct the National Science Foundation (NSF) to establish a federal grant program for a national system of community biology labs that would engage Americans in informal learning.

- What is most needed to support community biology labs?

- Should community labs be incorporated within universities or run as independent institutions?

De-Risking the U.S. Bioeconomy by Establishing Financial Mechanisms to Drive Growth and Innovation

The bioeconomy is a pivotal economic sector driving national growth, technological innovation, and global competitiveness. However, the biotechnology innovation and biomanufacturing sector faces significant challenges, particularly in scaling technologies and overcoming long development timelines that don’t align with short-term return expectations from investors. These extended timelines and the inherent risks involved lead to funding gaps that hinder the successful commercialization of technologies and bio-based products. If obstacles like the ‘Valleys of Death, a lack of capital at crucial development junctures, that companies and technology struggle to overcome are not addressed, this could result in economic stagnation and the U.S. losing its competitive edge in the global bioeconomy.

Government programs like SBIR and STTR lessen the financial gap inherent in the U.S. bioeconomy, but existing financial mechanisms have proven insufficient to fully de-risk the sector and attract the necessary private investment. In FY24, the National Defense Authorization Act established the Office of Strategic Capital within the Department of Defense to provide financial and technical support for its 31 ‘Covered Technology Categories’, which includes biotechnology and biomanufacturing. To address the challenges associated with de-risking biotechnology and biomanufacturing within the U.S. bioeconomy, the Office of Strategic Capital within the Department of Defense should house a Bioeconomy Finance Program. This program would offer tailored financial incentives such as loans, tax credits, and volume guarantees, targeting both short-term and long-term scale-up needs in biomanufacturing and biotechnology.

By providing these essential funding mechanisms, the Bioeconomy Finance Program will reduce the risks inherent in biotechnology innovation, encouraging more private sector investment. In parallel, states and regions across the country should develop regional specific strategies, like investing in necessary infrastructure, and fostering public-private partnerships, to complement the federal government’s initiatives to de-risk the sector. Together, these coordinated efforts will create a sustainable, competitive bioeconomy that supports economic growth, and strengthens U.S. national security.

Challenge & Opportunity

The U.S. bioeconomy encompasses economic activity derived from the life sciences, particularly in biotechnology and biomanufacturing. The sector plays an important role in driving national growth and innovation. Given its broad reach across industries, impact on job creation, potential for technological advancements, and requirement for global competitiveness, the U.S. bioeconomy is a critical sector for U.S. policymakers to support. With continued development and growth, the U.S. bioeconomy promises not only economic benefits, but also strengthens national security, health outcomes, and environmental sustainability for the country.

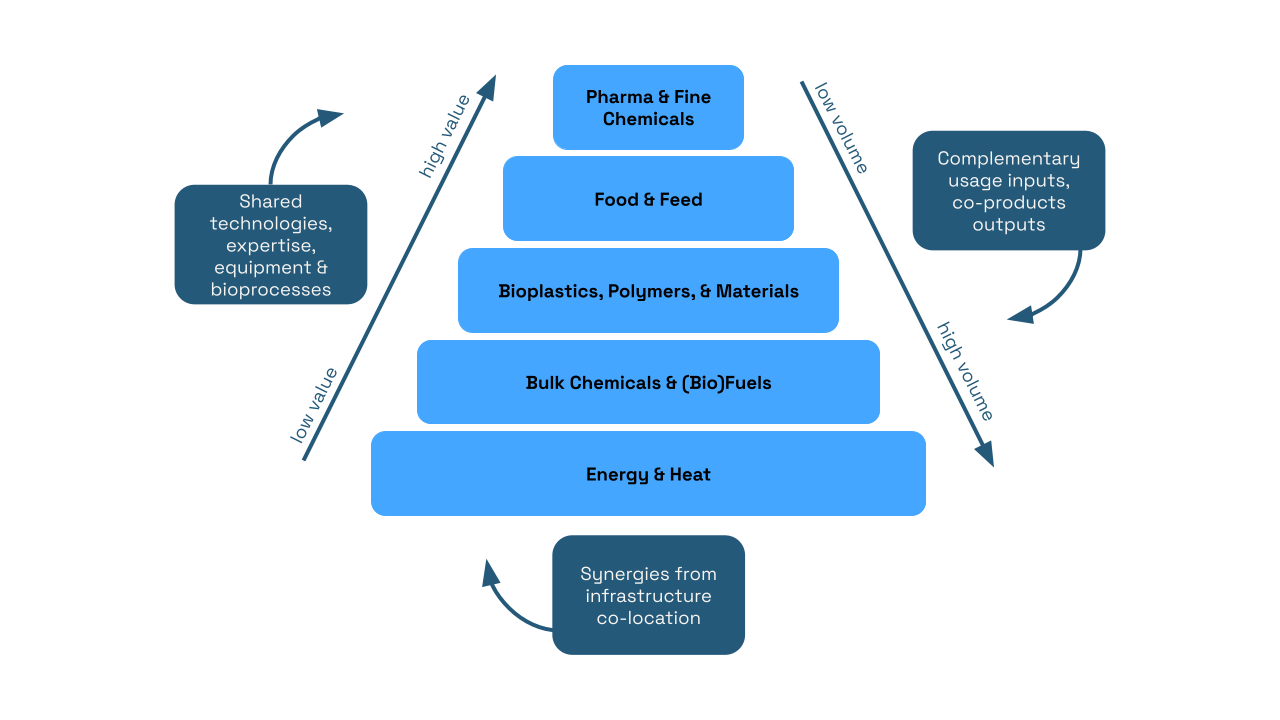

Ongoing advancements in biotechnology, including artificial intelligence and automation, have accelerated the growth of the bioeconomy, making the sector both globally competitive and an important domestic economic sector. In 2023, the U.S. bioeconomy supported nearly 644,000 domestic jobs, contributed $210 billion to the GDP, and generated $49 billion in wages. Biomanufactured products within the bioeconomy span multiple categories (Figure 1). Growth here will drive future economic development and address societal challenges, making the bioeconomy a key priority for government investment and strategic focus.

Biomanufactured products span a wide range of categories, from pharmaceuticals and chemicals, which require small volumes of biomass but yield high-value products, to energy and heat, which require larger volumes of biomass but result in lower-value products. Additionally, there are common infrastructure synergies, bioprocesses, and complementary input-output relationships that facilitate a circular bioeconomy within bioproduct manufacturing. Source: https://edepot.wur.nl/407896

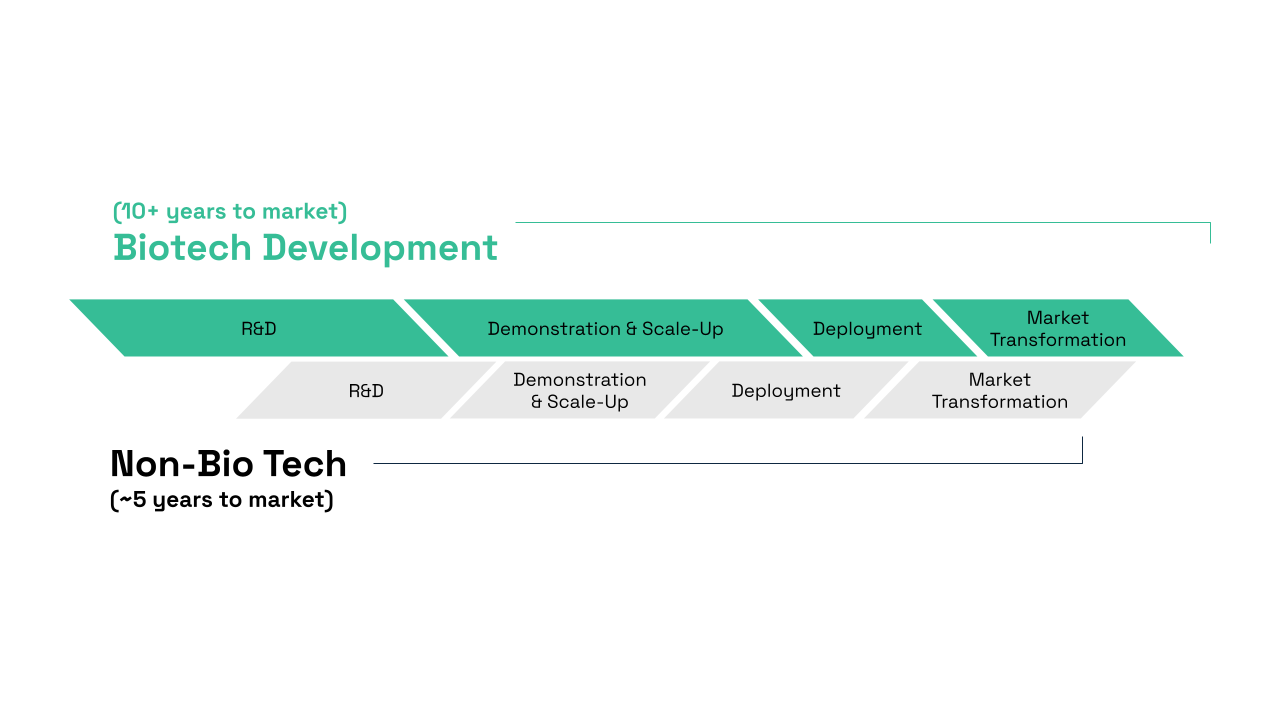

An important driving force for the U.S. bioeconomy is biotechnology and biomanufacturing innovation. However, bringing biotechnologies to market requires substantial investment, capital, and most importantly, time. Unlike other technology sectors which see returns on investment within a short period of time, often, there is a misalignment between scientific and capitalistic expectations. Many biotechnology based companies rely on venture capital, a form of private equity investments, to finance their operations. However, venture capitalists (VCs) typically operate on short return on investment timelines, which may not align with the longer development cycles characteristic of the biotechnology sector (Figure 2). Additionally, the need for large-scale and the high capital expenditures (CAPEX) required for commercially profitable production, along with the low-profit margins in high-volume commodity production, create further barriers to obtaining investment. While this misalignment is not universal, it remains a challenge for many biotech startups.

The U.S. government has implemented several programs to address the financing void that often arises during the biotechnology innovation process. These include the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, which provide phased funding across all Technology Readiness Levels (TRLs); the DOE Loan Program Office, which offers debt financing for energy-related innovations; the DOE Office of Clean Energy Demonstrations which provides funding for demonstration-scale projects that provide proof of concept; and the newly established Office of Strategic Capital (OSC) within the DOD (as outlined in the FY24 National Defense Authorization Act), which is tasked with issuing loans and loan guarantees to stimulate private investment in critical technologies. An example is the office’s new Equipment Loan Financing through OSC’s Credit Program.

Biotechnology development timelines typically take around ~10+ years to complete and reach the market due to longer R&D and Demonstration & Scale-Up phases, while non-biotechnology development timelines are generally much shorter, averaging around ~5+ years.

While these efforts are important, they are insufficient on their own to de-risk the sector to the degree which is needed to realize the full potential of the U.S. bioeconomy. To effectively support the biotechnology innovation pipeline at critical stages, the government must explore and implement additional financial mechanisms that attract more private investment and mitigate the inherent risks associated with biotechnology innovation. Building on existing resources like the Regional Technology and Innovation Hubs, NSF Regional Innovation Engines, and Manufacturing USA Institutes, help stimulate private sector investment and are crucial for strengthening the nation’s economic competitiveness.

The newly established Office of Strategic Capital (OSC) within the DOD is well-positioned to enhance resilience in critical sectors for national security, including biotechnology and biomanufacturing, through large-scale investments. Biotechnology and biomanufacturing inherently require significant CAPEX, expenses related to the purchase, upgrade, or maintenance of physical assets. This requires substantial amounts of strategic and concessional capital to de-risk and accelerate the biomanufacturing process. By creating, implementing, and leveraging various financial incentives and resources, the Office of Strategic Capital can help build the robust infrastructure necessary for private sector engagement.

To achieve this, the U.S. government should create the Bioeconomy Finance Program (BFP) within the OSC, specifically tasked with enabling and de-risking the biotechnology and biomanufacturing sectors through financial incentives and programs. The BFP should focus on different levels of funding based on the time required to scale, addressing potential ‘Valleys of Death’ that occur during the biomanufacturing and biotechnology innovation process. These funding levels would target short-term (1-2 years) scale-up hurdles to accelerate the biotechnology and biomanufacturing process, as well as long-term (3-5 years) scale-up challenges, providing transformative funding mechanisms that could either make or break entire sectors.

In addition to the federal programs within the BFP to de-risk the sector, states and regions must also make substantial investments and collaborate with federal efforts to accelerate biomanufacturing and biotechnology ecosystems within their own areas. While the federal government can provide a top-down strategy, regional efforts are critical for supporting the sector with bottom-up strategies that complement and align with federal investments and programs, ultimately enabling a sustainable and competitive biotechnology and biomanufacturing industry regionally. To facilitate this, regions should develop and implement state-wide investment initiatives like resource analysis, infrastructure programs, and a cohesive, long-term strategy focused on public-private partnerships. The federal government can encourage these regional efforts by ensuring continued funding for biotechnology hubs and creating additional opportunities for federal investment in the future.

Plan of Action

To strengthen and increase the competitiveness of the U.S. bioeconomy, a coordinated approach is needed that combines federal leadership with state-level action. This includes establishing a dedicated Bioeconomy Finance Program within the Office of Strategic Capital to create targeted financial mechanisms, such as loan programs, tax incentives, and volume guarantees. Additionally, states must be empowered to support commercial-scale biomanufacturing and infrastructure development, leveraging tech hubs, cross-regional partnerships, and building public-private partnerships to build capacity and foster innovation nationwide.

Recommendation 1. Establish and Fund a Bioeconomy Finance Program

Congress, in the next National Defense Authorization Act, should codify the Office of Strategic Capital (OSC) within DOD and authorize the creation of a Bioeconomy Finance Program (BFP) within the OSC to provide centralized federal structure for addressing financial gaps in the bioeconomy, thereby increasing productivity and competitiveness globally. In 2024, Congress expanded the OSCs mission to offer financial and technical support to entities within its 31 ‘Covered Technology Categories,’ including biotechnology and biomanufacturing. Additionally, in order to build resilience in the sector and maintain a competitive advantage globally while also strengthening national security, these substantial expenditures should be housed within the OSC. Establishing the BFP within the OSC at the DOD would allow for a targeted focus on these critical sectors, ensuring long-term stability and resilience against political shifts.

The DOD and OSC should leverage its own funding as well as its existing partnership with the Small Business Administration to direct $1 billion to set up the BFP to create and implement initiatives aimed at de-risking the U.S. bioeconomy. The Bioeconomy Finance Program should work closely with relevant federal agencies, such as the DOE, Department of Agriculture (USDA), and the Department of Commerce (DOC), to ensure a long-term cohesive strategy for financing bioeconomy innovation and biomanufacturing capacity.

Recommendation 2. Task the Bioeconomy Finance Program with Key Initiatives

A key element of the OSC’s mission and investment strategy is to provide financial incentives and support to entities within its 31 ‘Core Technology Categories’. By having BFP design and manage these financial initiatives for the biotechnology and biomanufacturing sectors, the OSC can leverage lessons from similar programs, such as the DOE’s loan program, to address the unique needs of these critical industries, which are essential for national security and economic growth.

Currently, the OSC has launched a credit program for equipment financing. While this is a necessary first step in fulfilling the office’s mission, the program is open to all 31 ‘Core Technology Categories’, resulting in broad, dilutive funding. To accelerate the bioeconomy and reduce risks in biotechnology and biomanufacturing, it is crucial to allocate resources specifically to these sectors. Therefore, BFP should take the lead in several key financial initiatives to support the growth of the bioeconomy, including:

Loan Programs

The BFP should develop specific biotechnology enabling loan programs, in addition to the new equipment loan financing program run by the OSC. These loan programs should be modeled after those in the DOE LPO, focusing on biomanufacturing scale-up, technology transfer, and overcoming financing gaps that hinder commercialization.

Example loan programs:

- DOE Title 17 Clean Energy Financing Program

- USDA Business & Industry Loan Guarantee

- Solar Foods EU Grant/Loan

Tax Incentives

The BFP office should create tax incentives tailored to the bioeconomy, such as, transferable investment and production tax credits. For example, the 45V tax credit for production of clean hydrogen could serve as a model for similar incentives aimed at other bioproducts.

Example tax incentives:

- The Inflation Reduction Act’s transferable tax credits are the gold standard for this category.

Volume Guarantees & Procurement Support

To mitigate risks in biomanufacturing, the office should establish volume guarantees for various bioproducts, offering financial assurance to manufacturers and encouraging private sector investment. An initial assessment should be conducted to identify which bioproducts are best suited for such guarantees. Additionally, the office should explore the possibility of procurement programs to increase government demand for bio-based products, further incentivizing industry growth and innovation. This effort should be undertaken in coordination with the USDA’s BioPreferred Program to minimize redundancy and to create a cohesive procurement strategy. In addition, the BFP should look to the procurement innovations promoted by the Office of Federal Procurement Policy to find solutions for forward funding to create a functioning market.

Example Volume Guarantees & Procurement Support:

- Heavy Forging Press Infrastructure Lease Agreement

- NASA and USAF buying Fairchild semiconductors in advance of needing them, and overbought performance

- Advance Market Commitments

- Joint Venture Partnerships

- Other Transaction Authorities

Recommendation 3. Develop Pipeline Programs to Address Financial and Time Horizon Needs

Utilizing the key initiatives highlighted above, the BFP should create a two-tiered financial mechanisms pipeline and program to address both the short-term and long-term financial needs. The different financial levels could potentially include:

- Level 1 – Short Term Scale-Up (1-2 years) Programs

- Subsidized cost of electricity and other utilities (waste, wastewater treatment, natural gas, energy, etc.)

- Funding for demonstration-scale projects and early-stage engineering development. Similar to the DOEs Office of Clean Energy Demonstrations or the DODs’ Defense Industrial Base Consortium round one $1-2M engineering grants)

- Tax holidays for corporate taxes and property taxes

- Allowing accelerated depreciation to reduce tax liabilities

- Land grants or subsidies for manufacturing assets

- Fast-track permitting and site preparation to avoid long waits

- Labor and workforce subsidies

- Removal of export duties on products created in the U.S. and shipped overseas

- Level 2 – Long Term Scale-Up (3-5 years) Programs

- Large-scale transferable tax credits (either production or investment tax credits) for manufacturing. Similar to the tax credits seen in the Inflation Reduction Act for clean energy.

- Large-scale manufacturing grants

- Large-scale, low-interest manufacturing loans and loan guarantees

- Government procurement contracts or commitment for offtake, such as partial/full volume guarantees

- Government direct or indirect equity investments in biomanufacturing and biotechnology innovations

Recommendation 4. State-Level Initiatives, Infrastructure Development, and Public-Private Partnerships

While federal efforts are crucial, a bottom-up approach is needed to support biomanufacturing and the bioeconomy at the state level. The federal government can support these regional activities by providing targeted funding, policy guidance, and financial incentives that align with regional priorities, ensuring a coordinated effort toward industry growth. States should be encouraged to complement federal initiatives by developing programs that support commercial-scale biomanufacturing. Key actions include:

- State-Level Bioeconomy Resource Analysis: Each state and region should conduct their own analysis to understand the bioeconomy resources at their disposal and determine what relevant resources they would need to establish or strengthen state or regional bioeconomies. Identifying these resources will help the nation understand its true bioeconomic potential by understanding where certain biomass is contained, what facilities are available and needed to develop an economically sustainable bioeconomy, and create data to better understand the economic return on investment.

- Once the analysis is completed, States should collaborate with federal agencies like the DOE, DOC, and Economic Development Administration (EDA) to create and apply for specialized grants for commercial-scale biomanufacturing facilities based off of these analyses. Grants should prioritize non-pharmaceutical biomanufacturing to expand the scope of bioeconomy growth beyond traditional sectors.

- Utility Infrastructure Grants: Another critical area is the creation of utility infrastructure needed to support biomanufacturing, such as wastewater treatment and electricity infrastructure. States should receive targeted funding for these infrastructure projects, which are essential for scaling up production. States should take these targeted funds and establish their own granting mechanism to build necessary, regional infrastructure that is needed long-term to support the U.S. bioeconomy.

- Tech Hub Partnerships: States should leverage existing tech hubs to serve as centers for innovation in bioeconomy technologies. These hubs, which are already positioned in regions with high technological readiness, can be incentivized to partner with other regions that may not yet have robust tech ecosystems. The goal is to create a collaborative, cross-regional network that fosters knowledge-sharing and builds capacity across the country.

- Foster Public-Private Partnerships (PPP): To ensure the success and sustainability of these initiatives, states should actively foster PPPs that bring together government, industry leaders, and academic institutions. These partnerships can help align private sector investment with public goals, enhance resource sharing, and accelerate the commercialization of bioeconomy technologies. By engaging in collaborative R&D, sharing infrastructure costs, and co-developing new biotechnologies, PPPs will play a crucial role in driving innovation and economic growth in the bioeconomy sector. In addition to fostering PPPs, regions should proactively work on creating models that enable these partnerships to become self-sustaining, helping to mitigate potential financial pitfalls if partners drop out of the partnership. By not only creating PPPs, but also ensuring they become fully independent over time, the associated risks with PPPs decrease significantly.

By addressing these steps at both the federal and state levels, the U.S. can create a robust, scalable framework for financing biomanufacturing and the broader bioeconomy, supporting the transition from early-stage innovation to commercial success and ensuring long-term economic competitiveness. A good example of how this approach works is the DOE Loan Program Office, which collaborates with state energy financing institutions. This partnership has successfully supported various projects by leveraging both federal and state resources to accelerate innovation and drive economic growth. This model makes sense for biomanufacturing and biotechnology within the BFP in the OSC, as it ensures coordination between federal and state efforts, de-risks the sector, and facilitates the scaling of transformative technologies.

Conclusion

Biotechnology innovation and biomanufacturing are critical components of the U.S. bioeconomy which drives innovation, economic growth, and global competitiveness, but these sectors face significant challenges due to the misalignment of development timelines and investment cycles. The sector’s inherent risks and long development processes create funding gaps, hindering the commercialization of vital biotechnologies and products. These challenges, including the ‘Valleys of Death,’ could stifle innovation, slow down progress, and result in the U.S. losing its global leadership in biotechnology if left unaddressed.

To overcome these obstacles, a coordinated and comprehensive approach to de-risk the sector is necessary. The establishment of the Bioeconomy Finance Program (BFP) within the DOD’s Office of Strategic Capital (OSC) offers a robust solution by providing targeted financial incentives, such as loans, tax credits, and volume guarantees, designed to de-risk the sector and attract private investment. These financial mechanisms would address both short-term and long-term scale-up needs, helping to bridge funding gaps and accelerate the transition from innovation to commercialization. Furthermore, building on existing government resources, alongside fostering state-level initiatives such as infrastructure development, and public-private partnerships, will create a holistic ecosystem that supports biotechnology and biomanufacturing at every stage and will substantially de-risk the sector. By empowering regions to develop their own bioeconomy strategies and leverage local federal government programs, like the EDA Tech Hubs, the U.S. can create a sustainable, scalable framework for growth. By taking these steps, the U.S. can strengthen both its economic position but also lead the world in development of transformative biotechnologies.

BioMADE, a Manufacturing Innovation Institute sponsored by the U.S. Department of Defense, plays an important role in advancing and developing the U.S. bioeconomy. Yet, BioMADE currently funds pilot to intermediate-scale projects, rather than commercial-scale projects. This leaves a significant funding gap, creating a distinct and significant challenge for the bioeconomy.. By contrast, the BFP within OSC would complement existing efforts by specifically targeting and mitigating risks in the biotechnology and biomanufacturing pipeline that current programs do not address. Furthermore, given that BioMADE is also funded by the DOD, enhanced coordination between these programs willenable a more robust and cohesive strategy to accelerate the growth of the U.S. bioeconomy.

While Private-Public Partnerships (PPPs) are already embedded in some federal regional programs, such as the EDA Tech Hubs, not all states or regions have access to these initiatives or funding. To ensure equitable growth and fully harness the economic potential of the bioeconomy across the nation, it will be important for regions and states to actively seek additional partnerships beyond federally-driven programs. This will empower them to build their own regional bioeconomies, or microbioeconomies, by tapping into regional strengths, resources, and expertise to drive localized innovation. Moreover, federal programs like EDA Tech Hubs are often focused on advancing existing technologies, rather than fostering the development of new ones. By expanding PPPs across the biotech sector, states and regions can spur broader economic growth and innovation by holistically developing all areas of biotechnology and biomanufacturing, enhancing the overall bioeconomy.

The Emerging Reach of the Bioeconomy

On Tuesday, 4/8/25, the bipartisan National Security Commission on Emerging Biotechnology (NSCEB) released their findings on how the U.S. can support and bolster the emerging bioeconomy sector. This sector, which includes biotechnology and biomanufacturing, is increasingly important to scientists working across disciplines – and will continue to shape the economic fortunes of regions across the country.

FAS looks forward to dissecting, advancing, and advocating for the Commission’s report. FAS has been active and influential in this sector and has worked with various stakeholders and experts to advance evidence-based policy recommendations to boost the U.S. bioeconomy (more below). While the report provides an essential starting point to grow and secure our biotechnology and biomanufacturing enterprise, it will be important to advocate for the recommendations found within it, but also to add and refine recommendations to meet the ever evolving U.S. bioeconomy.

FAS is especially enthusiastic about the recommendations that emphasize prioritizing and advancing biotechnology at the national level, ensuring the U.S. maintains its innovation edge. We also strongly support the recommendations aimed at scaling biotechnologies and biomanufacturing by fostering private sector growth and leveraging various financial mechanisms. These recommendations are crucial in addressing some of the most urgent challenges facing the U.S. bioeconomy and will serve as a vital step toward establishing a dynamic and adaptable national strategy for the sector. See our policy statement for more details.

Cautious and Enthusiastic Interest

While FAS is optimistic of the impact that this report can have, it is also important for FAS to be cautious around national security issues due to our 80 year old legacy. FAS began in response to how new technologies (nuclear) could be used for war (nuclear weapons). Today we remain watchful of technologies with the potential of misuse. FAS team members involved with national security take an understandably cautionary approach. The confluence of technology and access mean that there is risk associated with bio-products, too. “This opportunity must also be balanced with a clear-eyed understanding that increasing economic competition, heating geopolitics, and advancing life sciences capabilities may change how countries and other actors view the utility of globally repugnant capabilities such as biological weapons.” said Yong-Bee Lim, Associate Director of Global Risk at the Federation of American Scientists.

The report details the importance of safeguarding the biotechnology and biomanufacturing enterprise to remain competitive at the global scale, especially with China (recall the recent semiconductor shortages). However, “it’ll be important to balance both innovation capabilities and risk as we work towards ensuring that the U.S. bioeconomy is a priority area for both the Nation and for National Security.” said Nazish Jeffery, Bioeconomy Policy Manager at the Federation of American Scientists.

Bioeconomy Presents Significant Opportunities

Still, FAS continues advocating and promoting this area with great enthusiasm. The nascent bioeconomy is more than just leading edge biology meets computational gains. There are a myriad of scientific, economic, and social benefits to be had by leveraging this new industry.