Antitrust in the AI Era: Strengthening Enforcement Against Emerging Anticompetitive Behavior

The advent of artificial intelligence (AI) has revolutionized business practices, enabling companies to process vast amounts of data and automate complex tasks in ways previously unimaginable. However, while AI has gained much praise for its capabilities, it has also raised various antitrust concerns. Among the most pressing is the potential for AI to be used in an anticompetitive manner. This includes algorithms that facilitate price-fixing, predatory pricing, and discriminatory pricing (harming the consumer market), as well as those which enable the manipulation of wages and worker mobility (harming the labor market). More troubling perhaps is the fact that the overwhelming majority of the AI landscape is controlled by just a few market players. These tech giants—some of the world’s most powerful corporations—have established a near-monopoly over the development and deployment of AI. Their dominance over necessary infrastructure and resources makes it increasingly challenging for smaller firms to compete.

While the antitrust enforcement agencies—the FTC and DOJ—have recently begun to investigate these issues, they are likely only scratching the surface. The covert and complex nature of AI makes it difficult to detect when it is being used in an anticompetitive manner. To ensure that business practices remain competitive in the era of AI, the enforcement agencies must be adequately equipped with the appropriate strategies and resources. The best way to achieve this is to (1) require the disclosure of AI technologies during the merger-review process and (2) reinforce the enforcement agencies’ technical strategy in assessing and mitigating anticompetitive AI practices.

Challenge & Opportunity

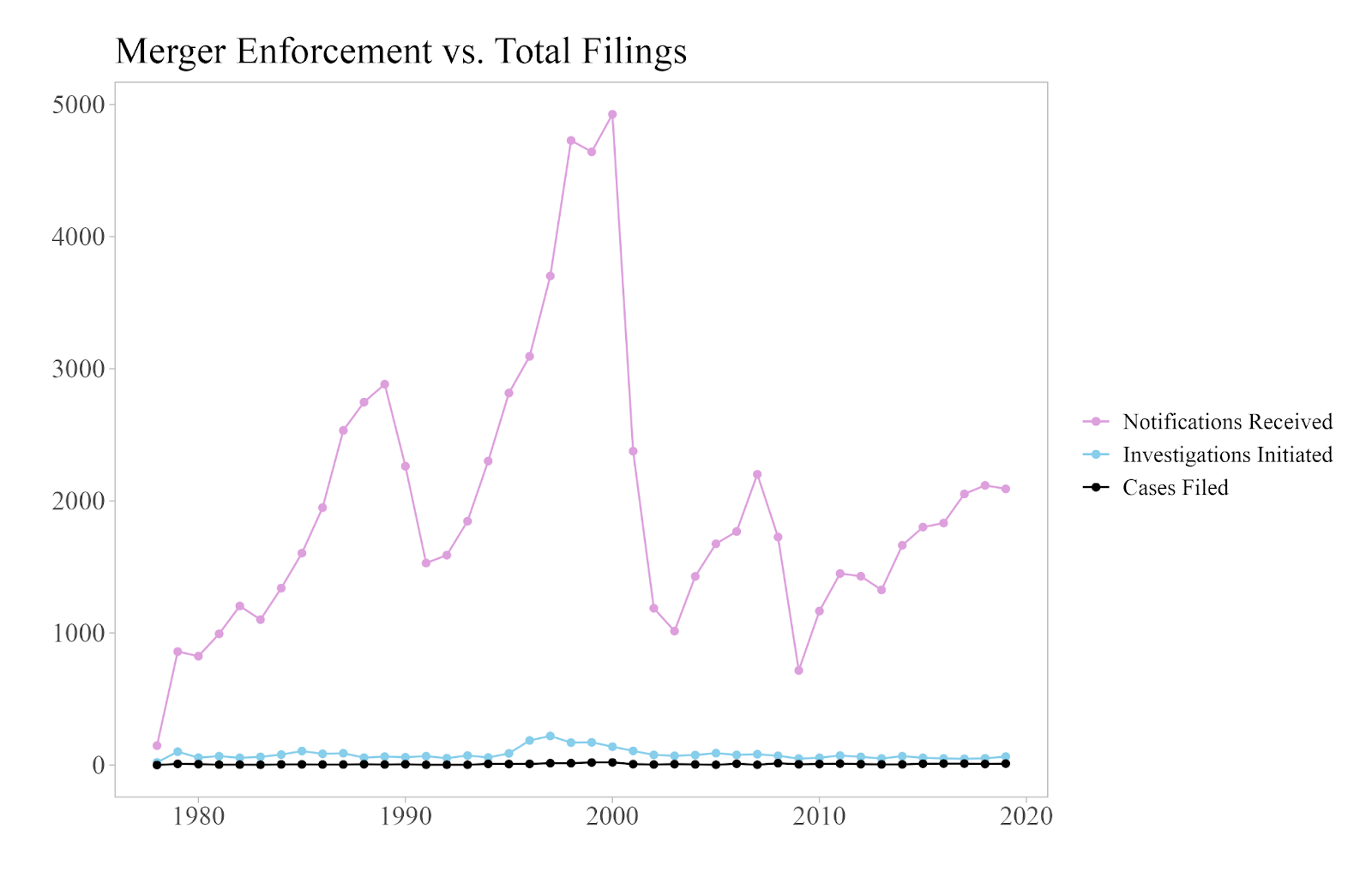

Since the late 1970s, antitrust enforcement has been in decline, in part due to a more relaxed antitrust approach put forth by the Chicago school of economics. Both the budgets and the number of full-time employees at the enforcement agencies have steadily decreased, while the volume of permitted mergers and acquisitions has risen (see Figure 1). This resource gap has limited the ability of the agencies to effectively oversee and regulate anticompetitive practices.

Changing attitudes surrounding big business, as well as recent shifts in leadership at the enforcement agencies—most notably President Biden’s appointment of Lina Khan to FTC Chair—have signaled a more aggressive approach to antitrust law. But even with this renewed focus, the agencies are still not operating at their full potential.

This landscape provides a significant opportunity to make some much-needed changes. Two areas for improvement stand out. First, agencies can make use of the merger review process to aid in the detection of anticompetitive AI practices. In particular, the agencies should be on the look-out for algorithms that facilitate price-fixing, where competitors use AI to monitor and adjust prices automatically, covertly allowing for tacit collusion; predatory pricing algorithms, which enable firms to undercut competitors only to later raise prices once dominance is achieved; and dynamic pricing algorithms, which allow firms to discriminate against different consumer groups, resulting in price disparities that may distort market competition. On the labor side, agencies should screen for wage-fixing algorithms and other data-driven hiring practices that may suppress wages and limit job mobility. Requiring companies to disclose the use of such AI technologies during merger assessments would allow regulators to examine and identify problematic practices early on. This is especially useful for flagging companies with a history of anticompetitive behavior or those involved in large transactions, where the use of AI could have the strongest anticompetitive effects.

Second, agencies can use AI to combat AI. Research has demonstrated that AI can be more effective in detecting anticompetitive behavior than other traditional methods. Leveraging such technology could transform enforcement capabilities by allowing agencies to cover more ground despite limited resources. While increasing funding for these agencies would be requisite, AI nonetheless provides a cost-effective solution, enhancing efficiency in detecting anticompetitive practices, without requiring massive budget increases.

The success of these recommendations hinges on the enforcement agencies employing technologists who have a deep understanding of AI. Their knowledge on algorithm functionality, the latest insights in AI, and the interplay between big data and anticompetitive behavior is instrumental. A detailed discussion of the need for AI expertise is covered in the following section.

Plan Of Action

Recommendation 1. Require Disclosure of AI Technologies During Merger-Review.

Currently, there is no formal requirement in the merger review process that mandates the reporting of AI technologies. This lack of transparency allows companies to withhold critical information that may help agencies determine potential anticompetitive effects. To effectively safeguard competition, it is essential that the FTC and DOJ have full visibility of businesses’ technologies, particularly those that may impact market dynamics. While the agencies can request information on certain technologies further in the review process, typically during the second request phase, a formalized reporting requirement would provide a more proactive approach. Such an approach would be beneficial for several reasons. First, it would enable the agencies to identify anticompetitive technologies they might have otherwise overlooked. Second, an early assessment would allow the agencies to detect and mitigate risk upfront, rather than having to address it post-merger or further along in the merger review process, when remedies may be more difficult to enforce. This is particularly applicable with regard to deep integrations that often occur between digital products post-merger. For instance, the merger of Instagram and Facebook complicated the FTC’s subsequent efforts to challenge Meta. As Dmitry Borodaenko, a former Facebook engineer, explained:

“Instagram is no longer viable outside of Facebook’s infrastructure. Over the course of six years, they integrated deeply… Undoing this would not be a simple task—it would take years, not just the click of a button.”

Lastly, given the rapidly evolving nature of AI, this requirement would help the agencies identify trends and better determine which technologies are harmful to competition, under what circumstances, and in which industries. Insights gained from one sector could inform investigations in other sectors, where similar technologies are being deployed. For example, the DOJ recently filed suit against RealPage, a property management software company, for allegedly using price-fixing algorithms to coordinate rent increases among competing landlords. The case is the first of its kind, as there had not been any previous lawsuit addressing price-fixing in the rental market. With this insight, however, if the agencies detect similar algorithms during the merger review process, they would be better equipped to intervene and prevent such practices.

There are several ways the government could implement this recommendation. To start, The FTC and DOJ should issue interpretive guidelines specifying that anticompetitive effects stemming from AI technologies are within the purview of the Hart-Scott-Rodino (HSR) Act, and that accordingly, such technologies should be disclosed in the pre-merger notification process. In particular, the agencies should instruct companies to report detailed descriptions of all AI technologies in use, how they might change post-merger, and their potential impact on competition metrics (e.g., price, market share). This would serve as a key step in signaling to companies that AI considerations are integral during merger review. Building on this, Congress could pass legislation mandating AI disclosures, thereby formalizing the requirement. Ultimately, in a future round of HSR revisions, the agencies could incorporate this mandate as a binding rule within the pre-merger framework. To avoid unnecessary burden on businesses, reporting should only be required when AI plays a significant role in the company’s operations or is expected to post-merger. What constitutes a ‘significant role’ should be left to the discretion of the agencies but could include AI systems central to core functions such as pricing, customer targeting, wage-setting, or automation of critical processes.

Recommendation 2. Reinforce the FTC and DOJ’s Technical Strategy in Assessing and Mitigating Anticompetitive AI Practices.

Strengthening the agencies’ ability to address AI requires two actions: integrating computational antitrust strategies and increasing technical expertise. A wave of recent research has highlighted AI as a powerful tool in helping detect anticompetitive behavior. For instance, scholars at the Stanford Computational Antitrust Project have demonstrated that methods such as machine learning, natural language processing, and network analysis can assist with tasks, ranging from uncovering collusion between firms to distinguishing digital markets. While the DOJ has already partnered with the Project, the FTC could benefit by pursuing a similar collaboration. More broadly, the agencies should deepen their technical expertise by expanding workshops and training with AI academic leaders. Doing so would not only provide them with access to the most sophisticated techniques in the field, but would also help bridge the gap between academic research and real-world implementation. Examples may include the use of machine learning algorithms to identify price-fixing and wage-setting; sentiment analysis, topic modeling, and other natural language processing tools to detect intention to collude in firm communications; or reverse-engineering algorithms to predict outcomes of AI-driven market manipulation.

Leveraging such computational strategies would enable regulators to analyze complex market data more effectively, enhancing the efficiency and precision of antitrust investigations. Given AI’s immense power, only a small—but highly skilled—team is needed to make significant progress. For instance, the UK’s Competition and Markets Authority (CMA) recently stood up a Data, Technology and Analytics unit, whereby they implement machine learning strategies to investigate various antitrust matters. For the U.S. agencies to facilitate this, the DOJ and FTC should hire more ML/AI experts, data scientists, and technologists, who could serve several key functions. First, they could conduct research on the most effective methods for detecting collusion and anticompetitive behavior in both digital and non-digital markets. Second, based on such research, they could guide the implementation of selected AI solutions in investigations and policy development. Third, they could perform assessments of AI technologies, evaluating the potential risks and benefits of AI applications in specific markets and companies. These assessments would be particularly useful during merger review, as previously discussed in Recommendation 1. Finally, they could help establish guidelines for transparency and accountability, ensuring the responsible and ethical use of AI both within the agencies and across the markets they regulate.

To formalize this recommendation, the President should submit a budget proposal to Congress requesting increased funding for the FTC and DOJ to (1) hire technology/AI experts and (2) provide necessary training for other selected employees on AI algorithms and datasets. The FTC may separately consider using its 6(b) subpoena powers to conduct a comprehensive study of the AI industry or of the use of AI practices more generally (e.g., to set prices or wages). Finally, the agencies should strive to foster collaboration between each other (e.g., establishing a Joint DOJ-FTC Computational Task Force), as well as with those in academia and the private sector, to ensure that enforcement strategies remain at the cutting edge of AI advancements.

Conclusion

The nation is in the midst of an AI revolution, and with it comes new avenues for anticompetitive behavior. As it stands, the antitrust enforcement agencies lack the necessary tools to adequately address this growing threat.

However, this environment also presents a pivotal opportunity for modernization. By requiring the disclosure of AI technologies during the merger review process, and by reinforcing the technical strategy at the FTC and DOJ, the antitrust agencies can strengthen their ability to detect and prevent anticompetitive practices. Leveraging the expertise of technologists in enforcement efforts can enhance the agencies’ capacity to monitor levels of competition in markets, as well as allow them to identify patterns between certain technologies and violations of antitrust.

Given the rapid pace of AI advancement, a proactive effort triumphs over a reactive one. Detecting antitrust violations early allows agencies to save both time and resources. To protect consumers, workers, and the economy more broadly, it is imperative that the FTC and DOJ adapt their enforcement strategies to meet the complexities of the AI era.

This action-ready policy memo is part of Day One 2025 — our effort to bring forward bold policy ideas, grounded in science and evidence, that can tackle the country’s biggest challenges and bring us closer to the prosperous, equitable and safe future that we all hope for whoever takes office in 2025 and beyond.

PLEASE NOTE (February 2025): Since publication several government websites have been taken offline. We apologize for any broken links to once accessible public data.

The Federation of American Scientists supports Congress’ ongoing bipartisan efforts to strengthen U.S. leadership with respect to outer space activities.

By preparing credible, bipartisan options now, before the bill becomes law, we can give the Administration a plan that is ready to implement rather than another study that gathers dust.

Even as companies and countries race to adopt AI, the U.S. lacks the capacity to fully characterize the behavior and risks of AI systems and ensure leadership across the AI stack. This gap has direct consequences for Commerce’s core missions.

As states take up AI regulation, they must prioritize transparency and build technical capacity to ensure effective governance and build public trust.