Emerging Technology

day one project

Fresh Ideas to Address China’s Rising Foundational Chips Industry

06.26.24

|

1 min read

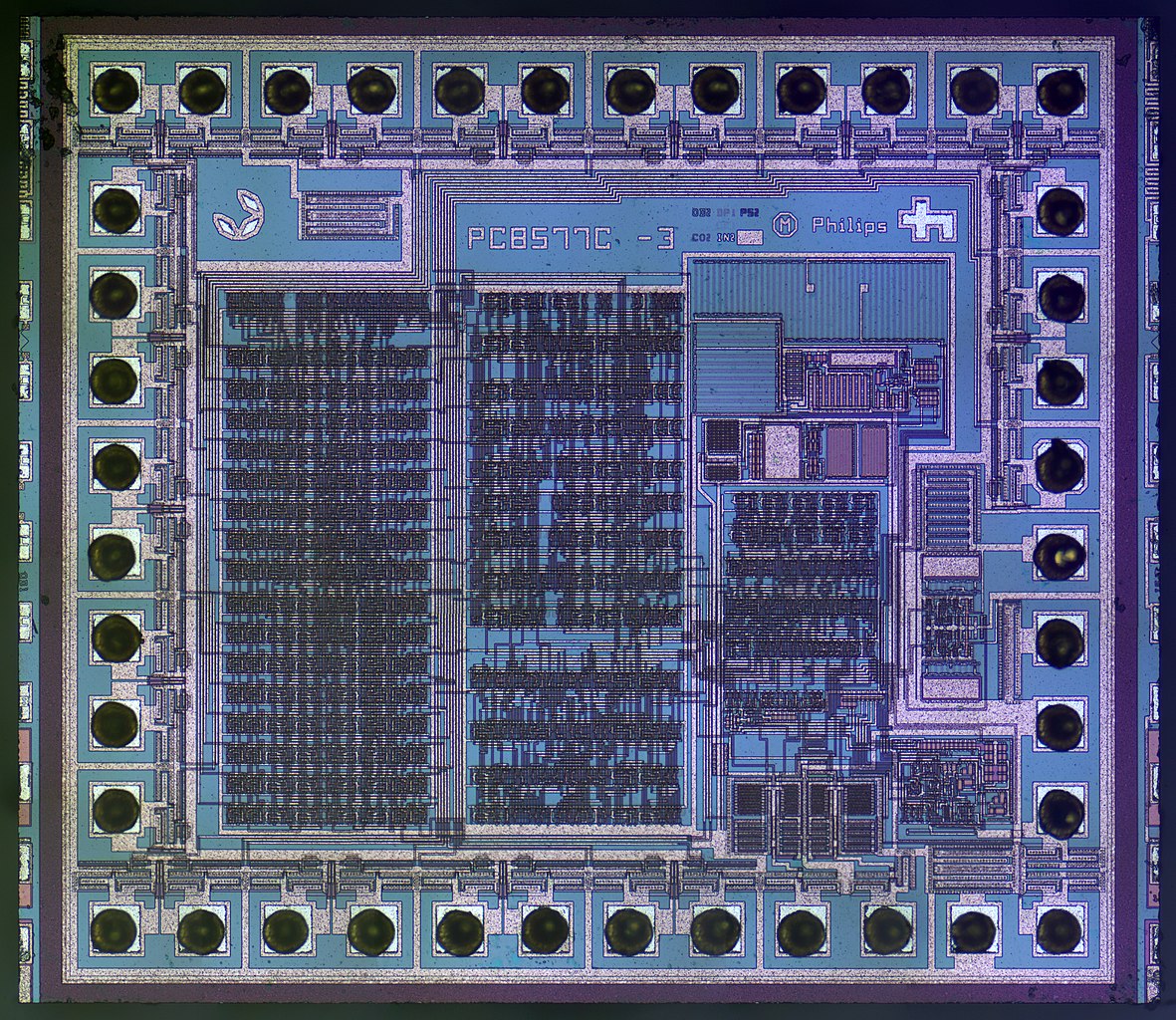

As Jimmy Goodrich, advisor at RAND, has recently written: “China is building an immense number of legacy chip factories as evidenced in skyrocketing chip tool imports and sales. However, there are indications that China is building more supply than demand, which has stirred fears of oversupply in western capitals. Already, Chinese foundries are engaged in a price war with their domestic competitors that has spilled over to impact similar firms in Taiwan and South Korea.”

Why care?

- Growing Chinese capacity impacts Western firms’ future willingness to invest. Western firms are already facing calls to reduce capital expenditures in the face of projected pricing pressures.

- Increased Chinese chip exports to the West raises economic and data security risks as Western manufacturers grow increasingly reliant on Chinese components.

- One powerful force keeping peace across the Taiwan Strait is that, today, knocking Taiwan’s chipmakers offline would be highly costly to China and the U.S. As China builds out its domestic chipmaking capabilities, confidence in “mutually assured economic destruction” as a factor pushing all sides toward peace may decline.

What steps, if any, should the U.S. take to address China’s growing global share of legacy chip manufacturing?

publications

Emerging Technology

day one project

Winning the Next Phase of the Chip War

02.07.25

|

22 min read

read more

Emerging Technology

day one project

Taking on the World’s Factory: A Path to Contain China on Legacy Chips

02.06.25

|

21 min read

read more

Emerging Technology

day one project

Using Targeted Industrial Policy to Address National Security Implications of Chinese Chips

02.04.25

|

17 min read

read more