China Is Building A Second Nuclear Missile Silo Field

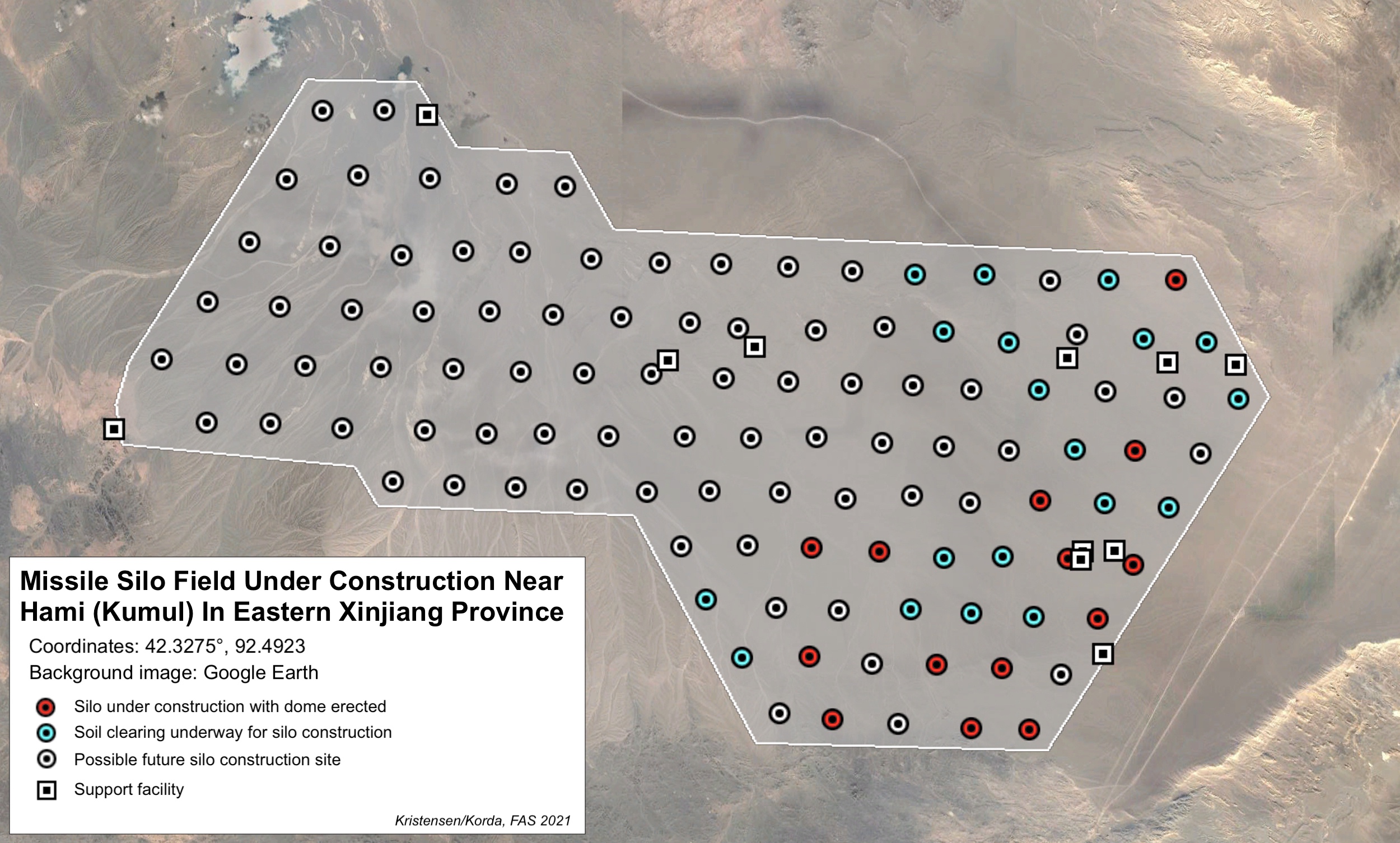

The Hami missile silo field covers an area of about 800 square kilometers and is in the early phases of construction.

Satellite images reveal that China is building a second nuclear missile silo field. The discovery follows the report earlier this month that China appears to be constructing 120 missile silos near Yumen in Gansu province. The second missile silo field is located 380 kilometers (240 miles) northwest of the Yumen field near the prefecture-level city of Hami in Eastern Xinjiang.

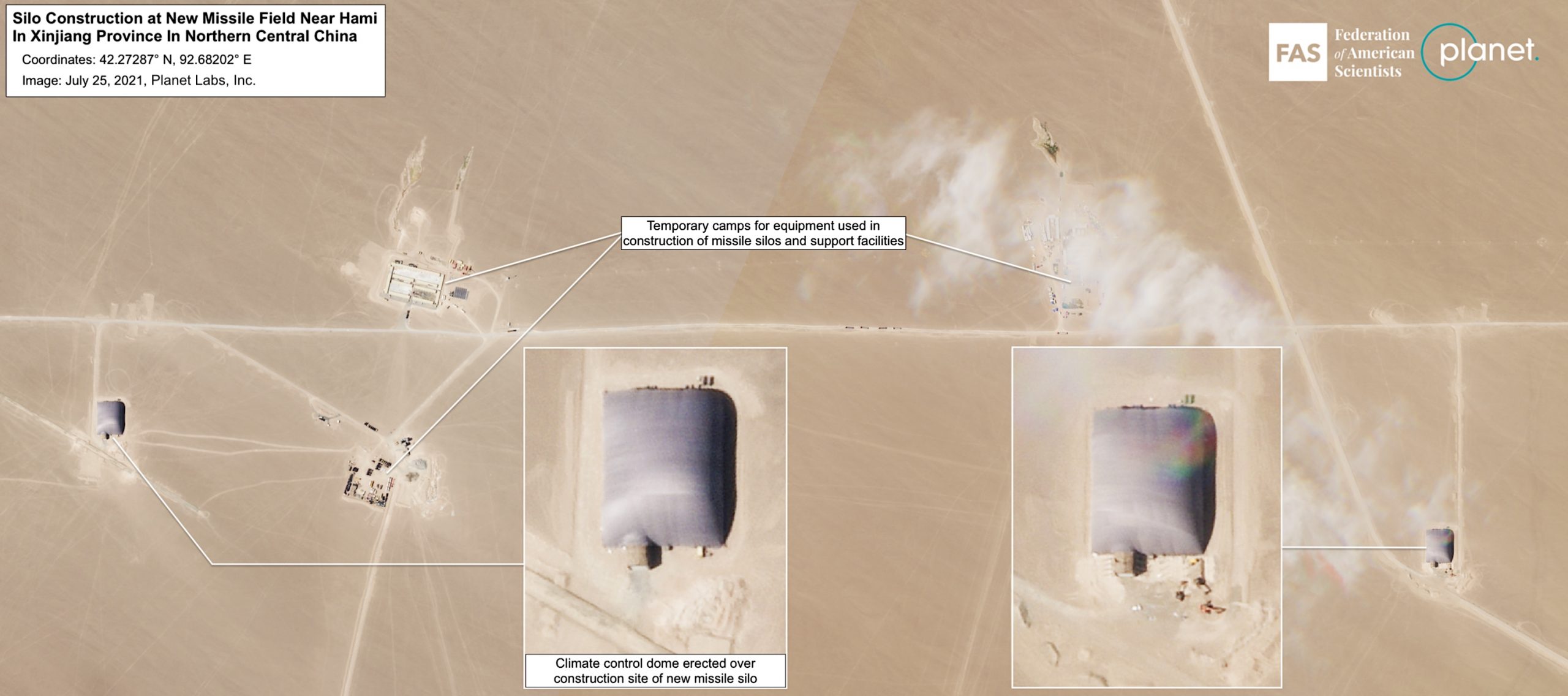

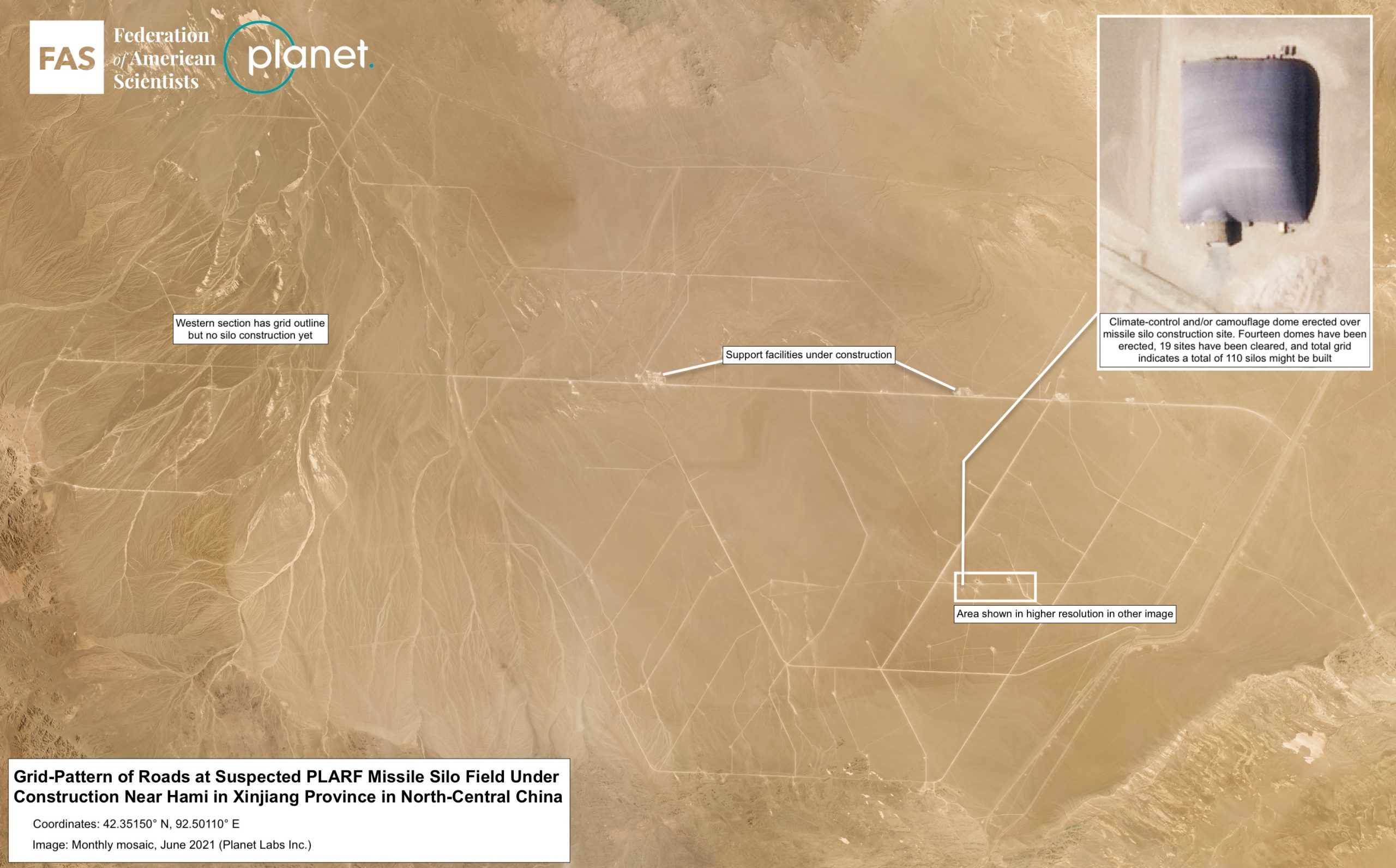

The Hami missile silo field is in a much earlier stage of development than the Yumen site. Construction began at the start of March 2021 in the southeastern corner of the complex and continues at a rapid pace. Since then, dome shelters have been erected over at least 14 silos and soil cleared in preparation for construction of another 19 silos. The grid-like outline of the entire complex indicates that it may eventually include approximately 110 silos.

Dome structures have been erected over 14 silo construction sites. Preparation is underway for another 19, and the entire missile field might eventually include 110 silos.

The Hami site was first spotted by Matt Korda, Research Associate for the Nuclear Information Project at the Federation of American Scientists, using commercial satellite imagery. Higher resolution images of the site were subsequently provided by Planet.

The silos at Hami are positioned in an almost perfect grid pattern, roughly three kilometers apart, with adjacent support facilities. Construction and organization of the Hami silos are very similar to the 120 silos at the Yumen site, and are also very similar to the approximately one-dozen silos constructed at the Jilantai training area in Inner Mongolia. These shelters are typically removed only after more sensitive construction underneath is completed. Just like the Yumen site, the Hami site spans an area of approximately 800 square kilometers.

The Hami missile silo field has a grid-pattern where the silos are located approximately 3 kilometers from each other.

Impact on the Chinese nuclear arsenal

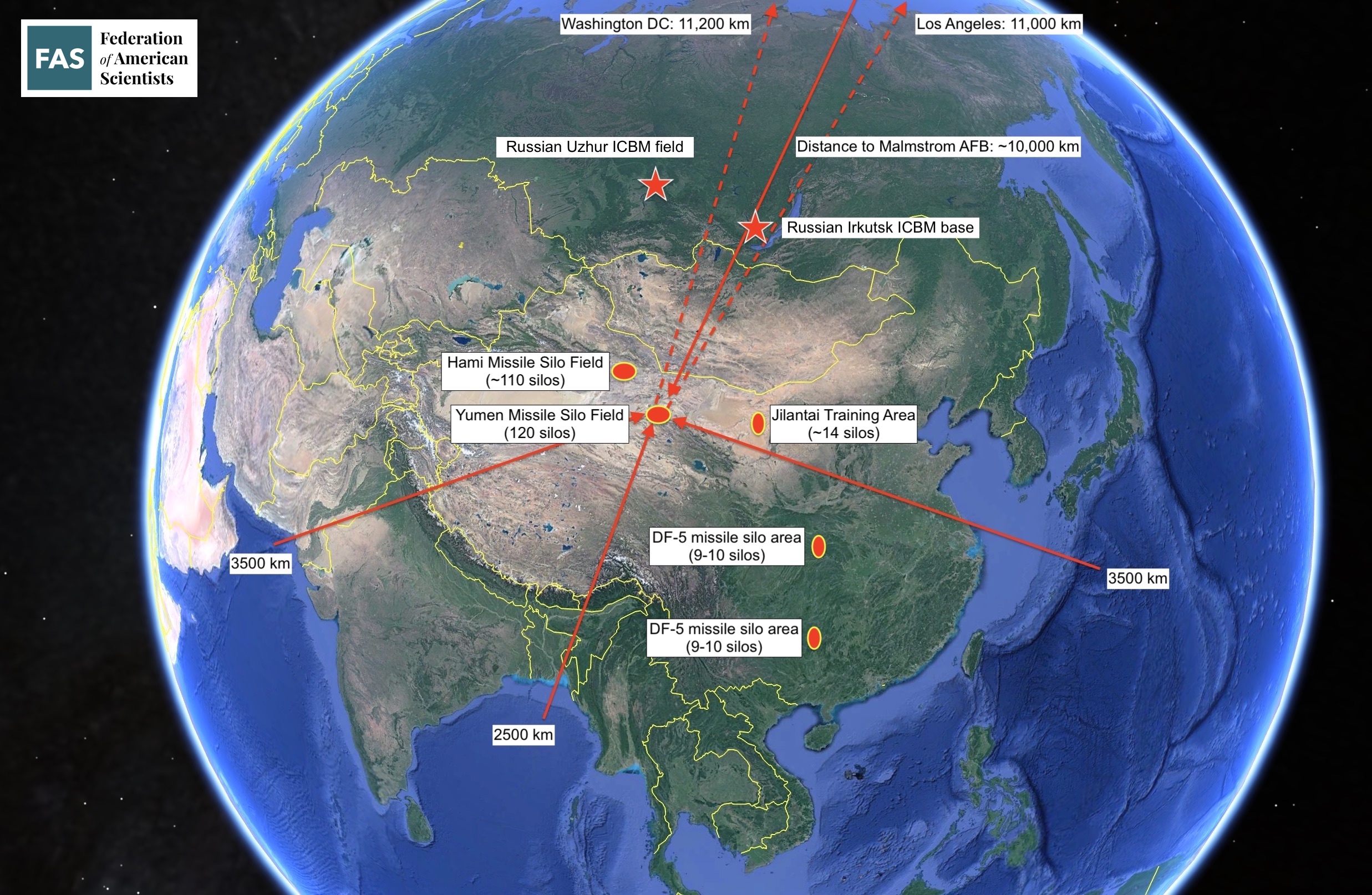

The silo construction at Yumen and Hami constitutes the most significant expansion of the Chinese nuclear arsenal ever. China has for decades operated about 20 silos for liquid-fuel DF-5 ICBMs. With 120 silos under construction at Yumen, another 110 silos at Hami, a dozen silos at Jilantai, and possibly more silos being added in existing DF-5 deployment areas, the People’s Liberation Army Rocket Force (PLARF) appears to have approximately 250 silos under construction – more than ten times the number of ICBM silos in operation today.

The number of new Chinese silos under construction exceeds the number of silo-based ICBMs operated by Russia, and constitutes more than half of the size of the entire US ICBM force. The Chinese missile silo program constitutes the most extensive silo construction since the US and Soviet missile silo construction during the Cold War.

The 250 new silos under construction are in addition to the force of approximately 100 road-mobile ICBM launchers that PLARF deploys at more than a dozen bases. It is unclear how China will operate the new silos, whether it will load all of them with missiles or if a portion will be used as empty decoys. If they are all loaded with single-warhead missiles, then the number of warheads on Chinese ICBMs could potentially increase from about 185 warheads today to as many as 415 warheads. If the new silos are loaded with the new MIRVed DF-41 ICBMs, then Chinese ICBMs could potentially carry more than 875 warheads (assuming 3 warheads per missile) when the Yumen and Hami missile silo fields are completed.

It should be emphasized that it is unknown how China will operate the new silos and how many warheads each missile will carry. Regardless, the silo construction represents a significant increase of the Chinese arsenal, which the Federation of American Scientists currently estimates includes approximately 350 nuclear warheads. The Pentagon stated last year that China had “an operational nuclear warhead stockpile in low-200s,” and STRATCOM commander Adm. Charles Richard said early this year that “China’s nuclear weapons stockpile is expected to double (if not triple or quadruple) over the next decade.” The new silos could allow China to accomplish this goal, if it is indeed the goal.

Although significant, even such an expansion would still not give China near-parity with the nuclear stockpiles of Russia and the United States, each of whom operate nuclear warhead stockpiles close to 4,000 warheads.

The Hami missile silo field domes are identical to silo domes seen at the Yumen missile silo field and the Jilantai training area.

Chinese motivations

There are several possible reasons why China is building the new silos. Regardless of how many silos China ultimately intends to fill with ICBMs, this new missile complex represents a logical reaction to a dynamic arms competition in which multiple nuclear-armed players––including Russia, India, and the United States––are improving both their nuclear and conventional forces as well as missile defense capabilities. Although China formally remains committed to its posture of “minimum” nuclear deterrence, it is also responding to the competitive relationship with countries adversaries in order to keep its own force survivable and capable of holding adversarial targets at risk. Thus, while it is unlikely that China will renounce this policy anytime soon, the “minimum” threshold for deterrence will likely continue to shift as China expands its nuclear arsenal. The decision to build the large number of new silos has probably not been caused by a single issue but rather by a combination of factors, listed below in random order:

Ensuring survivability of nuclear retaliatory capability: China is concerned that its current ICBM silos are too vulnerable to US (or Russian) attack. By increasing the number of silos, more ICBMs could potentially survive a preemptive strike and be able to launch their missiles in retaliation. China’s development of its current road-mobile solid-fuel ICBM force was, according to the US Central Intelligence Agency, fueled by the US Navy’s deployment of Trident II D5 missiles in the Pacific. This action-reaction dynamic is most likely a factor in China’s current modernization.

Increasing the readiness of the ICBM force: Transitioning from liquid-fuel missiles to solid-fuel missiles in silos will increase the reaction-time of the ICBM force.

Protecting ICBMs against non-nuclear attack: All existing DF-5 silos are within range of US conventional cruise missiles. In contrast, the Yumen and Hami missile silo fields are located deeper inside China than any other Chinese ICBM base (see map below) and out of reach of US conventional missiles.

Overcoming potential effects of US missile defenses: Concerns that missile defenses might undermine China’s retaliatory capability have always been prominent. China has already decided to equip its DF-5B ICBM with multiple warheads (MIRV); each missile can carry up to five. The new DF-41 ICBM is also capable of MIRV and the future JL-3 SLBM will also be capable of carrying multiple warheads. By increasing the number of silos-based solid-fuel missiles and the number of warheads they carry, China would seek to ensure that they can continue to penetrate missile defense systems.

Transitioning to solid-fuel silo missiles: China’s old liquid-fuel DF-5 ICBMs take too long to fuel before they can launch, making them more vulnerable to attack. Handling liquid fuel is also cumbersome and dangerous. By transitioning to solid-fuel missile silos, survivability, operational procedures, and safety of the ICBM force would be improved.

Transitioning to a peacetime missile alert posture: China’s missiles are thought to be deployed without nuclear warheads installed under normal circumstances. US and Russian ICBMs are deployed fully ready and capable of launching on short notice. Because military competition with the United States is increasing, China can no longer be certain it would have time to arm the missiles that will need to be on alert to improve the credibility of China deterrent. The Pentagon in 2020 asserted that the silos at Jilantai “provide further evidence China is moving to a LOW posture.”

Balancing the ICBM force: Eighty percent of China’s roughly 110 ICBMs are mobile and increasing in numbers. The US military projects that number will reach 150 with about 200 warheads by 2025. Adding more than 200 silos would better balance the Chinese ICBM force between mobile and fixed launchers.

Increasing China’s nuclear strike capability: China’s “minimum deterrence” posture has historically kept nuclear launchers at a relatively low level. But the Chinese leadership might have decided that it needs more missiles with more warheads to hold more adversarial facilities at risk. Adding nearly 250 new silos appears to move China out of the “minimum deterrence” category.

National prestige: China is getting richer and more powerful. Big powers have more missiles, so China needs to have more missiles too, in order to underpin its status as a great power.

The Hami and Yumen missile silo fields are located deeper inside China than any other ICBM base and beyond the reach of conventional cruise missiles. Click on image to view full size. Image: Google Earth.

What to do about it?

China’s construction of nearly 250 new silos has serious implications for international relations and China’s role in the world. The Chinese government has for decades insisted it has a minimum deterrent and that it is not part of any nuclear arms race. Although it remains unclear how many silos will actually be filled with missiles, the massive silo construction and China’s other nuclear modernization programs are on a scale that appears to contradict these polices: the build-up is anything but “minimum” and appears to be part of a race for more nuclear arms to better compete with China’s adversaries. The silo construction will likely further deepen military tension, fuel fear of China’s intensions, embolden arguments that arms control and constraints are naïve, and that US and Russian nuclear arsenals cannot be reduced further but instead must be adjusted to take into account the Chinese nuclear build-up.

The disclosure of the second Chinese silo missile field comes only days before US and Russian negotiators meet to discuss strategic stability and potential arms control measures. Responding to the Chinese build-up with more nuclear weapons would be unlikely to produce positive results and could cause China build up even more. Moreover, even when the new silos become operational, the Chinese nuclear arsenal will still to be significantly smaller than those of Russia and the United States.

The clearest path to reining in China’s nuclear arsenal is through arms control, but this is challenging. The United States has been trying to engage China on nuclear issues since the late-1990s, but so far with minimal success. Rather than discuss specific limitations on weapon systems, these efforts have been limited to increasing transparency about force structure plans and strategy, and well as discussing nuclear doctrine and intentions.

The Trump administration correctly sought to broaden nuclear arms control to include China, but fumbled the effort by turning it into a public-relations pressure stunt and insisting that China should be part of a New START treaty extension. Beijing not surprisingly rejected the effort, and Chinese officials have plainly stated that “it is unrealistic to expect China to join [the United States and Russia] in a negotiation aimed at nuclear arms reduction,” particularly while China’s arsenal remains a fraction of the size.

Bringing China and other nuclear-armed states into a sustained arms control dialogue will require a good-faith effort that will require the United States to clearly articulate what it is willing to trade in return for limits on Chinese forces. In this regard, it is worth noting that the absence of limits on US missile defenses is of particular and longstanding concern to both China and Russia. When the Bush administration decided to withdraw from the Anti-Ballistic Missile Treaty in 2002, officials from both countries explicitly stated that the treaty’s demise would be highly destabilizing, and implied that they would take steps to offset this perceived US advantage. Nearly 20 years later, the knock-on effects of this decision are clear. Putting US missile defenses on the negotiating table could help clear the path towards enacting a new arms control agreement that ultimately keeps both Chinese and Russian nuclear arsenals in check.

But the Chinese nuclear modernization is driven by more than just missile defenses. This includes the nuclear modernization programs of the United States, India, and Russia, the significant enhancements of the conventional forces of those countries and their allies, as well as China’s own ambitions about world power status.

Later this year (or early next year) the parties to the nuclear Non-Proliferation Treaty (NPT) will meet to review the progress of the treaty. Although the treaty does not explicitly prohibit a country from modernizing or even increasing its nuclear arsenal, reduction and eventually elimination of nuclear weapons are key pillars of the treaty’s goal as reaffirmed by numerous previous NPT conferences. It is difficult to see how adding nearly 250 nuclear missile silos is consistent with China’s obligation to “pursue negotiations in good faith on effective measures relating to cessation of the nuclear arms race at an early date and to nuclear disarmament…”

Background information:

- China Expanding Missile Training Area: More Silos, Tunnels, and Support Facilities

- Chinese nuclear forces, 2021 (SIPRI Yearbook)

- The Pentagon’s 2020 China Report

Our Hami missile silo discovery was first featured in the New York Times on 26 July 2021.

This publication was made possible by generous support from the John D. and Catherine T. MacArthur Foundation, the New Land Foundation, the Ploughshares Fund, and the Prospect Hill Foundation. The statements made and views expressed are solely the responsibility of the author.

The last remaining agreement limiting U.S. and Russian nuclear weapons has now expired. For the first time since 1972, there is no treaty-bound cap on strategic nuclear weapons.

The Pentagon’s new report provides additional context and useful perspectives on events in China that took place over the past year.

Successful NC3 modernization must do more than update hardware and software: it must integrate emerging technologies in ways that enhance resilience, ensure meaningful human control, and preserve strategic stability.

The FY2026 National Defense Authorization Act (NDAA) paints a picture of a Congress that is working to both protect and accelerate nuclear modernization programs while simultaneously lacking trust in the Pentagon and the Department of Energy to execute them.