Environmental Data in the Inflation Reduction Act

“It is a capital mistake,” Sherlock Holmes once observed, “to theorize before one has data.” In the Inflation Reduction Act, fortunately, Congress avoided making that capital mistake a Capitol one.

Tax credits and other incentives for clean energy, clean manufacturing, and clean transportation dominate the IRA’s environmental spending. But the bill also makes key investments in environmental data. This is important because data directly informs how efficiently dollars are spent. (You could have avoided wasting money on that extra jug of olive oil if you’d just had better data at hand on the contents of your pantry.)

The IRA’s environmental-data investments can be broken down into three categories: investments in specific datasets, investments in specific data infrastructure, and general support for data-related activities. Let’s take a closer look at each of these and why they matter.

Investments in specific datasets

The IRA appropriates $850 million (over six years) for the Environmental Protection Agency (EPA) to create incentives for methane mitigation and monitoring. The IRA directs EPA to use some of the funds to “prepare inventories, gather empirical data, and track emissions” related to the incentive program. This information will allow EPA (and third parties) to evaluate the program’s success, which could be very powerful indeed. Because methane is such a potent and short-lived greenhouse gas (with a 20-year global warming potential that is more than 70 times greater than that of carbon dioxide), scientists agree that cutting methane emissions quickly is one of the best opportunities for reducing near-term global warming. Understanding whether and which incentives spur significant methane mitigation would therefore help policymakers decide if and where to double down on mitigation incentives moving forward.

The IRA appropriates $1.3 billion (over nine years) for the U.S. Department of Agriculture’s Natural Resources Conservation Service (NRCS) to provide conservation technical assistance to farmers and ranchers—and to quantify the climate benefits. NRCS was established in 1935 to help farmers and ranchers conserve land, soil, water, and other key agricultural resources. The IRA boosts NRCS’s funding by an additional $1 billion over nine years. But it also kicks in an additional $300 million for NRCS to collect and use field-based data to quantify how much NRCS-based efforts sequester carbon and slash greenhouse-gas emissions. Insights could boost national support for practices like regenerative agriculture, incorporation of ecosystem services into agricultural cost-benefit analyses, and good soil stewardship.

The IRA appropriates $42.5 million (over six years) for the Department of Housing and Urban Development (HUD) to conduct energy and water benchmarking studies. Utility benchmarking helps property managers understand how efficient a given building is relative to other, similar buildings. Benchmarking results guide investments into upgrades. For instance, a property manager with $100,000 to spend may wisely decide to spend that money on “low-hanging fruit” fixes (such as replacing old lightbulbs, or installing weatherstripping around doors and windows) at their least-efficient properties instead of investing in upgrades at more-efficient properties that will yield only marginal portfolio improvements. The IRA funds collection of data to expand utility benchmarking across HUD-supported housing.

The IRA appropriates $32.5 million (over four years) to the White House Council on Environmental Quality (CEQ) to collect data on which communities are disproportionately harmed by negative environmental impacts, and to develop related decision-support tools. This component of the IRA directly supports the Biden administration’s Justice40 Initiative. Justice40 establishes a national goal of ensuring that so-called “environmental justice communities” realize at least 40% of the benefits of certain federal investments. But as an executive-led initiative, Justice40 can only direct existing federal funds—it can’t bring in additional money. While advocates have argued that the IRA does not go far enough in bolstering environmental justice, designating new funding for the White House to realize Justice40 objectives is undoubtedly a step in the right direction.

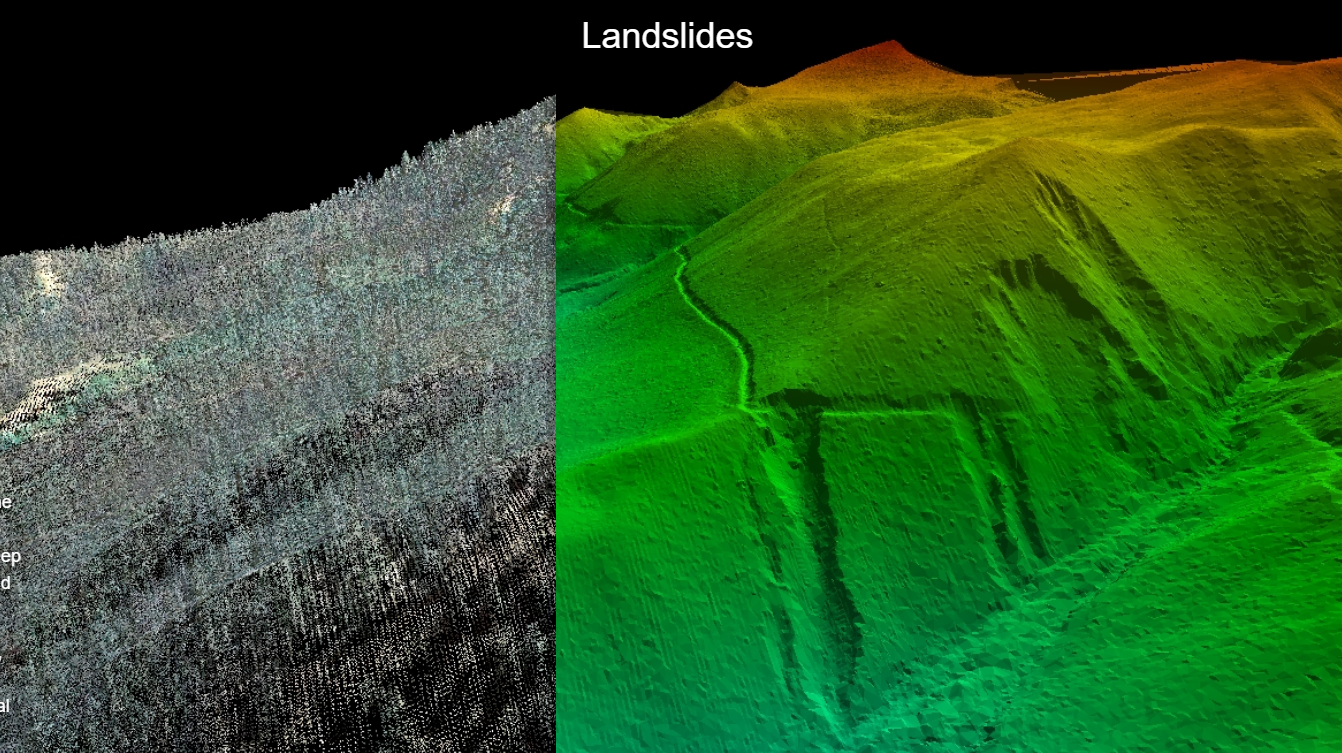

The IRA appropriates $25.5 million for the U.S. Geological Survey to “produce, collect, disseminate, and use 3D elevation data.” There’s no other way to say it: 3D elevation data are cool. These data, collected by aircraft-mounted sensors, can be stitched together to produce models of our world underneath surface features like trees and buildings. These models support everything from landslide prediction (see box) to flood-risk assessment. IRA funds USGS in continuing to fill gaps in the 3D elevation data available for the United States. Example of a model constructed using 3D elevation data. Clouds of data points (left) can be stitched into 3D elevation models (right) that, for instance, reveal past landslides and steep slopes at risk of failure. These features could be impossible to identify through aerial images that also capture surface features. (Source: USGS.)

Clouds of data points (left) can be stitched into 3D elevation models (right) that, for instance, reveal past landslides and steep slopes at risk of failure. These features could be impossible to identify through aerial images that also capture surface features. (Source: USGS).

The IRA appropriates $5 million (over four years) for EPA to collect and analyze lifecycle fuels data. The diversifying U.S. energy system is triggering heated debates over the pros and cons of different fuels. Hydrogen-powered cars produce zero emissions at the tailpipe, yes. But given the carbon and energy footprints of generating fuel-grade hydrogen on the front end, are hydrogen cars really cleaner than their gas/electric hybrid counterparts? Biofuels are all renewable by definition, but certainly not all created equal. The IRA enables the EPA to empirically contribute to these debates.

Investments in specific data infrastructure

The IRA appropriates $190 million (over four years) for the National Oceanic and Atmospheric Administration (NOAA) to invest in high-performance computing and data management. This funding responds to concerns raised by NOAA’s Science Advisory Board that NOAA lacks the technical capacity to continue to advance U.S. weather research. The Board argued that this need is especially acute with regard to understanding and predicting high-impact weather amid rapidly changing climate, population, and development trends.

The IRA appropriates $18 million (over nine years) for EPA to update its Integrated Compliance Information System (ICIS). ICIS is EPA’s principal compliance and enforcement data system, including for regulatory pillars such as the Clean Air Act and Clean Water Act. While an outdated data-management system is hardly the primary reason why violations of U.S. environmental laws are rampant (a near 30% erosion of funding for EPA’s compliance office over the past decade is a bigger problem), it certainly doesn’t help. The IRA will enhance EPA’s efforts to operationalize an existing plan for modernizing the ICIS.

The IRA directs the Secretary of Energy to “develop and publish guidelines for States relating to residential electric and natural gas energy data sharing.” While not an investment per se, this brief provision nevertheless merits mention. The IRA channels funds through the Department of Energy (DOE) to state energy offices for new rebate programs that reward homeowners making energy-efficiency house retrofits. The IRA directs the Secretary of Energy to establish guidelines for sharing data related to these programs. Proactively developing such guidelines will be useful both for facilitating productive data exchange (e.g., among those trying to understand how widespread efficiency upgrades affect energy demand) as well as for forestalling adverse effects (e.g., cyberattacks from bad actors exploiting grid vulnerabilities).

General support for data-related activities

In addition to the specific investments outlined above, the IRA appropriates (over the next nine years) $150 million, $115 million, $100 million, and $40 million, respectively, to the Department of the Interior, the Department of Energy, the Federal Energy Regulatory Commission, and the Environmental Protection Agency for activities including “the development of environmental data or information systems.”

This broad language gives agencies latitude to allocate resources as needs arise. It also underscores the fact that multiple agencies have pressing environmental-data and -technology needs, many of which overlap. The federal government should therefore consider creating a centralized entity—a Digital Service for the Planet—“with the expertise and mission to coordinate environmental data and technology across agencies.”

The hundreds of millions of dollars that the IRA invests in environmental-data collection and analysis will serve as critical scaffolding to efficiently guide federal spending on environmental initiatives in the coming years—spending that is poised to massively increase in years to come due to the IRA as well as other key recent and pending legislative packages (including the Infrastructure Investment and Jobs Act, the CHIPS and Science Act if authorized funds are appropriated, and the Recovering America’s Wildlife Act that has a strong chance of passing this Congress). The foundation for data-driven change has been laid. The game is officially afoot.

How DOE can emerge from political upheaval achieve the real-world change needed to address the interlocking crises of energy affordability, U.S. competitiveness, and climate change.

As Congress begins the FY27 appropriations process this month, congress members should turn their eyes towards rebuilding DOE’s programs and strengthening U.S. energy innovation and reindustrialization.

Politically motivated award cancellations and the delayed distribution of obligated funds have broken the hard-earned trust of the private sector, state and local governments, and community organizations.

Over the course of 2025, the second Trump administration has overseen a major loss in staff at DOE, but these changes will not deliver the energy and innovation impacts that this administration, or any administration, wants.