How the U.S. Government Can Support the Development of Domestic Production Capacity for the Battery Supply Chain

Access to critical minerals supply chains will be crucial to the clean energy transition in the United States. Batteries for electric vehicles, in particular, will require the U.S. to consume an order of magnitude more lithium, nickel, cobalt, and graphite than it currently consumes. Currently, these materials are sourced from around the world. Mining of critical minerals is concentrated in just a few countries for each material, but is becoming increasingly geographically diverse as global demand incentivizes new exploration and development. Processing of critical minerals, however, is heavily concentrated in a single country—China—raising the risk of supply chain disruption.

To address this, the U.S. government has signaled its desire to onshore and diversify critical minerals supply chains through key legislation, such as the Bipartisan Infrastructure Law and the Inflation Reduction Act, and trade policies. The development of new mining and processing projects entails significant costs, however, and project financiers require developers to demonstrate certainty that projects will generate profit through securing long-term offtake agreements with buyers. This is made difficult by two factors: critical minerals markets are volatile, and, without subsidies or trade protections, domestically-produced critical minerals have trouble competing against low-priced imports, making it difficult for producers and potential buyers to negotiate a mutually agreeable price (or price floor). As a result, progress in expanding the domestic critical minerals supply may not occur fast enough to catch up to the growing consumption of critical minerals.

To accelerate project financing and development, the Department of Energy (DOE) should help generate demand certainty through backstopping the offtake of processed, battery-grade critical minerals at a minimum price floor. Ideally, this would be accomplished by paying producers the difference between the market price and the price floor, allowing them to sign offtake agreements and sell their products at a competitive market price. Offtake agreements, in turn, allow developers to secure project financing and proceed at full speed with development.

While demand-side support can help address the challenges faced by individual developers, market-wide issues with price volatility and transparency require additional solutions. Currently, the pricing mechanisms available for battery-grade critical minerals are limited to either third-party price assessments with opaque sources or the market exchange traded price of imperfect proxies. Concerns have been raised about the reliability of these existing mechanisms, hindering market participation and complicating discussions on pricing.

As the North American critical minerals industry and market develops, DOE should support the parallel development of more transparent, North American based pricing mechanisms to improve price discovery and reduce uncertainty. In the short- and medium-term, this could be accomplished through government-backed auctions, which could be combined with offtake backstop agreements. Auctions are great mechanisms for price discovery, and data from them can help improve market price assessments. In the long-term, DOE could support the creation of new market exchanges for trading critical minerals in North America. Exchange trading enables greater price transparency and provides opportunities for hedging against price volatility.

Through this two-pronged approach, DOE would simultaneously accelerate the development of the domestic critical minerals supply chain through addressing short-term market needs, while building a more transparent and reliable marketplace for the future.

Introduction

The global transportation system is currently undergoing a transition to electric vehicles (EVs) that will fundamentally transform not only our transportation system, but also domestic manufacturing and supply chains. Demand for lithium ion batteries, the most important and expensive component of EVs, is expected to grow 600% by 2030 compared to 2023, and the U.S. currently imports a majority of its lithium batteries. To ensure a stable and successful transition to EVs, the U.S. needs to reduce its import-dependence and build out its domestic supply chain for critical minerals and battery manufacturing.

Crucial to that will be securing access to battery-grade critical minerals. Lithium, nickel, cobalt, and graphite are the primary critical minerals used in EV batteries. All four were included in the 2023 Department of Energy (DOE) Critical Minerals List. Cobalt and graphite are considered at risk of shortage in the short-term (2020-2025), while all four materials are at risk in the medium-term (2025-2030).

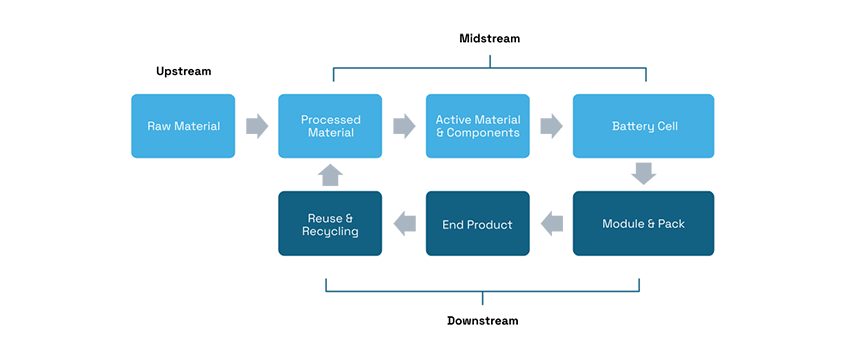

As shown in Figure 1, the domestic supply chain for batteries and critical minerals consists primarily of downstream buyers like automakers and battery assemblers, though there are a growing number of battery cell manufacturers thanks to domestic sourcing requirements in the Inflation Reduction Act (IRA) incentives. The U.S. has major gaps in upstream and midstream activities—mining of critical minerals, refining/processing, and the production of active materials and battery components. These industries are concentrated globally in a small number of countries, presenting supply chain risks. By developing new domestic industries within these gaps, the federal government can help build out new, resilient clean energy supply chains.

This report is organized into three main sections. The first section provides an overview of current global supply chains and the process of converting different raw materials into battery-grade critical minerals. The second section delves into the pricing and offtake challenges that projects face and proposes demand-side support solutions to provide the price and volume certainty necessary to obtain project financing. The final section takes a look at existing pricing mechanisms and proposes two approaches that the government can take to facilitate price discovery and transparency, with an eye towards mitigating market volatility in the long term. Given DOE’s central role in supporting the development of domestic clean energy industries, the policies proposed in this report were designed with DOE in mind as the main implementer.

Adapted from Li-BRIDGE

Segments highlighting in light blue indicated gaps in U.S. supply chains. See original graphic from Li-BRIDGE for more information.

Section 1. Understanding Critical Minerals Supply Chains

Global Critical Minerals Sources

Globally, 65% or more of processed lithium, cobalt, and graphite originates from a single country: China (Figure 2). This concentration is particularly acute for graphite, 91% of which was processed by China in 2023. This market concentration has made downstream buyers in the U.S. overly dependent on sourcing from a single country. The concentration of supply chains in any one country makes them vulnerable to disruptions within that country—whether they be natural disasters, pandemics, geopolitical conflict, or macroeconomic changes. Moreover, lithium, nickel, cobalt, and graphite are all expected to experience shortages over the next decade. In the case of future shortages, concentration in other countries puts U.S. access to critical minerals at risk. Rocky foreign relations and competition between the U.S. and China over the past few years have put further strain on this dependence. In October 2023, China announced new export controls on graphite, though it has not yet restricted supply, in response to the U.S.’s export restrictions on semiconductor chips to China and other “foreign entities of concern” (FEOC).

Expanding domestic processing of critical minerals and manufacturing of battery components can help reduce dependence on Chinese sources and ensure access to critical minerals in future shortages. However, these efforts will hurt Chinese businesses, so the U.S. will also need to anticipate additional protectionist measures from China.

On the other hand, mining of critical minerals—with the exception of graphite and rare earth elements—occurs primarily outside of China. These operations are also concentrated in a small handful of countries, shown in Figure 3. Consequently, geopolitical disruptions affecting any of those primary countries can significantly affect the price and supply of the material globally. For example, Russia is the third largest producer of nickel. In the aftermath of Russia’s invasion of Ukraine at the beginning of 2022, expectations of shortages triggered a historic short squeeze of nickel on the London Metal Exchange (LME), the primary global trading platform, significantly disrupting the global market.

To address global supply chain concentration, new incentives and grant programs were passed in the IRA and the Bipartisan Infrastructure Law. These include the 30D clean vehicle tax credit, the 45X advanced manufacturing production credit, and the Battery Materials Processing Grants Program (see Domestic Price Premium section for further discussion). Thanks to these policies, there are now on the order of a hundred North American projects in mining, processing, and active1 material manufacturing in development. The success of these and future projects will help create new domestic sources of critical minerals and batteries to feed the EV transition in the U.S. However, success is not guaranteed. A number of challenges to investment in the critical minerals supply chain will need to be addressed first.

Battery Materials Supply Chain

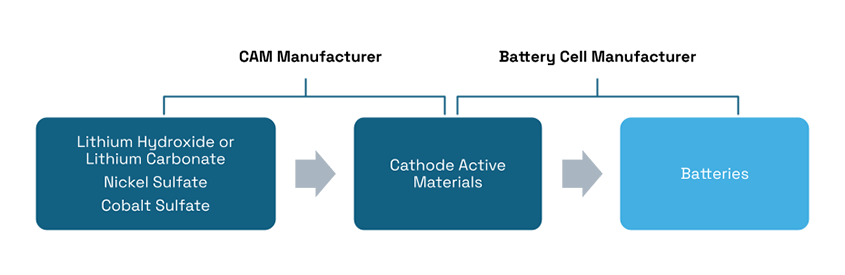

Critical minerals are used to make battery electrodes. These electrodes require specific forms of critical minerals for their production processes: typically lithium hydroxide or carbonate, nickel sulfate, cobalt sulfate, and a blend of coated spherical graphite and synthetic graphite.2

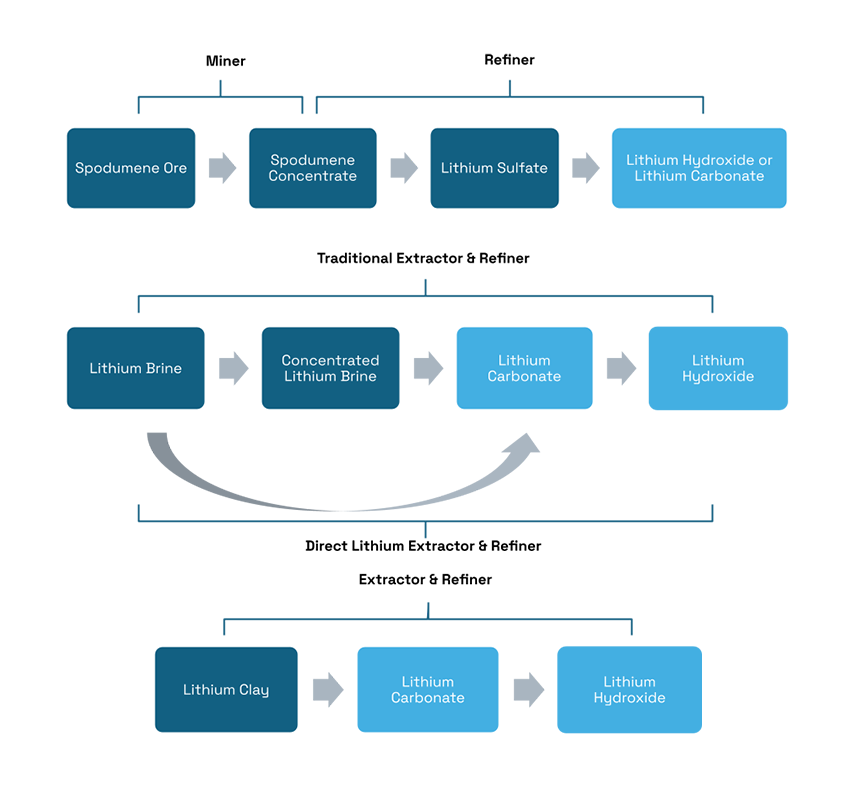

Lithium hydroxide/carbonate typically comes from two sources: spodumene, a hard rock ore that is mined primarily in Australia, and lithium brine, which is primarily found in South America (Figure 3). Traditionally, lithium brine must be evaporated in large open-air pools before the lithium can be extracted, but new technologies are emerging for direct lithium extraction that significantly reduces the need for evaporation. Whereas spodumene mining and refining are typically conducted by separate entities, lithium brine operations are typically fully integrated. A third source of lithium that has yet to be put into commercial production is lithium clay. The U.S. is leading the development of projects to extract and refine lithium from clay deposits.

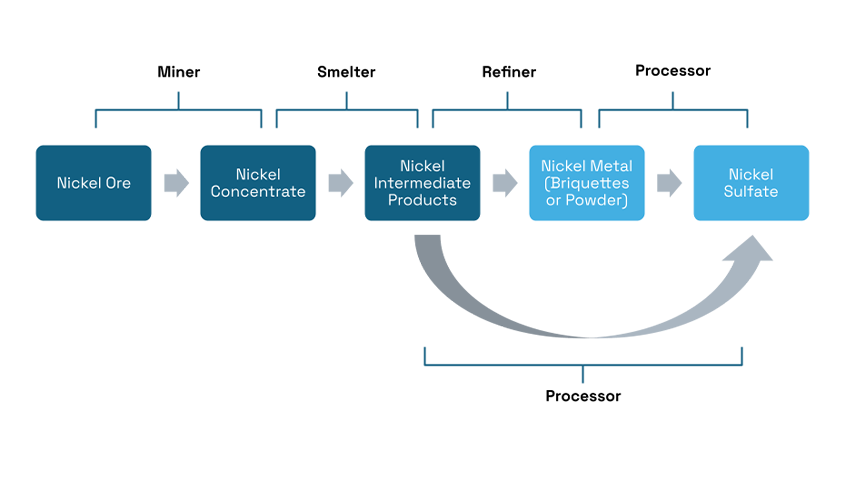

Nickel sulfate can be made from either nickel metal, which was historically the preferred feedstock, or directly from nickel intermediate products, such as mixed hydroxide precipitate and nickel matte, which are the feedstocks that most Chinese producers have switched to in the past few years (Figure 4). Though demand from batteries is driving much of the nickel project development in the U.S., since nickel metal has a much larger market than nickel sulfate, developers are designing their projects with the flexibility to produce either nickel metal or nickel sulfate.

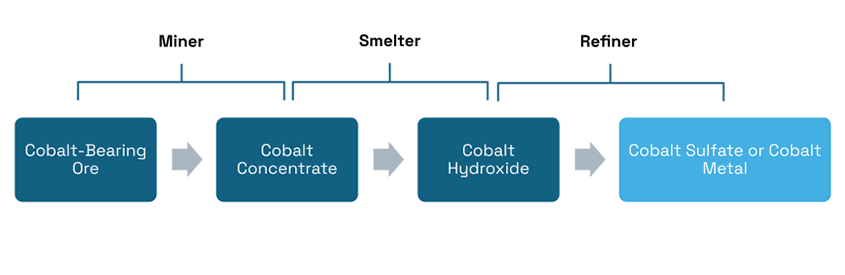

Cobalt is primarily produced in the Democratic Republic of the Congo from cobalt-copper ore. Cobalt can also be found in lesser amounts in nickel and other metallic ores. Cobalt concentrate is extracted from cobalt-bearing ore and then processed into cobalt hydroxide. At this point, the cobalt hydroxide can be further processed into either cobalt sulfate for batteries or cobalt metal and other chemicals for other purposes.

Battery cathodes come in a variety of chemistries: lithium nickel manganese cobalt (NMC) is the most common in lithium-ion batteries thanks to its higher energy density, while lithium iron phosphate is growing in popularity for its affordability and use of more abundantly available materials, but is not as energy dense. Cathode active material (CAM) manufacturers purchase lithium hydroxide/carbonate, nickel sulfate, and cobalt sulfate and then convert them into CAM powders. These powders are then sold to battery cell manufacturers, who coat them onto copper electrodes to produce cathodes.

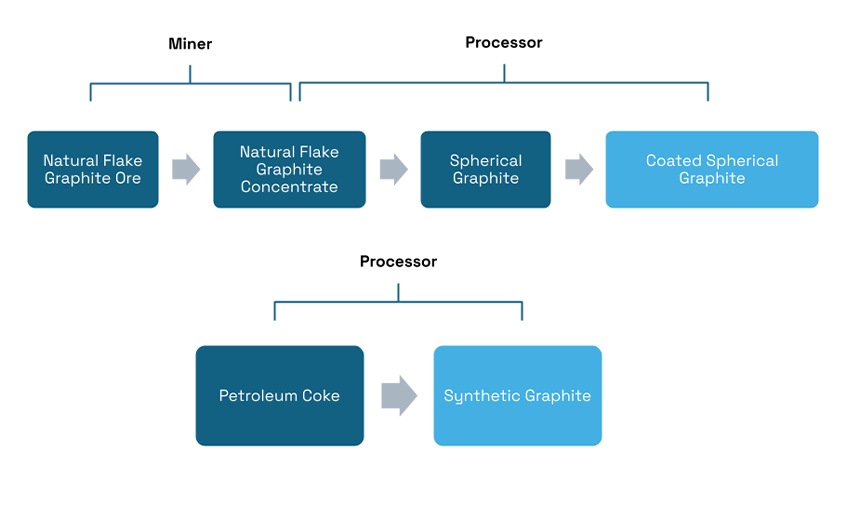

Graphite can be synthesized from petroleum needle coke, a fossil fuel waste material, or mined from natural deposits. Natural graphite typically comes in the form of flakes and is reshaped into spherical graphite to reduce its particle size and improve its material properties. Spherical graphite is then coated with a protective layer to prevent unwanted chemical reactions when charging and discharging the battery.

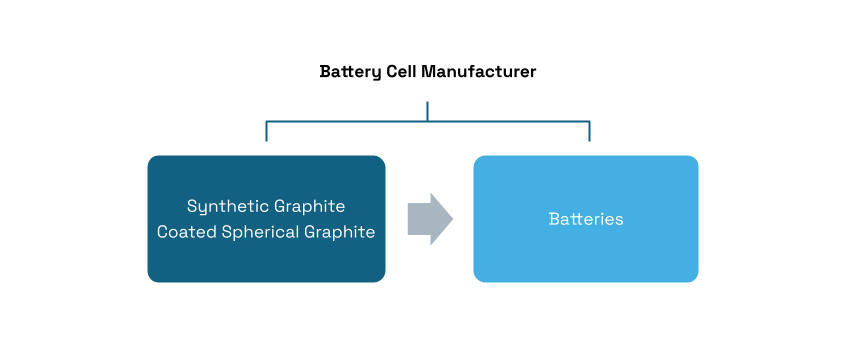

The majority of battery anodes on the market are made using just graphite, so there is no intermediate step between processors and battery cell manufacturers. Producers of battery-grade synthetic graphite and coated spherical graphite sell these materials directly to cell manufacturers, who coat them onto electrodes to make anodes. These battery-grade forms of graphite are also referred to as graphite anode powder or, more generally, as anode active materials. Thus, the terms graphite processor and graphite anode manufacturer are interchangeable.

Section 2. Building Out Domestic Production Capacity

Challenges Facing Project Developers

Offtake Agreements

Offtake agreements (a.k.a. supply agreements or contracts) are an agreement between a producer and a buyer to purchase a future product. They are a key requirement for project financing because they provide lenders and investors with the certainty that if a project is built, there will be revenue generated from sales to pay back the loan and justify the valuation of the business. The vast majority of feedstocks and battery-grade materials are sold under offtake agreements, though small amounts are also sold on the spot market in one-off transactions. Offtake agreements are made at every step of the supply chain: between miners and processors (if they’re not vertically integrated), between processors and component manufacturers; and between component manufacturers and cell manufacturers. Due to domestic automakers’ concerns about potential material shortages upstream and the desire to secure IRA incentives, many of them have also been entering into offtake agreements directly with North American miners and processors. Tesla has started constructing their own domestic lithium processing plant.

Historically, these offtake agreements were structured as fixed-price deals. However, when prices on the spot market go too high, sellers often find a way to rip up the contract, and vice versa, when spot prices go too low, buyers often find a way to get out of the contract. As a result, more and more offtake agreements for battery-grade lithium, nickel, and cobalt have become indexed to spot prices, with price floors and/or ceilings set as guardrails and adjustments for premiums and discounts based on other factors (e.g. IRA compliance, risk from a greenfield producer, etc.).

Graphite is the one exception where buyers and suppliers have mostly stuck to fixed-price agreements. There are two main reasons for this: graphite pricing is opaque and products exhibit much more variation, complicating attempts to index the price. As a result, cell manufacturers don’t consider the available price indexes to accurately reflect the value of the specific products they are buying.

Offtake agreements for battery cells are also typically partially indexed on the price of the critical minerals used to manufacture them. In other words, a certain amount of the price per unit of battery cell is fixed in the agreement, while the rest is variable based on the index price of critical minerals at the time of transaction.

Domestic critical minerals projects face two key challenges to securing investment and offtake agreements: market volatility and a lack of price competitiveness. The price difference between materials produced domestically and those produced internationally stems from two underlying causes: the current oversupply from Chinese-owned companies and the domestic price premium.

Market Volatility

Lithium, cobalt, and graphite have relatively low-volume markets with a small customer base compared to traditional commodities. Low-volume products experience low liquidity, meaning it can be difficult to buy or sell quickly, so slight changes in supply and demand can result in sharp price swings, creating a volatile market. Because of the higher risk and smaller market, companies and investors tend to prefer mining and processing of base metals, such as copper, which have much larger markets, resulting in underinvestment in production capacity.

In comparison, nickel is a base metal commodity, primarily used for stainless steel production. However, due to its rapidly growing use in battery production, its price has become increasingly linked to other battery materials, resulting in greater volatility than other base metals. Moreover, the short squeeze in 2022 forced LME to suspend trading and cancel transactions for the first time in three decades. As a result, trust in the price of nickel on LME faltered, many market participants dropped out, and volatility grew due to low trading volumes.

For all four of these materials, prices reached record highs in 2022 and subsequently crashed in 2023 (Figure 4). Nickel, cobalt, and graphite experienced price declines of 30-45%, while lithium prices dropped by an enormous 75%. As discussed above, market volatility discourages investment into critical minerals production capacity. The current low prices have caused some domestic projects to be paused or canceled. For example, Jervois halted operation of its Idaho cobalt mine in March 2023 due to cobalt prices dropping below its operating costs. In January 2024, lithium giant Albemarle announced that it was delaying plans to begin construction on a new South Carolina lithium hydroxide processing plant.

Retrospective analysis suggests that mining companies, battery investors, and automakers had all made overly optimistic demand projections and ramped up their production a bit too fast. These projections assumed that EV demand would keep growing as fast as it did immediately after the pandemic and that China’s lifting of pandemic restrictions would unlock even faster growth in the largest EV market. Instead, China, which makes up over 60% of the EV market, emerged into an economic downturn, and global demand elsewhere didn’t grow quite as fast as projected, as backlogs built up during the pandemic were cleared. (It is important to note that the EV market is still growing at significant rates—global EV sales increased by 35% from 2022 to 2023—just not as fast as companies had wished.) Consequently, supply has temporarily outpaced demand. Midstream and upstream companies stopped receiving new purchase orders while automakers worked through their stock build-up. Prices fell rapidly as a result and are now bottoming out. Some companies are waiting for prices to recover before they restart construction and operation of existing projects or invest in expanding production further.

While companies are responding to short-term market signals, the U.S. government needs to act in anticipation of long-term demand growth outpacing current planned capacity. Price volatility in critical minerals markets will need to be addressed to ensure that companies and financiers continue investing in expanding production capacity. Otherwise, demand projections suggest that the supply chain will experience new shortages later this decade.

Oversupply

The current oversupply of critical minerals has been exacerbated by below market-rate financing and subsidies from the Chinese government. Many of these policies began in 2009, incentivizing a wave of investment not just in China, but also in mineral-rich countries. These subsidies played a large role in the 2010s in building out nascent battery critical minerals supply chains. Now, however, they are causing overproduction from Chinese-owned companies, which threatens to push out competitors from other countries.

Overproduction begins with mining. Chinese companies are the primary financial backers for 80% of both the Democratic Republic of the Congo’s cobalt mines and Indonesia’s nickel mines. Chinese companies have also expanded their reach in lithium, buying half of all the lithium mines offered for sale since 2018, in addition to domestically mining 18% of global lithium. For graphite, 82% of natural graphite was mined directly in China in 2023, and nearly all natural and synthetic graphite is processed in China.

After the price crash in 2023, while other companies pulled back their production volume significantly, Chinese-owned companies pulled back much less and in some cases continued to expand their production, generating an oversupply of lithium, cobalt, nickel, and natural and synthetic graphite. Government policies enabled these decisions by making it financially viable for Chinese companies to sell materials at low prices that would otherwise be unsustainable.

Domestic Price Premium (and Current Policies Addressing It)

Domestically-produced critical minerals and battery electrode active materials come with a higher cost of production over imported materials due to higher wages and stricter environmental regulations in the U.S. The IRA’s new 30D and 45X tax credit and upcoming section 301 tariffs help address this problem by creating financial incentives for using domestically produced materials, allowing them to compete on a more even playing field with imported materials.

The 30D New Clean Vehicle Tax Credit provides up to $7,500 per EV purchased, but it requires eligible EVs to be manufactured from critical minerals and battery components that are FEOC-compliant, meaning they cannot be sourced from companies with relationships to China, North Korea, Russia, and Iran. It also requires that an increasing percentage of critical minerals used to make the EV batteries be extracted or processed in the U.S. or a Free Trade Agreement country. These two requirements apply to lithium, nickel, cobalt, and graphite. For graphite, however, since nearly all processing occurs in China and there is currently no domestic supply, the US Treasury has chosen to exempt it from the 30D tax credit’s FEOC and domestic sourcing requirements until 2027 to give automakers time to develop alternate supply chains.

The 45X Advanced Manufacturing Production Tax Credit subsidizes 10% of the production cost for each unit of critical minerals processed. The Internal Revenue Service’s proposed regulations for this tax credit interprets the legislation for 45X as applying only to the value-added production cost, meaning that the cost of purchasing raw materials and processing chemicals is not included in the covered production costs. This limits the amount of subsidy that will be provided to processors. The strength of 45X, though, is that unlike the 30D tax credit, there is no sunset clause for critical minerals, providing a long term guarantee of support.

In terms of tariffs, the Biden administration announced in May 2024, a new set of section 301 tariffs on Chinese products, including EVs, batteries, battery components, and critical minerals. The critical minerals tariffs include a 25% tariff on cobalt ores and concentrates that will go into effect in 2024 and a 25% tariff on natural flake graphite that will go into effect in 2026. In addition, there are preexisting 25% tariffs in section 301 for natural and synthetic graphite anode powder. These tariffs were previously waived to give automakers time to diversify their supply chains, but the U.S. Trade Representative (USTR) announced in May 2024 that the exemptions would expire for good on June 14th, 2024, citing the lack of progress from automakers as a reason for not extending them.

Current State of Supply Chain Development

For lithium, despite market volatility, offtake demand for existing domestic projects has remained strong thanks to IRA incentives. Based on industry conversations, many of the projects that are developed enough to make offtake agreements have either signed away their full output capacity or are actively in the process of negotiating agreements. Strong demand combined with tax incentives has enabled producers to negotiate offtake agreements that guarantee a price floor at or above their capital and operating costs. Lithium is the only material for which the current planned mining and processing capacity for North America is expected to meet demand from planned U.S. gigafactories.

Graphite project developers report that the 25% tariff coming into force will be sufficient to close the price gap between domestically produced materials and imported materials, enabling them to secure offtake agreements at a sustainable price. Furthermore, the Internal Revenue Service will require 30D tax credit recipients to submit period reports on progress that they are making on sourcing graphite outside of China. If automakers take these reports and the 2027 exemption deadline seriously, there will be even more motivation to work with domestic graphite producers. However, the current planned production capacity for North America still falls significantly short of demand from planned U.S. battery gigafactories. Processing capacity is the bottleneck for production output, so there is room for additional investment in processing capacity.

Pricing has been a challenge for cobalt though. Jervois briefly opened the only primary cobalt mine in the U.S. before shutting down a few months later due to the price crash. Jervois has said that as soon as prices for standard-grade cobalt rise above $20/pound, they will be able to reopen the mine, but that has yet to happen. Moreover, the real bottleneck is in cobalt processing, which has attracted less attention and investment than other critical minerals in the U.S. There are currently no cobalt sulfate refineries in North America; only one or two are in development in the U.S. and a few more in Canada.3

Nickel sulfate is also facing pricing challenges, and, similar to cobalt, there is an insufficient amount of nickel sulfate processing capacity being developed domestically. There is one processing plant being developed in the U.S. that will be able to produce either nickel metal or nickel sulfate and a few more nickel sulfate refineries being developed in Canada.

Policy Solutions to Support the Development of Processing Capacity

The U.S. government should prioritize the expansion of processing capacity for lithium, graphite, cobalt, and nickel. Demand from domestic battery manufacturing is expected to outpace the current planned capacity for all of these materials, and processing capacity is the key bottleneck in the supply chain. Tariffs and tax incentives have resulted in favorable pricing for lithium and graphite project developers, but cobalt and nickel processing has gotten less support and attention.

DOE should provide demand-side support for processed, battery-grade critical minerals to accelerate the development of processing capacity and address cobalt and nickel pricing needs. The Office of Manufacturing and Energy Supply Chains (MESC) within DOE would be the ideal entity to administer such a program, given its mandate to address vulnerabilities in U.S. energy supply chains. In the immediate term, funding could come from MESC’s Battery Materials Processing Grants program, which has roughly $1.9B in remaining, uncommitted funds. Below we propose a few demand-support mechanisms that MESC could consider.

Long term, the Bipartisan Policy Center proposes that Congress establish and appropriate funding for a new government corporation that would take on the responsibility of administering demand-support mechanisms as necessary to mitigate volume and price uncertainty and ensure that domestic processing capacity grows to sufficiently meet critical minerals needs.

Offtake Backstops

Offtake backstops would commit MESC to guaranteeing the purchase of a specific amount of materials at a minimum negotiated price if producers are unable to find buyers at that price. This essentially creates a price floor for specific producers while also providing a volume guarantee. Offtake backstops help derisk project development and enable developers to access project financing. Backstop agreements should be made for at least the first five years of a plant’s operations, similar to a regular offtake agreement. Ideally, MESC should prioritize funding for critical minerals with the largest expected shortages based on current planned capacity—i.e., nickel, cobalt, and graphite.

There are two primary ways that DOE could implement offtake backstops:

First. The simplest approach would be for DOE to pay processors the difference between the spot price index (adjusted for premiums and discounts) and the pre-negotiated price floor for each unit of material, similar to how a pay-for-difference or one-sided contract-for-difference would work.4 This would enable processors to sign offtake agreements with no price floor, accelerating negotiations and thus the pace of project development. Processors could also choose to keep some of their output capacity uncommitted so that they can sell their products on the spot market without worrying about prices collapsing in the future.

A more limited form of this could look like DOE subsidizing the price floor for specific offtake agreements between a processor and a buyer. This type of intervention requires a bit more preliminary work from processors, since they would have to identify and bring a buyer to the table before applying for support.

Second. Purchasing the actual materials would be a more complex route for DOE to take, since the agency would have to be ready to receive delivery of the materials. The agency could do this by either setting up a system of warehouses suitable for storing battery-grade critical minerals or using “virtual warehousing,” as proposed by the Bipartisan Policy Center. An actual warehousing system could be set up by contracting with existing U.S. warehouses, such as those in LME and CME’s networks, to expand or upgrade their facilities to store critical minerals. These warehouses could also be made available for companies’ to store their private stockpiles, increasing the utility of the warehousing system and justifying the cost of setting it up. Virtual warehousing would entail DOE paying producers to store materials on-site at their processing plants.

The physical reserve provides an additional opportunity for DOE to address market volatility by choosing when it sells materials from the reserve. For example, DOE could pause sales of a material when there is an oversupply on the market and prices dip or ramp up sales when there is a shortage and prices spike. However, this can only be used to address short-term fluctuations in supply and demand (e.g. a few months to a few years at most), since these chemicals have limited shelf lives.

A third way to implement offtake backstops that would also support price discovery and transparency is discussed in Section 3.

Section 3. Creating Stable and Transparent Markets

Concerns about Pricing Mechanisms

Market volatility in critical minerals markets has raised concerns about just how reliable the current pricing mechanisms for these markets are. There are two main ways that prices in a market are determined: third-party price assessments and market exchanges. A third approach that has attracted renewed attention this year is auctions. Below, we walk through these three approaches and propose potential solutions for addressing challenges in price discovery and transparency.

Index Pricing

Price reporting agencies like Fastmarkets and Benchmark Mineral Intelligence offer subscription services to help market participants assess the price of commodities in a region. These agencies develop rosters of companies for each commodity, who regularly contribute information on transaction prices. That intel is then used to generate price indexes. Fastmarkets and Benchmark’s indexes are primarily based on prices provided by large, high-volume sellers and buyers. Smaller buyers may pay higher than index prices.

It can be hard to establish reliable price indexes in immature markets if there is an insufficient volume of transactions or if the majority of transactions are made by a small set of companies. For example, lithium processing is concentrated among a small number of companies in China and spot transactions are a minority share of the market. New entrants and smaller producers have raised concern that these companies have significant control over Asian spot prices reported by Fastmarkets and Benchmark, which are used to set offtake agreement prices, and that the price indexes are not sufficiently transparent.

Exchange Trading

Market exchanges are a key feature of mature markets that helps reduce market volatility. Market exchanges allow for a wider range of participants, improving market liquidity, and enables price discovery and transparency. Companies up and down the supply chain can use physically-delivered futures and options contracts to hedge against price volatility and gain visibility into expectations for the market’s general direction to help inform decision-making. This can help derisk the effect of market volatility on investments in new production capacity.

Of the materials we’ve discussed, nickel and cobalt metal are the only two that are physically traded on a market exchange, specifically LME. Metals make good exchange commodities due to their fungibility. Other forms of nickel and cobalt are typically priced as a percentage of the payable price for nickel and cobalt metal. LME’s nickel price is used as the global benchmark for many nickel products, while the in-warehouse price of cobalt metal in Rotterdam, Europe’s largest seaport, is used as the global benchmark for many cobalt products. These pricing relationships enable companies to use nickel and cobalt metal as proxies for hedging related materials.

After nickel trading volumes plummeted on LME in the wake of the short squeeze, doubts were raised about LME’s ability to accurately benchmark its price, sparking interest in alternative exchanges. In April 2024, UK-based Global Commodities Holdings Ltd (GCHL) launched a new trading platform for nickel metal that is only available to producers, consumers, and merchants directly involved in the physical market, excluding speculative traders. The trading platform will deliver globally “from Baltimore to Yokohama.” GCHL is using the prices on the platform to publish its own price index and is also working with Intercontinental Exchange to create cash-settled derivatives contracts. This new platform could potentially expand to other metals and critical minerals.

In addition to LME’s troubles though, changes in the battery supply chain have led to a growing divergence between the nickel and cobalt metal traded on exchanges and the actual chemicals used to make batteries. Chinese processors who produce most of the global supply of nickel sulfate have mostly switched from nickel metal to cheaper nickel intermediate products as their primary feedstock. Consequently, market participants say that the LME exchange price for nickel metal, which is mostly driven by stainless steel, no longer reflects market conditions for the battery sector, raising the need for new tradeable contracts and pricing mechanisms. For the cobalt industry, 75% of demand comes from batteries, which use cobalt sulfate. Cobalt metal makes up only 18% of the market, of which only 10-15% is traded on the spot market. As a result, cobalt chemicals producers have transitioned away from using the metal reference price towards fixed-prices or cobalt sulfate payables.

These trends motivate the development of new exchange contracts for physically trading nickel and cobalt chemicals that can enable price discovery separate from the metals markets. There is also a need to develop exchange contracts for materials like lithium and graphite with immature markets that exhibit significant volatility.

However, exchange trading of these materials is complicated by their nature as specialty chemicals: they have limited shelf lives and more complex storage requirements, unlike metal commodities. Lithium and graphite products also exhibit significant variations that affect how buyers can use them. For example, depending on the types and level of impurities in lithium hydroxide/carbonate, manufacturers of cathode active materials may need to conduct different chemical processes to remove them. Offtakers may also require that products meet additional specifications based on the characteristics they need for their CAM and battery chemistries.

For these reasons, major exchanges like LME, the Chicago Mercantile Exchange (CME), and the Singapore Exchange (SGX) have instead chosen to launch cash-settled contracts for lithium hydroxide/carbonate and cobalt hydroxide that allow for financial trading, but require buyers and sellers to arrange physical delivery separately from the exchange. Large firms have begun to participate increasingly in these derivatives markets to hedge against market volatility, but the lack of physical settlement limits their utility to producers who still need to physically deliver their products in order to make a profit. Nevertheless, CME’s contracts for lithium and cobalt have seen significant growth in transaction volume. LME, CME, and SGX all use Fastmarkets’ price indexes as the basis for their cash-settled contracts.

As regional industries mature and products become more standardized, these exchanges may begin to add physically settled contracts for battery-grade critical minerals. For example, the Guangzhou Futures Exchange (GFEX) in China, where the vast majority of lithium refining currently occurs, began offering physically settled contracts for lithium carbonate in August 2023. Though the exchange exhibited significant volatility in its first few months, raising concerns, the first round of physical deliveries in January 2024 occurred successfully, and trading volumes have been substantial this year. Access to GFEX is currently limited to Chinese entities and their affiliates, but another trading platform could come to do the same for North America over the next few decades as lithium production volume grows and a spot market emerges. Abaxx Exchange, a Singapore-based startup, has also launched a physically settled futures contract for nickel sulfate with delivery points in Singapore and Rotterdam. A North American delivery point could be added as the North American supply chain matures.

No market exchange for graphite currently exists, since products in the industry vary even greater than other materials. Even the currently available price indexes are not seen as sufficiently robust for offtake pricing.

Auctions

In the absence of a globally accessible market exchange for lithium and concerns about the transparency of index pricing, Albemarle, the top producer of lithium worldwide, has turned to auctions of spodumene concentrate and lithium carbonate as a means to improve market transparency and an “approach to price discovery that can lead to fair product valuation.” Albemarle’s first auction in March of spodumene concentrate in China closed at a price of $1200/ton, which was in line with spot prices reported by Asian Metal, but about 10% greater than prices provided by other price reporting agencies like Fastmarkets. Plans are in place to continue conducting regular auctions at the rate of about one per week in China and other locations like Australia. Lithium hydroxide will be auctioned as well. Auction data will be provided to Fastmarkets and other price reporting agencies to be formulated into publicly available price indexes.

Auctions are not a new concept: in 2021 and 2022, Pilbara Minerals regularly conducted auctions of spodumene on its own platform Battery Metals Exchange, helping to improve market sentiment. Now, though, the company says that most of its material is now committed to offtakers, so auctions have mostly stopped, though it did hold an auction for spodumene concentrate in March. If other lithium producers join Albemarle in conducting auctions, the data could help improve the accuracy and transparency of price indexes. Auctions could also be used to inform the pricing of other battery-grade critical minerals.

Policy Solutions to Support Price Discovery and Transparency Across the Market

Right now, the only pricing mechanisms available to domestic project developers are spot price indexes for battery-grade critical minerals in Asia or global benchmarks for proxies like nickel and cobalt metal. Long-term, the development of new pricing mechanisms for North America will be crucial to price discovery and transparency in this new market. There are two ways that DOE could help facilitate this: one that could be implemented immediately for some materials and one that will require domestic production volume to scale up first.

First. Government-Backed Auctions: Auctions require project developers to keep a portion of their expected output uncommitted to any offtakers. However, there is a risk that future auctions won’t generate a price sufficient to offset capital and operating expenses, so processors are unlikely to do this on their own, especially for their first domestic project. MESC could address this by providing a backstop guarantee for the portion of a producer’s output that they commit to regularly auctioning for a set timespan. If, in the future, auctions are unable to generate a price above a pre-negotiated price floor, then DOE would pay sellers the difference between the highest auction price and the price floor for each unit sold. Such an agreement could be made using DOE’s Other Transaction Authority. DOE could separately contract with a platform such as MetalsHub to conduct the auction.

Government-backed auctions would enable the discovery of a true North American price for different battery-grade critical minerals and the raw materials used to make them, generating a useful comparison point with Asian spot prices. Such a scheme would also help address developers’ price and demand needs for project financing. These backstop-auction agreements could be complementary to the other types of backstop agreements proposed earlier and potentially more appealing than physically offtaking materials since the government would not have to receive delivery of the materials and there would be a built-in mechanism to sell the materials to an appropriate buyer. If successful, companies could continue to conduct auctions independently after the agreements expire.

Second. New Benchmark Contracts: Employ America has proposed that the Loan Programs Office (LPO) could use Section 1703 to guarantee lending to a market exchange to develop new, physically settled benchmark contracts for battery-grade critical minerals. The development of new contracts should include producers in the entire North American region. Canada also has a significant number of mines and processing plants in development. Including those projects would increase the number of participants, market volume, and liquidity of new benchmark contracts.

In order for auctions or new benchmark contracts to operate successfully, three prerequisites must be met:

- There must be a sufficient volume of materials available for sale (i.e. production output that is not committed to an offtaker).

- There must be sufficient product standardization in the industry such that materials produced by different companies can be used interchangeably by a significant number of buyers.

- There must be a sufficient volume of demand from buyers, brokers, and traders.

Market exchanges typically conduct research into stakeholders to understand whether or not the market is mature enough to meet these requirements before they launch a new contract. Interest from buyers and sellers must indicate that there would be sufficient trading volume for the exchange to make a profit greater than the cost of setting up the new contract. A loan from LPO under Section 1703 can help offset some of those upfront costs and potentially make it worthwhile for an exchange to launch a new contract in a less mature market than they typically would.

Government-backed auctions, on the other hand, solve the first prerequisite by offering guarantees to producers for keeping a portion of their production output uncommitted. Product standardization can also be less stringent, since each producer can hold separate auctions, with varying material specifications, unlike market exchanges where there must be a single set of product standards.

Given current market conditions, no battery-grade critical minerals can meet the above prerequisites for new benchmark contracts, primarily due to a lack of available volume, though there are also issues with product standardization for certain materials. However, nickel, cobalt, lithium, and graphite could be good candidates for government-backed auctions. DOE should start engaging with project developers that have yet to fully commit their output to offtakers and gauge their interest in backstop-auction agreements.

Nickel and Cobalt

As discussed prior, there are only a handful of nickel and cobalt sulfate refineries currently being developed in North America, making it difficult to establish a benchmark contract for North America. None of the project developers have yet signed offtake agreements covering their full production capacity, so backstop-auction agreements could be appealing to project developers and their investors. Given that more than half of the projects in development are located in Canada, MESC and DOE’s Office of International Affairs should collaborate with the Canadian government in designing and implementing government-backed auctions.

Lithium

Domestic companies have expressed interest in establishing North American-based spot markets and price indexes for lithium hydroxide and carbonate, but say that it will take quite a few years before production volume is large enough to warrant that. Product variation has also been a concern from lithium processors when the idea of a market exchange or public auction has been raised. Lessons could be learned from the GFEX battery-grade lithium carbonate contracts. GFEX set standards on the purity, moisture, loss on ignition, and maximum content of different impurities. Some Chinese companies were able to meet these standards, while others were not, preventing them from participating in the futures market or requiring them to trade their materials as lower-purity industrial-grade lithium carbonate, which sells for a discounted price. Other companies producing lithium of much higher quality than the GFEX standards, opted to continue selling on the spot market because they could charge a premium on the standard price. Despite some companies choosing not to participate, trading volumes on GFEX have been substantial, and the exchange was able to weather through initial concerns of a short squeeze, suggesting that challenges with product variation can be overcome through standardization.

Analysts have proposed that spodumene could be a better candidate for exchange trading, since it is fungible and does not have the limited shelf-life or storage requirements of lithium salts. 60% of global lithium comes from spodumene, and the U.S. has some of the largest spodumene deposits in the world, so spodumene would be a good proxy for lithium salts in North America. However, the two domestic developers of spodumene mines are planning to construct processing plants to convert the spodumene into battery-grade lithium on-site. Similarly, the two Canadian mines that currently produce spodumene are also planning to build their own processing plants. These vertical integration plans mean that there is unlikely to be large amounts of spodumene available for sale on a market exchange in the near future.

DOE could, however, work with miners and processors to sign backstop-auction agreements for smaller amounts of lithium hydroxide/carbonate and spodumene that they have yet to commit to offtakers. This may be especially appealing to companies that have announced delays to project development due to current low market prices and help derisk bringing timelines forward. Interest in these future auctions could also help gauge the potential for developing new benchmark contracts for lithium hydroxide/carbonate further down the line.

Graphite

Natural and synthetic graphite anode material products currently exhibit a great range of variation and insufficient product standardization, so a market exchange would not be viable at the moment. As the domestic graphite industry develops, DOE should work with graphite anode material producers and battery manufacturers to understand the types and degree of variations that exist across products and discuss avenues towards product standardization. Government-backed auctions could be a smaller-scale way to test the viability of product standards developed from that process, perhaps using several tiers or categories to group products. Natural and synthetic graphite would have to be treated separately, of course.

Conclusion

The current global critical minerals supply chain partially reflects the results of over a decade of focused, industrial policies implemented by the Chinese government. If the U.S. wants to lead the clean energy transition, critical minerals will also need to become a cornerstone of U.S. industrial policy. Developing a robust North American critical minerals industry would bolster U.S. energy security and independence and ensure a smooth energy transition.

Promising progress has already been made in lithium, with planned processing capacity expected to meet demand from future battery manufacturing. However, market and pricing challenges remain for battery-grade nickel, cobalt, and graphite, which will fall far short of future demand without additional intervention. This report proposes that DOE take a two-pronged approach to supporting the critical minerals industry through offtake backstops, which address project developers’ current pricing dilemmas, and the development of more reliable and transparent pricing mechanisms such as government-backed auctions, which will set up markets for the future.

While the solutions proposed in this report focus on DOE as the primary implementer, Congress also has a role to play in authorizing and appropriating new funding necessary to execute a cohesive industrial strategy on critical minerals . The policies proposed in this report can also be applied to other critical minerals crucial for the energy transition and our national security. Similar analysis of other critical minerals markets and end uses should be conducted to understand how these solutions can be tailored to those industry needs.

Cement and concrete production is one of the hardest industries to decarbonize. Using its Other Transactions Authority, DOE could design a demand-support program involving double-sided auctions, contracts for difference, or price and volume guarantees.

Here’s how the Department of Energy can utilize Other Transaction Authority to invest in and kickstart a new era of abundant and firm geothermal energy.