“Going Back to Cali” for AI Governance Lessons as States Take the Lead on AI Implementation

Imagine you are a state-level technology leader. Recent advancements in artificial intelligence promise to make approving small business licenses faster, or improve K-12 student learning, or even standardize compliance between agencies. All of which promise to improve the experience of your state’s constituents. Eager to deploy this new technology responsibly, you look to peers in other states for guidance. Their answers vary wildly, and in the absence of federal guidance, it quickly becomes clear that there is no standardized playbook. You must chart the path forward on your own, with far more limited resources.

This scenario is becoming increasingly common as AI systems are moving rapidly into consumer-facing services. Without federal action on AI, state government leaders are increasingly shouldering the responsibility for both protecting consumers from potential algorithmic harms and also supporting responsible innovation to improve service delivery to their constituents. States have structural advantages that position them to experiment with regulatory approaches: shorter legislative cycles that allow for quicker course corrections, authority to pilot programs, and the use of sunset provisions that make it easier to revise or retire early-stage governance models. This often places states as the most agile regulators who can swiftly set up guardrails for rapidly evolving AI technologies that impact their residents.

But this regulatory agility must be matched with the necessary government capacity in order to be a success. The current lack of federal action is forcing states not only to pass new AI laws, but also to take on huge implementation challenges, without the AI expertise typically found in federal agencies or major private employers. Building this capacity within state governments will demand resources and technical expertise that most states are only just starting to chart . Without deliberate investment in transparency and talent, even the most well-crafted legislation might not achieve their intended goals. As State legislative cycles start back up for the 2026 year, state policymakers should move forward with proposals that increase transparency, accountability, and bring new technical experts directly into government to meet the scale of need in the current moment.

Increased Transparency to Build Public Trust

One of the most immediate ways that state legislatures can move forward with transparency-improving legislation is with the passage and successful implementation of use-case inventories. A use-case inventory is a public-facing publication of algorithmic tools and their specific uses. They disclose when and where state governments are utilizing algorithmic tools in consumer-facing transactions such as applications for social programs and public assistance benefits. They are typically conducted by governments as a mechanism for transparency and to facilitate third-party auditing of outcomes.

The benefits of public-facing AI use-case inventories are far reaching: they increase government transparency into automated decision-making outcomes, can provide valuable insights to private-sector product vendors, facilitate third-party auditing and bias-testing, and can even increase interagency sharing of best practices when AI tools are effectively used. They are particularly important in high-risk decisions such as those related to government benefits and services. Alternatively, a lack of transparency in expensive acquisitions from private and third party vendors can mean that an agency or entity is unaware of what tools they have acquired and whether or not they are safe to deploy in consumer-facing settings without bias or other inaccuracies.

When increasing numbers of Americans are growing skeptical of the practical uses of AI tools, it is doubly important to design public systems that encourage transparency when algorithmic tools are deployed in the public and private sectors alike.

Despite a lack of federal legislation regulating responsible AI usage, one area where the federal government has led is in the production of regular AI use-case inventories since 2021. First requested via Executive Order 13960 in 2020 during the first Trump administration, and implemented in the Summer of 2021, the federal government provides a relatively transparent accounting of where AI is adopted within the federal enterprise. This policy has had bipartisan appeal, and the Biden administration continued the production of regularly updated inventories for the public. The Trump administration with its recently updated inventory now has the opportunity to use this tool to deliver increased public trust in AI, a clear administration priority.

Case Study: Implementation Challenges in California

While the federal experience demonstrates that AI use-case inventories can work, it also reveals an important limitation: transparency mechanisms rely on technical talent and focused implementation to be successful. California offers a cautionary example. In 2023, the state legislature passed Assembly Bill 302 requesting the State Department of Technology to “conduct a comprehensive inventory of all high-risk automated decision systems [ADS] being used by state agencies and submit a report to the Legislature by January 1, 2025, and annually thereafter.” Importantly, the bill covered systems that are “used to assist or replace human discretionary decisionmaking.” The bill was envisioned as a critical first step in gaining insight into the ways AI was being deployed in consumer-facing interactions by state government agencies. It was also in reaction to public reporting of biased technology being used on those applying for public services and benefits.

However, the initial implementation deadline for the bill passed in early 2025 and the only report provided to the public was a single document stating that there are “no high-risk ADS [tools] being used by State agencies”—a fact that is easily disputed by a simple Google search. For example, the state healthcare exchange uses automated document processing tools to gauge eligibility for affordable health insurance policies, the state unemployment insurance program uses an algorithmic tool developed by a private company to rate applicants on the likelihood of their application being fraudulent, and the state Department of Finance even plans to use generative AI tools as part of fiscal analysis and state budgeting work. These are significant decisions that can have real repercussions for California residents. Rather than creating a transparent use-case inventory that can tell Californians where AI is being used in consumer-facing interactions, we instead have a letter which incorrectly states —based on examples above—that there are no algorithmic tools being used. The table below has additional examples of publicly disclosed automated decision-making system use cases in California state government.

Results like this underscore the urgent need to embed technical talent within state governments to ensure that laws are implemented as designed. When implementing its use case inventories, the federal government provided guidance to reporting agencies and publicly released a final inventory for a majority of agencies. Even with substantial support during the federal government’s collection process, there were still notable implementation challenges faced when creating a federal use-case inventory. Most notably, many agencies initially failed to disclose all use-cases, and a promised template for agencies to use has yet to come to fruition. The State of California, by contrast, instead relied on an ad hoc process, polling state agency officials through two successive emails to conduct its inventory evaluation.

Scaling Government Talent to Bridge the Technical Capacity Gap

California’s experience implementing a use-case inventory is, unfortunately, not unique. Across the country, well-intentioned legislation is often passed into law only to falter during implementation. Once enacted, agency staff are tasked with operationalizing complex policies, often without the necessary technical expertise, staffing capacity, or financial resources to succeed. Without deliberate investment in these areas, the responsibility of properly regulating emerging technologies and protecting consumers from harm is shifted to government employees that are poorly equipped to handle the growing scope and technical complexity of their workloads. That is why, in addition to transparency, states need to find ways to quickly bring in technical talent and expertise in digital technologies to drive forward effective implementation of the coming onslaught of bills.

In the midst of massive layoffs within the federal government and private sector, individual states now have access to historic levels of human capital and can bring forward some of the innovations developed within the federal government in recent years. Methods like skills-based hiring to rapidly bring in technical talent and scale new teams within government have also been developed and thoroughly tested in recent years through entities like the United States Digital Service (USDS) and the Consumer Financial Protection Bureau’s in-house technologists. These initiatives brought skilled workers into government at less than half the recruiting cost of private sector hiring and saved hundreds of millions of dollars through reimbursable agreements with agencies in lieu of costly private sector consultancy contracts.

During periods of financial uncertainty it can be deeply challenging for state leaders to make the investments necessary to hire additional staff and build robust government teams. One other method to bridge the gap between policymakers and those who implement it is through the development of modernized policy fellowships that utilize endowments or other private funds to bring cutting-edge researchers and experts directly into government. California has most recently unveiled a revamped science and technology fellowship that will place additional AI experts within state agencies or the legislature to propel forward-thinking and informed policymaking.

Conclusion

With no federal framework in place, state governments will be the primary drivers of accountability and transparency needed to ensure AI serves the public rather than erodes democratic norms. This presents us with a crucial window for state policymakers to establish both processes that further transparency and robust talent pipelines that can manage responsible deployment in order to restore public trust and prevent harms before AI systems become further entrenched in critical public services. States that build transparent AI use-case inventories and invest in technical expertise will be best positioned to translate lofty regulatory principles into real protections for their citizens—while also fostering a fairer, more trustworthy environment for innovation to thrive.

Tax Filing as Easy as Mobile Banking: Creating Product-Driven Government

Americans trade stocks instantly, but spend 13 hours on tax forms. They send cash by text, but wait weeks for IRS responses. The nation’s revenue collector ranks dead last in citizen satisfaction. The problem isn’t just paperwork — it’s how the government builds.

The fix: build for users, not compliance. Ship daily, not yearly. Cultivate talent, don’t rent it. Apple doesn’t outsource the creation of its products; the IRS shouldn’t outsource taxpayer experience. Why?

The goal: make taxes as easy as mobile banking.

The IRS, backed by a Congress and an administration that truly wants real improvements and efficiencies, must invest in building its tax products in house. Start with establishing a Chief Digital Officer (CDO) at the IRS directly reporting to the Commissioner. This CDO must have the authority to oversee digital and business transformation across the organization. This requires hiring hundreds of senior engineers, product managers, and designers—all deeply embedded with IRS accountants, lawyers, and customer service agents to rebuild taxpayer services. This represents true government efficiency: redirecting contractor spending to fund internal teams that build what American taxpayers should own rather than rent.

This is about more than broken technology. This is a roadmap for building modern, user-centric government organizations. The IRS touches every American, making it the perfect lab for proving the government can work.

Transform the IRS first, then apply these principles across every agency where citizens expect digital experiences that actually work.

Challenge & Opportunity

It’s April 15th. For the first time, you’re not fretting.

You finished filing your taxes on a free app. It took 15 minutes. Your income? Already there. Your credits? Pre-calculated and ready to claim. Your refund? Hitting your bank account tomorrow.

For millions around the world, swift, painless tax filing isn’t a dream. It’s the norm. It should be for Americans, too.

But in the U.S., the IRS experience is still slow, opaque, process-heavy, and frustrating. Tax filing is one of the few universal interactions Americans have with their government—and it’s not one that earns much trust.

It doesn’t have to be this way. We were on the path to delivering that with IRS Direct File and needed to recommit. To deliver wildly easier taxes for Americans, we can, and must, build an IRS that meets high modern expectations: fast, transparent, digital-first, and relentlessly taxpayer-focused.

The Diagnosis

Each year, the IRS collects more than 96% of the revenue that funds the federal government—$5.1 trillion supporting everything from Social Security, defense, infrastructure, veterans’ services, and investing in America’s future.

The quote from Justice Oliver Wendell Holmes, carved into the limestone face of the IRS headquarters in D.C., captures the spirit well:

“Taxes are what we pay for civilized society.”

It is not only essential to the functioning of government—it is also a major way most Americans interact with it. And that experience? Frustrating, costly, and confusing. According to a recent Pew survey, Americans rate the IRS less favorably than any other federal agency. The average taxpayer spends 13 hours and $270 out of pocket just to file their return.

The core problem: The IRS needs to be user-focused.

Despite the stakes, the IRS operates far behind what Americans expect. We live in a world where people can tap to pay, split bills by text, or trade stocks in slick apps. But that world does not include the IRS.

A staggering 63% of the 10.4 billion hours Americans spend dealing with the federal government are consumed by IRS paperwork. But much of the source of that pain isn’t the IRS, but Congress with the crushing complexity of decades long tax code changes, sedimented on top of each other. This year was no different. The “One Big Beautiful Bill” runs 331 pages, with large swaths devoted to new, intricate tax changes.

Dealing with the IRS still often involves paper forms, long phone waits, chasing down documents, and confusing processes.

If you’ve dealt with the IRS for anything beyond filing, it feels impossible to get a task finished. Will someone pick up the phone? Can I get an answer to my questions and resolve my situation? Would I expect the same answer if I talked to someone else? Last year the IRS answered just 49% of the 100 million calls it received, including automated answering.

This underperformance is beyond outdated technology—it’s structural and institutional. The IRS’s core systems are brittle and fragmented. Ancient procurement rules and funding constraints have made sustained modernization nearly impossible. Siloed organizations sit within siloes. In place of long-term investment, the agency leans heavily on short-term contractor fixes, band-aids applied to legacy wounds.

This complexity has stymied scaled change.

The root cause: The IRS has never treated world-class technology and product development as mission-critical capabilities core to its identity, to be hired, owned, and continually improved by internal teams focused on user outcomes.

A modern service agency builds end-to-end experiences for users—from pre-populating data through to filing and refunds. Empowered teams building these features have a holistic viewpoint and control over their service to ensure taxpayers are able to repeatedly and reliably complete their task.

Today’s reality is different: federal agencies like the IRS treat technical and product expertise as afterthoughts—all nice-to-haves that serve bureaucratic processes rather than core capabilities essential to their mission. Strategy and execution get outsourced by default. This creates a growing divide between “business” and “IT” teams, each lacking a deep understanding of the other’s work, despite both being critical to delivering services that actually function for taxpayers.

This outsourcing has hollowed out the agency’s internal technical capacity. Rather than building technical competency in-house, and paying that talent a salary approaching private companies, the IRS grows more dependent on vendors. It no longer knows what it needs technically, what questions to ask or which paths to pursue. Instead they must trust the vendors–companies financially incentivised towards ballooning scopes, lock-in, and complexity.

The result: a siloed experience that mirrors a siloed organization, one that is risk-averse, paper-heavy IRS, too slow to meet modern expectations.

The agency approaches service delivery as a compliance and bureaucratic process to digitize, rather than a product to design. “Never ship your org-chart” is a common refrain you’ll hear at tech companies, to explain how products tend to take on the communication style of their builders. Yet IRS product faultlines visibly follow its org structure and thus fail to deliver a holistic experience.

There were bright spots. Direct File showed what’s possible when empowered teams build for users. A dead simple idea: let Americans file taxes directly on the IRS site was a reality. It worked. It was well regarded. In surveys, users beamed about Direct File: 9 out of 10 gave it an “excellent” or “above average” rating, 74% said they preferred it over what they used before, and 86% said it increased their trust in the IRS.

The government actually delivered for its citizens, and they felt it.

But it didn’t last. The project was abruptly dismantled due to political ideology, not taxpayer experience or feedback.

Many of the people with the technical skills and vision to modernize the IRS have left, often without a choice. The agency will likely slide further backward—into deeper dependence on systems built by the lowest bidder or those currying political favor, with poorer service and diminished public trust in return.

We’ve seen this up close.

Both of us worked at The White House’s technology arm; the U.S. Digital Service. One of us helped lead Direct File into existence and built the Consumer Financial Protection Bureau’s digital team. The other previously led Google’s first large language model products and prototyped AI tools at the IRS to streamline internal knowledge work.

In our work at the IRS, we witnessed how far the agency must go. Inside the IRS Commissioner’s office, with leaders across the agency, we built a collaborative digital strategic plan. This memo details those proposals since left by the wayside after seven different IRS commissioners rotated in the seat, just this year.

The IRS needs more than modernization. It will need a systemic rebuild from:

- compliance, to user-centered design and product thinking

- vendor dependence to empowered internal product teams

- once-a-year panic to real-time, year-round services

- fragile mainframes to composable platforms and APIs

- waterfall contracting to iterative, continuous delivery

We’re sharing these recommendations for a future Day One—when there’s a refocus on rebuilding the government. When that day comes, the blueprint will be here: drawn from inside experience, built on hard lessons, and focused on what it will take to deliver a digital IRS that truly works for the American people.

What we need is the mandate to build a tax system that makes Americans think: “That was it? That was easy.”

Plan of Action

The IRS must rebuild taxpayer services around citizen needs rather than compliance and bureaucratic processes. This requires in-housing the talent to strategically build it. We propose establishing a Chief Digital Officer directly reporting to the Commissioner, with the authority to oversee digital and business transformation across the organization, hire hundreds of senior engineers, product managers, and designers. The goal, a team empowered to deliver a tax-filling product experience that meets modern expectations.

The Products

Build for Users, Not Internal Compliance

We’ve become accustomed to a user-focused fit-and-finish in the app era. Let’s deliver that same level for taxpayers.

It all starts around building a digital platform that empowers taxpayers, businesses, and preparers with the information, tools and services to handle taxes accurately and confidently. A fully-featured online account becomes the one-stop, self-service hub for all tasks. Taxpayers access their complete tax profile, updated in real-time, with current data across income sources, financial institutions, and full tax history. The system proactively recommends tax breaks, credits, and withholding adjustments they’re eligible for.

Critically, this can’t be built in a vacuum. It requires rapid iteration with users as part of a constant feedback loop. This digital platform runs on robust APIs that power internal tools, IRS public sites, and third-party software. Building this way ensures alignment across IRS teams, eliminates duplicate efforts, and lifts the entire tax software ecosystem.

This is what we need to build for Americans:

Online tax filing: From annual panic to year-round readiness

Reboot Direct File. Stop forcing everything into tax season. Let taxpayers update information year-round—add a child, change addresses, adjust withholdings, upload documents. When April arrives, their return is already 90% complete.

This is a natural evolution of Direct File and the existing non-editable online account dashboard into a living, breathing system taxpayers optimize throughout the year. And not just for individuals—this should be extended to businesses—reducing this burden for as many filer types as possible.

Pre-populated returns: Stop making people provide what the IRS already knows

The IRS already has W-2s, 1099s, and financial data. Use it. Pre-populate returns to cut filing time from hours to minutes. Deliver secure APIs so any tax software can access IRS data (with taxpayer permission), and use machine learning to flag issues including fraud before submission. This increases accuracy, reduces errors, and spurs competition by making it easy to switch between tax-filing programs.

Income verification as a service: Turn tax data into financial opportunity

The IRS sits on verified income data that could help Americans access government services, credit, mortgages, and benefits like student aid. Instead of weeks-long transcript requests, offer instant verification through secure APIs. This creates a government-backed source alongside credit bureaus, increases financial access, and reduces paperwork across all government services.

Tax calculator as a platform: One source of truth

Every tax software company recreates the same calculations, each slightly different. Across the organization, the IRS itself uses multiple third-party tax calculators in audits. This should be a core, integral service the IRS offers—build a definitive tax calculator as an API, the single source of truth that internal audits and checks use, and external software can access or run on their own. Make it transparent, auditable, and open source. Put up cash “bounties” to encourage the public to find bugs and errors and invite taxation-critics to review the code. Use generative AI to aid IRS accountants, lawyers and engineers translate tax law changes into code–speeding the roll out of Congressional tax changes.

When everyone calculates taxes the same way the IRS does, errors vanish. When everyone can see how the IRS does it, trust grows.

Modern MeF: From submission pipe to intelligent platform

Today’s Modernized e-File (MeF) is barely modern—it’s a dumb pipe that accepts tax returns and hopes for the best. Transform it into intelligent infrastructure that validates in real-time, catches errors immediately (not weeks later in confusing notices), and stops fraud before refunds are deposited. Build it like a real API, not XML dumps. Enable multi-part submissions so taxpayers can fix mistakes without starting over. This isn’t just a technical upgrade—it’s the foundation that makes every other improvement possible.

The Process

Ship Daily, Not Yearly

Taxpayer-first product development

The IRS is the single largest interaction point between Americans and their government. Every improvement saves millions of hours and builds trust. This requires abandoning bureaucratic processes for product thinking.

Build with taxpayers from day one through constant user testing and feedback loops. Organize around taxpayer journeys—”I need to update my withholdings” or “I’m checking my refund”—not org charts.

Measure what matters: time-to-file, satisfaction scores, error rates, not only compliance metrics. Internal Objectives and Key Results planning makes priorities clear and syncs the organization towards focused goals. Publish Service Level Objectives on external products to ensure we target creating systems that others can confidently rely and build on.

Give full-stack product teams the authority to make integrated technical, design, policy and legal decisions together. Staff these teams with internal technologists embedded alongside accountants and lawyers in functional organizations, building IRS competency while reducing contractor dependence. Today’s IRS is highly siloed across functions with authority so fragmented it’s unclear who “owns” what. Yet go to any top tech organization and you’ll see what we’re pushing for: aligned and cross-functional teams whose job is delivering with clear ownership. Inherently we’re pushing for more than a new team, we’re factoring out unclear ownership in general away from IT and Business Divisions.

When teams own outcomes, we can better ensure taxpayer experience transforms from painful to painless.

API-first architecture

The IRS is fundamentally a data organization, yet information flows through siloed systems that can’t talk to each other. Amazon solved this with a simple mandate: all teams must expose their data and communicate through APIs. (This mindset set in motion the seeds of Amazon Web Services, the company’s most profitable division).

The IRS needs the same revolution.

Every team exposes data and functionality through standardized REST APIs—no direct database access, no per-department clones of the data, no exceptions. Design every API to be externalizable (with strong access controls) from day one, unlocking government APIs to become platforms for innovation. When systems communicate through versioned APIs instead of tangled dependencies, teams can ship improvements daily without compromising everything else. This isn’t just technical architecture—it’s how modern organizations move fast without breaking things.

The People

Cultivate it, Don’t Outsource It; Build a Delivery Culture

A digital IRS that delivers for Americans cannot be built by the lowest bidder. Its core capability isn’t digitized forms–it’s people who can understand taxpayers’ needs, imagine solutions, design thoughtfully, ship them fast, listen to users, and keep improving based on feedback.

Silicon Valley understands this instinctively on two fronts. The fight for great engineers is the fight to build teams that can deliver great products. And two, no leading tech company outsources its own R&D. Delivering well-functioning and beloved products requires tight ownership of the product iteration loop.

Businesses long learned to never outsource a core competency. OpenAI would never outsource the training of its models, Apple its industrial design, Google its search algorithm, or Facebook its social graph. The same should be true for the IRS.

Yet, despite accepting 93% of its tax returns digitally, it still does not consider itself to be a digital-first agency. Building great teams is inseparable from building great taxpayer experiences. For decades, the agency has outsourced its technical mission and vision.

What we witnessed at the IRS was often vendor theater. Consultants transformed routine meetings into sales presentations that should have been dedicated to improving the products. Solutions specialists added layers of proprietary middleware, despite readily available enterprise-grade open source solutions running on commodity servers could easily meet the objectives. All of this unfolded within an organizational culture where securing contracts took precedence over delivering meaningful outcomes. Contracts that, of course, cost multiples more than the price of a competent internal team.

Commodities like cloud infrastructure or off-the-shelf software that serve broad, generic needs should absolutely be acquired externally. But the IRS’s critical, taxpayer-facing products—the systems at the heart of filing, payments, and taxpayer accounts—must be built and owned internally. There is only one agency that collects taxes for the United States of America.

When everything is handed to vendors, the IRS sends more than money out the door; it loses institutional memory, technical craft, quality systems, and the ability to move quickly. A modern IRS cannot be built on rented skills.

Talent: Build a Permanent Product Core

This transformation starts with the people: build and keep an in-house corps of top-tier technologists—engineers, product managers, designers, user experience researchers—working in small, empowered, cross-functional teams hand in hand with fellow IRS accountants, auditors, customer service representatives and lawyers. Not a handful of digital specialists scattered in a bureaucracy as it was, but several hundred people whose full-time job is delivering and evolving the IRS’s core taxpayer experiences and services.

- Create a dedicated Digital Profession inside the IRS, led by a Chief Digital Officer with the authority to hire, fire, and shape teams and technology stacks.

- Break the straitjacket of outdated civil service rules by creating specialist pay bands to compete for top talent like the CFPB has done.

- Empower cross-functional teams to ship without endless escalation. Start small, test early, iterate quickly, and make product decisions by those close to the work.

Funding: Invest in Teams, Not Projects

Current funding locks the IRS into one-off projects that end when the money runs out, leaving no path for iteration. A product-centered IRS needs enduring funding for enduring teams. Long-lived services, not short-lived milestones. This should be no surprise for a tax organization. There are two certainties in life; death and taxes. We should properly set ourselves up to manage the latter.

- Fund continuous development rather than one-and-done “delivery.”

- Tie funding to taxpayer outcomes like faster filing, fewer errors, higher satisfaction, instead of compliance checklists.

- Secure multi-year budgets for core product teams so they can improve services year-round, not scramble for appropriations each cycle.

This shift will reduce long-term capital costs and ensure that every dollar invested keeps improving the taxpayer experience.

Quality & Standards: Build Once, Build Right

Owning our products means owning their quality. That requires clear, enforceable service standards, like performance, usability, scalability, and accessibility, that every IRS product must meet.

- Establish service performance benchmarks and hold teams accountable to them. These should be highly taxpayer centric; time to file, support response time, ease of use.

- Create communities of practice inside the organization to share patterns, tooling, and lessons learned across the agency.

- Apply spend controls that tie contract renewals to measurable outcomes and prevent redundant vendor builds.

Culture Eats Strategy: Time to Invest in a Delivery Culture

“Culture eats strategy for breakfast,” as Peter Drucker famously said. Yet government agencies too often treat culture-building as off-limits or irrelevant. This is backwards. Creating a shared, collaborative culture centered on delivery isn’t just important; it’s the foundation that makes everything else possible. The hardest and most critical step is investing in people. Give employees space to collaborate meaningfully, contribute their expertise, and take ownership of outcomes. Leadership must empower teams with real authority, establish clear performance standards, and hold everyone accountable for meeting—or exceeding—those benchmarks. Without this cultural shift, even the best strategy becomes just another plan gathering dust.

When every product meets the same high standard, trust in the IRS will grow—because taxpayers will feel it in every interaction.

A template for all agencies

The IRS touches more Americans than any other federal agency–making it the perfect proof point that the government can deliver digital products that work seamlessly. The principles–build for users, not compliance, shipping daily, not yearly, and keeping the talent in house is not unique to the IRS.

We believe these goals and strategies apply to nearly every agency and level of government. Imagine Social Security retirement planning tools that lead to easy withholding adjustments, a Medicare/Medicaid that is easy to enroll in, or a FEMA with easy to file disaster relief disbursement.

Transform the IRS this towards this path, and then use these lessons to reset and lift up expectations between Americans and their government. One so easy citizens say: “That was it? That was easy.”

Federal Climate Policy Is Being Gutted. What Does That Say About How Well It Was Working?

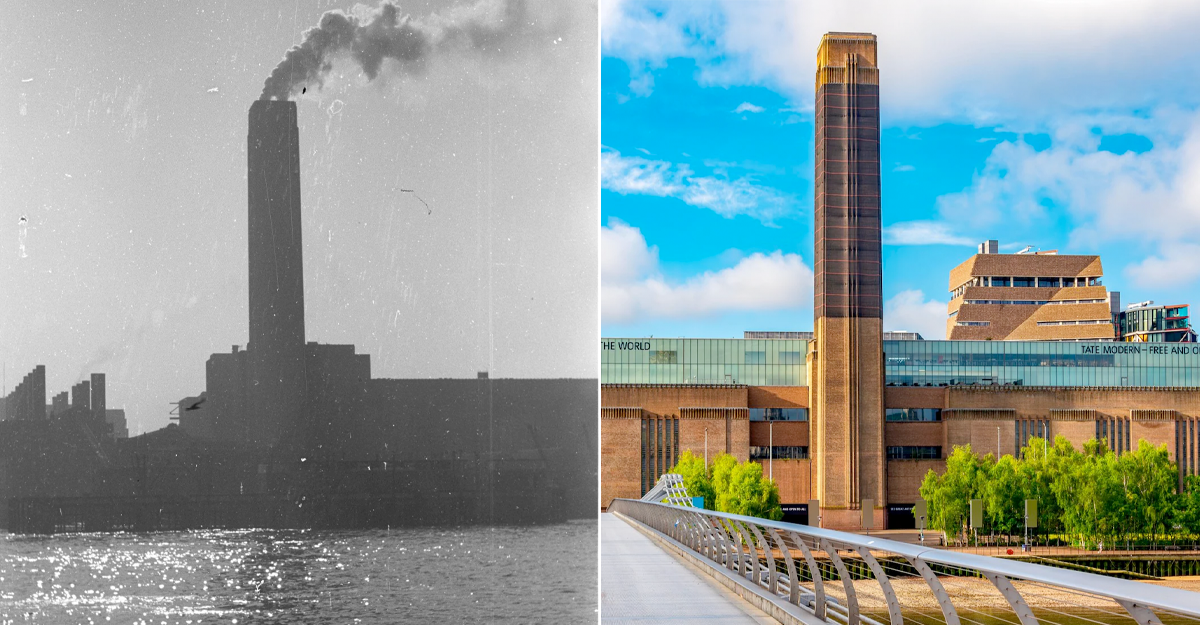

On the left is the Bankside Power Station in 1953. That vast relic of the fossil era once towered over London, oily smoke pouring from its towering chimney. These days, Bankside looks like the right:

The old power plant’s vast turbine hall is now at the heart of the airy Tate Modern Art Museum; sculptures rest where the boilers once churned.

Bankside’s evolution into the Tate illustrates that transformations, both literal and figurative, are possible for our energy and economic systems. Some degree of demolition – if paired with a plan – can open up space for something innovative and durable.

Today, the entire energy sector is undergoing a massive transformation. After years of flat energy demand served by aging fossil power plants, solar energy and battery storage are increasingly dominating energy additions to meet rising load. Global investment in clean energy will be twice as big as investment in fossil fuels this year. But in the United States, the energy sector is also undergoing substantial regulatory demolition, courtesy of a wave of executive and Congressional attacks and sweeping potential cuts to tax credits for clean energy.

What’s missing is a compelling plan for the future. The plan certainly shouldn’t be to cede leadership on modern energy technologies to China, as President Trump seems to be suggesting; that approach is geopolitically unwise and, frankly, economically idiotic. But neither should the plan be to just re-erect the systems that are being torn down. Those systems, in many ways, weren’t working. We need a new plan – a new paradigm – for the next era of climate and clean energy progress in the United States.

Asking Good Questions About Climate Policy Designs

How do we turn demolition into a superior remodel? First, we have to agree on what we’re trying to build. Let’s start with what should be three unobjectionable principles.

Principle 1. Climate change is a problem worth fixing – fast. Climate change is staggeringly expensive. Climate change also wrecks entire cities, takes lives, and generally makes people more miserable. Climate change, in short, is a problem we must fix. Ignoring and defunding climate science is not going to make it go away.

Principle 2. What we do should work. Tackling the climate crisis isn’t just about cleaning up smokestacks or sewer outflows; it’s about shifting a national economic system and physical infrastructure that has been rooted in fossil fuels for more than a century. Our responses must reflect this reality. To the extent possible, we will be much better served by developing fit-for-purpose solutions rather than just press-ganging old institutions, statutes, and technologies into climate service.

Principle 3. What we do should last. The half-life of many climate strategies in the United States has been woefully short. The Clean Power Plan, much touted by President Obama, never went into force. The Trump administration has now turned off California’s clean vehicle programs multiple times. Much of this hyperpolarized back-and-forth is driven by a combination of far-right opposition to regulation as a matter of principle and the fossil fuel industry pushing mass de-regulation for self-enrichment – a frustrating reality, but one that can only be altered by new strategies that are potent enough to displace vocal political constituencies and entrenched legacy corporate interests.

With these principles in mind, the path forward becomes clearer. We can agree that ambitious climate policy is necessary; protecting Americans from climate threats and destabilization (Principle 1) directly aligns with the founding Constitutional objectives of ensuring domestic tranquility, providing for the common defense, and promoting general welfare. We can also agree that the problem in front of us is figuring out which tools we need, not how to retain the tools we had, regardless of their demonstrated efficacy (Principle 2). And we can recognize that achieving progress in the long run requires solutions that are both politically and economically durable (Principle 3).

Below, we consider how these principles might guide our responses to this summer’s crop of regulatory reversals and proposed shifts in federal investment.

Honing Regulatory Approaches

The Trump Administration recently announced that it plans to dismantle the “endangerment finding” – the legal predicate for the Environmental Protection Agency (EPA) to regulate greenhouse gas emissions from power plants and transportation; meanwhile, the Senate revoked permission for California to enforce key car and truck emission standards. It has also proposed to roll back key power plant toxic and greenhouse gas standards. We agree with those who think that these actions are scientifically baseless and likely illegal, and therefore support efforts to counter them. But we should also reckon honestly with how the regulatory tools we are defending have played out so far.

Federal and state pollution rules have indisputably been a giant public-health victory. EPA standards under the Clean Air Act led directly to dramatic reductions in harmful particulate matter and other air pollutants, saving hundreds of thousands of lives and avoiding millions of cases of asthma and other respiratory diseases. Federal regulations similarly caused mercury pollution from coal-fired power plants to drop by 90% in just over a decade. Pending federal rollbacks of mercury rules thus warrant vocal opposition. In the transportation sector, tailpipe emissions standards for traditional combustion vehicles have been impressively effective. These and other rules have indeed delivered some climate benefits by forcing the fossil fuel industry to face pollution clean-up costs and driving development of clean technologies.

But if our primary goal is motivating a broad energy transition (i.e., what needs to happen per Principle 1), then we should think beyond pollution rules as our only tools – and allocate resources beyond immediate defensive fights. Why? The first reason is that, as we have previously written, these rules are poorly equipped to drive that transition. Federal and state environmental agencies can do many things well, but running national economic strategy and industrial policy primarily through pollution statutes is hardly the obvious choice (Principle 2).

Consider the power sector. The most promising path to decarbonize the grid is actually speeding up replacement of old coal and gas plants with renewables by easing unduly complex interconnection processes that would speed adding clean energy to address rising demand, and allow the old plants to retire and be replaced – not bolting pollution-control devices on ancient smokestacks. That’s an economic and grid policy puzzle, not a pollution regulatory challenge, at heart. Most new power plants are renewable- or battery-powered anyway. Some new gas plants might be built in response to growing demand, but the gas turbine pipeline is backed up, limiting the scope of new fossil power, and cheaper clean power is coming online much more quickly wherever grid regulators have their act together. Certainly regulations could help accelerate this shift, but the evidence suggests that they may be complementary, not primary, tools.

The upshot is that economics and subnational policies, not federal greenhouse gas regulation, have largely driven power plant decarbonization to date and therefore warrant our central focus. Indeed, states that have made adding renewable infrastructure easy, like Texas, have often been ahead of states, like California, where regulatory targets are stronger but infrastructure is harder to build. (It’s also worth noting that these same economics mean that the Trump Administration’s efforts to revert back to a wholly fossil fuel economy by repealing federal pollution standards will largely fail – again, wrong tool to substantially change energy trajectories.)

The second reason is that applying pollution rules to climate challenges has hardly been a lasting strategy (Principle 3). Despite nearly two decades of trying, no regulations for carbon emissions from existing power plants have ever been implemented. It turns out to be very hard, especially with the rise of conservative judiciaries, to write legal regulations for power plants under the Clean Air Act that both stand up in Court and actually yield substantial emissions reductions.

In transportation, pioneering electric vehicle (EV) standards from California – helped along by top-down economic leverage applied by the Obama administration – did indeed begin a significant shift and start winning market share for new electric car and truck companies; under the Biden administration, California doubled down with a new set of standards intended to ultimately phase out all sales of gas-powered cars while the EPA issued tailpipe emissions standards that put the industry on course to achieve at least 50% EV sales by 2030. But California’s EV standards have now been rolled back by the Trump administration and a GOP-controlled Congress multiple times; the same is true for the EPA rules. Lest we think that the Republican party is the sole obstacle to a climate-focused regulatory regime that lasts in the auto sector, it is worth noting that Democratic states led the way on rollbacks. Maryland, Massachusetts, Oregon, and Vermont all paused, delayed, or otherwise fuzzed up their plans to deploy some of their EV rules before Congress acted against California. The upshot is that environmental standards, on their own, cannot politically sustain an economic transition at this scale without significant complementary policies.

Now, we certainly shouldn’t abandon pollution rules – they deliver massive health and environmental benefits, while forcing the market to more accurately account for the costs of polluting technologies, But environmental statutes built primarily to reduce smokestack and tailpipe emissions remain important but are simply not designed to be the primary driver of wholesale economic and industrial change. Unsurprisingly, efforts to make them do that anyway have not gone particularly well – so much so that, today, greenhouse gas pollution standards for most economic sectors either do not exist, or have run into implementation barriers. These observations should guide us to double down on the policies that improve the economics of clean energy and clean technology — from financial incentives to reforms that make it easier to build — while developing new regulatory frameworks that avoid the pitfalls of the existing Clean Air Act playbook. For example, we might learn from state regulations like clean electricity standards that have driven deployment and largely withstood political swings.

To mildly belabor the point – pollution standards form part of the scaffolding needed to make climate progress, but they don’t look like the load-bearing center of it.

Refocusing Industrial Policy

Our plan for the future demands fresh thinking on industrial policy as well as regulatory design. Years ago, Nobel laureate Dr. Elinor Ostrom pointed out that economic systems shift not as a result of centralized fiat, from the White House or elsewhere, but from a “polycentric” set of decisions rippling out from every level of government and firm. That proposition has been amply borne out in the clean energy space by waves of technology innovation, often anchored by state and local procurement, regional technology clusters, and pioneering financial institutions like green banks.

The Biden Administration responded to these emerging understandings with the CHIPS and Science Act, Bipartisan Infrastructure Law (BIL), and Inflation Reduction Act (IRA) – a package of legislation intended to shore up U.S. leadership in clean technology through investments that cut across sectors and geographies. These bills included many provisions and programs with top-down designs, but the package as a whole but did engage with, and encourage, polycentric and deep change.

Here again, taking a serious look at how this package played out can help us understand what industrial policies are most likely to work (Principle 2) and to last (Principle 3) moving forward.

We might begin by asking which domestic clean-technology industries need long-term support and which do not in light of (i) the multi-layered and polycentric structure of our economy, and (ii) the state of play in individual economic sectors and firms at the subnational level. IRA revisions that appropriately phase down support for mature technologies in a given sector or region where deployment is sufficient to cut emissions at an adequate pace could be worth exploring in this light – but only if market-distorting supports for fossil-fuel incumbents are also removed. We appreciate thoughtful reform proposals that have been put forward by those on the left and right.

More directly: If the United States wants to phase down, say, clean power tax credits, such changes should properly be phased with removals of support for fossil power plants and interconnection barriers, shifting the entire energy market towards a fair competition to meet increasing load, as well as new durable regulatory structures that ensure a transition to a low-carbon economy at a sufficient pace. Subsidies and other incentives could appropriately be retained for technologies (e.g., advanced battery storage and nuclear) that are still in relatively early stages and/or for which there is a particularly compelling argument for strengthening U.S. leadership. One could similarly imagine a gradual shift away from EV tax credits – if other transportation system spending was also reallocated to properly balance support among highways, EV charging stations, transit, and other types of transportation infrastructure. In short, economic tools have tremendous power to drive climate progress, but must be paired with the systemic reforms needed to ensure that clean energy technologies have a fair pathway to achieving long-term economic durability.

Our analysis can also touch on geopolitical strategy. It is true that U.S. competitors are ahead in many clean technology fields; it is simultaneously true that the United States has a massive industrial and research base that can pivot ably with support. A pure on-shoring approach is likely to be unwise – and we have just seen courts enjoin the administration’s fiat tariff policy that sought that result. That’s a good opportunity to have a more thoughtful conversation (in which many are already engaging) on areas where tariffs, public subsidies, and other on-shoring planning can actually position our nation for long-term economic competition on clean technology. Opportunities that rise to the top include advanced manufacturing, such as for batteries, and critical industries, like the auto sector. There is also a surprising but potent national security imperative to center clean energy infrastructure in U.S. industrial policy, given the growing threat of foreign cyberattacks that are exploiting “seams” in fragile legacy energy systems.

Finally, our analysis suggests that states, which are primarily responsible for economic policy in their jurisdictions, have a role to play in this polycentric strategy that extends beyond simply replicating repealed federal regulations. States have a real opportunity in this moment to wed regulatory initiatives with creative whole-of-the-economy approaches that can actually deliver change and clean economic diversification, positioning them well to outlast this period of churn and prosper in a global clean energy transition.

A successful and “sticky” modern industrial policy must weave together all of the above considerations – it must be intentionally engineered to achieve economic and political durability through polycentric change, rather than relying solely or predominantly on large public subsidies.

Conclusion

The Trump Administration has moved with alarming speed to demolish programs, regulations, and institutions that were intended to make our communities and planet more liveable. Such wholesale demolition is unwarranted, unwise, and should not proceed unchecked. At the same time, it is, as ever, crucial to plan for the future. There is broad agreement that achieving an effective, equitable, and ethical energy transition requires us to do something different. Yet there are few transpartisan efforts to boldly reimagine regulatory and economic paradigms. Of course, we are not naive: political gridlock, entrenched special interests, and institutional inertia are formidable obstacles to overcome. But there is still room, and need, to try – and effort bears better fruit when aimed at the right problems. We can begin by seriously debating which past approaches work, which need to be improved, which ultimately need imaginative recasting to succeed in our ever-more complex world. Answers may be unexpected. After all, who would have thought that the ultimate best future of the vast oil-fired power station south of the Thames with which we began this essay would, a few decades later, be a serene and silent hall full of light and reflection?

Building an Environmental Regulatory System that Delivers for America

The Clean Air Act. The Clean Water Act. The National Environmental Policy Act. These and most of our nation’s other foundational environmental laws were passed decades ago – and they have started to show their age. The Clean Air Act, for instance, was written to cut air pollution, not to drive the whole-of-economy response that the climate crisis now warrants. The Energy Policy and Conservation Act of 1975 was designed to make cars more efficient in a pre-electric vehicle era, and now puts the Department of Transportation in the awkward position of setting fuel economy standards in an era when more and more cars don’t burn gas.

Trying to manage today’s problems with yesterday’s laws results in government by kludge. Legacy regulatory architecture has foundered under a patchwork of legislative amendments and administrative procedures designed to bridge the gap between past needs and present realities. Meanwhile, Congressional dysfunction has made purpose-built updates exceptionally difficult to land. The Inflation Reduction Act, for example, was mostly designed to move money rather than rethink foundational statutes or regulatory processes – because those rethinks couldn’t make it past the filibuster.

As the efficacy of environmental laws has waned, so has their durability. What was once a broadly shared goal – protecting Americans from environmental harm – is now a political football, with rules that whipsaw back and forth depending on who’s in charge.

The second Trump Administration launched the biggest environmental deregulatory campaign in history against this backdrop. But that campaign, coupled with massive reductions in the federal civil service and a suite of landmark court decisions (including Loper Bright) about how federal agencies regulate, risks pushing U.S. regulatory architecture past the point of sensible and much-needed reform and into a state of complete disrepair.

Dismantling old systems has proven surprisingly easy. Building what comes next will be harder. And the work must begin now.

It is time to articulate a long-term vision for a government that can actually deliver in an ever-more complex society. The Federation of American Scientists (FAS) is meeting this moment by launching an ambitious new project to reimagine the U.S. environmental regulatory state, drawing ideas from across ideological lines.

The Beginning of a New Era

Fear of the risks of systemic change often prevent people from entertaining change in earnest. Think of the years of U.S. squabbles over how or whether to reform permitting and environmental review, while other countries simply raced ahead to build clean energy projects and establish dominance in the new world economy. Systemic stagnation, however, comes with its own consequences.

The Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA) are a case in point when it comes to climate and the environment. Together, these two pieces of legislation represented the largest global investment in the promise of a healthier, more sustainable, and, yes, cheaper future. Unfortunately, as proponents of the “abundance” paradigm and others have observed, rollout was hampered by inefficient processes and outdated laws. Implementing the IRA and the IIJA via old systems, in short, was like trying to funnel an ocean through a garden hose – and as a result, most Americans experienced only a trickle of real-world impact.

Similar barriers are constraining state progress. For example, the way we govern and pay for electricity has not kept pace with a rapidly changing energy landscape – meaning that the United States risks ceding leadership on energy technologies critical to national security, economic competitiveness, and combating climate change.

But we are perhaps now entering a new era. The United States appears to be on the edge of real political realignments, with transpartisan stakes around the core role of government in economic development that do not match up neatly to current coalitions. This realignment presents a crucial opportunity to catalyze a new era of climate, environmental, and democratic progress.

FAS will leverage this opportunity by providing a forum for debate and engagement on different facets of climate and environmental governance, a platform to amplify insights, and the capacity to drive forward solutions. Examples of topics ripe for exploration include:

- Balancing agility and accountability. As observed, regulatory approaches of the past have struggled to address the interconnected, quickly evolving nature of climate and environmental challenges. At the same time, mechanisms for ensuring accountability have been disrupted by an evolving legal landscape and increasingly muscular executive. There is a need to imagine and test new systems designed to move quickly but responsibly on climate and environmental issues.

- Complementing traditional regulation through novel strategies. There is growing interest in using novel financial, contractual, and other strategies as a complement to regulation for driving climate and environmental progress. There is considerable room to go deeper in this space, identifying both the power of these strategies and their limits.

- Rethinking stakeholder engagement. The effectiveness of regulation depends on its ability to serve diverse stakeholder needs while advancing environmental goals. Public comment and other pipelines for engaging stakeholders and integrating external perspectives and expertise into regulations have been disrupted by technologies such as AI, while the relationship between regulated entities and their regulators has become increasingly adversarial. There is a need to examine synergies and tradeoffs between centering stakeholders and centering outcomes in regulatory processes, as well as examine how stakeholder engagement could be improved to better ensure regulations that are informed, feasible, durable, and distributively fair.

In working through topics like these, FAS seeks to lay out a positive vision of regulatory reconstruction that is substantively superior to either haphazard destruction or incremental change. Our vision is nothing less than to usher in a new paradigm of climate and environmental governance: one that secures a livable world while reinforcing democratic stability, through systems that truly deliver for America.

We will center our focus on the federal government given its important role in climate and environmental issues. However, states and localities do a lot of the work of a federated government day-to-day. We recognize that federal cures are unlikely to fully alleviate the symptoms that Americans are experiencing every day, from decaying infrastructure to housing shortages. We are committed to ensuring that solutions are appropriately matched to the root cause of state capacity problems and that federal climate and environmental regulatory regimes are designed to support successful cooperation with local governments and implementation partners.

FAS is no stranger to ambitious endeavors like these. Since our founding in 1945, we have been committed to tackling the major science policy issues that reverberate through American life. This new FAS workstream will be embedded across our Climate and Environment, Clean Energy, and Government Capacity portfolios. We have already begun engaging and activating the diverse community of scholars, experts, and leaders laying the intellectual groundwork to develop compelling answers to urgent questions surrounding the climate regulatory state, against the backdrop of a broader state capacity movement. True to our nonpartisan commitment, we will build this work on a foundation of cross-ideological curiosity and play on the tension points in existing coalitions that strike us all as most productive.

We invite you to join us in conversation and collaboration. If you want to get involved, contact Zoë Brouns (zbrouns@fas.org).

Policy Experiment Stations to Accelerate State and Local Government Innovation

The federal government transfers approximately $1.1 trillion dollars every year to state and local governments. Yet most states and localities are not evaluating whether the programs deploying these funds are increasing community well-being. Similarly, achieving important national goals like increasing clean energy production and transmission often requires not only congressional but also state and local policy reform. Yet many states and localities are not implementing the evidence-based policy reforms necessary to achieve these goals.

State and local government innovation is a problem not only of politics but also of capacity. State and local governments generally lack the technical capacity to conduct rigorous evaluations of the efficacy of their programs, search for reliable evidence about programs evaluated in other contexts, and implement the evidence-based programs with the highest chances of improving outcomes in their jurisdictions. This lack of capacity severely constrains the ability of state and local governments to use federal funds effectively and to adopt more effective ways of delivering important public goods and services. To date, efforts to increase the use of evaluation evidence in federal agencies (including the passage of the Evidence Act) have not meaningfully supported the production and use of evidence by state and local governments.

Despite an emerging awareness of the importance of state and local government innovation capacity, there is a shortage of plausible strategies to build that capacity. In the words of journalist Ezra Klein, we spend “too much time and energy imagining the policies that a capable government could execute and not nearly enough time imagining how to make a government capable of executing them.”

Yet an emerging body of research is revealing that an effective strategy to build government innovation capacity is to partner government agencies with local universities on scientifically rigorous evaluations of the efficacy of their programs, curated syntheses of reliable evaluation evidence from other contexts, and implementation of evidence-based programs with the best chances of success. Leveraging these findings, along with recent evidence of the striking efficacy of the national network of university-based “Agriculture Experiment Stations” established by the Hatch Act of 1887, we propose a national network of university-based “Policy Experiment Stations” or policy innovation labs in each state, supported by continuing federal and state appropriations and tasked with accelerating state and local government innovation.

Challenge

Advocates of abundance have identified “failed public policy” as an increasingly significant barrier to economic growth and community flourishing. Of particular concern are state and local policies and programs, including those powered by federal funds, that do not effectively deliver critically important public goods and services like health, education, safety, clean air and water, and growth-oriented infrastructure.

Part of the challenge is that state and local governments lack capacity to conduct rigorous evaluations of the efficacy of their policies and programs. For example, the American Rescue Plan, the largest one-time federal investment in state and local governments in the last century, provided $350 billion in State and Local Fiscal Recovery Funds to state, territorial, local, and Tribal governments to accelerate post-pandemic economic recovery. Yet very few of those investments are being evaluated for efficacy. In a recent survey of state policymakers, 59% of those surveyed cited “lack of time for rigorous evaluations” as a key obstacle to innovation. State and local governments also typically lack the time, resources, and technical capacity to canvass evaluation evidence from other settings and assess whether a program proven to improve outcomes elsewhere might also improve outcomes locally. Finally, state and local governments often don’t adopt more effective programs even when they have rigorous evidence that these programs are more effective than the status quo, because implementing new programs disrupts existing workflows.

If state and local policymakers don’t know what works and what doesn’t, and/or aren’t able to overcome even relatively minor implementation challenges when they do know what works, they won’t be able to spend federal dollars more effectively, or more generally to deliver critical public goods and services.

Opportunity

A growing body of research on government innovation is documenting factors that reliably increase the likelihood that governments will implement evidence-based policy reform. First, government decision makers are more likely to adopt evidence-based policy reforms when they are grounded in local evidence and/or recommended by local researchers. Boston-based researchers sharing a Boston-based study showing that relaxing density restrictions reduces rents and house prices will do less to convince San Francisco decision makers than either a San Francisco-based study, or San Francisco-based researchers endorsing the evidence from Boston. Proximity matters for government innovation.

Second, government decision makers are more likely to adopt evidence-based policy reforms when they are engaged as partners in the research projects that produce the evidence of efficacy, helping to define the set of feasible policy alternatives and design new policy interventions. Research partnerships matter for government innovation.

Third, evidence-based policies are significantly more likely to be adopted when the policy innovation is part of an existing implementation infrastructure, or when agencies receive dedicated implementation support. This means that moving beyond incremental policy reforms will require that state and local governments receive more technical support in overcoming implementation challenges. Implementation matters for government innovation.

We know that the implementation of evidence-based policy reform produces returns for communities that have been estimated to be on the order of 17:1. Our partners in government have voiced their direct experience of these returns. In Puerto Rico, for example, decision makers in the Department of Education have attributed the success of evidence-based efforts to help students learn to the “constant communication and effective collaboration” with researchers who possessed a “strong understanding of the culture and social behavior of the government and people of Puerto Rico.” Carrie S. Cihak, the evidence and impact officer for King County, Washington, likewise observes,

“It is critical to understand whether the programs we’re implementing are actually making a difference in the communities we serve. Throughout my career in King County, I’ve worked with County teams and researchers on evaluations across multiple policy areas, including transportation access, housing stability, and climate change. Working in close partnership with researchers has guided our policymaking related to individual projects, identified the next set of questions for continual learning, and has enabled us to better apply existing knowledge from other contexts to our own. In this work, it is essential to have researchers who are committed to valuing local knowledge and experience–including that of the community and government staff–as a central part of their research, and who are committed to supporting us in getting better outcomes for our communities.”

The emerging body of evidence on the determinants of government innovation can help us define a plan of action that galvanizes the state and local government innovation necessary to accelerate regional economic growth and community flourishing.

Plan of Action

An evidence-based plan to increase state and local government innovation needs to facilitate and sustain durable partnerships between state and local governments and neighboring universities to produce scientifically rigorous policy evaluations, adapt evaluation evidence from other contexts, and develop effective implementation strategies. Over a century ago, the Hatch Act of 1887 created a remarkably effective and durable R&D infrastructure aimed at agricultural innovation, establishing university-based Agricultural Experiment Stations (AES) in each state tasked with developing, testing, and translating innovations designed to increase agricultural productivity.

Locating university-based AES in every state ensured the production and implementation of locally-relevant evidence by researchers working in partnership with local stakeholders. Federal oversight of the state AES by an Office of Experiment Stations in the US Department of Agriculture ensured that work was conducted with scientific rigor and that local evidence was shared across sites. Finally, providing stable annual federal appropriations for the AES, with required matching state appropriations, ensured the durability and financial sustainability of the R&D infrastructure. This infrastructure worked: agricultural productivity near the experiment stations increased by 6% after the stations were established.

Congress should develop new legislation to create and fund a network of state-based “Policy Experiment Stations.”

The 119th Congress that will convene on January 3, 2025 can adapt the core elements of the proven-effective network of state-based Agricultural Experiment Stations to accelerate state and local government innovation. Mimicking the structure of 7 USC 14, federal grants to states would support university-based “Policy Experiment Stations” or policy innovation labs in each state, tasked with partnering with state and local governments on (1) scientifically rigorous evaluations of the efficacy of state and local policies and programs; (2) translations of evaluation evidence from other settings; and (3) overcoming implementation challenges.

As in 7 USC 14, grants to support state policy innovation labs would be overseen by a federal office charged with ensuring that work was conducted with scientific rigor and that local evidence was shared across sites. We see two potential paths for this oversight function, paths that in turn would influence legislative strategy.

Pathway 1: This oversight function could be located in the Office of Evaluation Sciences (OES) in the General Services Administration (GSA). In this case, the congressional committees overseeing GSA, namely the House Committee on Oversight and Responsibility and the Senate Committee on Homeland Security and Governmental Affairs, would craft legislation providing for an appropriation to GSA to support a new OES grants program for university-based policy innovation labs in each state. The advantage of this structure is that OES is a highly respected locus of program and policy evaluation expertise.

Pathway 2: Oversight could instead be located in the Directorate of Technology, Innovation, and Partnerships in the National Science Foundation (NSF TIP). In this case, the House Committee on Science, Space, and Technology and the Senate Committee on Commerce, Science, and Transportation would craft legislation providing for a new grants program within NSF TIP to support university-based policy innovation labs in each state. The advantage of this structure is that NSF is a highly respected grant-making agency.

Either of these paths is feasible with bipartisan political will. Alternatively, there are unilateral steps that could be taken by the incoming administration to advance state and local government innovation. For example, the Office of Management and Budget (OMB) recently released updated Uniform Grants Guidance clarifying that federal grants may be used to support recipients’ evaluation costs, including “conducting evaluations, sharing evaluation results, and other personnel or materials costs related to the effective building and use of evidence and evaluation for program design, administration, or improvement.” The Uniform Grants Guidance also requires federal agencies to assess the performance of grant recipients, and further allows federal agencies to require that recipients use federal grant funds to conduct program evaluations. The incoming administration could further update the Uniform Grants Guidance to direct federal agencies to require that state and local government grant recipients set aside grant funds for impact evaluations of the efficacy of any programs supported by federal funds, and further clarify the allowability of subgrants to universities to support these impact evaluations.

Conclusion

Establishing a national network of university-based “Policy Experiment Stations” or policy innovation labs in each state, supported by continuing federal and state appropriations, is an evidence-based plan to facilitate abundance-oriented state and local government innovation. We already have impressive examples of what these policy labs might be able to accomplish. At MIT’s Abdul Latif Jameel Poverty Action Lab North America, the University of Chicago’s Crime Lab and Education Lab, the University of California’s California Policy Lab, and Harvard University’s The People Lab, to name just a few, leading researchers partner with state and local governments on scientifically rigorous evaluations of the efficacy of public policies and programs, the translation of evidence from other settings, and overcoming implementation challenges, leading in several cases to evidence-based policy reform. Yet effective as these initiatives are, they are largely supported by philanthropic funds, an infeasible strategy for national scaling.

In recent years we’ve made massive investments in communities through federal grants to state and local governments. We’ve also initiated ambitious efforts at growth-oriented regulatory reform which require not only federal but also state and local action. Now it’s time to invest in building state and local capacity to deploy federal investments effectively and to galvanize regional economic growth. Emerging research findings about the determinants of government innovation, and about the efficacy of the R&D infrastructure for agricultural innovation established over a century ago, give us an evidence-based roadmap for state and local government innovation.

This action-ready policy memo is part of Day One 2025 — our effort to bring forward bold policy ideas, grounded in science and evidence, that can tackle the country’s biggest challenges and bring us closer to the prosperous, equitable and safe future that we all hope for whoever takes office in 2025 and beyond.

PLEASE NOTE (February 2025): Since publication several government websites have been taken offline. We apologize for any broken links to once accessible public data.