A Carbon Tax to Combat Climate Change and Support Low-Income Households

Summary

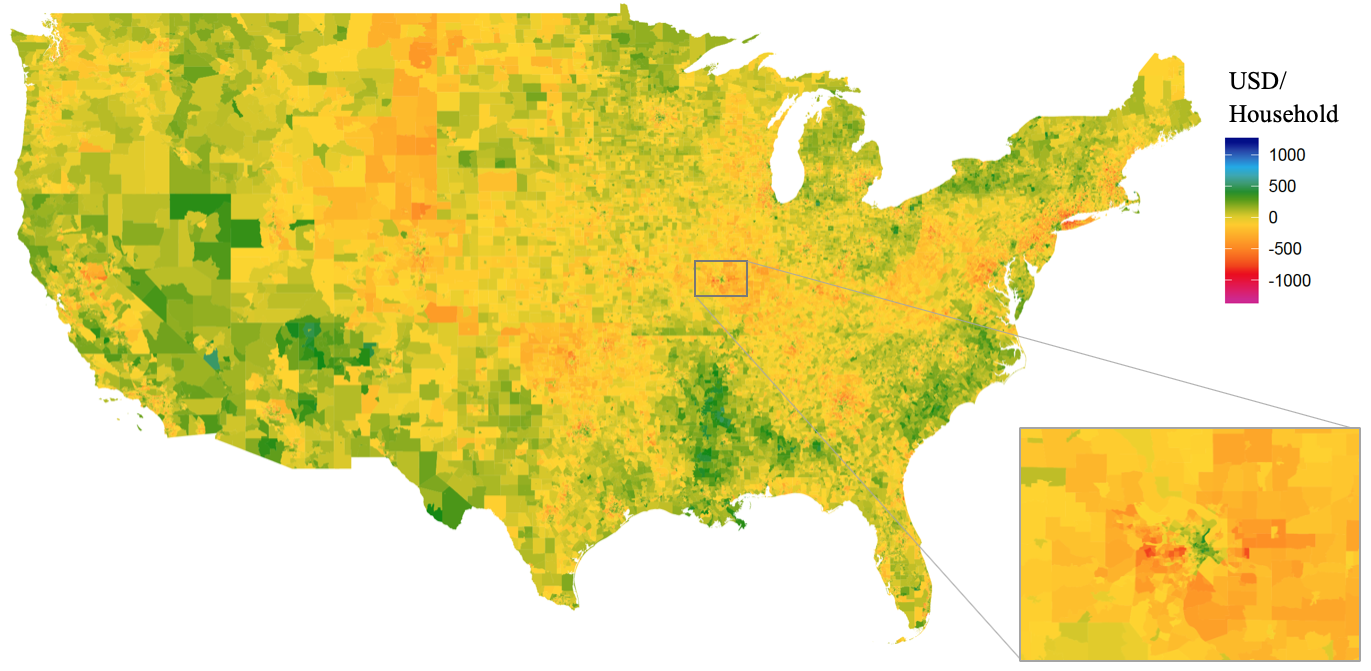

Putting a price on carbon is fundamental to achieving U.S. climate goals for 2050. Many options for carbon price-setting exist, and in this policy brief we propose a tax-and-dividend approach that mitigates the challenging impacts that carbon policies have on poor and suburban/rural communities, particularly those in Middle America. Such a plan will be a net gain for low-income households, in contrast to other proposed climate change policies which will adversely affect the poor. Furthermore, it has been shown that even a modest carbon tax can have large benefits in terms of cost-effectiveness.

For that reason, we propose the following:

- Introduce a carbon tax-and-dividend plan as part of any federal climate policy.

- Use revenue to offset impacts on low-income households, taking into account enormousregional disparities.

- If political dynamics favor regulatory standards, consider coupling such standards with amodest carbon tax whose revenue can be used to offset their regressive effects.

A deeper understanding of methane could help scientists better address these impacts – including potentially through methane removal.

We are encouraged that the Administration and Congress are recognizing the severity of the wildfire crisis and elevating it as a national priority. Yet the devil is in the details when it comes to making real-world progress.

The good news is that even when the mercury climbs, heat illness, injury, and death are preventable. The bad news is that over the past five months, the Trump administration has dismantled essential preventative capabilities.

The Federation of American Scientists supports H.Res. 446, which would recognize July 3rd through July 10th as “National Extreme Heat Awareness Week”.