Using Targeted Industrial Policy to Address National Security Implications of Chinese Chips

Last year the Federation of American Scientists (FAS), Jordan Schneider (of ChinaTalk), Chris Miller (author of Chip War) and Noah Smith (of Noahpinion) hosted a call for ideas to address the U.S. chip shortage and Chinese competition. A handful of ideas were selected based on the feasibility of the idea and its and bipartisan nature. This memo is one of them.

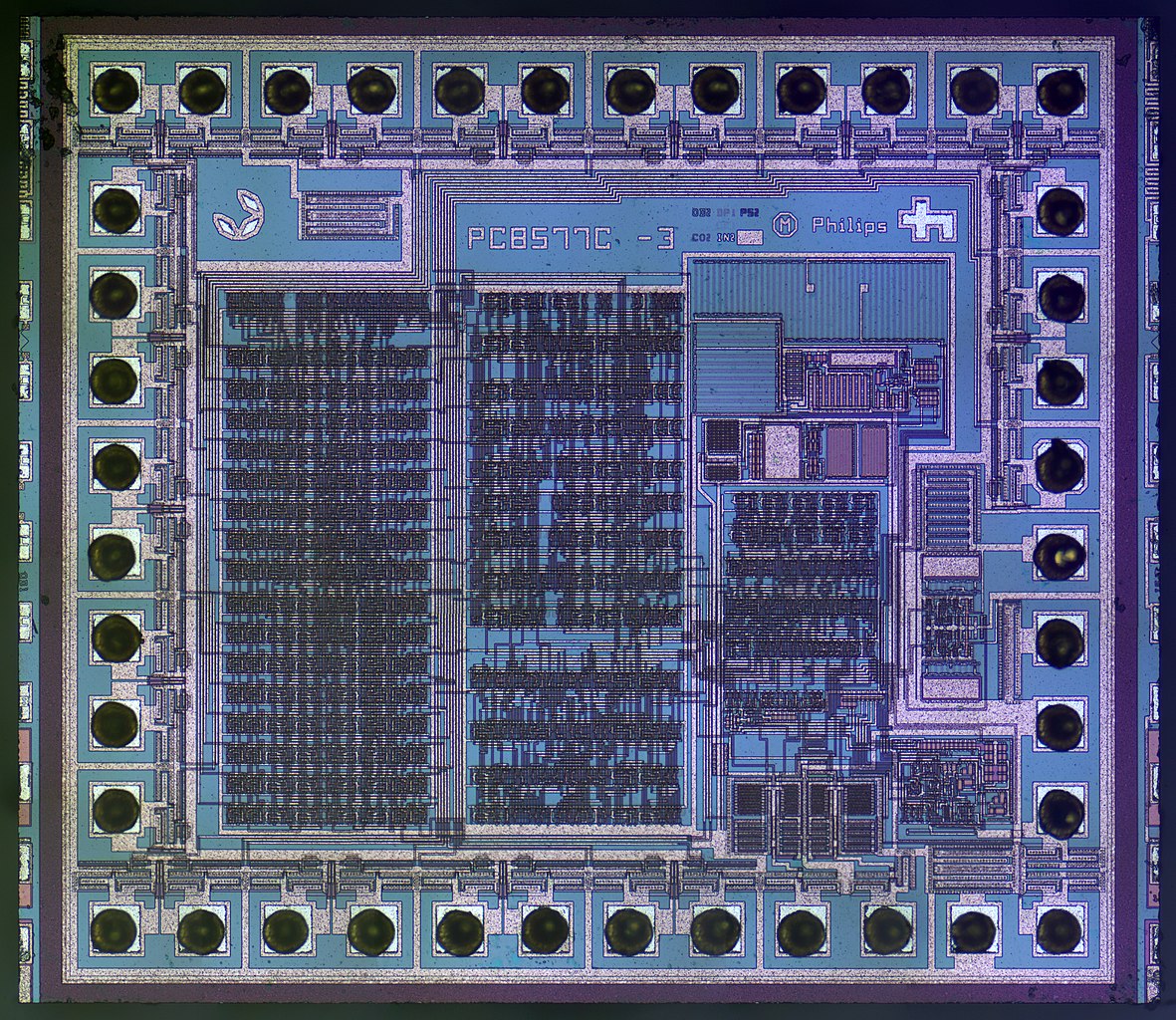

In recent years, China has heavily subsidized its legacy chip manufacturing capabilities. Although U.S. sanctions have restricted China’s access to and ability to develop advanced AI chips, they have done nothing to undermine China’s production of “legacy chips,” which are semiconductors built on process nodes 28nm or larger. It is important to clarify that the “22 nm” “20nm” “28nm” or “32nm” lithography process is simply a commercial name for a generation of a certain size and its technology that has no correlation to the actual manufacturing specification, such as the gate length or half pitch. Furthermore, it is important to note that different firms have different specifications when it comes to manufacturing. For instance, Intel’s 22nm lithography process uses a 193nm wavelength argon fluoride laser (ArF laser) with a 90nm Gate Pitch and a 34 nm Fin height. These specifications vary between fab plats such as Intel and TSMC. The prominence of these chips makes them a critical technological component in applications as diverse as medical devices, fighter jets, computers, and industrial equipment. Since 2014, state-run funds in China have invested more than $40 billion into legacy chip production to meet their goal of 70% chip sufficiency by 2030. Chinese legacy chip dominance—made possible only through the government’s extensive and unfair support—will undermine the position of Western firms and render them less competitive against distorted market dynamics.

Challenge and Opportunity

Growing Chinese capacity and “dumping” will deprive non-Chinese chipmakers of substantial revenue, making it more difficult for these firms to maintain a comparative advantage. China’s profligate industrial policy has damaged global trade equity and threatens to create an asymmetrical market. The ramifications of this economic problem will be most felt in America’s national security, as opposed to from the lens of consumers, who will benefit from the low costs of Chinese dumping programs until a hostile monopoly is established. Investors—anticipating an impending global supply glut—are already encouraging U.S. firms to reduce capital expenditures by canceling semiconductor fabs, undermining the nation’s supply chain and self-sufficiency. In some cases, firms have decided to cease manufacturing particular types of chips outright due to profitability concerns and pricing pressures. Granted, the design of chip markets is intentionally opaque, so pricing data is insufficient to fully define the extent of this phenomenon; however, instances such as Taiwan’s withdrawal from certain chip segments shortly after a price war between China and its competitors in late 2023 indicate the severity of this issue. If they continue, similar price disputes are capable of severely subverting the competitiveness of non-Chinese firms, especially considering how Chinese firms are not subject to the same fiscal constraints as their unsubsidized counterparts. In an industry with such high fixed costs, the Chinese state’s subsidization gives such firms a great advantage and imperils U.S. competitiveness and national security.

Were the U.S. to engage in armed conflict with China, reduced industrial capacity could quickly impede the military’s ability to manufacture weapons and other materials. Critical supply chain disruptions during the COVID-19 pandemic illustrate how the absence of a single chip can hold hostage entire manufacturing processes; if China gains absolute legacy chip manufacturing dominance, these concerns would be further amplified as Chinese firms become able to outright deny American access to critical chips, impose harsh costs through price hikes, or impose diplomatic compromises and quid-pro-quo.Furthermore, decreased Chinese reliance on Taiwanese semiconductors reduces their economic incentive to pursue a diplomatic solution in the Taiwan Strait—making armed conflict in the region more likely. This weakened posture endangers global norms and the balance of power in Asia—undermining American economic and military hegemony in the region.

China’s legacy chip manufacturing is fundamentally an economic problem with national security consequences. The state ought to interfere in the economy only when markets do not operate efficiently and in cases where the conduct of foreign adversaries creates market distortion. While the authors of this brief do not support carte blanche industrial policy to advance the position of American firms, it is the belief of these authors that the Chinese government’s efforts to promote legacy chip manufacturing warrant American interference to ameliorate harms that they have invented. U.S. regulators have forced American companies to grapple with the sourcing problems surrounding Chinese chips; however, the issue with chip control is largely epistemic. It is not clear which firms do and do not use Chinese chips, and even if U.S. regulators knew, there is little political appetite to ban them as corporations would then have to pass higher costs onto consumers and exacerbate headline inflation. Traditional policy tools for achieving economic objectives—such as sanctions—are therefore largely ineffectual in this circumstance. More innovative solutions are required.

If its government fully commits to the policy, there is little U.S. domestic or foreign policy can do to prevent China from developing chip independence. While American firms can be incentivized to outcompete their Chinese counterparts, America cannot usurp Chinese political directives to source chips locally. This is true because China lacks the political restraints of Western countries in financially incentivizing production, but also because in the past—under lighter sanctions regimes—China’s Semiconductor Manufacturing International Corporation (SMIC) acquired multiple Advanced Semiconductor Materials Lithography (ASML) DUV (Deep Ultraviolet Light) machines. Consequently, any policy that seeks to mitigate the perverse impact of Chinese dominance of the legacy chip market must a) boon the competitiveness of American and allied firms in “third markets” such as Indonesia, Vietnam, and Brazil and b) de-risk America’s supply chain from market distortions and the overreliance that Chinese policies have affected. China’s growing global share of legacy chip manufacturing threatens to recreate the global chip landscape in a way that will displace U.S. commercial and security interests. Consequently, the United States must undertake both defensive and offensive measures to ensure a coordinated response to Chinese disruption.

Plan of Action

Considering the above, we propose the United States enact a policy mutually predicated on innovative technological reform and targeted industrial policy to onshore manufacturing capabilities.

Recommendation 1. Weaponizing electronic design automation

Policymakers must understand that from a lithography perspective, the United States controls all essential technologies when it comes to the design and manufacturing of integrated circuits. This is a critically overlooked dimension in contemporary policy debates because electronic design automation (EDA) software closes the gap between high-level chip design in software and the lithography system itself. Good design simulates a proposed circuit before manufacturing, plans large integrated circuits (IC) by “bundling” small subcomponents together, and verifies the design is connected correctly and will deliver the required performance. Although often overlooked, the photolithography process, as well as the steps required before it, is a process as complex as coming up with the design of the chip itself.

No profit-maximizing manufacturer would print a chip “as designed” because it would suffer certain distortions and degradations throughout the printing process; therefore, EDA software is imperative to mitigate imperfections throughout the photolithography process. In much the same way that software within a home-use printer automatically screens for paper material (printer paper vs glossy photo paper) and automatically adjusts the mixture of solvent, resins, and additives to display properly, EDA software learns design kinks and responds dynamically. In the absence of such software, the yield of usable chips would be much lower, making these products less commercially viable. Contemporary public policy discourse focuses only on chips as a commodified product, without recognizing the software ecosystem that is imperative in their design and use.

Today, there exist only two major suppliers of EDA software for semiconductor manufacturing: Synopsys and Cadence Design Systems. This reality presents a great opportunity for the United States to assert dominance in the legacy chips space. In hosting all EDA in a U.S.-based cloud—for instance, a data center located in Las Vegas or another secure location—America can force China to purchase computing power needed for simulation and verification for each chip they design. This policy would mandate Chinese reliance on U.S. cloud services to run electromagnetic simulations and validate chip design. Under this proposal, China would only be able to use the latest EDA software if such software is hosted in the U.S., allowing American firms to a) cut off access at will, rendering their technology useless and b) gain insight into homegrown Chinese designs built on this platform. Since such software would be hosted on a U.S.-based cloud, Chinese users would not download the software which would greatly mitigate the risk of foreign hacking or intellectual property theft. While the United States cannot control chips outright considering Chinese production, it can control where they are integrated. A machine without instructions is inoperable, and the United States can make China’s semiconductors obsolete.

The emergence of machine learning has introduced substantial design innovation in older lithography technologies. For instance, Synopsis has used new technologies to discern the optimal route for wires that link chip circuits, which can factor in all the environmental variables to simulate the patterns a photo mask design would project throughout the lithography process. While the 22nm process is not cutting edge, it is legacy only in the sense of its architecture. Advancements in hardware design and software illustrate the dynamism of this facet in the semiconductor supply chain. In extraordinary circumferences, the United States could also curtail usage of such software in the event of a total trade war. Weaponizing this proprietary software could compel China to divulge all source code for auditing purposes since hardware cannot work without a software element.

The United States must also utilize its allied partnerships to restrict critical replacement components from enabling injurious competition from the Chinese. Software notwithstanding, China currently has the capability to produce 14nm nodes because SMIC acquired multiple ASML DUV machines under lighter Department of Commerce restrictions; however, SMIC heavily relies on chip-making equipment imported from the Netherlands and Japan. While the United States cannot alter the fact of possession, it has the capacity to take limited action against the realization of these tools’ potential by restricting China’s ability to import replacement parts to service these machines, such as the lenses they require to operate. Only the German firm Zeiss has the capability to produce such lenses that ArF lasers require to focus—illustrating the importance of adopting a regulatory outlook that encompasses all verticals within the supply chain. The utility of controlling critical components is further amplified by the fact that American and European firms have limited efficacy in enforcing copyright laws against Chinese entities. For instance, while different ICs are manufactured within the 22nm instruction set, not all run on a common instruction set such as ARM. However, even if such designs run on a copyrighted instruction set, the United States has no power to enforce domestic copyright law in a Chinese jurisdiction. China’s capability to reverse engineer and replicate Western-designed chips further underscores the importance of controlling 1) the EDA landscape and 2) ancillary components in the chip manufacturing process. This reality presents a tremendous yet overlooked opportunity for the United States to reassert control over China’s legacy chip market.

Recommendation 2. Targeted industrial policy

In the policy discourse surrounding semiconductor manufacturing, this paper contends that too much emphasis has been placed on the chips themselves. It is important to note that there are some areas in which the United States is not commercially competitive with China, such as in the NAND flash memory space. China’s Yangtze Memory Technologies has become a world leader in flash storage and can now manufacture a 232-layer 3D NAND on par with the most sophisticated American and Korean firms, such as Western Digital and Samsung, at a lower cost. However, these shortcomings do not preclude America from asserting dominance over the semiconductor market as a whole by leveraging its dynamic random-access memory (DRAM) dominance, bolstering nearshore NAND manufacturing, and developing critical mineral processing capabilities. Both DRAM and NAND are essential components for any computationally integrated technology.

While the U.S. cannot compete on rote manufacturing prowess because of high labor costs, it would be strategically beneficial to allow supply chain redundancies with regard to NAND and rare earth metal processing. China currently processes upwards of 90% of the world’s rare earth metals, which are critical to any type of semiconductor chips. While the U.S. possesses strategic reserves for commodities such as oil, it does not have any meaningful reserve when it comes to rare earth metals—making this a critical national security threat. Should China stop processing rare earth metals for the U.S., the price of any type of semiconductor—in any form factor—would increase dramatically. Furthermore, as a strategic matter, the United States would not have accomplished its national security objectives if it built manufacturing capabilities yet lacked critical inputs to supply this potential. Therefore, any legacy chips proposal must first establish sufficient rare earth metal processing capabilities or a strategic reserve of these critical resources.

Furthermore, given the advanced status of U.S. technological manufacturing prowess, it makes little sense to outright onshore legacy chip manufacturing capabilities—especially considering high U.S. costs and the substantial diversion of intellectual capital that such efforts would require. Each manufacturer must develop their own manufacturing process from scratch. A modern fab runs 24×7 and has a complicated workflow, with its own technique and software when it comes to lithography. For instance, since their technicians and scientists are highly skilled, TSMC no longer focuses on older generation lithography (i.e., 22nm) because it would be unprofitable for them to do so when they cannot fulfill their demand for 3nm or 4nm. The United States is better off developing its comparative advantage by specializing in cutting-edge chip manufacturing capabilities, as well as research and development initiatives; however, while American expertise remains expensive, America has wholly neglected the potential utility of its southern neighbors in shoring up rare earth metals processing. Developing Latin American metals processing—and legacy chip production—capabilities can mitigate national security threats. Hard drive manufacturers have employed a similar nearshoring approach with great success.

To address both rare earth metals and onshoring concerns, the United States should pursue an economic integration framework with nations in Latin America’s Southern Cone, targeting a partialized (or multi-sectoral) free trade agreement with the Southern Common Market (MERCOSUR) bloc. The United States should pursue this policy along two industry fronts, 1) waiving the Common External Tariff for United States’ petroleum and other fuel exports, which currently represent the largest import group for Latin American members of the bloc, and 2) simultaneously eliminating all trade barriers on American importation of critical minerals––namely arsenic, germanium, and gallium––which are necessary for legacy chip manufacturing. Enacting such an agreement and committing substantial capital to the project over a long-term time horizon would radically increase semiconductor manufacturing capabilities across all verticals of the supply chain. Two mutually inclusive premises underpin this policy’s efficacy:

Firstly, the production of economic interdependence with a bloc of Latin American states (as opposed to a single nation) serves to diversify risk in the United States; each nation provides different sets and volumes of critical minerals and has competing foreign policy agendas. This reduces the capacity of states to exert meaningful and organized diplomatic pressure on the United States, as supply lines can be swiftly re-adjusted within the bloc. Moreover, MERCOSUR countries are major energy importers, specifically with regard to Bolivian natural gas and American petroleum. Under an energy-friendly U.S. administration, the effects of this policy would be especially pronounced: low petroleum costs enable the U.S. to subtly reassert its geopolitical sway within its regional sphere of influence, notably in light of newly politically friendly Argentinian and Paraguayan governments. China has been struggling to ratify its own trade accords with the bloc given industry vulnerability, this initiative would further undermine its geopolitical influence in the region. Refocusing critical mineral production within this regional geography would decrease American reliance on Chinese production.

Secondly, nearshoring the semiconductor supply chain would reduce transport costs, decrease American vulnerability to intercontinental disruptions, and mitigate geopolitical reliance on China. Reduced extraction costs in Latin America, minimized transportation expenses, and reduced labor costs in especially Midwestern and Southern U.S. states enable America to maintain export competitiveness as a supplier to ASEAN’s booming technology industry in adjacent sectors, which indicates that China will not automatically fill market distortions. Furthermore, establishing investment arbitration procedures compliant with the General Agreement on Tariffs and Trade’s Dispute Settlement Understanding should accompany the establishment of transcontinental commerce initiatives, and therefore designate the the World Trade Organization as the exclusive forum for dispute settlement.

This policy is necessary to avoid the involvement of corrupt states’ backpaddling on established systems, which has historically impeded corporate involvement in the Southern Cone. This international legal security mechanism serves to assure entrepreneurial inputs that will render cooperation with American enterprises mutually attractive. However, partial free trade accords for primary sector materials are not sufficient to revitalize American industry and shift supply lines. To address the demand side, the exertion of downward pressure on pricing, alongside the reduction of geopolitical risk, should be accompanied by the institution of a state-subsidized low-interest loan, with available rate reset for approved legacy chip manufacturers, and a special-tier visa for hired personnel working in legacy chip manufacturing. Considering the sensitive national security interests at stake, the U.S. Federal Contractor Registration ought to employ the same awarding mechanisms and security filtering criteria used for federal arms contracts in its company auditing mechanisms. Under this scheme, vetted and historically capable legacy chip manufacturing firms will be exclusively able to take advantage of significant subventions and exceptional ‘wartime’ loans. Two reasons underpin the need for this martial, yet market-oriented industrial policy.

Firstly, legacy chip production requires highly specialized labor and immensely expensive fixed costs given the nature of accompanying machinery. Without targeted low-interest loans, the significant capital investment required for upgrading and expanding chip manufacturing facilities would be prohibitively high–potentially eroding the competitiveness of American and allied industries in markets that are heavily saturated with Chinese subsidies. Such mechanisms for increased and cheap liquidity also render it easier to import highly specialized talent from China, Taiwan, Germany, the Netherlands, etc., by offering more competitive compensation packages and playing onto the attractiveness of the United States lifestyle. This approach would mimic the Second World War’s “Operation Paperclip,” executed on a piecemeal basis at the purview of approved legacy chip suppliers.

Secondly, the investment fluidity that accompanies significant amounts of accessible capital serves to reduce stasis in the research and development of sixth-generation automotive, multi-use legacy chips (in both autonomous and semi-autonomous systems). Much of this improvement a priori occurs through trial-and-error processes within state-of-the-art facilities under the long-term commitment of manufacturing, research, and operations teams.

Acknowledging the strategic importance of centralizing, de-risking, and reducing reliance on foreign suppliers will safeguard the economic stability, national defense capabilities, and the innovative flair of the United States––restoring the national will and capacity to produce on its own shores. The national security ramifications of Chinese legacy chip manufacturing are predominantly downstream of their economic consequences, particularly vis-à-vis the integrity of American defense manufacturing supply chains. In implementing the aforementioned solutions and moving chip manufacturing to closer and friendlier locales, American firms can be well positioned to compete globally against Chinese counterparts and supply the U.S. military with ample chips in the event of armed conflict.

In 2023, the Wall Street Journal exposed the fragility of American supply chain resilience when they profiled how one manufacturing accident took offline 100% of the United States’ production capability for black powder—a critical component of mortar shells, artillery rounds, and Tomahawk missiles. This incident illustrates how critical a consolidated supply chain can be for national security and the importance of mitigating overreliance on China for critical components. As firms desire lower prices for their chips, ensuring adequate capacity is a significant component of a successful strategy to address China’s growing global share of legacy chip manufacturing. However, there are additional national security concerns for legacy chip manufacturing that supersede their economic significance–mitigating supply chain vulnerabilities is among the most consequential of these considerations.

Lastly, when there are substantial national security objectives at stake, the state is justified in acting independently of economic considerations; markets are sustained only by the imposition of binding and common rules. Some have argued that the possibility of cyber sabotage and espionage through military applications of Chinese chip technology warrants accelerating the timeline of procurement restrictions. The National Defense Authorization Act for Fiscal Year 2023’s Section 5949 prohibits the procurement of China-sourced chips from 2027 onwards. Furthermore, the Federal Communications Commission has the power to restrict China-linked semiconductors in U.S. critical infrastructure under the Secure Networks Act and the U.S. Department of Commerce reserves the right to restrict China-sourced semiconductors if they pose a threat to critical communications and information technology infrastructure.

However, Matt Blaze’s 1994 article “Protocol Failure in the Escrowed Encryption Standard” exposed the shortcomings of supposed hardware backdoors, such as the NSA’s “clipper chip” that they designed in the 1990s to surveil users. In the absence of functional software, a Chinese-designed hardware backdoor into sensitive applications could not function. This scenario would be much like a printer trying to operate without an ink cartridge. Therefore, instead of outright banning inexpensive Chinese chips and putting American firms at a competitive disadvantage, the federal government should require Chinese firms to release source code to firmware and supporting software for the chips they sell to Western companies. This would allow these technologies to be independently built and verified without undermining the competitive position of American industry. The U.S. imposed sanctions against Huawei in 2019 on suspicion of the potential espionage risks that reliance on Chinese hardware poses. While tighter regulation of Chinese semiconductors in sensitive areas seems to be a natural and pragmatic extension of this logic, it is unnecessary and undermines American dynamism.

Conclusion

Considering China’s growing global share of legacy chip manufacturing as a predominantly economic problem with substantial national security consequences, the American foreign policy establishment ought to pursue 1) a new technological outlook that exploits all facets of the integrated chip supply chain—including EDA software and allied replacement component suppliers—and 2) a partial free-trade agreement with MERCOSUR to further industrial policy objectives.

To curtail Chinese legacy chip dominance, the United States should weaponize its monopoly on electronic design automation software. By effectively forcing Chinese firms to purchase computing services from a U.S.-based cloud, American EDA software firms can audit and monitor Chinese innovations while reserving the ability to deny them service during armed conflict. Restricting allied firms’ ability to supply Chinese manufacturers with ancillary components can likewise slow the pace of Chinese legacy chip ascendence.

Furthermore, although China no longer relies on the United States or allied countries for NAND manufacturing, the United States and its allies maintain DRAM superiority. The United States must leverage capabilities to maintain Chinese reliance on its DRAM prowess and sustain its competitive edge while considering restricting the export of this technology for Chinese defense applications under extraordinary circumstances. Simultaneously, efforts to nearshore NAND technologies in South America can delay the pace of Chinese legacy chip ascendence, especially if implemented alongside a strategic decision to reduce reliance on Chinese rare earth metals processing.

In nearshoring critical mineral inputs to the end of preserving national security and reducing costs, the United States should adopt a market-oriented industrial policy of rate-reset, and state-subsidized low-interest loans for vetted legacy chip manufacturing firms. Synergy between greater competitiveness, capital solvency, and de-risked supply chains would enable U.S. firms to compete against Chinese counterparts in critical “third markets,” and reduce supply chain vulnerabilities that undermine national security. As subsidy-induced Chinese market distortions weigh less on the commercial landscape, the integrity of American defense capabilities will simultaneously improve, especially if bureaucratic agencies move to further insulate critical U.S. infrastructure against potential cyber espionage.

The transition to a clean energy future and diversified sources of energy requires a fundamental shift in how we produce and consume energy across all sectors of the U.S. economy.

Advancing the U.S. leadership in emerging biotechnology is a strategic imperative, one that will shape regional development within the U.S., economic competitiveness abroad, and our national security for decades to come.

Inconsistent metrics and opaque reporting make future AI power‑demand estimates extremely uncertain, leaving grid planners in the dark and climate targets on the line

As AI becomes more capable and integrated throughout the United States economy, its growing demand for energy, water, land, and raw materials is driving significant economic and environmental costs, from increased air pollution to higher costs for ratepayers.