Energy and World Economic Growth

Introduction

Rapid growth in the developing world has changed the economic center of gravity towards Asia, especially with regard to the world’s energy economy. World-wide demand for energy, especially energy that can propel automobiles, is increasing. High energy growth is producing two problems. The first, widely recognized, is the increased greenhouse gas concentrations that result from burning fossil fuels. Barring a substantial reduction of fossil fuel use, world-wide temperatures could increase to dangerous levels. While the huge infrastructure of the energy economy rules out quick changes, if action is taken now, the necessary world-wide reduction of greenhouse gas emissions may still be possible. However, the required uptake of clean energy technologies will require strong government policies to offset initial investment costs.1

The second problem is less widely recognized. The share of GDP that must be spent on oil supplies may also limit economic growth. At times, the price of oil is limited only by the strain it places on the world economy. We have seen episodes where high and rising oil prices precede an economic downturn. During the downturn, oil prices can drop to levels that, along with a weak economy, discourage investment in new oil production. When strong growth returns, we can see the cycle repeated.

These events are not surprising because oil has a very low elasticity of demand and supply with respect to price. That means very large price changes are required to increase supply or decrease demand. In addition, oil has a very high elasticity of demand with respect to income. That means economic growth strongly increases oil demand. Lastly, oil expenditures can be a large enough component of GDP to adversely affect economic growth if they grow too large. Added together, these interactions can produce the following cycle:

- High GDP growth drives oil prices to high levels since high income elasticity increases oil demand while low price elasticities require high oil prices to balance demand and supply2;

- The resulting high share of GDP spent on oil reverses GDP growth;

- With lower GDP growth, high income elasticity reduces oil demand;

- With lower oil demand, low oil price elasticities sharply lower oil prices; and

- Low oil prices reduce oil production investments but encourage high GDP growth.

Oil prices are only one factor affecting the world economy. Nonetheless, world GDP growth and oil prices are periodically engaged in the cycle described above. Oil prices can also stabilize at levels that are not high enough to cause a downturn in GDP growth, while GDP growth is not high enough to push oil prices past the level where the share of GDP spent on oil reverses GDP growth.3

The Clean Energy Challenge

High economic growth encourages more fossil fuel use and increased greenhouse gas concentrations. High oil prices also provide an opportunity for clean alternatives to be more competitive. However, if high oil prices periodically blunt economic growth, it is more difficult to make clean-energy policies a government priority. Economies that are struggling with low growth and high unemployment are less likely to maintain strong clean-energy policies. Without these policies, we cannot hope to limit the increase of world-wide temperatures to 2oC above pre-industrial levels, the level deemed likely to avoid the more serious consequences of climate change and accepted by the G8 countries as a target to be achieved by international climate policies.4

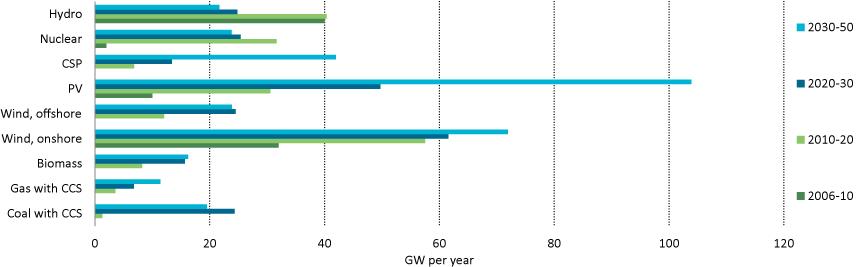

A recent IEA study5 estimated the increase in clean power-sector technologies that would be needed to prevent a world-wide temperature increase of over 2oC (Figure 1). They estimate that the future annual growth of nuclear power must be between 23 and 31 gigawatts (GW). To put this into perspective, the historic high in building nuclear power plants was 27 gigawatts per year (GW/yr). Photovoltaic power must, after 2020, reach 50 GW/yr and, after 2030, exceed 100 GW/yr. Onshore wind investments must exceed 60 GW/yr from now through 2050. Offshore wind must exceed 20 GW/yr after 2020. After 2020, coal with carbon capture and storage would need to grow by more than 20 GW/yr.

The challenges to achieving the 2oC scenario in the transport sector are no less daunting, requiring that the world sales of electric vehicles double each year between 2012 and 2020. Advanced biofuel production must grow from ~ zero to 22 billion gallons by 2020. IEA estimates that the incremental energy-sector investment that would be needed to keep world-wide temperatures from increasing over 2oC is $37 trillion (cumulative investment between now and 2050).6 The bulk of this investment would have to be made in the developing world. It is not likely that these additional investments, over and above what is necessary to provide required energy supplies, will be made without strong government policies, even though they would produce offsetting savings in the long term. Without strong world-wide economic growth, it will be difficult, if not impossible, to implement the policies necessary to achieve the 2oC scenario.

Average Annual Electricity Capacity Additions to 2050

2012 IEA Energy Technology Perspectives 2oC Scenario

Source: IEA, Energy Technology Perspectives 2012

Oil and Economic Growth

World oil prices have, from time to time, reached levels that have impaired world economic growth such as the aftermath of the 1973 oil embargo. This first “energy crisis” accompanied a major change in the way petroleum was controlled and priced. Prior to 1970, world oil prices were managed by a relatively small number of large oil companies. These companies enjoyed liberal access to most countries’ oil resources. They could develop large oil fields in host countries with terms that allowed ample world supply at non-competitive but reasonable prices. These companies pursued a strategy to maintain affordable and stable oil prices that supported economic growth in the industrialized world and encouraged increased demand for oil. These arrangements were undone by reforms in the member-countries of the Organization of Petroleum Exporting Countries (OPEC). The reforms moved the control of the world’s largest oil resources from the international oil companies to OPEC and, given sufficient OPEC cohesion, the ability to control of world oil prices. OPEC’s control of oil prices was short-lived. The rapid price hikes associated with the 1973 embargo and the 1979 Iranian revolution stimulated new supplies, especially from the North Sea and Alaska. High oil prices also stymied demand as consumers turned to more efficient automobiles.

By 1981, oil prices began a steady decline. Saudi Arabia tried to maintain higher prices by cutting production until by 1985, its output had fallen to 3 million barrels per day (mmb/d), 70 percent lower than it had been in 1980. In 1986, Saudi Arabia adopted netback pricing7 to regain market share. Oil prices collapsed to $10 per barrel (/b)8. By 1988, the OPEC pricing regime was replaced by commodity market pricing, a system that remains in place today and for the foreseeable future. The London InterContinental Exchange (ICE) established a contract for Brent, a mixture of high quality North Sea crudes[ref]The selection of Brent and WTI as marker crudes reflected several factors: 1) the desirability of Brent and WTI to most refiners; 2) the sources of Brent (UK and Norway) and WTI (United States) relative to the world’s financial capitals, London and New York; 3) the supply of Brent and WTI would not be controlled by national governments or OPEC; and 4) Brent and WTI were produced in sufficient volume to be an important component of world oil supply.[/ref]. Additionally, the New York Merchantville Exchange (NYMEX) established a contract for West Texas Intermediate (WTI), high-quality crude similar to Brent.

Only a small percentage of the world’s crude petroleum is WTI, Brent or other traded crudes. Nonetheless, these marker crudes affect the contract price of other types of crude oil since most crude oil contracts are indexed to one or more marker crudes. Spot oil prices also respond to whether the oil commodity markets are in backwardation or contango9

This new pricing regime did not entirely eliminate OPEC’s price setting role. A few OPEC countries maintain spare production capacity. Saudi Arabia, by far, keeps the largest production capacity in reserve. Saudi Arabia can increase or decrease its oil production in response to world market conditions. If Saudi Arabia believes that prices are too high, they can put spare capacity into production, putting downward pressure on market prices. Likewise, if Saudi Arabia believes that prices are too low, they can reduce production (increasing spare capacity) putting upward pressure on market prices. Most other oil producing countries and all private oil companies are price takers. They only respond to higher or lower oil prices by increasing or decreasing planned investments in new production capacity. Whether or not these investments are made has little impact on current oil supplies or prices, but has a large impact on future oil supplies and prices.

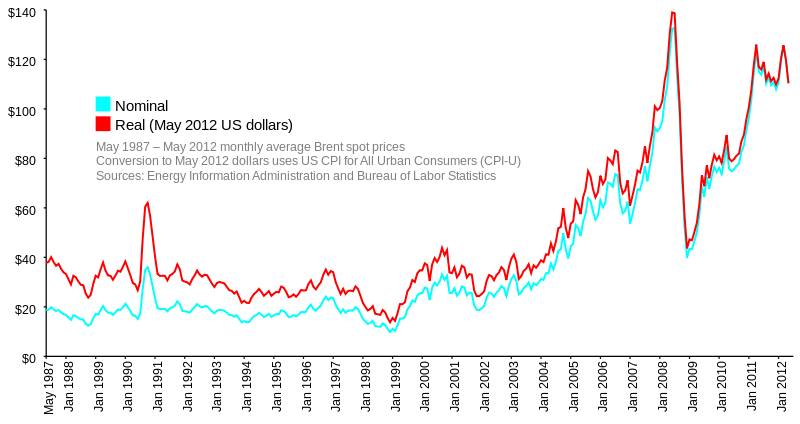

The new pricing regime produced relatively stable oil prices until 1999 (except for a sharp increase in 1990 due to the Gulf War). In 1999, oil prices began a sharp upward trend culminating in an extremely sharp $40/b rise from January 2007 to June 2008. With record high oil prices, U.S. demand finally slackened and, soon after, failing financial institutions launched a world-wide banking crisis. Oil prices plummeted reversing in one year the gains made since 2005.

Since 2008 there have been two rapid increases in oil prices. In early 2011, the Libyan civil war removed 1.5 mmb/d of light-sweet crude from the market. Oil prices spiked again in 2012 due to increased supply outages from Iran, Nigeria, Sudan and Yemen. The 2012 run-up was followed by a significant price slide due to a deteriorating economic outlook in the Eurozone and uncertainty whether the EU and the European Central Bank would take the necessary actions to prevent an unraveling of the euro.

Source: IEA, World Energy Outlook 2011

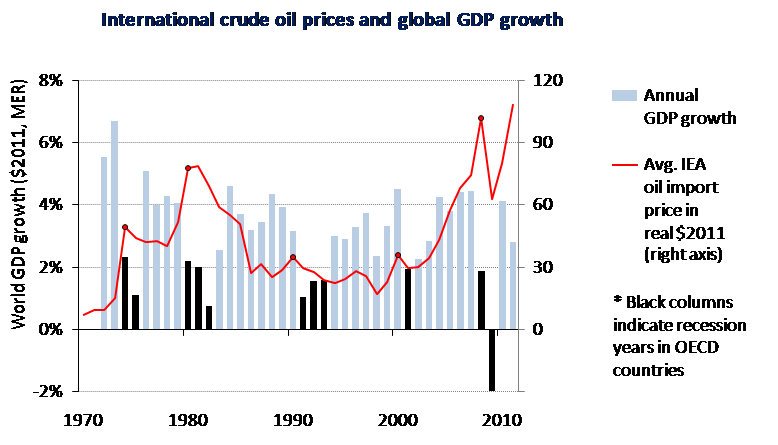

Figure 3 shows oil prices and annual changes in world-GDP. Each spike in oil prices was followed by a sharp drop in world GDP growth. The price rise from the 1973 oil embargo preceded a 4% drop in world GPD growth. Within two years, world growth slid from over 6% to 1%. The oil-supply outage resulting from the 1979 Iranian revolution doubled oil prices. Growth slid from 4% to 2% and, later, to below 1%.

The spike in oil prices resulting from the 1990 Gulf War led to a drop in world GDP growth from over 3% in 1990 to 1% in 1991. GDP growth did not reach 3% until 1994. The price spike from 1999-2000 was followed by a drop in world GDP growth from over 4% in 2000 to 2% in 2001. The world economy appeared to survive the long price rise from 2002 to 2007 until 2008, when the world suffered the worst financial crisis since the 1930s. World GDP growth dropped from over 4% in 2007, declined to less than 2% in 2008 and plummeted to -2% in 2009. While these high oil prices did not cause the world-wide recession, they were a contributing factor. High oil prices directly affected automobile sales and travel-related industries. High oil prices also reduced a household’s disposable income for other goods and services that remained after paying unavoidable fuel expenses.10

While each oil spike has been followed by a sharp drop in world economic growth, since 198711, there has been only one sharp reduction in world economic growth that was not preceded by an oil price spike.12 GDP growth has remained above 3%, apart from the 2nd or 3rd years following an oil price spike.

The world oil market has been subject to unplanned supply outages for quite some time. However, since 2011, supply outages have increased considerably from most prior years. They also reflect causes are likely to be chronic conditions as opposed to one-off events. During 2010, oil supply outages averaged less than 1 mmb/d; since 2011, they have averaged ~ 3 mmb/d and remain high today. Reports of insurgent attacks on oil-producing and distribution infrastructure, ethnic or sectarian conflict and civil war in the oil-producing states of the Middle East and North Africa (MENA) are too common to enumerate. The security situation has caused private industry to withdraw personnel from regions that are not deemed to be safe. In addition to loss of trained personnel, insurgent attacks on infrastructure, political disputes concerning sovereignty, disagreements about the validity of oil-related contracts and other problems are not likely to be passing problems that we can assume will be resolved. While these may be necessary side effects as countries replace autocratic rule with democratic governments, they nonetheless pose a great risk for future oil supplies. The International Energy Agency recently warned that relatively stable oil prices should not conceal “an abundance of risk” as “much of the Middle East and North Africa remains in turmoil.” “The current stalemate between the West and Iran” is “unsustainable” and “sooner or later, something has to give.” The political situation in the MENA region reflects a “precarious balance” that does not bode well for “clear, stable and predictable oil policies, let alone supplies.”13

OPEC production capacity has been essentially flat for the last 30 years. Over that time, growing oil demand has been met by additions to non-OPEC capacity. A number of disappointing non-OPEC supply developments helped drive the sharp rise in oil prices from 2002 and 2008. During that period, the cost of oil and gas drilling equipment and support activities increased by 260%.14 More recently, the growth of Canadian oil sands and U.S. tight oil production has kept the world oil market in balance. Without increased oil production in the United States and Canada, non-OPEC production would have been in decline in recent years.

Sufficiently high oil prices are needed to sustain the growth on non-OPEC oil. The IEA estimates that the cost of oil sands and tight oil production ranges from $45/b to over $100/b. 15 As production moves from the most productive plays to less promising plays, costs will tend to move to the upper end of the IEA range. For example, Global Energy Securities estimates that the price of oil needed to generate an attractive internal rate of return increases from $67/b in Eagle Ford (Texas) to $84/b in Monterey/Santos (California).16 While current oil prices are higher than they need to be to justify increased investment, they are not that much higher than what’s needed to motivate the large investments needed to grow non-OPEC oil production.17

As long as world oil demand grows, so will the cost of oil. The only long-term pathway to lower oil prices is to reduce and reverse the growth of world oil demand.

World Economic Growth, Unemployment and Poverty

In OECD 18 economies, unemployment is the most serious consequence of limited GDP growth. Okun’s law describes a statistical relationship between an economy’s potential rate of growth, its actual rate of growth and changes in unemployment. According to this rough relationship, a 2% difference between a country’s actual GDP and its potential is associated with 1% more unemployment. Applied over time, unemployment will grow by 1% if economic growth is 2% below an economy’s potential.19 The picture in developing countries is more complicated because of movements of labor between the agricultural and industrialized economies. Growth below a developing country’s economic potential limits or reverses the movement from the agricultural sector to the industrial sector causing underemployment.20

While increasing productivity within the agricultural sector is a development priority, it also leads to underemployment in the agricultural sector.

The relationship between economic growth and the movement of the population out of the agricultural sector is vividly illustrated in the recent history of China. By the late 1970s China possessed an inefficient agricultural economy with a rudimentary industrial sector. China possessed a population exceeding 1 billion people, of which the vast majority lived in poverty. Economic reforms produced a sustained GDP growth that has averaged 10.2 percent per year.21As a result, China has moved 400 million people out of poverty into the modern economy. Currently, ~ 650 million people still live in the agricultural sector, 450 million more people than are needed.

High Chinese economic growth would permit more people to move out of the underemployed agricultural economy to productive labor in the modern economy, as there are 450 million people living in poverty.22 Within one generation, emigration out of the agricultural sector can be the first step to careers in commerce, business, education, medicine, engineering, science and management.

Reducing Petroleum Demand

By 2014, more oil will be consumed outside the OECD than within.23 Increased personal income and increased auto ownership appear to be as inextricably linked in rapidly developing economies as it had been in the OECD after the Second World War. With economic growth, automobiles (especially luxurious automobiles), are likely to be purchased in increasing numbers. Domestic automobile consumption will also help developing economies move from export reliance to supplying domestic markets.

With a rapidly increasing consumption of energy for personal mobility, it is imperative to satisfy this growth with non-petroleum energy. If the world continues to rely on petroleum fuels for personal mobility, high oil prices are likely to cause periodic episodes of low growth causing significant hardships for hundreds of millions of people.

Energy Security Trust

The Energy Security Trust, proposed by President Obama,24 aims to make current electric vehicle technologies cheaper and better with $2 billion for research. In addition to advances in batteries, electric vehicles and ubiquitous electric refueling, it will also fund sustainable biofuels.25 As stated by the White House; “In each of the last four years, domestic production of oil and gas has gone up and our use of foreign oil has gone down. And while America uses less foreign oil now than we’ve used in almost two decades, there’s more work to do. That’s why we need to keep reaching for greater energy security. And that’s why we must keep developing new energy supplies and new technologies that use less oil. The Secure Energy Trust will ensure American scientists and research labs have the support they need to keep our country competitive and create the jobs of the future.” The success of initiatives like the Energy Trust Fund would produce world-wide benefits as the uptake of competitive advanced clean energy technologies would be global. Competitive alternatives to petroleum-fueled personal transportation, combined with strong clean-energy policies, would go a long way to achieving the G8’s 2oC climate goal. They would also remedy an important impediment to world GDP growth.

Carmine Difiglio is the Deputy Assistant Secretary for Policy Analysis, U.S. Department of Energy and may be reached at carmine.difiglio@hq.doe.gov. His work and publications include the first engineering-economic transportation-energy model, several other modeling projects including the International Energy Agency’s Energy Technology Perspectives project, studies of international oil and natural gas markets, and policies to promote energy security, energy efficiency, motor-vehicle efficiency and alternative transportation fuels. Difiglio also serves as Co-Chair of the World Federation of Scientists’ Permanent Monitoring Panel on Energy and Vice-Chair of the IEA Standing Group on the Oil Market. He was Vice-Chair of the IEA Committee on Energy Research and Technology, Chairman of the IEA Energy Efficiency Working Party and Chairman of the Transportation Research Board Committee on Energy and Transportation. Difiglio’s Ph.D. is from the University of Pennsylvania. The data and views expressed in this paper are those of the author and are not endorsed by the U.S. Department of Energy or the United States government.

How DOE can emerge from political upheaval achieve the real-world change needed to address the interlocking crises of energy affordability, U.S. competitiveness, and climate change.

As Congress begins the FY27 appropriations process this month, congress members should turn their eyes towards rebuilding DOE’s programs and strengthening U.S. energy innovation and reindustrialization.

Politically motivated award cancellations and the delayed distribution of obligated funds have broken the hard-earned trust of the private sector, state and local governments, and community organizations.

Over the course of 2025, the second Trump administration has overseen a major loss in staff at DOE, but these changes will not deliver the energy and innovation impacts that this administration, or any administration, wants.