Goodbye IRS Direct File, Hello Inefficiency

Decision to Sunset IRS’ Direct File Previews Worse Taxpayer Experience in 2026

Yesterday, tens of thousands of taxpayers filed their returns using IRS Direct File, the agency’s new free, public, online tax filing service now in its second filing season. They joined hundreds of thousands who have used the service, and who have been nearly-unanimously thrilled to fulfill their tax obligations easily and directly. It seems we have finally done the impossible: make Tax Day anything but the most dreaded day of the year. At least we did.

Today, the Associated Press reported that the Treasury Department will discontinue the program. “Cutting costs and saving money for families were just empty campaign promises,” says Adam Ruben, a vice president at the Economic Security Project of the administration’s decision to end the program.

I was an original architect of Direct File from 2021 until just a few months ago, and got to see its impact on government and on taxpayers directly. Make no mistake: Direct File is a shining example of government capacity and government efficiency. By providing a critical government service for free, and helping taxpayers file more timely and more accurate returns, it is projected to eventually generate $11 billion in net savings for taxpayers every year.

The dismantling of the program is not, at all, a step toward government efficiency. This is a move that will degrade our government services, incurring massive costs for people trying to file their taxes, further damaging the capacity of the nation’s revenue-collection agency, and making our institutions less robust and less capable.

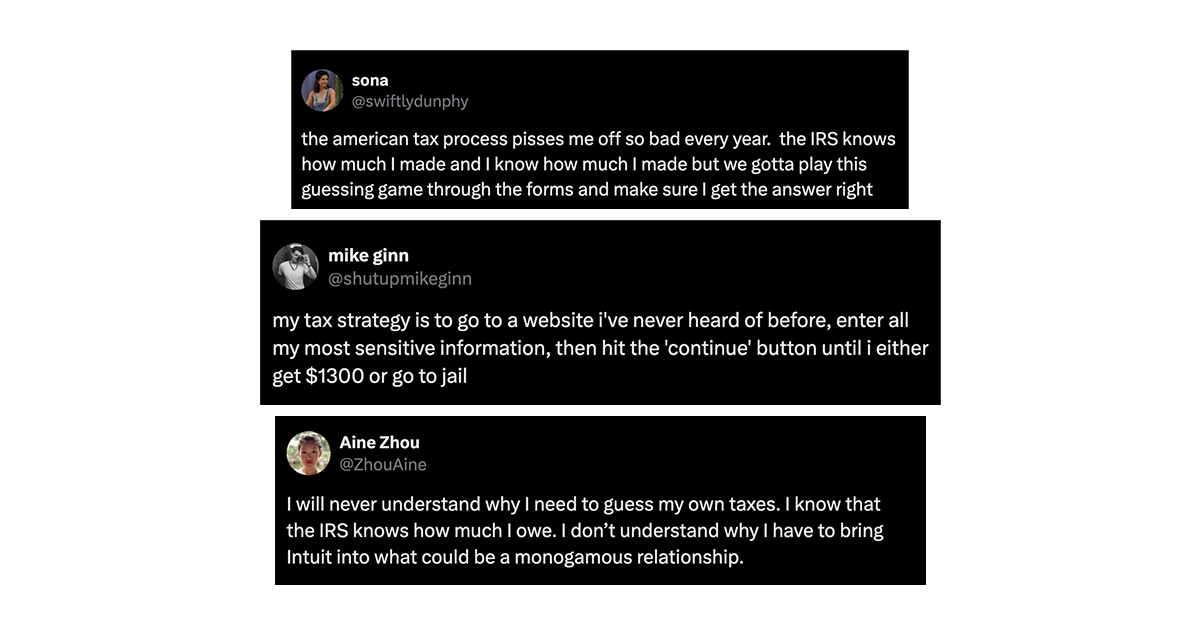

It’s no secret: Americans do not love tax season.

The Direct File story started for me, personally, when I moved back to the U.S. after living in London for 9 years. I had already spent years working in digital services: I had built the first in-house digital team at the brand-new Consumer Financial Protection Bureau in 2010, and then worked on multiple projects in London, culminating in helping the London Borough of Camden digitally transform its entire operations practically overnight during the pandemic. I moved back to the States and joined the US Digital Service to help rebuild after Covid, bringing the lessons I had learned from the UK. My first project at USDS was leading our efforts on Child Tax Credit expansion — ensuring that families across the country could access the enormous new child benefit that was created in the March 2021 American Rescue Plan.

But there was a problem: families naturally had to file a tax return to claim their tax credit. And I was pretty surprised to learn that our government still did not, in 2021, offer a free, online way to file your taxes directly with the government. Around the world, tax collection is seen as an inherent government function and, as such, tax filing is a service that the government offers free of charge. I thought we should too, especially if we were going to make such critical social supports contingent on it during a crisis.

Instead, in the U.S., we relied on a confusing — and sometimes costly — mishmash of private offerings and support from non-profits designed to ensure most people could maybe, sort of, file a return for free if they needed to. It made the barrier to entry high, both in terms of trying to navigate how to simply file a return, nevermind to do so without cost. Tax filing, I thought, is a core function of government, and making it free and easy to use would cut through this waste and deliver for the American people.

I wasn’t the only one who thought this way. By 2021, a free public filing service was already the “white whale” of civic tech; everyone knew this was the critical government function to bring into a modern digital product, and yet it was too big, too daunting, too much of a change. Honestly, never in a million years did I think we would pull it off, either. The IRS, for all its genuine accomplishments in the face of constantly shrinking budgets and aging technology, had no real experience launching an enormous, high-stakes tech product designed to simplify the mind-numbing complexities of an American tax return. This was government capacity we would have to create.

But, we did. Since Direct File launched as a pilot in March 2023, hundreds of thousands of people have now filed their returns with it, to stunning results. In its pilot year, 86% of users said that Direct File increased their trust in the IRS. In its second year, it is winning awards and killing it with users, with a Net Promoter Score in the +80s, up from +74 last year (Apple’s, which is considered astronomically high, is +72). Direct File is a wildly successful government startup. Not only that, but the IRS now has its own in-house capacity to continue building awesome digital experiences — capacity that could have gone toward cost savings and experience improvements in all matter of IRS operations. This is all capacity, needless to say, that has gone away, all in the name of “efficiency.”

The impact for taxpayers from Direct File alone are, and would have been, enormous. In the U.S., the IRS estimates that it takes the average person over 9 hours and costs $160 to file your taxes each year. We even heard anecdotally from Direct File users who had paid thousands of dollars to do what Direct File does for free. There also remain millions of households who, every year, don’t file their returns at all, leaving sizable refunds on the table, because they can’t navigate the confusing tax filing “offers” advertising tax filing services. These households would have stood to finally access billions of dollars they leave unclaimed every year.

Not only are taxpayers saving these hundreds of dollars, they also feel newly empowered to interact with their government and take control of their tax situations. For decades, Americans have been told that they are not smart enough to do your own taxes; only highly-paid specialists that you have to pay for, can do it for you. Direct File stripped away the noise and showed taxpayers that filing can be simple and easy. The valuable trust this creates in government and public institutions is impossible to quantify.

Finally, there is the issue of data privacy and security. Taxpayers filing via private services must expose their most sensitive personal and financial information to third parties that monetize their data, sometimes illegally and without taxpayers’ consent. Without a public filing option, taxpayers are more or less required to sacrifice their privacy and the security of their data just to fulfill their filing obligations. Direct File gives taxpayers the option to protect their data and provide it straight to the tax agency, without a middleman.

All this — the in-house capacity to modernize the IRS, billions of dollars in cost savings, an empowered public — is what is cancelled today. But they have it exactly backwards. It’s a functional, high-quality government that’s efficient. The chaos they are sowing is anything but.

In a year when management issues like human capital, IT modernization, and improper payments have received greater attention from the public, examining this PMA tells us a lot about where the Administration’s policy is going to be focused through its last three years.

Congress must enact a Digital Public Infrastructure Act, a recognition that the government’s most fundamental responsibility in the digital era is to provide a solid, trustworthy foundation upon which people, businesses, and communities can build.

To increase the real and perceived benefit of research funding, funding agencies should develop challenge goals for their extramural research programs focused on the impact portion of their mission.

Americans trade stocks instantly, but spend 13 hours on tax forms. They send cash by text, but wait weeks for IRS responses. The nation’s revenue collector ranks dead last in citizen satisfaction. The problem isn’t just paperwork — it’s how the government builds.