Digital Product Passports: Transforming America’s Linear Economy to Combat Waste, Counterfeits, and Supply Chain Vulnerabilities

The U.S. economy is being held back by outdated, linear supply chains that waste valuable materials, expose businesses to counterfeits, and limit consumer choice. American companies lose billions each year to fraudulent goods—everything from fake pharmaceuticals to faulty electronics—while consumers are left in the dark about what they’re buying. At the same time, global disruptions like the COVID-19 pandemic revealed just how fragile and opaque our supply chains really are, especially in critical industries. Without greater transparency and accountability, the U.S. economy will remain vulnerable to these risks, stifling growth and innovation while perpetuating inequities and environmental harm.

A shift toward more circular, transparent systems would not only reduce waste and increase efficiency, but also unlock new business models, strengthen supply chain resilience, and give consumers better, more reliable information about the products they choose. Digital Product Passports (DPP) – standardized digital records that contain key information about a product’s origin, materials, lifecycle, and authenticity – are a key tool that will help the United States achieve these goals.

The administration should establish a comprehensive Digital Product Passport Initiative that creates the legal, technical, and organizational frameworks for businesses to implement decentralized digital passports for their products while ensuring consumer ownership rights, supply chain integrity, and international interoperability. This plan should consider which entities provide up-front investment until the benefits of a digital product passport (DPP) are manifested.

Challenge and Opportunity

The United States faces an urgent sustainability challenge driven by its linear economic model, which prioritizes resource extraction, production, and disposal over reuse and recycling. This approach has led to severe environmental degradation, excessive waste generation, and unsustainable resource consumption, with marginalized communities—often communities of color and low-income areas—bearing the brunt of the damage. From toxic pollution to hazardous waste dumps, these populations are disproportionately affected, exacerbating environmental injustice. If this trajectory continues, the U.S. will not only fall short of its climate commitments but also deepen existing economic inequities. To achieve a sustainable future, the nation must transition to a more circular economy, where resources are responsibly managed, reused, and kept in circulation, rather than being discarded after a single use.

At the same time, the U.S. is contending with widespread counterfeiting and fragile supply chains that threaten both economic security and public health. Counterfeit goods, from unsafe pharmaceuticals to faulty electronics, flood the market, endangering lives and undermining consumer confidence, while costing the economy billions in lost revenue. Furthermore, the COVID-19 pandemic exposed deep weaknesses in global supply chains, particularly in critical sectors like healthcare and technology, leading to shortages that disproportionately affected vulnerable populations. These opaque and fragmented supply chains allow counterfeit goods to flourish and make it difficult to track and verify the authenticity of products, leaving businesses and consumers at risk.

Achieving true sustainability in the United States requires a shift to item circularity, where products and materials are kept in use for as long as possible through repair, reuse, and recycling. This model not only minimizes waste but also reduces the demand for virgin resources, alleviating the environmental pressures created by the current linear economy. Item circularity helps to close the loop, ensuring that products at the end of their life cycles re-enter the economy rather than ending up in landfills. It also promotes responsible production and consumption by making it easier to track and manage the flow of materials, extending the lifespan of products, and minimizing environmental harm. By embracing circularity, industries can cut down on resource extraction, reduce greenhouse gas emissions, and mitigate the disproportionate impact of pollution on marginalized communities.

One of the most powerful tools to facilitate this transition is the digital product passport (DPP). A DPP is a digital record that provides detailed information about a product’s entire life cycle, including its origin, materials, production process, and end-of-life options like recycling or refurbishment. With this information easily accessible, consumers, businesses, and regulators can make informed decisions about the use, maintenance, and eventual disposal of products. DPPs enable seamless tracking of products through supply chains, making it easier to repair, refurbish, or recycle items. This ensures that valuable materials are recovered and reused, contributing to a circular economy. Additionally, DPPs empower consumers by offering transparency into the sustainability and authenticity of products, encouraging responsible purchasing, and fostering trust in both the products and the companies behind them.

In addition to promoting circularity, digital product passports (DPPs) are a powerful solution for combating counterfeits and ensuring supply chain integrity. In 2016, counterfeits and pirated products represented $509B and 3.3% of world trade. By assigning each product a unique digital identifier, a DPP enables transparent and verifiable tracking of goods at every stage of the supply chain, from raw materials to final sale. This transparency makes it nearly impossible for counterfeit products to infiltrate the market, as every legitimate product can be traced back to its original manufacturer with a clear, tamper-proof digital record. In industries where counterfeiting poses serious safety and financial risks—such as pharmaceuticals, electronics, and luxury goods—DPPs provide a critical layer of protection, ensuring consumers receive authentic products and helping companies safeguard their brands from fraud.

Moreover, DPPs offer real-time insights into supply chain operations, identifying vulnerabilities or disruptions more quickly. This allows businesses to respond to issues such as production delays, supplier failures, or the introduction of fraudulent goods before they cause widespread damage. With greater visibility into where products are sourced, produced, and transported, companies can better manage their supply chains, ensuring that products meet regulatory standards and maintaining the integrity of goods as they move through the system. This level of traceability strengthens trust between businesses, consumers, and regulators, ultimately creating more resilient and secure supply chains.

Beyond sustainability and counterfeiting, digital product passports (DPPs) offer transformative potential in four additional key areas:

- First, they enhance compliance and regulatory oversight by providing clear, accessible records of a product’s materials, production methods, and supply chain journey, helping industries meet environmental, labor, and safety standards.

- Second, DPPs strengthen supply chain risk mitigation and resilience by improving real-time visibility and accountability, allowing businesses to detect and address disruptions or vulnerabilities faster.

- Third, they empower informed consumer choices and consumer protection by offering transparency into a product’s origin, sustainability, and authenticity, enabling people to make ethical, safe purchasing decisions.

- Finally, DPPs fuel data-driven innovation and new business models by generating insights that can inform better product design, maintenance strategies, and circular economy opportunities, such as take-back programs or leasing services. In these ways, DPPs act as a versatile tool that not only addresses immediate challenges but also positions industries for long-term, sustainable growth.

Plan of Action

The administration should establish a comprehensive Digital Product Passport Initiative that creates the legal, technical, and organizational frameworks for businesses to implement decentralized digital passports for their products while ensuring consumer ownership rights, supply chain integrity, and international interoperability. This plan should consider which entities provide up-front investment until the benefits of DPP are realized.

Recommendation 1. Legal Framework Development (Lead: White House Office of Science and Technology Policy)

The foundation of any successful federal initiative must be a clear legal framework that establishes authority, defines roles, and ensures enforceability. The Office of Science and Technology Policy is uniquely positioned to lead this effort given its cross-cutting mandate to coordinate science and technology policy across federal agencies and its direct line to the Executive Office of the President.

- Draft executive order establishing federal DPP program authority

- Coordinate with Department of Commerce (DOC) and Environmental Protection Agency (EPA) to identify rulemaking authority, engaging Congress as needed

- Define enforcement mechanisms and penalties

- Coordinate with DOC to define legal requirements for DPP data portability

- Establish liability framework for DPP data accuracy

- Create legal framework for consumer DPP ownership rights, engaging Congress as needed

- Identify the role of Congress, if needed; for example, in defining rulemaking authorities, DPP data probabilities, and consumer DPP ownership rights

- Timeline: First 9 months

Recommendation 2. Product Category Definition & Standards Development (Lead: DOC/NIST)

The success of the DPP initiative depends on clear, technically sound standards that define which products require passports and what information they must contain. This effort must consider the industries and products that will benefit from DPPs, as goods of varying value will find different returns on the investment of DPPs. NIST, as the nation’s lead standards body with deep expertise in digital systems and measurement science, is the natural choice to lead this critical definitional work.

- Establish an interagency working group led by NIST to define priority product categories

- Develop technical standards for DPP data structure and interoperability

- Timeline: First 6 months

Recommendation 3. Consumer Rights & Privacy Framework (Lead: FTC Bureau of Consumer Protection)

A decentralized DPP system must protect consumer privacy while ensuring consumers maintain control over the digital passports of products they own. The FTC’s Bureau of Consumer Protection, with its statutory authority to protect consumer interests and experience in digital privacy issues, is best equipped to develop and enforce these critical consumer protections.

- Define consumer DPP ownership rights and transfer mechanisms

- Establish privacy standards for DPP data

- Develop consumer access and control protocols

- Create standards for consumer authorization of third-party DPP access

- Define requirements for consumer notification of DPP changes

- Timeline: 12-18 months

Recommendation 4. DPP Architecture & Verification Framework (Lead: GSA Technology Transformation Services)

A decentralized DPP system requires robust technical architecture that enables secure data storage, seamless transfers, and reliable verification across multiple private databases. GSA’s Technology Transformation Services, with its proven capability in building and maintaining federal digital infrastructure and its experience in implementing emerging technologies across government, is well-equipped to design and oversee this complex technical ecosystem.

- Define methodology for storing and verifying DPPs

- Develop API standards for industry integration

- Ensure cybersecurity protocols meet NIST standards

- Implement blockchain or distributed ledger technology for traceability

- Develop standards for DPP transfer between product clouds

- Create protocols for consumer DPP ownership transfer

- Establish verification registry for authorized product clouds

- Define minimum security requirements for private DPP databases

- Timeline: 12-18 months

Recommendation 5. Industry Engagement & Compliance Program (Lead: DOC Office of Business Liaison)

Successful implementation of DPPs requires active participation and buy-in from the private sector, as businesses will be responsible for creating and maintaining their product clouds. The DOC Office of Business Liaison, with its established relationships across industries and experience in facilitating public-private partnerships, is ideally suited to lead this engagement and ensure that implementation guidelines meet both government requirements and business needs.

- Create industry advisory board with representatives from key sectors

- Develop compliance guidelines and technical assistance programs

- Establish pilot programs with volunteer companies

- Partner with trade associations for outreach and education

- Develop guidelines for product cloud certification

- Create standards for DPP ownership transfer during resale

- Establish protocols for managing orphaned DPPs

- Timeline: Ongoing from months 3-24

Recommendation 6. Supply Chain Verification System (Lead: Customs and Border Protection)

Digital Product Passports must integrate seamlessly with existing import/export processes to effectively combat counterfeiting and ensure supply chain integrity. Customs and Border Protection, with its existing authority over imports and expertise in supply chain security, is uniquely positioned to incorporate DPP verification into its existing systems and risk assessment frameworks.

- Integrate DPP verification into existing Customs and Border Protection systems

- Develop automated scanning and verification protocols

- Create risk assessment frameworks for import screening

- Timeline: 18-24 months

Recommendation 7. Sustainability Metrics Integration (Lead: EPA Office of Pollution Prevention)

For DPPs to meaningfully advance sustainability goals, they must capture standardized, verifiable environmental impact data throughout product lifecycles. The EPA’s Office of Pollution Prevention brings decades of expertise in environmental assessment and verification protocols, making it the ideal leader for developing and overseeing these critical sustainability metrics.

- Define required environmental impact data points

- Develop lifecycle assessment standards

- Create verification protocols for environmental claims

- Timeline: 12-18 months

Recommendation 8. International Coordination (Lead: State Department Bureau of Economic Affairs)

The global nature of supply chains requires that U.S. DPPs be compatible with similar initiatives worldwide, particularly the EU’s DPP system. The State Department’s Bureau of Economic Affairs, with its diplomatic expertise and experience in international trade negotiations, is best positioned to ensure U.S. DPP standards align with global frameworks while protecting U.S. interests.

- Survey and coordinate with similar efforts around the world (e.g., European Commission’s Digital Product Passport initiative)

- Engage with WTO to ensure compliance with trade rules

- Develop framework for international data sharing

- Develop protocols for cross-border DPP transfers

- Establish international product cloud interoperability standards

- Timeline: Ongoing from months 6-24

Recommendation 9. Small Business Support Program (Lead: Small Business Administration)

The technical and financial demands of implementing DPPs could disproportionately burden small businesses, potentially creating market barriers. The Small Business Administration, with its mandate to support small business success and experience in providing technical assistance and grants, is the natural choice to lead efforts ensuring small businesses can effectively participate in the DPP system.

- Create technical assistance programs

- Provide implementation grants

- Develop simplified compliance pathways

- Timeline: Launch by month 18

Conclusion

Digital Product Passports represent a transformative opportunity to address two critical challenges facing the United States: the unsustainable waste of our linear economy and the vulnerability of our supply chains to counterfeiting and disruption. Through a comprehensive nine-step implementation plan led by key federal agencies, the administration can establish the frameworks necessary for businesses to create and maintain digital passports for their products while ensuring consumer rights and international compatibility. This initiative will not only advance environmental justice and sustainability goals by enabling product circularity, but will also strengthen supply chain integrity and security, positioning the United States as a leader in the digital transformation of global commerce.

Agenda for an American Renewal

Imperative for a Renewed Economic Paradigm

So far, President Trump’s tariff policies have generated significant turbulence and appear to lack a coherent strategy. His original tariff schedule included punitive tariffs on friends and foes alike on the mistaken basis that trade deficits are necessarily the result of an unhealthy relationship. Although they have been gradually paused or reduced since April 2, the uneven rollout (and subsequent rollback) of tariffs continues to generate tremendous uncertainty for policymakers, consumers, and businesses alike. This process has weakened America’s geopolitical standing by encouraging other countries to seek alternative trade, financial, and defense arrangements.

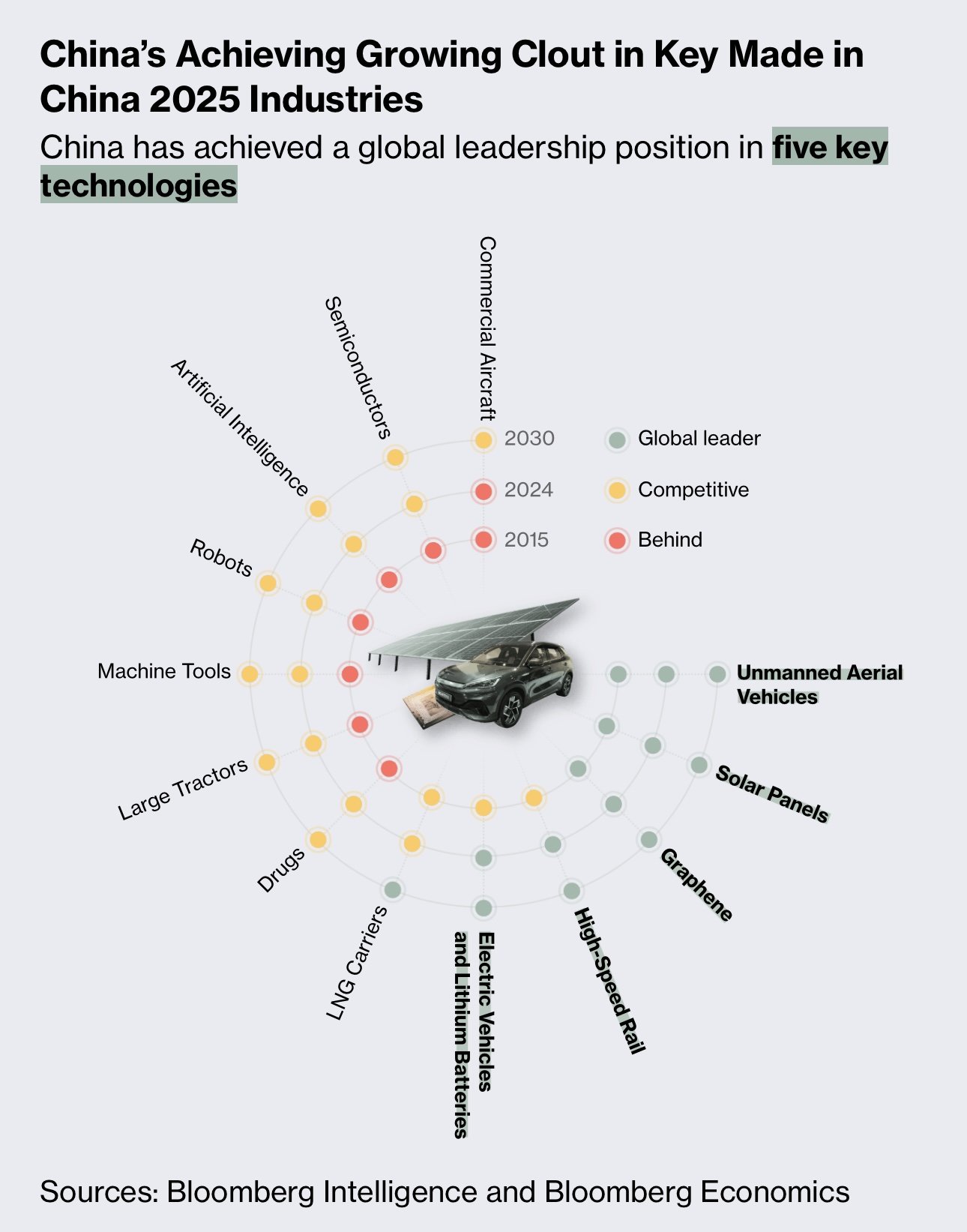

However, notwithstanding the uncoordinated approach to date, President Trump’s mistaken instinct for protectionism belies an underlying truth: that American manufacturing communities have not fared well in the last 25 years and that China’s dominance in manufacturing poses an ever-growing threat to national security. After China’s admission to the WTO in 2001, its share of global manufacturing grew from less than 10% to over 35% today. At the same time, America’s share of manufacturing shrank from almost 25% to less than 15%, with employment shrinking from more than 17 million at the turn of the century to under 13 million today. These trends also create a deep geopolitical vulnerability for America, as in the event of a conflict with China, we would be severely outmatched in our ability to build critical physical goods: for example, China produces over 80% of the world’s batteries, over 90% of consumer drones, and has a 200:1 shipbuilding capacity advantage over the U.S. While not all manufacturing is geopolitically valuable, the erosion in strategic industries, which went hand-in-hand with the loss of key manufacturing skills in recent decades, poses potential long-term challenges for America.

In addition to its growing manufacturing dominance, China is now competing with America’s preeminence in technology leadership, having leveraged many of the skills gained in science, engineering, and manufacturing for lower-value add industries to compete in higher-end sectors. DeepSeek demonstrated that China can natively generate high-quality artificial intelligence models, an area in which the U.S. took its lead for granted. Meanwhile, BYD rocketed past Tesla in EV sales and accounted for 22% of global sales in 2024 as compared to Tesla’s 10%. China has also been operating an extensive satellite-enabled secure quantum communications channel since 2016, preventing others from eavesdropping.

China’s growing leadership in advanced research may give it a sustained edge beyond its initial gains: according to one recent analysis of frontier research publications across 64 critical technologies, global leadership has shifted dramatically to China, which now leads in 57 research domains. These are not recent developments: they have been part of a series of five year plans, the most well known of which is Made in China 2025, giving China an edge in many critical technologies that will continue to grow if not addressed by an equally determined American response.

An Integrated Innovation, Economic Foreign Policy, and Community Development Approach

Despite China’s growing challenge and recent self-inflicted damage to America’s economic and geopolitical relationships, America still retains many ingrained advantages. The U.S. still has the largest economy, the deepest public and private capital pools for promising companies and technologies, and the world’s leading universities; it has the most advanced military, continues to count most of the world’s other leading armed forces as formal treaty allies, and remains the global reserve currency. Ordinary Americans have benefited greatly from these advantages in the form of access to cutting edge products and cheaper goods that increase their effective purchasing power and quality of life – notwithstanding Secretary Bessent’s statements to the contrary.

The U.S. would be wise to leverage its privileged position in high-end innovation and in global financial markets to build “industries of the future.” However, the next economic and geopolitical paradigm must be genuinely equitable, especially to domestic communities that have been previously neglected or harmed by globalization. For these communities, policies such as the now-defunct Trade Adjustment Assistance program were too slow and too reactive to help workers displaced by the “China Shock,” which is estimated to have caused up to 2.4 million direct and indirect job losses.

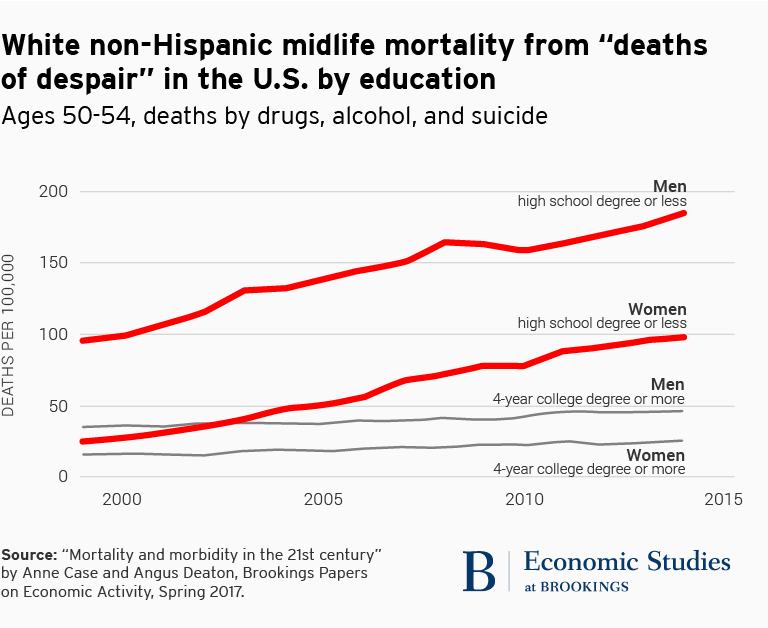

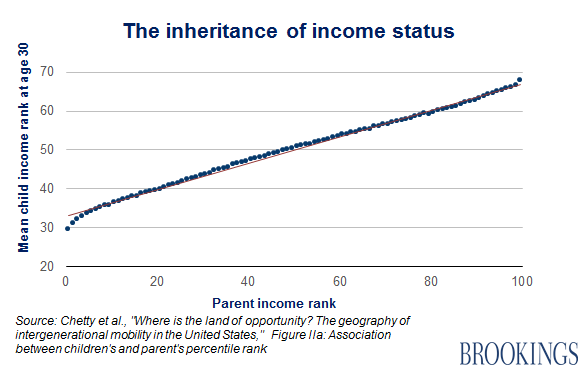

Although jobs in trade-affected communities were eventually “replaced,” the jobs that came after were disproportionately lower-earning roles, accrued largely to individuals who had college degrees, and were taken by new labor force entrants rather than providing new opportunities for those who had originally been displaced. Moreover, as a result of ineffective policy responses, this replacement took over a decade and has contributed to heinous effects: look no further than the rate at which “deaths of despair” for white individuals without a college degree skyrocketed after 2000.

Nonetheless, surrendering America’s hard-won advantages in technology and international commerce, especially in the face of a growing challenge from China, would be an existential error. Rather, our goal is to address the shortcomings of previous policy approaches to the negative externalities caused by globalization. Previous approaches have focused on maximizing growth and redistributing the gains, but in practice, America failed to do either by underinvesting in the foundational policies that enable both. Thus, we are proposing a two-pronged approach that focuses on spurring cutting-edge technologies, growing novel industries, and enhancing production capabilities while investing in communities in a way that provides family-supporting, upwardly mobile jobs as well as critical childcare, education, housing, and healthcare services. By investing in broad-based prosperity and productivity, we can build a more equitable and dynamic economy.

Our agenda is intentionally broad (and correspondingly ambitious) rather than narrow in focus on manufacturing communities, even though current discourse is focused on trade. This is not simply a “political bargain” that provides greater welfare or lip-service concessions to hollowed-out communities in exchange for a return to the prior geoeconomic paradigm. Rather, we genuinely believe that economic dynamism which is led by an empowered middle-class worker, whether they work in manufacturing or in a service industry, is essential to America’s future prosperity and national security – one in which economic outcomes are not determined by parental income and one where black-white disparities are closed in far less than the current pace of 150+ years.

Thus, the ideas and agenda presented here are neither traditionally “liberal” nor “conservative,” “Democrat” nor “Republican.” Instead, we draw upon the intellectual traditions of both segments of the political spectrum. We agree with Ezra Klein’s and Derek Thompson’s vision in Abundance for a technology-enabled future in which America remembers how to build; at the same time, we take seriously Oren Cass’s view in The Once and Future Worker that the dignity of work is paramount and that public policy should empower the middle-class worker. What we offer in the sections below is our vision for a renewed America that crosses traditional policy boundaries to create an economic and political paradigm that works for all.

Policy Recommendations

Investing in American Innovation

Given recent trends, it is clear that there is no better time to re-invigorate America’s innovation edge by investing in R&D to create and capture “industries of the future,” re-shoring capital and expertise, and working closely with allies to expand our capabilities while safeguarding those technologies that are critical to our security. These investments will enable America to grow its economic potential, providing fertile ground for future shared prosperity. We emphasize five key components to renewing America’s technological edge and manufacturing base:

Invest in R&D. Increase federally funded R&D, which has declined from 1.8% of GDP in the 1960s to 0.6% of GDP today. Of the $200 billion federal R&D budget, just $16 billion is allocated to non-healthcare basic science, an area in which the government is better suited to fund than the private sector due to positive spillover effects from public funding. A good start is fully funding the CHIPS and Science Act, which authorized over $200 billion over 10 years for competitiveness-enhancing R&D investments that Congress has yet to appropriate. Funding these efforts will be critical to developing and winning the race for future-defining technologies, such as next-gen battery chemistries, quantum computing, and robotics, among others.

Capability-Building. Develop a coordinated mechanism for supporting translation and early commercialization of cutting-edge technologies. Otherwise, the U.S. will cede scale-up in “industries of the future” to competitors: for example, Exxon developed the lithium-ion battery, but lost commercialization to China due to the erosion of manufacturing skills in America that are belatedly being rebuilt. However, these investments are not intended to be a top-down approach that selects winners and losers: rather, America should set a coordinated list of priorities (leveraging roadmaps such as the DoD’s Critical Technology Areas), foster competition amongst many players, and then provide targeted, lightweight financial support to industry clusters and companies that bubble to the top.

Financial support could take the form of a federally-funded strategic investment fund (SIF) that partners with private sector actors by providing catalytic funding (e.g., first-loss loans). This fund would focus on bridging the financing gap in the “valley of death” as companies transition from prototype to first-of-a-kind / “nth-of-a-kind” commercial product. In contrast to previous attempts at industrial policy, such as the Inflation Reduction Act (IRA) or CHIPS Act, they should have minimal compliance burdens and focus on rapidly deploying capital to communities and organizations that have proven to possess a durable competitive advantage.

Encourage Foreign Direct Investment (FDI). Provide tax incentives and matching funds (potentially from the SIF) for companies who build manufacturing plants in America. This will bring critical expertise that domestic manufacturers can adopt, especially in industries that require deep technical expertise that America would need to redevelop (e.g., shipbuilding). By striking investment deals with foreign partners, America can “learn from the best” and subsequently improve upon them domestically. In some cases, it may be more efficient to “share” production, with certain components being manufactured or assembled abroad, while America ramps up its own capabilities.

For example, in shipbuilding, the U.S. could focus on developing propulsion, sensor, and weapon systems, while allies such as South Korea and Japan, who together build almost as much tonnage as China, convert some shipyards to defense production and send technical experts to accelerate development of American shipyards. In exchange, they would receive select additional access to cutting-edge systems and financially benefit from investing in American shipbuilding facilities and supply chains.

Immigration. America has long been described as a “nation of immigrants.” Their role in innovation is impossible to deny: 46% of companies in the Fortune 500 were founded by immigrants and accounted for 24% of all founders; they are 19% of the overall STEM workforce but account for nearly 60% of doctorates in computer science, mathematics, and engineering. Rather than spurning them, the U.S. should attract more highly educated immigrants by removing barriers to working in STEM roles and offering accelerated paths to citizenship. At the same time, American policymakers should acknowledge the challenges caused by illegal immigration. One such solution is to pass legislation such as the Border Control Act of 2024, which had bipartisan support and increased border security, supplemented by a “points-based” immigration system such as Canada’s which emphasizes educational credentials and in-country work experience.

Create Targeted Fences. Employ tariffs and export controls to defend nascent, strategically important industries such as advanced chips, fusion energy, or quantum communications. However, rather than employing these indiscriminately, tariffs and export controls should be focused on ensuring that only America and its allies have access to cutting-edge technologies that shape the global economic and security landscape. They are not intended to keep foreign competition out wholesale; rather, they should ensure that burgeoning technology developers gain sufficient scale and traction by accelerating through the “learn curve.”

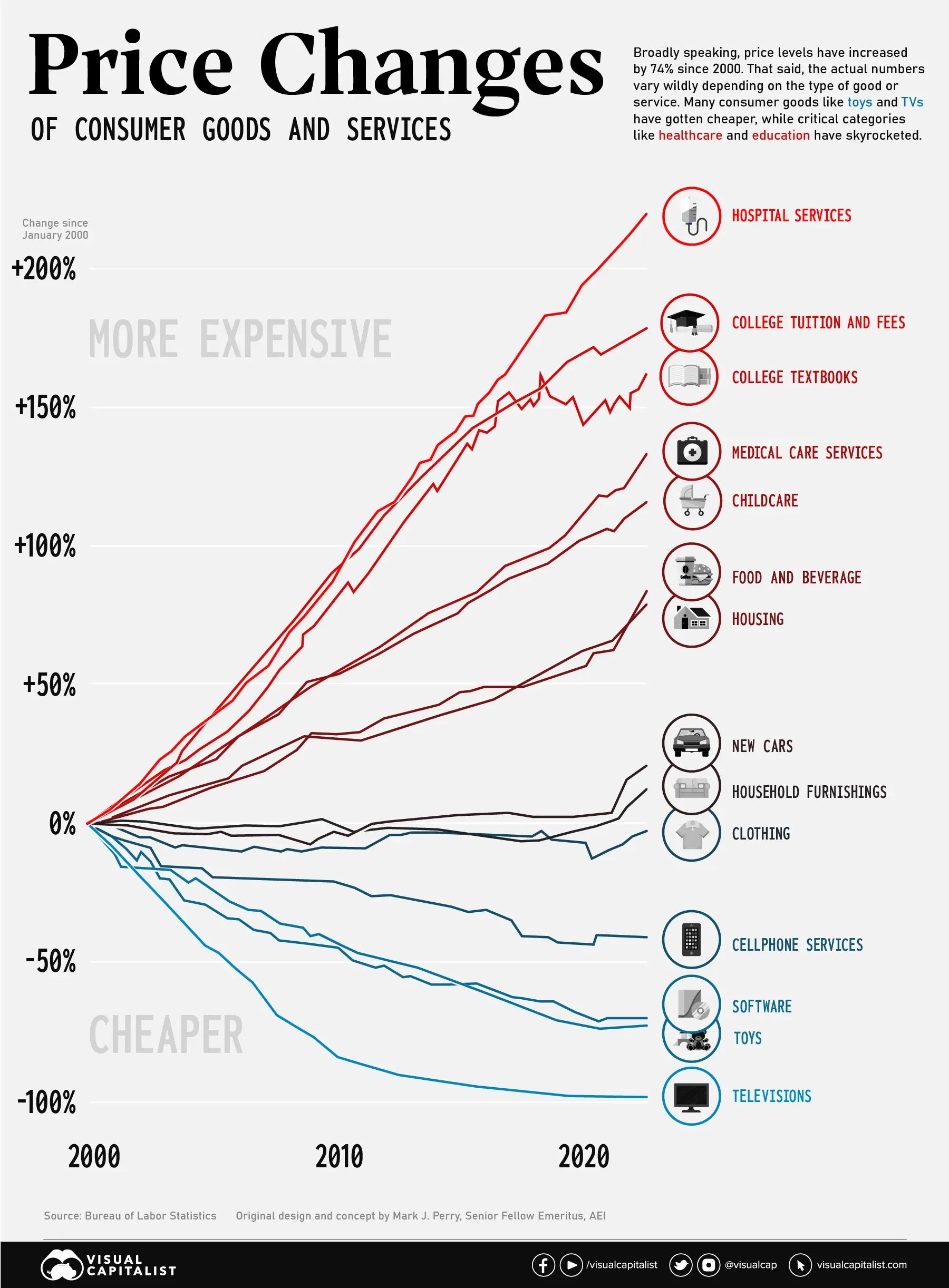

Building Strong Communities

Strong communities are the foundation of a strong workforce, without which new industries will not thrive beyond a small number of established tech hubs. However, strengthening American communities will require the country to address the core needs of a family-sustaining life. Childcare, education, housing, and healthcare are among the largest budget items for families and have been proven time and again to be critical to economic mobility. Nevertheless, they are precisely the areas in which costs have skyrocketed the most, as has been frequently chronicled by the American Enterprise Institute’s “Chart of the Century.” These essential services have been underinvested in for far too long, creating painful shortages for communities that need them most. As such, addressing these issues form the core pillars of our domestic reinvestment plan. Addressing them means grappling with the underlying drivers of their cost and scarcity. These include issues of state capacity, regulatory and licensing barriers, and low productivity growth in service-heavy care sectors. A new policy agenda that addresses the fundamental supply-side issues is needed to reshape the contours of this debate.

Expand Childcare. Inadequate childcare costs the U.S. economy $122 billion in lost wages and productivity as otherwise capable workers, especially women, are forced to reduce hours or leave the labor force. Access is further exacerbated by supply shortages: more than half the population lives in a “childcare desert,” where there are more than three times as many children as licensed slots. Addressing these shortages will alleviate the affordability issue, enabling workers to stay in the workforce and allow families to move up the income ladder.

Fund Early Education. Investments in early childhood education have been demonstrated to generate compelling ROI, with high-quality studies such as the Perry preschool study demonstrating up to $7 – $12 of social return for every $1 invested. While these gains are broadly applicable across the country, they would make an even greater difference in helping to rebuild manufacturing communities by making it easier to grow and sustain families. Given the return on investment and impact on social mobility, American policymakers should consider investing in universal pre-K.

Invest in Workforce Training and Community Colleges. The cost of a four-year college education now exceeds $38K per year, indicating a clear need for cheaper BA degrees but also credible alternatives. At the same time, community colleges can be reimagined and better funded to enable them to focus on high-paying jobs in sectors with critical labor shortages, many of which are in or adjacent to “industries of the future.” Some of these roles, such as IT specialists and skilled tradespeople, are essential to manufacturing. Others, such as nursing and allied healthcare roles, will help build and sustain strong communities.

Build Housing Stock. America has a shortage of 3.2 million homes. Simply put, the country needs to build more houses to address the cost of living and enable Americans to work and raise families. While housing policy is generally decided at lower levels of government, the federal government should provide grants and other incentives to states and municipalities to defray the cost of developing affordable housing; in exchange, state and local jurisdictions should relax zoning regulations to enable more multi-family and high-density single-family housing.

Expand Healthcare Access. American healthcare is plagued with many problems, including uneven access and shortages in primary care. For example, the U.S. has 3.1 primary care physicians (PCPs) per 10,000 people, whereas Germany has 7.1 and France has 9.0. As such, the federal government should focus on expanding the number of healthcare practitioners (especially primary care physicians and nurses), building a physical presence for essential healthcare services in underserved regions, and incentivizing the development of digital care solutions that deliver affordable care.

Allocating Funds to Invest in Tomorrow’s Growth

Investment Requirements

While we view these policies as essential to America’s reinvigoration, they also represent enormous investments that must be paid for at a time when fiscal constraints are likely to tighten. To create a sense of the size of the financial requirements and trade-offs required, we lay out each of the key policy prescriptions above and use bipartisan proposals wherever possible, many of which have been scored by the Congressional Budget Office (CBO) or another reputable institution or agency. Where this is not possible, we created estimates based on key policy goals to be accomplished. Although trade deals and targeted tariffs are likely to have some budget impact, we did not evaluate them given multiple countervailing forces and political uncertainties (e.g., currency impacts).

Potential Pay-Fors

Given the budgetary requirements of these proposals, we looked for opportunities to prune the federal budget. The CBO laid out a set of budgetary options that collectively could save several trillion over the next decade. In laying out the potential pay-fors, we used two approaches that focused on streamlining mandatory spending and optimizing tax revenues in an economically efficient manner. Our first approach is to include budgetary options that eliminate unnecessary spending that are distortionary in nature or are unlikely to have a meaningful direct impact on the population that they are trying to serve (e.g., kickback payments to state health plans). Our second approach is to include budgetary options in which the burden would fall upon higher-earning populations (e.g., raising the cap on payroll and Social Security taxes).

As the table below shows, there is a menu of options available to policymakers that raise funding well in excess of the required investment amounts above, allowing them to pick and choose which are most economically efficient and politically viable. In addition, they can modify many of these options to reduce the size or magnitude of the effect of the policy (e.g., adjust the point at which Social Security benefits for “high earners” is tapered or raise capital gains by 1% instead of 2%). While some of these proposals are potentially controversial, there is a clear and pressing need to reexamine America’s foundational policy assumptions without expanding the deficit, which is already more than 6% of GDP.

Conclusion

America is in need of a new economic paradigm that renews and refreshes rather than dismantles its hard-won geopolitical and technological advantages. Trump’s tariffs, should they be fully enacted, would be a self-defeating act that would damage America’s economy while leaving it more vulnerable, not less, to rivals and adversaries. However, we also recognize that the previous free trade paradigm was not truly equitable and did not do enough to support manufacturing communities and their core strengths. We believe that our two-pronged approach of investing in American innovation alongside our allies along with critical community investments in childcare, higher education, housing, and healthcare bridges the gap and provides a framework for re-orienting the economy towards a more prosperous, fair, and secure future.

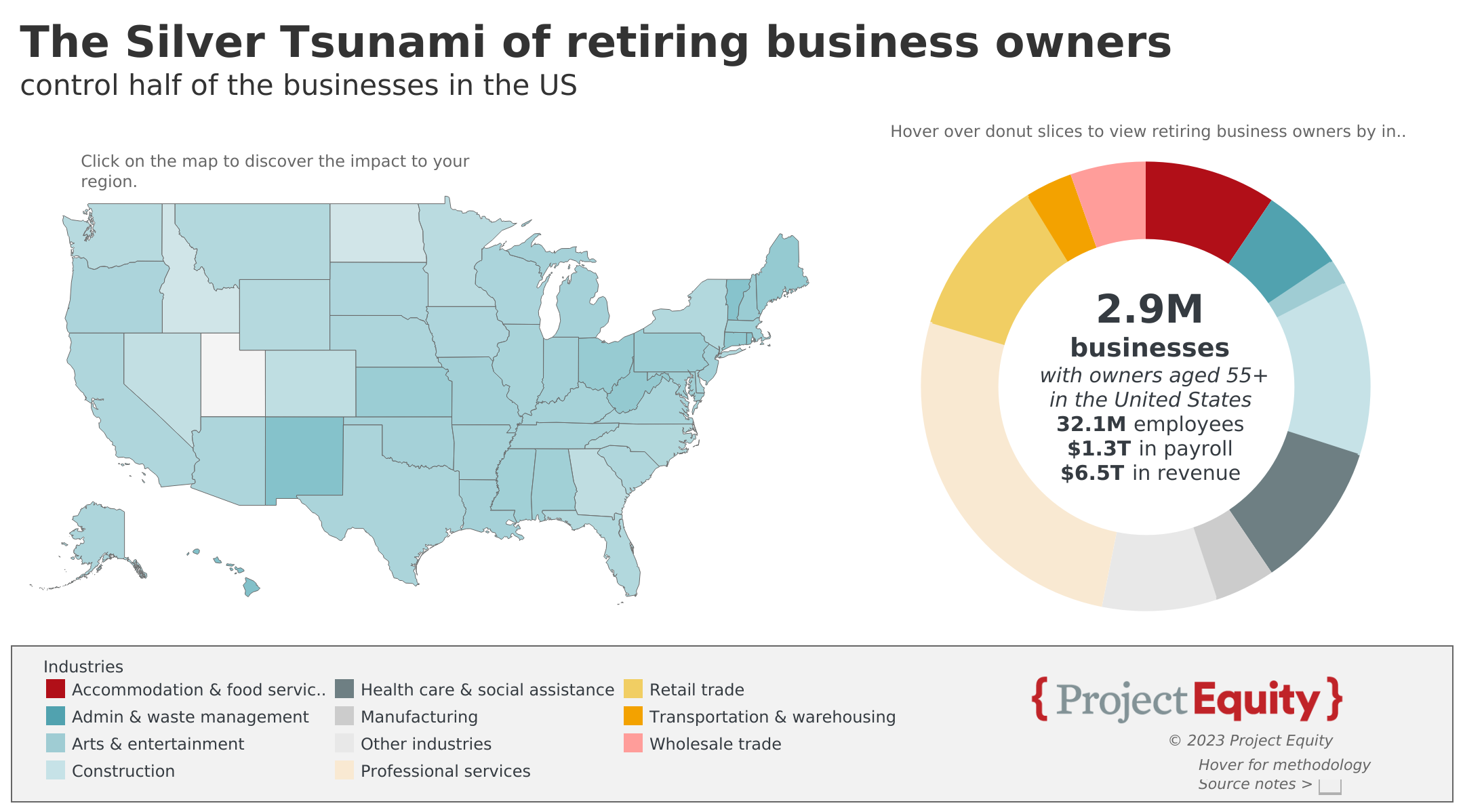

Retiring Baby Boomers Can Turn Workers into Owners: Securing American Business Ownership through Employee Ownership

The economic vitality and competitiveness of America’s economy is in jeopardy. The Silver Tsunami of retiring business owners puts half of small businesses at risk: 2.9 million companies are owned by someone at or near retirement age, of which 375,000 are manufacturing, trade, and distribution businesses critical to our supply chains. Add to this that 40 percent of U.S. corporate stock is owned by foreign investors, which funnels these companies’ profits out of our country, weakening our ability to reinvest in our own competitiveness. If the steps to expand the availability of employee ownership were to address even just 10% of the Silver Tsunami companies over 10 employees, this would preserve an estimated 57K small businesses and 2.6M jobs, affecting communities across the U.S. Six hundred billion dollars in economic activity by American-owned firms would be preserved, ensuring that these firms’ profits continue to flow into American pockets.

Broad-based employee ownership (EO) is a powerful solution that preserves local American business ownership, protects our supply chains and the resiliency of American manufacturing, creates quality jobs, and grows the household balance sheets of American workers and their families. Expanding access to financing for EO is crucial at this juncture, given the looming economic threats of the Silver Tsunami and foreign business ownership.

Two important opportunities expand capital access to finance sales of businesses into EO, building on over 50 years of federal support for EO and over 65 years of supporting the flow of small business private capital to where it is not in adequate supply: first, the Employee Equity Investment Act (EEIA), and second, addressing barriers in the SBA 7(a) loan guarantee program.

Three trends create tremendous urgency to leverage employee ownership small business acquisition: (1) the Silver Tsunami, representing $6.5T in GDP and one in five private sector workers nationwide, (2) fewer than 30 percent of businesses are being taken over by family members, and (3) only one in five businesses put up for sale is able to find a buyer.

Without preserving Silver Tsunami businesses, the current 40 percent share of foreign ownership will only grow. Supporting U.S. private investors in the mergers and acquisitions (M&A) space to proactively pitch EO to business owners, and come with readily available financing, enables EO to compete with other acquisition offers, including foreign firms.

In communities all across the U.S., from urban to suburban to rural (where arguably the need to find buyers and the impact of job losses can be most acute), EO is needed to preserve these businesses and their jobs in our communities, maintain U.S. stock ownership, preserve manufacturing production capacity and competitive know how, and create the potential for the next generation of business owners to create economic opportunity for themselves and their families.

Challenge and Opportunity

Broad-based employee ownership (EO) of American small businesses is one of the most promising opportunities to preserve American ownership and small business resiliency and vitality, and help address our country’s enormous wealth gap. EO creates the opportunity to have a stake in the game, and to understand what it means to be a part owner of a business for today’s small business workforces.

However, the growth of EO, and its ability to preserve American ownership of small businesses in our local economies, is severely hampered by access to financing.

Most EO transactions (which are market rate sales) require the business owner to first learn about EO, then to not only initiate the transaction (typically hiring a consultant to structure the deal for them), but also to finance as much as 50 percent or more of the sale. This contrasts to how the M&A market traditionally works: buyers who provide the financing are the ones who initiate the transaction with business owners. This difference is a core reason why EO hasn’t grown as quickly as it could, given all of the backing provided through federal tax breaks dating back to 1974.

More than one form of EO is needed to address the urgent Silver Tsunami and related challenges, including Employee Stock Ownership Plans (ESOPs) which are only a fit for companies of about 40 employees and above, and worker-owned cooperatives and Employee Ownership Trusts (EOTs), which are a fit for companies of about 10 employees and above (below 10 is a challenge for any EO transition). Of small businesses with greater than 10 employees, those with 10-19 employees make up 51% of the total; those with 20-49 employees make up 33%. In other words, the vast majority of companies with over 10 employees (the minimum size threshold for EO transitions) are below the 40+ employee threshold required for an ESOP. This underscores the importance of ensuring financing access for worker coops and EOTs that can support transitions of companies in the 10-40 employee range.

Without action, we are at risk of losing the small businesses and jobs that are in need of buyers as a result of the Silver Tsunami.

Across the entire small business economy, 2.9M businesses that provide 32.1M jobs are estimated to be at risk, representing $1.3T in payroll and $6.5T in business revenue. Honing in on only manufacturing, wholesale trade and transportation & warehousing businesses, there are an estimated 375,000 businesses at risk that provide 5.5M jobs combined, representing $279.2B of payroll and $2.3T of business revenue.

Plan of Action

Two important opportunities will expand capital access to finance sales of businesses into EO and solve the supply-demand imbalance created in the small business merger and acquisition marketplace with too many businesses needing buyers and being at risk of closing down due to the Silver Tsunami.

First, passing new legislation, the Employee Equity Investment Act (EEIA), would establish a zero-subsidy credit facility at the Small Business Administration, enabling Congress to preserve the legacy of local businesses and create quality jobs with retirement security by helping businesses transition to employee ownership. By supporting private investment funds, referred to as Employee Equity Investment Companies (EEICs), Congress can support the private market to finance the sale of privately-held small- and medium-sized businesses from business owners to their employees through credit enhancement capabilities at zero subsidy cost to the taxpayer.

EEICs are private investment companies licensed by the Small Business Administration that can be eligible for low-cost, government-backed capital to either create or grow employee-owned businesses. In the case of new EO transitions, the legislation intends to “crowd in” private institutional capital sources to reduce the need for sellers to self-finance a sale to employees. Fees paid into the program by the licensed funds enable it to operate at a zero-subsidy cost to the federal government.

The Employee Equity Investment Act (EEIA) helps private investors that specialize in EO to compete in the mergers & acquisition (M&A) space.

Second, addressing barriers to EO lending in the SBA 7(a) loan guarantee program by passing legislation that removes the personal guarantee requirement for worker coops and EOTs would help level the playing field, enabling companies transitioning to EO to qualify for this loan guarantee without requiring a single employee-owner to personally guarantee the loan on behalf of the entire owner group of 10, 50 or 500 employees.

Importantly, our manufacturing supply chain depends on a network of tier 1, 2 and 3 suppliers across the entire value chain, a mix of very large and very small companies (over 75% of manufacturing suppliers have 20 or fewer employees). The entire sector faces an increasingly fragile supply chain and growing workforce shortages, while also being faced with the Silver Tsunami risk. Ensuring that EO transitions can help us preserve the full range of suppliers, distributors and other key businesses will depend on having capital that can finance companies of all sizes. The SBA 7(a) program can guarantee loans of up to $5M, on the smaller end of the small business company size.

Even though the SBA took steps in 2023 to make loans to ESOPs easier than under prior rules, the biggest addressable market for EO loans that fit within the SBA’s 7(a) loan size range are for worker coops and EOTs (because ESOPs are only a fit for companies with about 40 employees or fewer, given higher regulatory costs). Worker coops and EOTs are currently not able to utilize this SBA product.

The legislative action needed is to require the SBA to remove the requirement for a personal guarantee under the SBA 7(a) loan guarantee program for acquisitions financing for worker cooperatives and Employee Ownership Trusts. The Capital for Cooperatives Act (introduced to both the House and the Senate most recently in May 2021) provides a strong starting point for the legislative changes needed. There is precedent for this change; the Paycheck Protection Program loans and SBA Economic Injury Disaster Loans (EIDL) were made during the pandemic to cooperatives without requiring personal guarantees as well as the aforementioned May 2023 rule change allowing majority ESOPs to borrow without personal guarantee.

There is not any expected additional cost to this program outside of some small updates to policies and public communication about the changes.

Addressing barriers to EO lending in the SBA 7(a) loan guarantee program would open up bank financing to the full addressable market of EO transactions.

The Silver Tsunami of retiring business owners puts half of all employer-businesses urgently at risk if these business owners can’t find buyers, as the last of the baby boomers turns 65 in 2030. Maintaining American small business ownership, with 40% of stock of American companies already owned by foreign stockholders, is also critical. EO preserves domestic productive capacity as an alternative to acquisition by foreign firms, including China, and other strategic competitors, which bolsters supply chain resiliency and U.S. strategic competitiveness. Manufacturing is a strong fit for EO, as it is consistently in the top two sectors for newly formed employee-owned companies, making up 20-25% of all new ESOPs.

Enabling private investors in the M&A space to proactively pitch EO to business owners, and come with readily available financing will help address these urgent needs, preserving small business assets in our communities, while simultaneously creating a new generation of American business owners.

This action-ready policy memo is part of Day One 2025 — our effort to bring forward bold policy ideas, grounded in science and evidence, that can tackle the country’s biggest challenges and bring us closer to the prosperous, equitable and safe future that we all hope for whoever takes office in 2025 and beyond.

PLEASE NOTE (February 2025): Since publication several government websites have been taken offline. We apologize for any broken links to once accessible public data.

There are an estimated 7,500+ EO companies in the U.S. today, with nearly 40,000 employee-owners and assets well above $2T. Most are ESOPs (about 6,500), plus about 1,000 worker cooperatives, and under 100 EOTs.

For every 1% of Silver Tsunami companies with more than 10 employees that is able to transition to EO based on these recommendations, an estimated 5.7K firms, $60.7B in sales, 260K jobs, and 12.3B in payroll would be preserved.

Congress and the federal government have demonstrated their support of small business and the EO form of small business in many ways, which this proposed two-pronged legislation builds on, for example:

- Creation of the SBIC program in the SBA in 1958 designed to stimulate the small business segment of the U.S. economy by supplementing “the flow of private equity capital and long-term loan funds which small-business concerns need for the sound financing of their business operations and for their growth, expansion, and modernization, and which are not available in adequate supply [emphasis added]”

- Passage of multiple pieces of federal legislation providing tax benefits to EO companies dating back to 1974

- Passage of the Main Street Employee Ownership Act in 2018, which was passed with the intention of removing barriers to SBA loans or guarantees for EO transitions, including to allow ESOPs and worker coops to qualify for loans under the SBA’s 7(a) program. The law stipulated that the SBA “may” make the changes the law provided, but the regulations SBA initially issued made things harder, not easier. Over the next few years, Representatives Dean Phillips (D-MN) and Nydia Velazquez (D-NY), both on the House Small Business Committee, led an effort to get the SBA to make the most recent changes that benefitted ESOPs but not the other forms of EO.

- Release of the first Job Quality Toolkit by the Commerce Department in July 2021, which explicitly includes EO as one of the job quality strategies

- Passage of the WORK Act (Worker Ownership, Readiness, and Knowledge) in 2023 (incorporated as Section 346 of the SECURE 2.0 Act), which directs the Department of Labor (DOL) to create an Employee Ownership Initiative within the department to coordinate and fund state employee ownership outreach programs and also requires the DOL to set new standards for ESOP appraisals. The program was to be funded at $4 million in fiscal year 2025 (which starts in October 2024), gradually increasing to $16 million by fiscal year 2029, but it has yet to be appropriated.

EO transitions using worker cooperatives have been happening for decades. Over the past ten years, this practice has grown significantly. There is a 30-member network of practitioners that actively support small business transitions utilizing worker coops and EOTs called Workers to Owners. Employee Ownership Trusts are newer in the U.S. (though they are the standard EO form in Europe, with decades of strong track record) and are a rapidly growing form of EO with a growing set of practitioners.

Given the supply ~ demand imbalance of retiring business owners created by the Silver Tsunami (lots of businesses need buyers), as well as the outsized positive benefits of EO, prioritizing this form of business ownership is critical to preserving these business assets in our local and national economies. Capital to finance the transactions is central to ensuring EO’s ability to play this important role.

The SBA 7(a) loan program has been and continues to be, critical to opening up bank (and some CDFI) financing for small businesses writ large by guaranteeing loans up to $5M. In FY23, the SBA guaranteed more than 57,300 7(a) loans worth $27.5 billion.

The SBA 7(a) loan program’s current rules require that all owners with 20% or more ownership of a business provide a personal guarantee for the loan, but absent anyone owning 20%, at least one individual must provide the personal guarantee. The previously mentioned May 2023 rule changes updated this for majority ESOPs.

Just as with the ESOP form of EO, the SBA would be able to consider documented proof of an EO borrower’s ability to repay the loan based on equity, cash flow, and profitability to determine lending criteria.

Research into employee ownership demonstrates that EO companies have faster growth, higher profits, and that they outlast their competitors in business cycle downturns. There is precedent for offering loans without a personal guarantee. First, during COVID, the SBA extended both EIDL (Economic Injury Disaster Loans) and PPP (Paycheck Protection Program) loans to cooperatives without requiring a personal guarantee. Second, the SBA’s May 2023 rule changes allow majority ESOPs to borrow without personal guarantee.

The overlap of the EO transaction value with the $5M ceiling for the 7(a) loan guarantee has the largest overlap with transaction values that are suitable for worker coops and EOTs. This is because ESOPs are not viable below about $750K-$1M transaction value due to higher regulatory-related costs, but the other forms of EO are viable down to about 10 or so employees.

A typical bank- or CDFI- financed EO transaction is a senior loan of 50-70% and a seller note of 30-50%. With a $5M ceiling for the 7(a) loan guarantee, this would cap the EO transaction value for 7(a) loans at $10M (a 50% seller note of $5M alongside a $5M bank loan). If a sale price is 4-6x EBITDA (a measure of annual profit) at this transaction value, this would cap the eligible company EBITDA at $1.7-$2.5M, which captures only the lowest company size thresholds that could be viable for the ESOP form.

Supply chain fragility and widespread labor shortages are the two greatest challenges facing American manufacturing operators today, with 75% of manufacturers citing attracting and retaining talent as their primary business challenge, and 65% citing supply chain disruptions as their next greatest challenge. Many don’t realize that the manufacturing sector is built like a block tower, with the Tier 1 (largest) suppliers to manufacturers at the top, Tier 2 suppliers at the next level down, and the widest foundational layer made up of Tier 3 suppliers. For example, a typical auto manufacturer will rely on 18,000 suppliers across its entire value chain, over 98% of which are small or medium sized businesses. In fact, 75% of manufacturing businesses have fewer than 20 employees. It is critical that we preserve American businesses across the entire value chain, and opening up financing for EO for companies of all sizes is absolutely critical.

The manufacturing sector generates 12% of U.S. GDP (gross domestic product), and if we count the value of the sector’s purchasing, the number goes to nearly one quarter of GDP. The sector also employs nearly one in ten American workers (over 14 million). Manufacturing plays a vital role in both our national security and in public health. Finally, the sector has long been a source of quality jobs and a cornerstone of middle class employment.

Though we aren’t certain the reasoning, it is most likely because ESOPs have the largest lobbying presence. Given the broad support by the federal government of ESOPs through a myriad of tax benefits designed to encourage companies to transition to ESOPs, it is the biggest form of EO, enabling its lobbying presence. As discussed, their size threshold (based on the costs to comply with the regulatory requirements) put ESOPs out of reach for companies with below $750K – $1M EBITDA (a measure of annual profit), which leaves a large swath of America’s small businesses not supported by the SBA 7(a) loan guarantee when they are transacting an employee ownership succession plan.

Likely, the lack of lobbying presence by parties representing the non-ESOP forms of employee ownership has resulted in the rule change not applying to the other forms of broad-based employee ownership. However, the data (as outlined above) clearly shows that worker cooperatives and EOTs are needed to address the full breadth of Silver Tsunami EO need, given the size overlap of loans that fit the size guidelines of the 7(a) loan guarantee and the fit with the form of EO. As such, legislators that are focused on American business resiliency and competitiveness are in the good positions to direct the SBA to mirror the ESOP personal loan guarantee treatment for worker cooperatives and EOTs.

Strategies to Accelerate and Expand Access to the U.S. Innovation Economy

In 2020, we outlined a vision for how the incoming presidential administration could strengthen the nation’s innovation ecosystem, encouraging the development and commercialization of science and technology (S&T) based ventures. This vision entailed closing critical gaps from lab to market, with an emphasis on building a broadly inclusive pipeline of entrepreneurial talent while simultaneously providing key support in venture development.

During the intervening years, we have seen extraordinary progress, in good part due to ambitious legislation. Today, we propose innovative ways that the federal government can successfully build on this progress and make the most of new programs. With targeted policy interventions, we can efficiently and effectively support the U.S. innovation economy through the translation of breakthrough scientific research from the lab to the market. The action steps we propose are predicated on three core principles: inclusion, relevance, and sustainability. Accelerating our innovation economy and expanding access to it can make our nation more globally competitive, increase economic development, address climate change, and improve health outcomes. A strong innovation economy benefits everyone.

Challenge

Our Day One 2020 memo began by pitching the importance of innovation and entrepreneurship: “Advances in scientific and technological innovations—and, critically, the ability to efficiently transform breakthroughs into scalable businesses—have contributed enormously to American economic leadership over the past century.” Now, it is widely recognized that innovation and entrepreneurship are key to both global economic leadership and addressing the challenges of changing climate. The question is no longer whether we must innovate but rather how effectively we can stimulate and expand a national innovation economy.

Since 2020, the global and U.S. economies have gone through massive change and uncertainty. The Global Innovation Index (GII) 2023 described the challenges involved in its yearly analysis of monitoring global innovation trends amid uncertainty brought on by a sluggish economic recovery from the COVID-19 pandemic, elevated interest rates, and geopolitical tensions. Innovation indicators like scientific publications, research and development (R&D), venture capital (VC) investments, and the number of patents rose to historic levels, but the value of VC investment declined by close to 40%. As a counterweight to this extensive uncertainty, the GII 2023 described the future of S&T innovation and progress as “the promise of Digital Age and Deep Science innovation waves and technological progress.”

In the face of the pressures of global competitiveness, societal needs, and climate change, the clear way forward is to continue to innovate based on scientific and technical advancements. Meeting the challenges of our moment in history requires a comprehensive and multifaceted effort led by the federal government with many public and private partners.

Grow global competitiveness

Around the world, countries are realizing that investing in innovation is the most efficient way to transform their economies. In 2022, the U.S. had the largest R&D budget internationally, with spending growing by 5.6%, but China’s investment in R&D grew by 9.8%. For the U.S. to remain a global economic leader, we must continue to invest in innovation infrastructure, including the basic research and science, technology, engineering, and math (STEM) education that underpins our leadership, while we grow our investments in translational innovation. This includes reframing how existing resources are used as well as allocating new spending. It will require a systems change orientation and long-term commitments.

Increase economic development

Supporting and growing an innovation economy is one of our best tools for economic development. From place-based innovation programs to investment in emerging research institutions (ERIs) and Minority-Serving Institutions (MSIs) to training S&T innovators to become entrepreneurs in I-Corps™, these initiatives stimulate local economies, create high-quality jobs, and reinvigorate regions of the country left behind for too long.

Address climate change

In 2023, for the first time, global warming exceeded 1.5°C for an entire year. It is likely that all 12 months of 2024 will also exceed 1.5°C above pre-industrial temperatures. Nationally and internationally, we are experiencing the effects of climate change; climate mitigation, adaptation, and resilience solutions are urgently needed and will bring outsized economic and social impact.

Improve U.S. health outcomes

The COVID-19 pandemic was devastating, particularly impacting underserved and underrepresented populations, but it spurred unprecedented medical innovation and commercialization of new diagnostics, vaccines, and treatments. We must build on this momentum by applying what we’ve learned about rapid innovation to continue to improve U.S. health outcomes and to ensure that our nation’s health care needs across regions and demographics are addressed.

Make innovation more inclusive

Representational disparities persist across racial/ethnic and gender lines in both access to and participation in innovation and entrepreneurship. This is a massive loss for our innovation economy. The business case for broader inclusion and diversity is growing even stronger, with compelling data tracking the relationship between leadership diversity and company performance. Inclusive innovation is more effective innovation: a multitude of perspectives and lived experiences are required to fully understand complex problems and create truly useful solutions. To reap the full benefits of innovation and entrepreneurship, we must increase access and pathways for all.

Opportunity

With the new presidential administration in 2025, the federal government has a renewed opportunity to prioritize policies that will generate and activate a wave of powerful, inclusive innovation and entrepreneurship. Implementing such policies and funding the initiatives that result is crucial if we as a nation are to successfully address urgent problems such as the climate crisis and escalating health disparities.

Our proposed action steps are predicated on three core principles: inclusion, relevance, and sustainability.

Inclusion

One of this nation’s greatest and most unique strengths is our heterogeneity. We must leverage our diversity to meet the complexity of the substantial social and economic challenges that we face today. The multiplicity of our people, communities, identities, geographies, and lived experiences gives the U.S. an edge in the global innovation economy: When we bring all of these perspectives to the table, we better understand the challenges that we face, and we are better equipped to innovate to meet them. If we are to harness the fullness of our nation’s capacity for imagination, ingenuity, and creative problem-solving, entrepreneurship pathways must be inclusive, equitable, and accessible to all. Moreover, all innovators must learn to embrace complexity, think expansively and critically, and welcome perspectives beyond their own frame of reference. Collaboration and mutually beneficial partnerships are at the heart of inclusive innovation.

Relevance

Innovators and entrepreneurs have the greatest likelihood of success—and the greatest potential for impact—when their work is purpose-driven, nimble, responsive to consumer needs, and adaptable to different applications and settings. Research suggests that “breakthrough innovation” occurs when different actors bring complementary and independent skills to co-create interesting solutions to existing problems. Place-based innovation is one strategy to make certain that technology development is grounded in regional concerns and aspirations, leading to better outcomes for all concerned.

Sustainability

Multiple layers of sustainability should be integrated into the innovation and entrepreneurship landscape. First and most salient is supporting the development of innovative technologies that respond to the climate crisis and bolster national resilience. Second is encouraging innovators to incorporate sustainable materials and processes in all stages of research and development so that products benefit the planet and risks to the environment are mitigated through the manufacturing process, whether or not climate change is the focus of the technology. Third, it is vital to prioritize helping ventures develop sustainable business models that will result in long-term viability in the marketplace. Fourth, working with innovators to incorporate the potential impact of climate change into their business planning and projections ensures they are equipped to adapt to changing needs. All of these layers contribute to sustaining America’s social well-being and economic prosperity, ensuring that technological breakthroughs are accessible to all.

Proposed Action

Recommendation 1. Supply and prepare talent.

Continuing to grow the nation’s pipeline of S&T innovators and entrepreneurs is essential. Specifically, creating accessible entrepreneurial pathways in STEM will ensure equitable participation. Incentivizing individuals to become innovators-entrepreneurs, especially those from underrepresented groups, will strengthen national competitiveness by leveraging new, untapped potential across innovation ecosystems.

Expand the I-Corps model

By bringing together experienced industry mentors, commercial experts, research talent, and promising technologies, I-Corps teaches scientific innovators how to evaluate whether their innovation can be commercialized and how to take the first practical steps of bringing their product to market. Ten new I-Corps Hubs, launched in 2022, have expanded the network of engaged universities and collaborators, an important step toward growing an inclusive innovation ecosystem across the U.S.

Interest in I-Corps far outpaces current capacity, and increasing access will create more expansive pathways for underrepresented entrepreneurs. New federal initiatives to support place-based innovation and to grow investment at ERIs and MSIs will be more successful if they also include lab-to-market training programs such as I-Corps. Federal entities should institute policies and programs that increase awareness about and access to sequenced venture support opportunities for S&T innovators. These opportunities should include intentional “de-risking” strategies through training, advising, and mentoring.

Specifically, we recommend expanding I-Corps capacity so that all interested participants can be accommodated. We should also strive to increase access to I-Corps so that programs reach diverse students and researchers. This is essential given the U.S. culture of entrepreneurship that remains insufficiently inclusive of women, people of color, and those from low-income backgrounds, as well as international students and researchers, who often face barriers such as visa issues or a lack of institutional support needed to remain in the U.S. to develop their innovations. Finally, we should expand the scope of what I-Corps offers, so that programs provide follow-on support, funding, and access to mentor and investor networks even beyond the conclusion of initial entrepreneurial training.

I-Corps has already expanded beyond the National Science Foundation (NSF) to I-Corps at National Institutes of Health (NIH), to empower biomedical entrepreneurs, and Energy I-Corps, established by the Department of Energy (DOE) to accelerate the deployment of energy technologies. We see the opportunity to grow I-Corps further by building on this existing infrastructure and creating cohorts funded by additional science agencies so that more basic research is translated into commercially viable businesses.

Close opportunity gaps by supporting emerging research institutions (ERIs) and Minority-Serving Institutions (MSIs)

ERIs and MSIs provide pathways to S&T innovation and entrepreneurship, especially for individuals from underrepresented groups. In particular, a VentureWell-commissioned report identified that “MSIs are centers of research that address the unique challenges and opportunities faced by BIPOC communities. The research that takes place at MSIs offers solutions that benefit a broad and diverse audience; it contributes to a deeper understanding of societal issues and drives innovation that addresses these issues.”

The recent codification of ERIs in the 2022 CHIPS and Science Act pulls this category into focus. Defining this group, which comprises thousands of higher education institutions, was the first step in addressing the inequitable distribution of federal research funding. That imbalance has perpetuated regional disparities and impacted students from underrepresented groups, low-income students, and rural students in particular. Further investment in ERIs will result in more STEM-trained students, who can become innovators and entrepreneurs with training and engagement. Additional support that could be provided to ERIs includes increased research funding, access to capital/investment, capacity building (faculty development, student support services), industry partnerships, access to networks, data collection/benchmarking, and implementing effective translation policies, incentives, and curricula.

Supporting these institutions—many of which are located in underserved rural or urban communities that experience underinvestment—provides an anchor for sustained talent development and economic growth.

Recommendation 2. Support place-based innovation.

Place-based innovation not only spurs innovation but also builds resilience in vulnerable communities, enhancing both U.S. economic and national security. Communities that are underserved and underinvested in present vulnerabilities that hostile actors outside of the U.S. can exploit. Place-based innovation builds resilience: innovation creates high-quality jobs and brings energy and hope to communities that have been left behind, leveraging the unique strengths, ecosystems, assets, and needs of specific regions to drive economic growth and address local challenges.

Evaluate and learn from transformative new investments

There have been historic levels of government investment in place-based innovation, funding the NSF’s Regional Innovation Engines awards and two U.S. Department of Commerce Economic Development Administration (EDA) programs: the Build Back Better Regional Challenge and Regional Technology and Innovation Hubs awards. The next steps are to refine, improve, and evaluate these initiatives as we move forward.

Unify the evaluation framework, paired with local solutions

Currently, evaluating the effectiveness and outcomes of place-based initiatives is challenging, as benchmarks and metrics can vary by region. We propose a unified framework paired with solutions locally identified by and tailored to the specific needs of the regional innovation ecosystem. A functioning ecosystem cannot be simply overlaid upon a community but must be built by and for that community. The success of these initiatives requires active evaluation and incorporation of these learnings into effective solutions, as well as deep strategic collaboration at the local level, with support and time built into processes.

Recommendation 3. Increase access to financing and capital.

Funding is the lifeblood of innovation. S&T innovation requires more investment and more time to bring to market than other types of ventures, and early-stage investments in S&T startups are often perceived as risky by those who seek a financial return. Bringing large quantities of early-stage S&T innovations to the point in the commercialization process where substantial private capital takes an interest requires nondilutive and patient government support. The return on investment that the federal government seeks is measured in companies successfully launched, jobs created, and useful technologies brought to market.

Disparities in access to capital by companies owned by women and underrepresented minority founders are well documented. The federal government has an interest in funding innovators and entrepreneurs from many backgrounds: they bring deep and varied knowledge and a multitude of perspectives to their innovations and to their ventures. This results in improved solutions and better products at a cheaper price for consumers. Increasing access to financing and capital is essential to our national economic well-being and to our efforts to build climate resilience.

Expand SBIR/STTR access and commercial impact

The SBIR and STTR programs spur innovation, bolster U.S. economic competitiveness, and strengthen the small business sector, but barriers persist. In a recent third-party assessment of the SBIR/STTR program at NIH, the second largest administrator of SBIR/STTR funds, the committee found outreach from the SBIR/STTR programs to underserved groups is not coordinated, and there has been little improvement in the share of applications from or awards to these groups in the past 20 years. Further, NIH follows the same processes used for awarding R01 research grants, using the same review criteria and typically the same reviewers, omitting important commercialization considerations.

To expand access and increase the commercialization potential of the SBIR/STTR program, funding agencies should foster partnerships with a broader group of organizations, conduct targeted outreach to potential applicants, offer additional application assistance to potential applicants, work with partners to develop mentorship and entrepreneur training programs, and increase the percentage of private-sector reviewers with entrepreneurial experience. Successful example programs of SBIR/STTR support programs include the NSF Beat-The-Odds Boot Camp, Michigan’s Emerging Technologies Fund, and the SBIR/STTR Innovation Summit.

Provide entrepreneurship education and training

Initiatives like NSF Engines, Tech Hubs, Build-Back-Better Regional Challenge, the Minority Business Development Agency (MBDA) Capital Challenge, and the Small Business Administration (SBA) Growth Accelerator Fund expansion will all achieve more substantial results with supplemental training for participants in how to develop and launch a technology-based business. As an example of the potential impact, more than 2,500 teams have participated in I-Corps since the program’s inception in 2012. More than half of these teams, nearly 1,400, have launched startups that have cumulatively raised $3.16 billion in subsequent funding, creating over 11,000 jobs. Now is an opportune moment to widely apply similarly effective approaches.

Launch a local investment education initiative

Angel investors are typically providing the first private funding available to S&T innovators and entrepreneurs. These very early-stage funders give innovators access to needed capital, networks, and advice to get their ventures off the ground. We recommend that the federal government expand the definition of an accredited investor and incentivize regionally focused initiatives to educate policymakers and other regional stakeholders about best practices to foster more diverse and inclusive angel investment networks. With the right approach and support, there is the potential to engage thousands more high-net-worth individuals in early-stage investing, contributing their expertise and networks as well as their wealth.

Encourage investment in climate solutions

Extreme climate-change-attributed weather events such as floods, hurricanes, drought, wildfire, and heat waves cost the global economy an average of $143 billion annually. S&T innovations have the potential to help address the impacts of climate change at every level:

- Mitigation. Promising new ideas and technologies can slow or even prevent further climate change by reducing or removing greenhouse gasses.

- Adaptation. We can adapt processes and systems to better respond to adverse events, reducing the impacts of climate change.

- Resilience. By anticipating, preparing for, and responding to hazardous events, trends, or disturbances caused by climate change, we can continue to thrive on our changing planet.

Given the global scope of the problem and the shared resources of affected communities, the federal government can be a leader in prioritizing, collaborating, and investing in solutions to direct and encourage S&T innovation for climate solutions. There is no question whether climate adaptation technologies will be needed, but we must ensure that these solutions are technologies that create economic opportunity in the U.S. We encourage the expansion and regular appropriations of funding for successful climate programs across federal agencies, including the DoE Office of Technology Transitions’ Energy Program for Innovation Clusters, the National Oceanic and Atmospheric Administration’s (NOAA) Ocean-Based Climate Resilience Accelerators program, and the U.S. Department of Agriculture’s Climate Hubs.

Recommendation 4. Shift to a systems change orientation.