Laying the Foundation for the Low-Carbon Cement and Concrete Industry

This report is part of a series on underinvested clean energy technologies, the challenges they face, and how the Department of Energy can use its Other Transaction Authority to implement programs custom tailored to those challenges.

Cement and concrete production is one of the hardest industries to decarbonize. Solutions for low-emissions cement and concrete are much less mature than those for other green technologies like solar and wind energy and electric vehicles. Nevertheless, over the past few years, young companies have achieved significant milestones in piloting their technologies and certifying their performance and emissions reductions. In order to finance new manufacturing facilities and scale promising solutions, companies will need to demonstrate consistent demand for their products at a financially sustainable price. Demand support from the Department of Energy (DOE) can help companies meet this requirement and unlock private financing for commercial-scale projects. Using its Other Transactions Authority, DOE could design a demand-support program involving double-sided auctions, contracts for difference, or price and volume guarantees. To fund such a program using existing funds, the DOE could incorporate it into the Industrial Demonstrations Program. However, additional funding from Congress would allow the DOE to implement a more robust program. Through such an initiative, the government would accelerate the adoption of low-emissions cement and concrete, providing emissions reductions benefits across the country while setting the United States up for success in the future clean industrial economy.

Introduction

Besides water, concrete is the most consumed material in the world. It is the material of choice for construction thanks to its durability, versatility, and affordability. As of 2022, the cement and concrete sector accounted for nine percent of global carbon emissions. The vast majority of the embodied emissions of concrete come from the production of Portland cement. Cement production emits carbon through the burning of fossil fuels to heat kilns (40% of emissions) and the chemical process of turning limestone and clay into cement using that heat (60% of emissions). Electrifying production facilities and making them more energy efficient can help decarbonize the former but not the latter, which requires deeper innovation.

Current solutions on the market substitute a portion of the cement used in concrete mixtures with Supplementary Cementitious Materials (SCMs) like fly ash, slag, or unprocessed limestone, reducing the embodied emissions of the resulting concrete. But these SCMs cannot replace all of the cement in concrete, and currently there is an insufficient supply of readily usable fly ash and slag for wider adoption across the industry.

The next generation of ultra-low-carbon, carbon-neutral, and even carbon-negative solutions seeks to develop alternative feedstocks and processes for producing cement or cementitious materials that can replace cement entirely and to capture carbon in aggregates and wet concrete. The DOE reports that testing and scaling these new technologies is crucial to fully eliminate emissions from concrete by 2050. Bringing these new technologies to the market will not only help the United States meet its climate goals but also promote U.S. leadership in manufacturing.

A number of companies have established pilot facilities or are in the process of constructing them. These companies have successfully produced near-carbon-neutral and even carbon-negative concrete. Building off of these milestones, companies will need to secure financing to build full-scale commercial facilities and increase their manufacturing capacity.

Challenges Facing Low-Carbon Cement and Concrete

A key requirement for accessing both private-sector and government financing for new facilities is that companies obtain long-term offtake agreements, which assure financiers that there will be a steady source of revenue once the facility is built. But the boom-and-bust nature of the construction industry discourages construction companies and intermediaries from entering into long-term financial commitments in case there won’t be a project to use the materials for. Cement, aggregates, and other concrete inputs also take up significant volume, so it would be difficult and costly for potential offtakers to store excess amounts during construction lulls. For these reasons, construction contractors procure concrete on an as-needed, project-specific basis.

Adding to the complexity, structural features of the cement and concrete market increase the difficulty of securing long-term offtake agreements:

- Long, fragmented supply chain: While the supply chain is highly concentrated at either end, there are multiple intermediaries between the actual producers of cement, aggregates, and other inputs and the final construction customers. These include the thousands of ready-mix concrete producers, along with materials dealers, construction contractors, and subcontractors. As a result, construction customers usually aren’t buying materials themselves, and their contractors or subcontractors often aren’t buying materials directly from cement producers.

- Regional fragmentation: Cement, aggregates, and other concrete inputs are heavy products, which entail high freight costs and embodied emissions from transportation, so producers have a limited range in which they are willing to ship their product. After these products are shipped to a ready-mix concrete facility, the fresh concrete must then be delivered to the construction site within 60 to 90 minutes or the concrete will harden. As a result, the localization of supply chains limits the potential customers for a new manufacturing plant.

- Low margins: The cement and concrete markets operate with very low margins, so buyers are highly sensitive to price. Consequently, low-carbon cement and concrete may struggle to compete against conventional options due to their green premiums.

Luckily, private construction is not the only customer for concrete. The U.S. government (federal, state, and local combined) accounts for roughly 50% of all concrete procurement in the country. Used correctly, the government’s purchasing power can be a powerful lever for spurring the adoption of decarbonized cement and concrete. However, the government faces similar barriers as the private sector against entering into long-term offtake agreements. Government procurement of concrete goes through multiple intermediaries and operates on an as-needed, project-specific basis: government agencies like the General Services Administration (GSA) enter into agreements with construction contractors for specific projects, and then the contractors or their subcontractors make the ultimate purchasing decisions for concrete.

Federal Support

The Federal Buy Clean Initiative, enacted in 2021 by the Biden Administration, is starting to address the procurement challenge for low-carbon cement and concrete. Among the initiative’s programs is the allocation of $4.5 billion from the Inflation Reduction Act (IRA) for the GSA and the Department of Transportation (DOT) to use lower-carbon construction materials. Under the initiative, the GSA is piloting directly procuring low-embodied-carbon materials for federal construction projects. To qualify as low-embodied-carbon concrete under the GSA’s interim requirements, concrete mixtures only have to achieve a roughly 25–50% reduction in carbon content,1 depending on the compressive strength. The requirement may be even less if no concrete meeting this standard is available near the project site. Since the bar is only slightly below traditional concrete, young companies developing the solutions to fully decarbonize concrete will have trouble competing in terms of price against companies producing more well-established but higher-emission solutions like fly ash, slag, and limestone concrete mixtures to secure procurement contracts. Moreover, the just-in-time and project-specific nature of these procurement contracts means they still don’t address juvenile companies’ need for long-term price and customer security in order to scale up.

The ideal solution for this is a demand-support program. The DOE Office of Clean Energy Demonstrations (OCED) is developing a demand-support program for the Hydrogen Hubs initiative, setting aside $1 billion for demand-support to accompany the $7 billion in direct funding to regional Hydrogen Hubs. In its request for proposals, OCED says that the hydrogen demand-support program will address the “fundamental mismatch in [the market] between producers, who need long-term certainty of high-volume demand in order to secure financing to build a project, and buyers, who often prefer to buy on a short-term basis at more modest volumes, especially for products that have yet to be produced at scale and [are] expected to see cost decreases.”

A demand-support program could do the same for low-carbon cement and concrete, addressing the market challenges that grants alone cannot. OCED is reviewing applications for the $6.3 billion Industrial Demonstrations Program. Similar to the Hydrogen Hubs, OCED could consider setting aside $500 million to $1 billion of the program funds to implement demand-support programs for the two highest-emitting heavy industries, low-carbon cement/concrete and steel, at $250 million to $500 million each.

Additional funding from Congress would allow DOE to implement a more robust demand-support program. Federal investment in industrial decarbonization grew from $1.5 billion in FY21 to over $10 billion in FY23, thanks largely to new funding from BIL and IRA. However, the sector remains underfunded relative to its emissions, contributing 23% of the country’s emissions while receiving less than 12% of Federal climate innovation funding. A promising piece of legislation that was recently introduced is The Concrete and Asphalt Innovation Act of 2023, which would, among other things, direct the DOE to establish a program of research, development, demonstration, and commercial application of low-emissions cement, concrete, asphalt binder, and asphalt mixture. This would include a demonstration initiative authorized at $200 million and the production of a five-year strategic plan to identify new programs and resources needed to carry out the mission. If the legislation is passed, the DOE could propose a demand-support program in its strategic plan and request funding from Congress to set it up, though the faster route would be for Congress to add a section to the Act directly establishing a demand-support program within DOE and authorizing funding for it before passing the Act.

Other Transactions Authority

BIL and IRA gave DOE an expanded mandate to support innovative technologies from early-stage research through commercialization. In order to do so, DOE must be just as innovative in its use of its available authorities and resources. Tackling the challenge of bringing technologies from pilot to commercialization requires DOE to look beyond traditional grant, loan, and procurement mechanisms. Previously, we have identified the DOE’s Other Transaction Authority (OTA) as an underleveraged tool for accelerating clean energy technologies.

OTA is defined in legislation as the authority to enter into transactions that are not government grants or contracts in order to advance an agency’s mission. This negative definition provides DOE with significant freedom to design and implement flexible financial agreements that can be tailored to address the unique challenges that different technologies face. DOE plans to use OTA to implement the hydrogen demand-support program, and it could also be used for a demand-support program for low-carbon cement and concrete. The DOE’s new Guide to Other Transactions provides official guidance on how DOE personnel can use the flexibilities provided by OTA.

Defining Products for Demand Support

Before setting up a demand-support program, DOE first needs to define what a low-carbon cement or concrete product is and the value it provides in emissions avoided. This is not straightforward due to (1) the heterogeneity of solutions, which prevents apples-to-apples comparisons in price, and (2) variations in the amount of avoided emissions that different solutions can provide. To address the first issue, for products that are not ready-mix concrete, the DOE should calculate the cost of a unit of concrete made using the product, based on a standardized mix ratio of a specific compressive strength and market prices for the other components of the concrete mix. To address the second issue, the DOE should then divide the calculated price per unit of concrete (e.g., $/m3) by the amount of CO2 emissions avoided per unit of concrete compared to the NRCMA’s industry average (e.g., kg/m3) to determine the effective price per unit of CO2 emissions avoided. The DOE can then fairly compare bids from different projects using this metric. Such an approach would result in the government providing demand support for the products that are most cost-effective at reducing carbon emissions, rather than solely the cheapest.

Furthermore, the DOE should put an upper limit on the amount of embodied carbon that the concrete product or concrete made with the product must meet in order to qualify as “low carbon.” We suggest that the DOE use the limits established by the First Movers Coalition, an international corporate advanced market commitment for concrete and other hard-to-abate industries organized by the World Economic Forum. The limits were developed through conversations with incumbent suppliers, start-ups, nonprofits, and intergovernmental organizations on what would be achievable by 2030. The limits were designed to help move the needle towards commercializing solutions that enable full decarbonization.

Companies that participate in a DOE demand-support program should be required after one or two years of operations to confirm that their product meets these limits through an Environmental Product Declaration.2 Using carbon offsets to reach that limit should not be allowed, since the goal is to spur the innovation and scaling of technologies that can eventually fully decarbonize the cement and concrete industry.

Below are some ideas for how DOE can set up a demand-support program for low-carbon cement and concrete.

Program Proposals

Double-Sided Auction

Double-sided auctions are designed to support the development of production capacity for green technologies and products and the creation of a market by providing long-term price certainty to suppliers and facilitating the sale of their products to buyers. As the name suggests, a double-sided auction consists of two phases: First, the government or an intermediary organization holds a reverse auction for long-term purchase agreements (e.g., 10 years) for the product from suppliers, who are incentivized to bid the lowest possible price in order to win. Next, the government conducts annual auctions of short-term sales agreements to buyers of the product. Once sales agreements are finalized, the product is delivered directly from the supplier to the buyer, with the government acting as a transparent intermediary. The government thus serves as a market maker by coordinating the purchase and sale of the product from producers to buyers. Government funding covers the difference between the original purchase price and the final sale price, reducing the impact of the green premium for buyers and sellers.

While the federal government has not yet implemented a double-sided auction program, OCED is considering setting up the hydrogen demand-support measure as a “market maker” that provides a “ready purchaser/seller for clean hydrogen.” Such a market maker program could be implemented most efficiently through double-sided auctions.

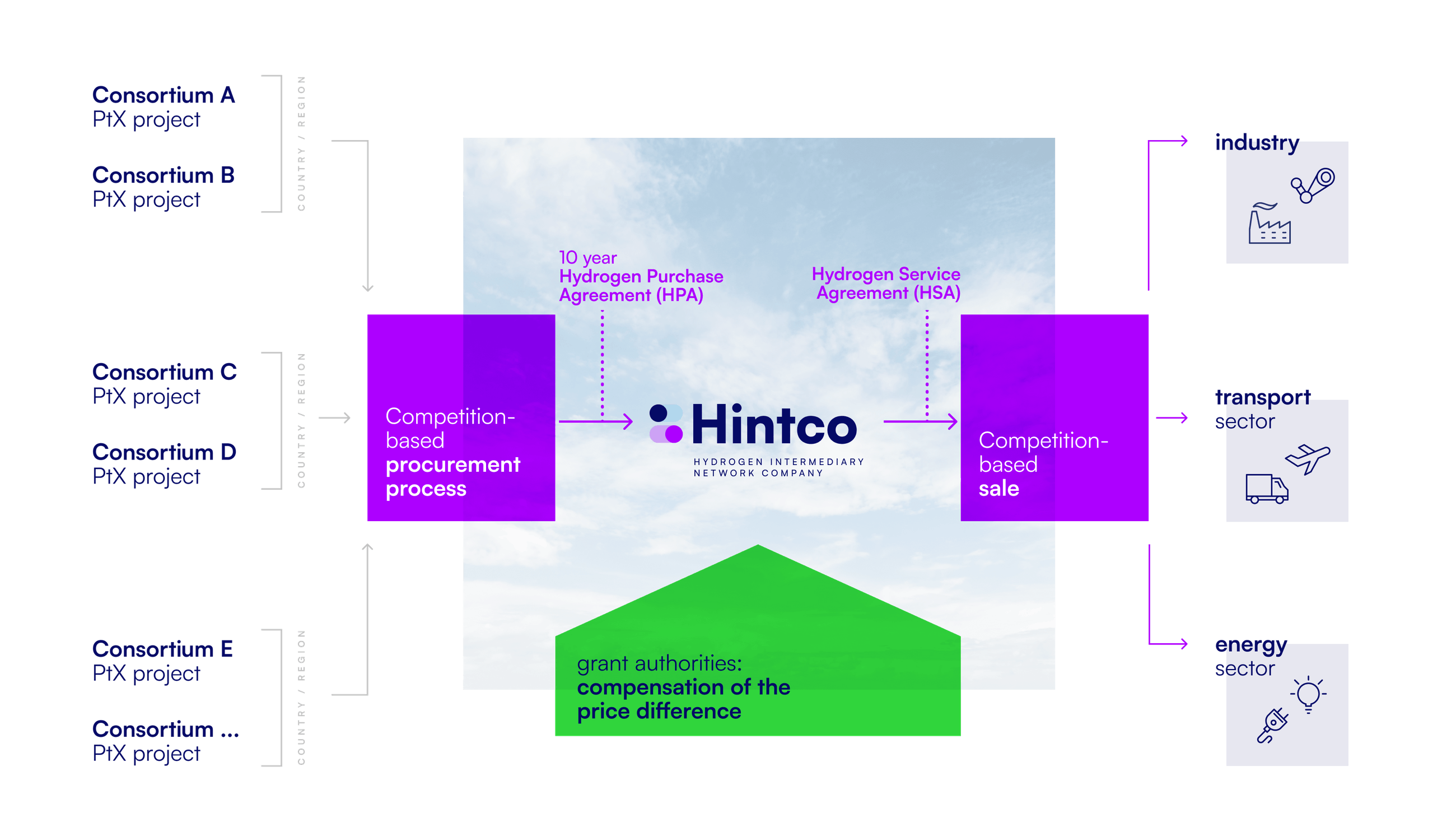

Germany was the first to conceive of and develop the double-sided auction scheme. The H2Global initiative was established in 2021 to support the development of production capacity for green hydrogen and its derivative products. The program is implemented by Hintco, an intermediary company, which is currently evaluating bids for its first auction for the purchase of green ammonia, methanol, and e-fuels, with final contracts expected to be announced as soon as this month. Products will start to be delivered by the end of 2024.

(Source: H2Global)

A double-sided auction scheme for low-carbon cement and concrete would address producers’ need for long-term offtake agreements while matching buyers’ short-term procurement needs. The auctions would also help develop transparent market prices for low-carbon cement and concrete products.

All bids for purchase agreements should include detailed technical specifications and/or certifications for the product, the desired price per unit, and a robust, third-party life-cycle assessment of the amount of embodied carbon per unit of concrete made with the product, at different compressive strengths. Additionally, bids of ready-mix concrete should include the location(s) of their production facility or facilities, and bids of cement and other concrete inputs should include information on the locations of ready-mix concrete facilities capable of producing concrete using their products. The DOE should then select bids through a pure reverse auction using the calculated effective price per unit of CO2 emissions avoided. To account for regional fragmentation, the DOE could conduct separate auctions for each region of the country.

A double-sided auction presents similar benefits to the low-carbon cement and concrete industry as an advance market commitment would. However, the addition of an efficient, built-in system for the government to then sell that cement or concrete allotment to a buyer means that the government is not obligated to use the cement or concrete itself. This is important because the logistics of matching cement or concrete production to a suitable government construction project can be difficult due to regional fragmentation, and the DOE is not a major procurer of cement and concrete.3 Instead, under this scheme, federal, state, or local agencies working on a construction project or their contractors could check the double-sided auction program each year to see if there is a product offering in their region that matches their project needs and sustainability goals for that year, and if so, submit a bid to procure it. In fact, this should be encouraged as a part of the Federal Buy Clean Initiative, since the government is such an important consumer of cement and concrete products.

Contracts for Difference

Contracts for difference (CfD, or sometimes called two-way CfD) programs aim to provide price certainty for green technology projects and close the gap between the price that producers need and the price that buyers are willing to offer. CfD have been used by the United Kingdom and France primarily to support the development of large-scale renewable energy projects. However, CfD can also be used to support the development of production capacity for other green technologies. OCED is considering CfD (also known as pay-for-difference contracts) for its hydrogen demand-support program.

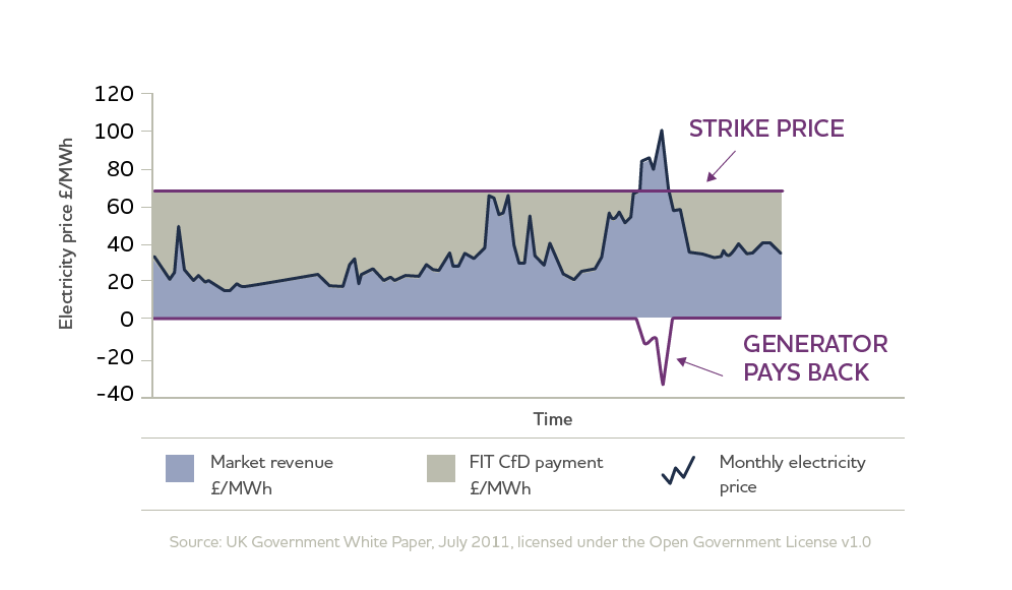

CfD are long-term contracts signed between the government or a government-sponsored entity and companies looking to expand production capacity for a green product.4 The contract guarantees that once the production facility comes online, the government will ensure a steady price by paying suppliers the difference between the market price for which they are able to sell their product and a predetermined “strike price.” On the other hand, if the market price rises above the strike price, the supplier will pay the difference back to the government. This prevents the public from funding any potential windfall profits.

(Source: Canadian Climate Institute)

A CfD program could provide a source of demand certainty for low-carbon cement and concrete companies looking to finance the construction of pilot- and commercial-scale manufacturing plants or the retrofitting of existing plants. The selection of recipients and strike prices should be determined through annual reverse auctions. In a typical reverse auction for CfD, the government sets a cap on the maximum number of units of product and the max strike price they’re willing to accept. Each project candidate then places a sealed bid for a unit price and the amount of product they plan to produce. The bids are ranked by unit price, and projects are accepted from low to high unit price until either the max total capacity or max strike price is reached. The last project accepted sets the strike price for all accepted projects. The strike price is adjusted annually for inflation but otherwise fixed over the course of the contract. Compared to traditional subsidy programs, a CfD program can be much more cost-efficient thanks to the reverse auction process. The UK’s CfD program has seen the strike price fall with each successive round of auctions.

Applying this to the low-carbon cement and concrete industry requires some adjustments, since there are a variety of products for decarbonizing cement and concrete. As discussed prior, the DOE should compare project bids according to the effective price per unit CO2 abated when the product is used to make concrete. The DOE should also set a cap on the maximum volume of CO2 it wishes to abate and the maximum effective price per unit of CO2 abated that it is willing to pay. Bids can then be accepted from low to high price until one of those caps is hit. Instead of establishing a single strike price, the DOE should use the accepted project’s bid price as the strike price to account for the variation in types of products.

Backstop Price Guarantee

A CfD program could be designed as a backstop price guarantee if one removes the requirement that suppliers pay the government back when market prices rise above the strike price. In this case, the DOE would set a lower maximum strike price for CO2 abatement, knowing that suppliers will be willing to bid lower strike prices, since there is now the opportunity for unrestricted profits above the strike price. The DOE would then only pay in the worst-case scenario when the market price falls below the strike price, which would operate as an effective price floor.

Backstop Volume Guarantee

Alternatively, the DOE could address demand uncertainty by providing a volume guarantee. In this case, the DOE could conduct a reverse auction for volume guarantee agreements with manufacturers, wherein the DOE would commit to purchasing any units of product short of the volume guarantee that the company is unable to sell each year for a certain price, and the company would commit to a ceiling on the price they will charge buyers.5 Using OTA, the DOE could implement such a program in collaboration with DOT or GSA, wherein DOE would purchase the materials and DOT or GSA would use the materials for their construction needs.

Other Considerations for Implementation

Rather than directly managing a demand-support program, the DOE should enter into an OT agreement with an external nonprofit entity to administer the contracts.6 The nonprofit entity would then hold auctions and select, manage, and fulfill the contracts. DOE is currently in the process of doing this for the hydrogen demand-support program.

A nonprofit entity could provide two main benefits. First, the logistics of implementing such a program would not be trivial, given the number of different suppliers, intermediaries, and offtakers involved. An external entity would have an easier and faster time hiring staff with the necessary expertise compared to the federal hiring process and limited budget for program direction that the DOE has to contend with. Second, the entity’s independent nature would make it easier to gain lasting bipartisan support for the demand-support program, since the entity would not be directly associated with any one administration.

Coordination with Other DOE Programs

The green premium for near-zero-carbon cement and concrete products is steep, and demand-support programs like the ones proposed in this report should not be considered a cure-all for the industry, since it may be difficult to secure a large enough budget for any one such program to fully address the green premium across the industry. Rather, demand-support programs can complement the multiple existing funding authorities within the DOE by closing the residual gap between emerging technologies and conventional alternatives after other programs have helped to lower the green premium.

The DOE’s Loan Programs Office (LPO) received a significant increase in their lending authorities from the IRA and has the ability to provide loans or loan guarantees to innovative clean cement facilities, resulting in cheaper capital financing and providing an effective subsidy. In addition, the IRA and the Bipartisan Infrastructure Law provided substantial new funding for the demonstration of industrial decarbonization technologies through OCED.

Policies like these can be chained together. For example, a clean cement start-up could simultaneously apply to OCED for funding to demonstrate their technology at scale and a loan or loan guarantee from LPO after due diligence on their business plan. Together, these two programs drive down the cost of the green premium and derisk the companies that successfully receive their support, leaving a much more modest price premium that a mechanism like a double-sided auction could affordably cover with less risk.

Successfully chaining policies like this requires deep coordination across DOE offices. OCED and LPO would need to work in lockstep in conducting technical evaluations and due diligence of projects that apply to both and prioritize funding of projects that meet both offices’ criteria for success. The best projects should be offered both demonstration funding from OCED and conditional commitments from LPO, which would provide companies with the confidence that they will receive follow-on funding if the demonstration is successful and other conditions are met, while posing no added risk to LPO since companies will need to meet their conditions first before receiving funds. The assessments should also consider whether the project would be a strong candidate for receiving demand support through a double-sided auction, CfD program, or price/volume guarantee, which would help further derisk the loan/loan guarantee and justify the demonstration funding.

Candidates for receiving support from all three public funding instruments would of course need to be especially rigorously evaluated, since the fiscal risk and potential political backlash of such a project failing is also much greater. If successful, such coordination would ensure that the combination of these programs substantially moves the needle on bringing emerging technologies in green cement and concrete to commercial scale.

Conclusion

Demand support can help address the key barrier that low-carbon cement and concrete companies face in scaling their technologies and financing commercial-scale manufacturing facilities. Whichever approach the DOE chooses to take, the agency should keep in mind (1) the importance of setting an ambitious standard for what qualifies as low-carbon cement and concrete and comparing proposals using a metric that accounts for the range of different product types and embodied emissions, (2) the complex implementation logistics, and (3) the benefits of coordinating a demand-support program with the agency’s demonstration and loan programs. Implemented successfully, such a program would crowd in private investment, accelerate commercialization, and lay the foundation for the clean industrial economy in the United States.